You can now apply online for a Michigan Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

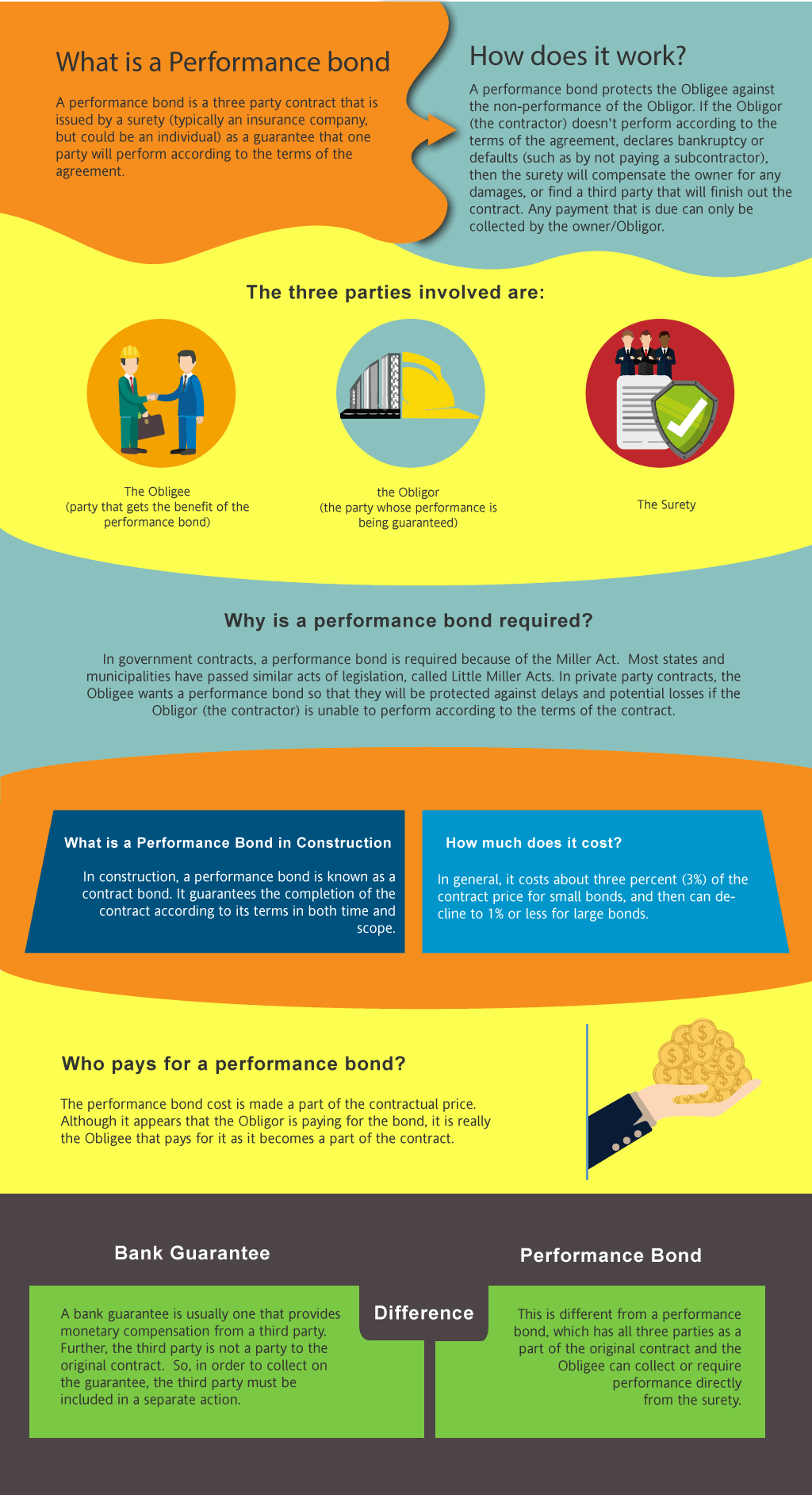

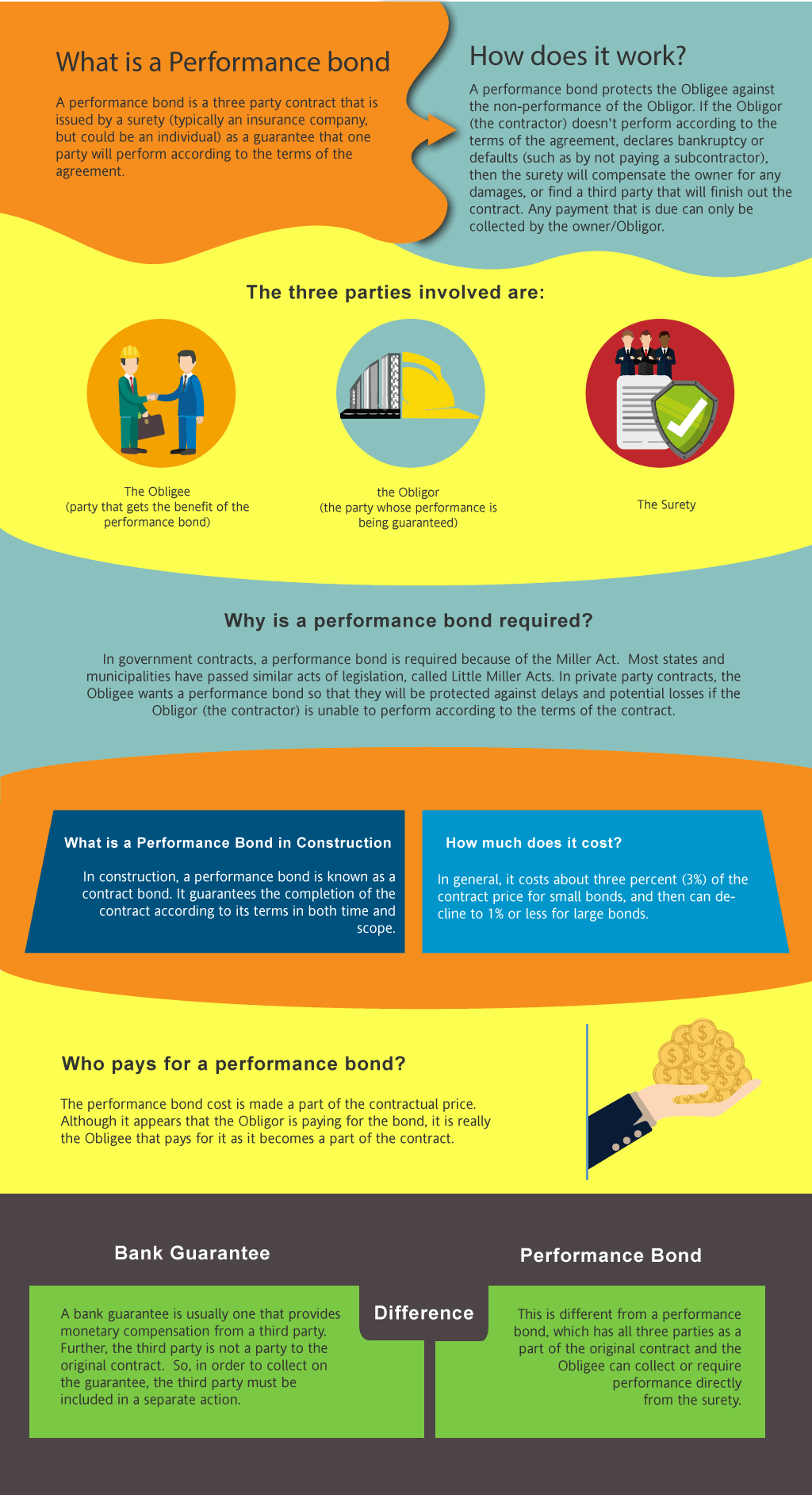

What is a Performance Bond in Michigan?

How do I get a Performance and Payment Bond in Michigan?

We make it easy to get a contract performance bond. Just click here to get our Michigan Performance Application. Fill it out and then email it and the Michigan contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in Michigan?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MI?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Michigan. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover who pays for a construction bond and ensure your project's financial security today!

How to Get a Performance Bond in MI

Just call us. We’ll work with you to get the best Michigan bond possible.

We provide performance and payment bonds in each of the following counties:

Alcona

Alger

Allegan

Alpena

Antrim

Arenac

Baraga

Barry

Bay

Benzie

Berrien

Branch

Calhoun

Cass

Charlevoix

Cheboygan

Chippewa

Clare

Clinton

Crawford

Delta

Dickinson

Eaton

Emmet

Genesee

Gladwin

Gogebic

Grand Traverse

Gratiot

Hillsdale

Houghton

Huron

Ingham

Ionia

Iosco

Iron

Isabella

Jackson

Kalamazoo

Kalkaska

Kent

Keweenaw

Lake

Lapeer

Leelanau

Lenawee

Livingston

Luce

Mackinac

Macomb

Manistee

Marquette

Mason

Mecosta

Menominee

Midland

Missaukee

Monroe

Montcalm

Montmorency

Muskegon

Newaygo

Oakland

Oceana

Ogemaw

Ontonagon

Osceola

Oscoda

Otsego

Ottawa

Presque Isle

Roscommon

Saginaw

St. Clair

St. Joseph

Sanilac

Schoolcraft

Shiawassee

Tuscola

Van Buren

Washtenaw

Wayne

Wexford

And Cities:

Detroit

Grand Rapids

Lansing

Ann Arbor

Flint

Kalamazoo

Saginaw

Traverse City

Dearborn

Livonia

See our Minnesota Performance Bond page here.

What Is The Rate Of A Performance Bond In Michigan?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect the rate are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How Best To Think Of Surety Bonds

Surety bonds could be quite complex to understand, specifically if you don't know how they actually work, or have never had to deal with them before. Most individuals look at this as insurance, but it is a wholly different financial product. This is a type of guarantee that the principal will perform their work properly. Insurance businesses can provide a surety bond, but it isn't insurance because its function is different. Many people will require you to get a surety performance bond because they will trust your services because this is a type of guarantee to them.

If you would like to obtain a performance bond, you must know how they work. We will offer some information on the significance of surety performance bonds in the following paragraphs.

An Explanation On Surety Performance Bonds

Surety performance bonds will be asked for by the public in a lot of situations since it will secure them from risk and it will guarantee that the principal would fulfill their duties. As the principal, you must obtain a license surety bond to guarantee that your company will adhere to the laws and you need a contract bond to make certain that a public construction project will be completed.

This is made for the consumers because they will be protected by the bond, but it could also provide benefits to you because they will trust you when you have this type of bond covering a project.

How It Works

Performance bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is the employer or company which will offer the services and the obliged is the project owner. Construction companies are typically required to purchase contract performance bonds if they are considering a public project. The government will also require the construction company to secure several bonds if they truly want to be considered for the project.

The primary function of a payment bond is for the sub-contractors and workers to make sure that they will be paid even if the contractor defaults. The contractor will cover the losses, but when they reach their limit, the duty will fall to the surety company.

The Application For A Surety Performance Bond

These bonds are provided by insurance businesses, but you may want to look for standalone surety organizations that only concentrate on these products. They know the finer workings of them and can ensure you get the exact bond you need. It won't be easy to apply for a bond since the applicant will have to go through a strict process that is very similar to when you are applying for a loan. The bond underwriters will review the financial history of the applicant, their credit profile and other key factors to make certain that they qulify to be approved. This also means that there is a chance you will be denied, especially if the underwriters finds something negative on your credit history.

How Much Are You Going To Spend For This?

There is no fixed rate as it depends upon numerous variables like the bond type, bond amount, where the bond will probably be issued, contractual risk, credit score of the applicant and more. There are many bonds available today and the cost will depend on the type that you need. The amount of the bond is not much of an issue because you can get a $10,000 bond or a $25,000 bond. If you have a credit history that is above or near 700, you may qualify for the standard bonding market and your rate will be about 1 to 4 percent of the performance bond amount. If you are applying for a $10,000 bond, it will only cost $100 to $400.

Your Application Could Be Rejected

There is a chance that your performance bond request will be denied by the surety company because it will depend on the results that they will get from the background check. If the surety company thinks that it would be a risk for them to issue a surety bond, they will deny your application. Your credit score is one of the most important factors to be accepted for a performance bond because if you have a bad credit history, this shows the underwriter you are a risk.

You can obtain a performance bond even if your credit rating is bad, but you'll pay an interest rate of 10 to 20 percent.

If you have a need to apply for a performance bond, you need to understand the process so you won't make a mistake. It will not be simple to apply, but if your requirements are complete and you are eligible, you can obtain a surety bond.

See more at our Arizona Performance Bond page.

Contact us for Michigan surety bond companies.