What are Performance Bonds?

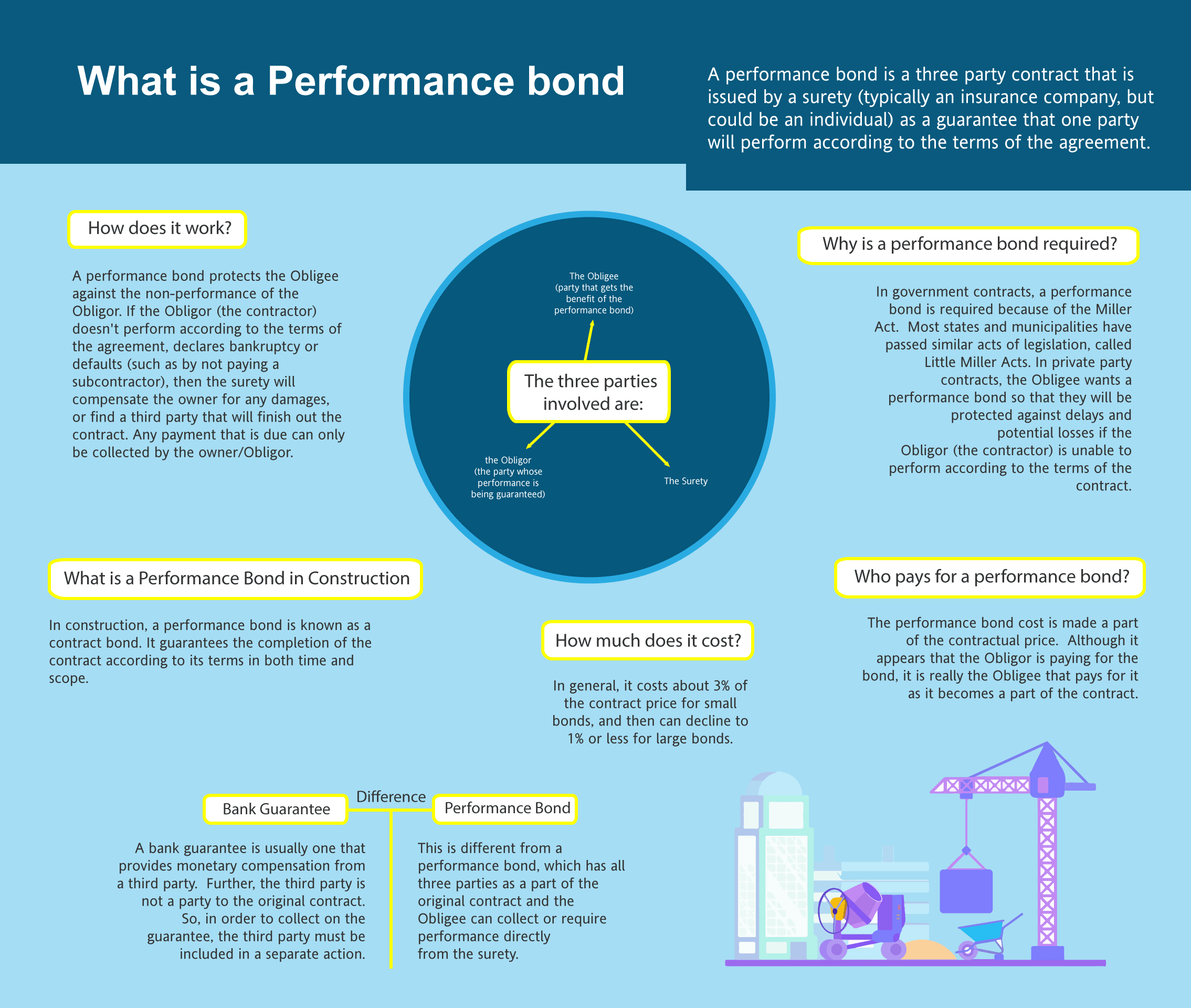

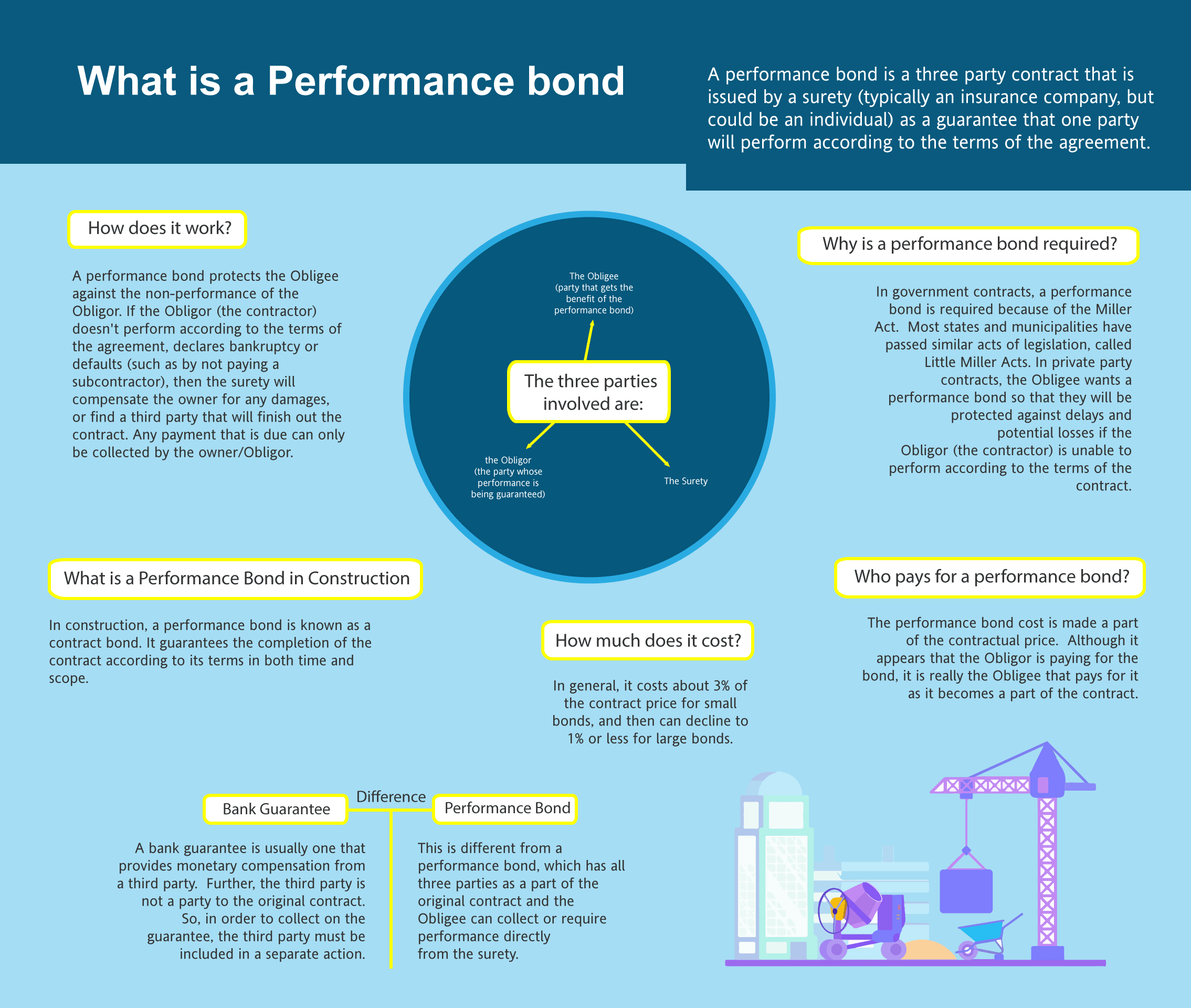

Simply put, it's a bond issued by a surety company (think large insurance company) that guarantees the satisfactory completion of a project or a job (i.e., a construction project).

Or you Can download our Express Performance Bond Application (click to download form) Complete the form and email to [email protected]

- Include the Contract and Notice of Award letter (bid specs from the obligee). 2. Send the bid results (i.e., bid tabs) if you have them

We are the nation’s leading provider of performance bonds. Our expertise spans the entire range of bonds and we’ve worked extremely hard over the years to develop deep relationships so that we can offer you the absolutely best bond rate available. We work with you to present the best case scenario to the surety bond company. Then, we utilize our deep relationships with those companies to get the right bond suited for your specific needs.

How are we able to do this? Through a lot of hard work. That’s how we’re successful. That’s why we’re the best. Hard work. Dedication. Experience. We’re the EXPERTS when it comes to bonds.

What does it cost? Can I get one with bad credit?

The cost of a performance bond can vary widely from company-to-company, but some general guidelines are that the rate is 3% for all bonds that are $250,000 and less. For bonds over this amount, we use a graduated scale for the bond rate. In general, most bonds are going to cost between 0.75%-3%. For companies with bad credit, the bond rate can be higher as there is more work involved to get a bond issued (and that work is much preferred to an expensive bank guarantee). We work with you to present your financials in the best light to the surety so that you can get on with your work.

What is a Payment Bond?

Payment bonds are a subset of surety bonds. These bonds are typically required on construction projects (and many times are required along with a performance bond). They provide assurance that the contractor (also known as the obligee) will pay all laborers, material supplier and contractors. Thus, the owner of the property knows that there will not be a mechanic’s lien placed on the property (which would interfere with their ability to market the property once the project was completed).

What is the difference between a payment bond and performance bond?

This may be easiest to explain with a good example.

Let’s assume that Gotham hires Falcone Contracting as the general contractor to build a mental hospital (and let’s call that facility, um, Arkham Asylum). Falcone Contracting then hires several other subcontractors

Let’s further assume that after constructing half of Arkham, Falcon Contracting goes out of business, leaving the other half to be finished later. Further, let’s assume that 20% of what was actually done was defective (10% of the total). Finally, let’s assume that Falcone Contracting did not pay Joker, Penguin for their work at all, and only paid Mr. Freeze for his labor, but not his supplies.

The performance bond would protect the owner (in this case, the city of Gotham) from the non-performance of Falcone Contracting, as well as the defective work of Falcone. Thus, the surety would have to find someone who would fix the 10% completed as well as complete the remaining 50% of the project (or pay damages to Gotham in the amount of the bond). However, the performance bond would not provide any protection for Joker, Penguin or Mr. Freeze. They would be forced to put a mechanic’s lien on Arkham.

Fortunately, Gotham was smart about this. Not only did they require Falcone to get a Performance Bond, but they also required them to get a Payment Bond. Thus, the surety company now has to pay Joker Construction, Penguin Plumbing and Supply in their entirety, and Mr. Freeze’s HVAC for the materials that they purchased.

Here is a Owner's checklist for performance and payment bonds.

How are Claims Made on Performance and Payment Bonds?

Performance and payment bonds are a type of indemnity bonds and should not be confused with an insurance policy. In a typical insurance policy, the insurer has to defend the insured as well as indemnify them. More importantly, they are not able to get repaid from the insured for the amount of any loss or any costs associated with the claim. Compare that to a claim on a bond. First, the surety looks to the contractor to make sure that there it is a valid claim and, more importantly, the surety will ask the contractor to indemnify it for any claim damages and lawsuit fees.

Discover what is a performance bond in construction and how it guarantees project completion!

Who benefits from a Payment Bond?

Subcontractors, laborers and suppliers are the ones that benefit from a payment bond.

The problem generally arises for a general contractor as they are unaware that there is a problem until they get a claim filed against them. Sureties also do not like payment bonds as they can, in some cases, end up paying for work twice.

Let’s go through an example. Let’s assume that Riddler Materials was not paid by Joker, even though Falcone made sure that Joker received their payment on time. So, Falcone would not even know that there was a problem (and would further assume that everything was just fine) until Riddler made a claim on the payment bond.

Falcone, if they were being diligent, would require a payment bond from Joker so as to eliminate this double payment risk.

How does a Bond differ from Insurance?

Insurance is written so that the risk of loss is spread among multiple parties while a bond is written with the assumption that there is not going to be any loss (although loss does occur). Thus, bond premiums are MUCH lower than insurance premiums. If bond rates were written in the same manner as insurance, then the cost would be somewhere in the 40% range – which is simply not sustainable for any construction activity.

Can I get a Performance Bond online?

Of course! What do you think we are, chopped liver?

What about a sample bond form?

We have posted several sample forms. You can find a sample bond form here, or a sample form here. Here's another Sample Contract bond.

Some common Misspellings and typos that we see: preformance bond, perfromance bond, peformance bond, perfomance bonds, perfomance bond, performace bond, performence bond, performa bond, performa ce, performan bond, contraxt performance bond, contstruction performance bond, performance suerety bond, performance bonda, performance.bond, constrcution performance bonding

How do these bonds work?

These bonds come with guarantees from a third-party guarantor instead of the construction contractor. This type of security bonds are usually taken out with the help of an insurance company or bank institution and this will cover the entire cost of the construction project if the contractor fails to deliver. These types of bonds generally take a much longer approval because they need to go through various institutions. They may also be associated with extra costs as an agency may need to be used to create the security bond. If the contractor is unable to complete work it can be extremely costly for them. Because of the extended approval process and extra costs only a few different types of construction projects may require a bond.

Understanding Performance Bonds in Construction

Performance bonds play a crucial role in the construction industry, ensuring that contractors fulfill their obligations under a contract. A performance bond, often referred to as a contract performance bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. These bonds protect the project owner by providing a financial guarantee that the contractor will perform the work according to the terms and conditions of the contract.

Key Concepts and Definitions:

- Performance Bond Definition: A performance bond is a surety bond that guarantees the contractor will complete the project as specified in the contract.

- Contract Performance Bond: This type of bond ensures that the terms of the contract are met by the contractor, providing protection to the project owner.

- Performance Bond Posting: The process of obtaining and submitting a performance bond to the project owner before the commencement of work.

- Insuring Performance Bonds: Insurance companies provide performance bonds to cover the risks associated with project completion.

- Municipal Performance Bonds: These bonds are required for public projects to ensure that taxpayer-funded projects are completed properly.

- Construction Performance Bond: A specific type of performance bond used in the construction industry to guarantee the completion of construction projects.

- Performance Bonding Surety & Insurance: These are the entities that provide the financial backing and guarantees for performance bonds.

- Bank-Backed Performance Bond: A performance bond that is secured by a bank, providing an additional layer of security for the project owner.

- Contractor’s Performance Bond: A bond obtained by the contractor to guarantee their performance on a project.

- Performance Bond Execution: The process of enforcing the terms of the performance bond if the contractor fails to meet their obligations.

Detailed Answers to Common Questions

- How do construction performance bonds work?

- Construction performance bonds work by providing a guarantee to the project owner that the contractor will complete the project according to the contractual terms. If the contractor fails to do so, the surety company will step in to cover the costs of completing the project.

- Are general contractors protected by performance bonds?

- Yes, general contractors are protected by performance bonds as they ensure that subcontractors fulfill their contractual obligations, preventing financial loss due to non-performance.

- What is the purpose of payment and performance bonds?

- Payment and performance bonds ensure that contractors meet their contractual obligations and pay their subcontractors, laborers, and material suppliers. This protects project owners from financial risks associated with contractor defaults.

- When are performance and payment bonds required?

- Performance and payment bonds are typically required before the commencement of a project, especially in public construction projects, to ensure that contractors adhere to the contractual terms and financial commitments.

- What does it mean to call a performance bond?

- Calling a performance bond means that the project owner or obligee requests the surety company to fulfill the contractor’s obligations under the bond because the contractor has failed to complete the project satisfactorily.

- What is the objective of a performance bond?

- The primary objective of a performance bond is to protect the project owner by ensuring that the contractor completes the project according to the contractual terms, thus mitigating financial risks associated with contractor non-performance.

By understanding these key aspects of performance bonds, stakeholders in the construction industry can better navigate the complexities of project management and risk mitigation, ensuring successful project completion and financial stability.

FAQ (Frequently Asked Questions), Definitions, and Short answers for you:

- Extension of performance bond: An extension of performance bond involves prolonging the validity period of the bond to cover additional project time.

- How performance bond work warrant: Performance bonds warrant that contractors will complete projects per the contract terms.

- Performance construction bond: A performance construction bond ensures that construction projects are completed according to the contract.

- Labour and performance bond: This bond covers both the performance of the contract and payment for labor.

- Performance bonding surety & insurance: These are financial guarantees provided by sureties and insurance companies to ensure contract fulfillment.

- Performance is guarantee bond copy: This is a copy of the bond that guarantees the performance obligations of the contractor.

- Outstanding performance bonds: These are bonds that are currently active and have not yet been released or claimed upon.

- Payment and performance bond capacity: This refers to the maximum amount a contractor can be bonded for payment and performance.

- GC payment and performance bond: General Contractors (GC) obtain these bonds to guarantee their payment and performance on projects.

- Payment and performance bond construction insurance: This insurance covers both payment and performance risks in construction projects.

- Government performance bonds: These bonds are required for government-funded construction projects to ensure project completion.

- Payment and performance bond how to get: Contractors obtain these bonds through surety companies after a thorough underwriting process.

- Performance bonds to cover premium: The premium for performance bonds is typically a percentage of the bond amount.

- Construction performance bonds definition: These bonds ensure the completion of construction projects according to contractual terms.

- Performance guarantee bond USA: In the USA, these bonds guarantee the satisfactory completion of projects.

- Payment performance labor materials bonds meaning: These bonds cover the payment for labor and materials and guarantee performance.

- Performance security bond definition: A performance security bond ensures the completion of contractual obligations.

- Bond guaranteeing contractual performance: This bond guarantees that the contractor will perform as per the contract.

- Performance surety bonds and insurance service: These services provide financial guarantees for contract performance.

- Contractor's performance bond: This bond is obtained by contractors to guarantee their performance on a project.

- How long does payment and performance bond take: Obtaining these bonds can take from a few days to several weeks, depending on the underwriting process.

- Bond guaranteeing contractual performance: This bond ensures that contractors meet their contractual obligations.

- How provides performance bonds: Surety companies typically provide performance bonds.

- Contractors bond for performance bond: Contractors must secure a performance bond to guarantee their project commitments.

- Insurance bonds performance: These are performance bonds provided by insurance companies.

- Performan bond general contractor: General contractors use performance bonds to ensure project completion.

- Construction industry performance bonds: These bonds are widely used in the construction industry to guarantee project completion.

- Performance and delay bond: This bond covers both performance and potential delays in project completion.

- What is purpose for payment and performance bond: The purpose is to ensure contractors complete projects and pay subcontractors and suppliers.

- Performance and labor bond: This bond covers both the performance of the contract and payment for labor.

- When to call performance bond: A performance bond is called when the contractor fails to fulfill their contractual obligations.

- Performance and payment bond terms: These terms outline the obligations and conditions of the bond.

- Performance bond RFP: A performance bond is often required in a Request for Proposal (RFP) for construction projects.

- Performance and payment bonds are made payable to who: These bonds are typically made payable to the project owner or obligee.

- Performance bond terms conditions: The terms and conditions define the scope and enforcement of the bond.

- Performance and payment bonds before contract: These bonds are usually required before the contract is signed and work begins.

- Performance and payment surety bond: This bond ensures contract performance and payment to subcontractors and suppliers.

- Performance bonding definition: Performance bonding refers to the process of securing a performance bond for a project.

- Performance and payment surety bonds: These bonds provide financial guarantees for both performance and payment obligations.

- Call up performance bond: To call up a performance bond means to make a claim against it due to contractor default.

- Performance and performance bond: This likely refers to ensuring performance on multiple aspects of a contract.

- Performance bonds construction industry: Performance bonds are critical in the construction industry to ensure project completion.

- Bond insurance performance: Performance bond insurance provides a financial guarantee for contract completion.

- Performance bonds for construction: These bonds guarantee that construction projects will be completed as per the contract.

- Performance bond 2: This likely refers to a secondary or additional performance bond for further project assurance.

- Guarantee performance bond: This bond guarantees the performance of the contractor on a project.

- Bank options for performance bond project completions: Banks may provide performance bonds as part of their financial services for project completion.

- Performance bonds meaning: Performance bonds are financial instruments that guarantee the fulfillment of contractual obligations.

- Contractual performance bond: This bond ensures that the contractor will perform according to the contract.

- Performance cash bond: A cash bond is a deposit that guarantees performance, which can be claimed if obligations are not met.

- Performance bond amount definition: The amount of a performance bond is the sum guaranteed to complete the project if the contractor defaults.

- How do construction performance bonds work: They work by providing a financial guarantee that the contractor will fulfill their obligations.

- Performance bond and insurance: These are financial instruments that ensure project completion and mitigate risks.

- Performance insurance bond: This bond provides insurance coverage for project performance.

- Performance bond asset: A performance bond can be considered an asset as it provides financial security.

- Performance surety bonds and insurance: These bonds and insurance provide guarantees for project completion.

- Performance bond building contracts: These bonds are used in building contracts to guarantee project completion.

- Performance warranty bond definition: This bond guarantees the quality and performance of the contractor’s work.

- Performance bond business definition: In business, a performance bond guarantees that a contractor will fulfill their obligations.

- Construction company performance bonding: Construction companies secure performance bonds to guarantee project completion.

- Performance bond by contractor: Contractors obtain these bonds to guarantee their performance on projects.

- Proof of performance bond: This is documentation proving that a performance bond has been secured.

- Performance bond called: When a bond is called, it means a claim has been made against it due to non-performance.

- Release of payment and performance bonds: Bonds are released once the contractor fulfills their obligations.

- Performance bond cheque: This could refer to a check used to secure a performance bond.

- Standard performance bond: This is a typical bond that guarantees project completion.

- Bonding performance: The act of securing a performance bond to guarantee contractual obligations.

- How performance bond works: Performance bonds ensure project completion by providing financial guarantees.

- Performance bond construction company: Construction companies use performance bonds to ensure their projects are completed.

- Importance of performance bond: Performance bonds are important for mitigating risks and ensuring project completion.

- Corporate performance bond guarantee: Corporations use these bonds to guarantee their contractual performance.

- Understanding the performance bond process: The process involves securing a bond to guarantee project completion and meeting obligations.

- Performance bond construction general contractor: General contractors use these bonds to ensure project performance and completion.

- What are performance bonds for: They are used to guarantee that contractors meet their contractual obligations.

- Performance bond construction how it works: They work by providing financial guarantees to ensure project completion.

- What is an insurance performance bond: It is a bond that provides insurance coverage for project performance.

- Performance bond construction industry: These bonds are crucial in the construction industry for ensuring project completion.

- Insurance guarantee for performance bond: Insurance companies provide guarantees for performance bonds.

- Performance bond construction insurance: This insurance provides coverage to guarantee construction project completion.

- What is performance bonds: Performance bonds are financial instruments that guarantee project completion.

- Performance bond construction law: These laws regulate the use and enforcement of performance bonds in construction.

- What is the performance bond: A performance bond guarantees that a contractor will complete a project as per the contract.

- Credit default insurance and performance bond definition: This insurance covers defaults on credit and ensures project performance.

- When are performance bonds used: They are used in construction projects to guarantee completion and in various other contracts.

- Performance bond construction owner: Project owners require these bonds to ensure contractors meet their obligations.

- When to submit performance bond: Performance bonds are typically submitted before the project begins.

- Performance bond construction process: This process involves securing a bond to ensure project completion.

- Performance bond construction US: In the US, these bonds are commonly used in construction to guarantee project completion.

- Performance bond service contract: These bonds are used in service contracts to guarantee performance.

- Performance bond contract: A performance bond contract outlines the terms and conditions of the bond.

- Performance bond suretyship: Suretyship involves a third party guaranteeing the performance of the contractor.

- Performance bond contract definition: This defines the obligations and conditions of the performance bond.

- Performance bond USA: In the USA, performance bonds are used to ensure contractual obligations are met.

- Performance bond contract meaning: This refers to the contract that outlines the performance bond's terms and obligations.

- Financial performance bond: This bond guarantees the financial performance of a contractor.

- Define cash performance bond: A cash performance bond is a deposit that guarantees project completion.

- Bonds for performance: These bonds guarantee that contractors meet their contractual obligations.

- Performance bonding construction: This process involves securing bonds to guarantee construction project completion.

- Bonds to ensure performance: These bonds provide financial guarantees for project completion.

- Performance bonding insurance: This insurance covers risks associated with project performance.

- Define construction performance bond: A construction performance bond ensures that construction projects are completed as per the contract.

- Performance bond definition law: Legal definitions outline the terms and enforcement of performance bonds.

- Performance bond execution: The process of enforcing the terms of a performance bond if the contractor defaults.

- GC performance bond: General contractors use these bonds to guarantee their performance on projects.

- Performance bond explained: Performance bonds guarantee that contractors will fulfill their contractual obligations.

- Construction performance bond requirements: These requirements outline what is needed to secure a performance bond for construction.

- Performance bond extension: Extending a performance bond prolongs its validity to cover additional project time.

- 2 performance bond definition: This likely refers to a secondary or additional performance bond for project assurance.

- Who pays for construction payment performance bond: Typically, the contractor pays for the performance bond.

- Performance bonds for construction projects: These bonds guarantee that construction projects are completed according to the contract.

- Define contract performance bond: This bond guarantees that the contractor will perform according to the contract terms.

- Performance bonds for residential construction: These bonds ensure that residential construction projects are completed as per the contract.

- 10 percent performance bond: This bond guarantees 10 percent of the project value for performance assurance.

- Performance bonds how do they work: They work by providing financial guarantees that the contractor will fulfill their obligations.

- Performance bond for: This bond guarantees project completion and fulfillment of contractual obligations.

- Performance bonds insurance definition: These bonds provide insurance coverage to ensure project completion.

- Define initial performance bond: The initial performance bond is the first bond secured for a project to guarantee its completion.

- Performance bonds means: They are financial instruments that guarantee project completion.

- Construction performance bond insurance: This insurance provides coverage to guarantee construction project completion.

- Performance bonds total outstanding: This refers to the total amount of active performance bonds.

- Performance bond for contractor: Contractors secure these bonds to guarantee their performance on projects.

- Performance company bond: Companies use these bonds to guarantee their performance on contracts.

- Performance bond for equipment purchase: This bond guarantees that the purchase and delivery of equipment will be completed.

- Homeowner performance bond on contractor: Homeowners use these bonds to ensure contractors complete home improvement projects.

- Performance bond for home improvement contract: This bond guarantees the completion of home improvement projects.

- Performance guarantee bond definition: This bond guarantees the performance of the contractor as per the contract.

- Performance bond for private construction: These bonds ensure that private construction projects are completed according to the contract.

- How do performance bond work: They provide a financial guarantee that the contractor will fulfill their obligations.

- Performance bond for private contracts: These bonds ensure that private contracts are completed as per the terms.

- Performance is guarantee bond: This bond guarantees the performance of the contractor.

- Performance bond for professional services: These bonds guarantee that professional services will be performed as per the contract.

- Performance payment bond development: This bond covers both the performance and payment aspects of a development project.

- Define performance bond guarantee: This bond guarantees that the contractor will fulfill their performance obligations.

- Performance security bond construction: This bond ensures that construction projects are completed according to the contract.

- Construction law who pays for payment performance bond: Typically, the contractor pays for the performance bond as required by construction law.

- Performance security surety bond: This bond provides financial security to guarantee project completion.

- Performance bond form definition: The form defines the terms and conditions of the performance bond.

- Cash performance bond meaning: A cash performance bond is a deposit that guarantees project completion.

- Performance bond government contract: These bonds ensure that government contracts are completed as per the terms.

- How does performance bonds work: They provide financial guarantees that the contractor will fulfill their obligations.

- Definition of performance bond: A performance bond is a surety bond that guarantees the contractor will complete the project.

- How long coverage under performance bond: Coverage typically lasts until the project is completed and all obligations are met.

- Performance bond guarantee definition: This bond guarantees that the contractor will fulfill their contractual obligations.

- Performance vs construction bond: Performance bonds guarantee project completion, while construction bonds cover broader risks.

- Performance bond guarantee insurance: This insurance provides a financial guarantee for project completion.

- Bank performance bond definition: A bank performance bond is a financial guarantee provided by a bank to ensure project completion.

- Construction performance bonding: This process involves securing bonds to guarantee construction project completion.

- Performance bond how does it work: It provides a financial guarantee that the contractor will complete the project as per the contract.

- President of contractor and performance bond: The president of a contracting company may be involved in securing and managing performance bonds.

- Building contract performance bond: This bond ensures that building contracts are completed according to the terms.

- Project performance bond explained: This bond guarantees that a project will be completed according to the contract.

- Construction performance bonds insurance: This insurance covers risks associated with performance bonds in construction.

- Public performance bond: These bonds are used for public projects to ensure completion according to the contract.

- Developers performance bond: Developers use these bonds to guarantee the completion of development projects.

- Real estate performance bond: These bonds ensure that real estate projects are completed as per the contract.

- Developers performance bond explanation: This bond guarantees that developers will complete their projects according to the terms.

- Requirements for performance bond: Requirements typically include financial assessments and underwriting to secure the bond.

- Performance bond insurance policy: This policy provides coverage for the performance bond to ensure project completion.

- Responsibility of performance bond: The responsibility lies with the contractor to fulfill the bond's obligations.

- Performance bond insurance wording: The wording specifies the terms and conditions of the performance bond insurance.

- Subcontractor performance bond example: An example would be a bond that ensures a subcontractor completes their portion of the project.

- Performance bond insurers: These are companies that provide performance bonds to contractors.

- Sureties performance bond: Surety companies provide these bonds to guarantee contractual performance.

- Performance bond issued after work begins: Typically, bonds are issued before work begins, but in some cases, they may be issued after.

- Contract performance bond provider: Surety companies are the primary providers of contract performance bonds.

- Performance bond issuer: The issuer is typically an insurance or surety company that guarantees the bond.

- Construction contract performance bond: This bond ensures that construction contracts are completed according to the terms.

- Performance bond IT: In IT projects, performance bonds guarantee that the contractor will complete the project.

- Industry standard performance bond: These bonds follow industry standards to guarantee project completion.

- Display of performance bond: This involves showing proof that a performance bond has been secured for the project.

- Trade performance bond: These bonds ensure that trade agreements and contracts are fulfilled.

- Performance bond legal definition: The legal definition outlines the terms and enforcement of the performance bond.

- US Treasury performance bonds: These bonds are issued by the US Treasury to guarantee contractual performance.

- Performance bond line: This refers to the credit line or capacity available for issuing performance bonds.

- Construction contractor performance bond: Contractors in construction use these bonds to guarantee their project performance.

- Building contractor performance bond: These bonds ensure that building contractors complete their projects according to the contract.

- What are vendor performance bonds: Vendor performance bonds guarantee that vendors will fulfill their contractual obligations.

- Performance bond means: Performance bonds are financial instruments that guarantee project completion.

- What happens when performance bond is called: The surety company steps in to cover the costs of completing the project if the bond is called.

- Performance bond money definition: The money guaranteed by the performance bond is used to ensure project completion.

- What is initial performance bond: The initial performance bond is the first bond secured to guarantee project completion.

- Performance bond number: This is a unique identifier for the performance bond issued for a project.

- Insurance company performance bond: Insurance companies provide performance bonds to guarantee project completion.

- Performance bond obligations surety: The surety is obligated to ensure the contractor fulfills their performance bond obligations.

- Contract performance guarantee bond: This bond guarantees that the contractor will meet their contractual performance obligations.

- Performance bond obtained: Contractors obtain performance bonds to guarantee their project performance.

- What is performance bonding: Performance bonding involves securing a bond to guarantee project completion.

- Performance bond parties: The parties involved are typically the contractor, the project owner, and the surety company.

- What is performance security bond: This bond provides financial security to guarantee the completion of a project.

- Performance bond practical completion: This refers to the stage when the project is practically complete as per the contract.

- What is the definition of performance bond: A performance bond guarantees that a contractor will complete a project as specified.

- Performance bond principal: The principal is the party (usually the contractor) who is required to perform the contract.

- When are payment and performance bonds required: They are typically required before the commencement of the project to ensure completion and payment.

- Performance bond principal definition: The principal is the contractor who must perform the contractual obligations guaranteed by the bond.

- Insurance performance bond definition: This bond provides insurance coverage to guarantee project completion.

- Performance bond process: The process involves securing a bond to guarantee the contractor's performance.

- When is performance bond required: It is required before the project starts to ensure the contractor will meet their obligations.

- Performance bond purpose: The purpose is to guarantee the completion of a project according to the contract.

- When to include performance bonds: Performance bonds should be included in contracts to mitigate risks and ensure project completion.

- Do contractors get their money back on performance bonds: Contractors do not get their money back, as the bond is a financial guarantee rather than a refundable deposit.

- Who are performance bonds made payable to: They are typically made payable to the project owner or obligee to ensure contract fulfillment.