Frequently Asked Questions

[lwptoc hideItems=”1″]

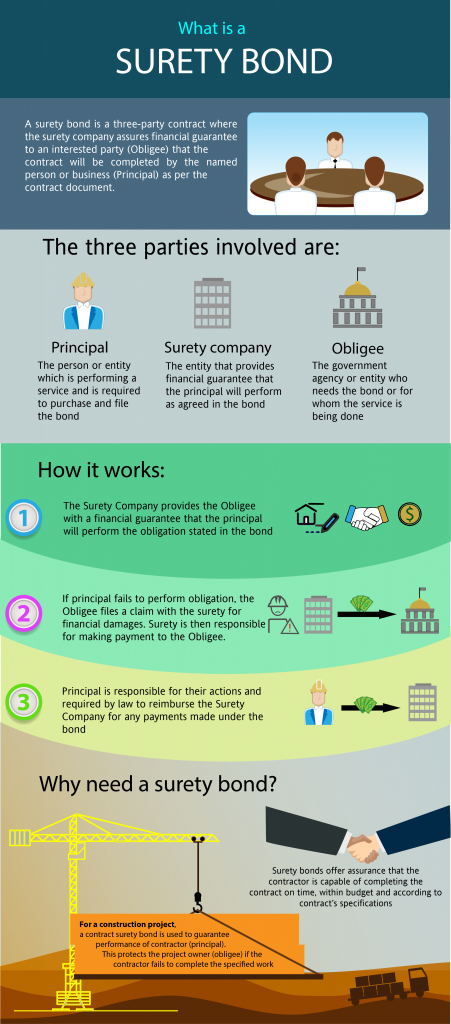

What is a Surety Bond?

A surety bond is a type of contractual agreement. The company or person making the promise, the one receiving that promise, and the company that guarantees performance are all necessary parts of this contract. There are two main types of surety bonds – Commercial Surety Bonds (License and Permit bonds) and Contract Surety Bonds.

- Contract bonds are a general term for surety bonds. The main categories of contract bond, which are Bid Bonds, Performance Bonds, Payment Bonds and Maintenance Bonds. Most states and municipalities require contractors involved in project over a certain amount to be covered by construction bonds. Federal projects also have this requirement, with the typical sum being $150,000 for an individual and $500,000 for companies.

- In this section, Commercial Surety Bonds includes many subcategories such as License Bonds, Probate BONDS, Permit Bonds, ICC Freight Broker Bonds, Fidelity Bonds, Public Official Bonds, Oil & Gas Bonds and Financial Institution Bonds. Unfortunately, we do not write bail bonds.

What is the difference between a surety bond and insurance?

Surety bonds are simply not insurance. While they do protect an individual from negligent actions, they don't actually provide any cover and it's best to think of them simply as a contract with some specific terms beyond the legal agreement between surety bond issuer and surety company. Surety bonds are actually a type of credit product, meaning that they are very closely related to areas like banking.

Consider a surety bond. General Indemnity Agreement (GIA) is only one of the contractual agreements that must take place before getting a surety bond from a company. The Principal(s) have obligations to the surety bond company. One of those obligations is always to reimburse the surety bond company for any losses they may occur.

Surety bonds are typically written with the anticipation of no losses, so they're affordable at a rate that is lower than 3% of the obligation. However, pricing loss into surety bond premiums would make them cost prohibitive. A property or casualty insurance policy works in a different way than life insurance. With property and casualty insurance, the owner of the policy usually only has to pay for a deductible. The rest of the claim goes to their insurer. These policies are priced with the assumption that you will incur some losses, but these losses are only around 20% on average.

The insurance company is mainly focused on safety and loss mitigation while a surety bond underwrites the Principal’s financial, character, and ability to complete an obligation. The amount of coverage an insurance company gives to its customers varies depending on the capacity it has set. Unlike credit limits, which are self-imposed by a client, insurance companies define your coverage based on factors like health status, portfolio risk and affordability. It is important to work with an expert in your insurance needs, but it's also vital to use an expert you trust for your surety bond solutions.

How do I get a surety bond?

Depending on the type of surety bond, the amount of guaranteed cash, and the length that is required for obligation, a small contract surety bond could be written with just an application while larger contracts need to go through full underwriting. Since many license and permit bonds are written freely, they rarely require any underwriting. Other commercial surety bonds such as Tax Bonds are a financial guarantee that typically need both the company's financial statements and documents on its owners. There are some surety bonds that require collateral because of the type of risk. Each bond has its own idiosyncrasies that you should be aware of before getting a particular surety bond arranged for your company.

What financial information is generally required for a surety bond?

Every surety bond company has different underwriting standards. Generally, the larger the surety bond or bond program, the more sophisticated the financial statements need to be. Small surety bonds can be written without corresponding financial statements. Some financial statements can be written with internal statements or tax returns. Others may require a CPA Compilation, Review or even an Audit depending on the size.

How You Can Get a Surety Bond With Bad Credit, including Judgments, Bankruptcy, or Liens

You can get a bond, but it depends on the circumstances and the type of surety bond. When it comes to commercial bonds, often it's just a matter of rate. For contract bonds, the decision to purchase will depend on other factors such as the company's financial strength. If you have a bankruptcy, lien or judgement against you, the Small Business Administration will guarantee your contract surety bond so long as it is discharged–satisfied or in the case of disagreement, paid on a monthly installment basis. Government-held tax liens present a problem for anyone who needs to provide security, as nobody wants to be behind the government. Non-contract bonds may offer other options to borrowers, such as collateral or funds control in the event that you are unable to make your monthly payments.

How much does a surety bond cost?

The surety bond fee depends on several factors and the type of bond you need. A normal range is between 1% to 3%. This depends on many factors. Generally, the stronger your credit history, the lower you bond rate will be. Find out more about the cost of a performance bond here. The cost of surety bonds will usually decrease as the size of your contract increases. For consumers with a good credit rating, a commercial surety bond will typically be at 1% or lower. For those with challenging credit scores, the rates can be as high as 10%. Commercial surety bond providers typically receive discounts when they pay for several years at the same time.

Does My Spouse Have To Sign The Indemnity Agreement?

Surety bonds, at their core, are an indemnity product. The surety bond company expects to be reimbursed for any loss. In some cases, the surety bond company may request reimbursement from both organizations (the company and the owners) depending on their agreement. Spouses are often expected to indemnify, or agree to take responsibility for the debt if their spouse does. This prevents a party from sheltering assets from the other party, or shifting them to the spouse. If a spouse does not have any ownership in the company, it is usually still the case. There are exceptions to this rule, but they're uncommon.

Why Is My Other Business Required To Sign The Indemnity Agreement?

This happens for a couple of different reasons. Surety underwriters may be relying on another business's assets in order to approve an application for a bonding policy. There are exceptions to this general policy if the circumstances qualify.

Can I cancel my surety bond?

A surety bond is a type of insurance policy taken out by someone who promises to fulfill contractual obligations for another under the condition that they do not. If you want to quit your position as collateral, then you must eventually surrender all rights, privileges and documentation of said position. This includes giving up any benefits under the bond. Also, cancelling does depend on the surety bond type.

Contract bonds such as bid bonds, performance bonds, payment bonds and supply bonds cannot be cancelled once issued. If a is determined that the bonds are not needed, they must be returned to the surety before a refund can be issued. In general, commercial bonds such as license and permit bonds can be cancelled. However, some policies do have time requirements of 60 days’ notice. The Obligee may also need to consent before cancelling, depending on the agreement. There are certain types of surety bonds that require one to be replaced by another sort of surety bond and company before they can be canceled.

How Can I Remove Myself from Personal Liability On Construction Bonds?

Construction bonds do not need to be cancelled. The guarantee simply expires once the obligation is complete. For example, there is no need to return performance bonds or payment bonds. After the project is complete and you are paid, there will be no further obligation. The same can be said of bid and maintenance bonds. A surety bond protects the contractor from financial loss in the event they do not complete an agreed-upon contract, but once that ends the obligation is over. Obligees are often not required to return these surety bonds, as it's unnecessary.

What About Using a Letter of Credit Instead of a Surety Bond?

Many obligees will allow you to post a letter of credit in place of a surety bond. There are many reasons not to do this. Surety bonds are unsecured so they will not tie up your resources. Posting letters of credit will limit your borrowing ability, if you are willing to accept such a limitation then it may serve as an alternative. Surety bonds cost less than 3% while most letters of credit have a variable rate. Additionally, surety bond companies are generally obligated to investigate claims before paying, while letters of credit have no such provision. A valid or invalid claim may be paid out under a letter of credit.

What is the difference between cost overruns and cost underruns?

The premium for contract surety is based on the contract's final value. This could be more or less than the original agreed-upon deal. Many surety bond companies send out Contract Status Reports throughout the ongoing project to the Obligee. The principal may be liable for additional premium if the final contract was more than the original contract. This is known as an overrun. The surety bond company may owe money back to the Principal when there has been an Underrun.

What are the differences between surety bond companies?

There are more than 100 surety bonds companies operating in the United States. Although company’s have their own unique underwriting appetite, there is some overlap. We work with many different surety bond providers to find the best fit for each client. We believe that companies should be at an “A-” or better rating by a credible agency such as A.M. Best, regardless of the industry they are in. According to most contracts, they should also be listed on the U.S. Treasury's 570 Circular.

What are the key differences between surety bond brokers?

Most insurance agents can easily get licensed to be a broker for surety bonds as nearly all state insurance departments only require a property and casualty insurance license to write them. Getting a license to sell insurance requires no knowledge of the financial statements, or surety and business operations. As a result, entry is free and many surety bond agents are run by those with backgrounds in contractor digital marketing or insurance. Apply for a bond through our company, but be sure to work with an expert. Search for those brokers that have NASBP or AFSB certification. Brokers who specialize in surety bonds can make acquiring your bond less stressful. A number of our customers have been rejected by other brokers before, and that should tell you something.