ERISA Bond – Protecting an Employee Benefit Plan

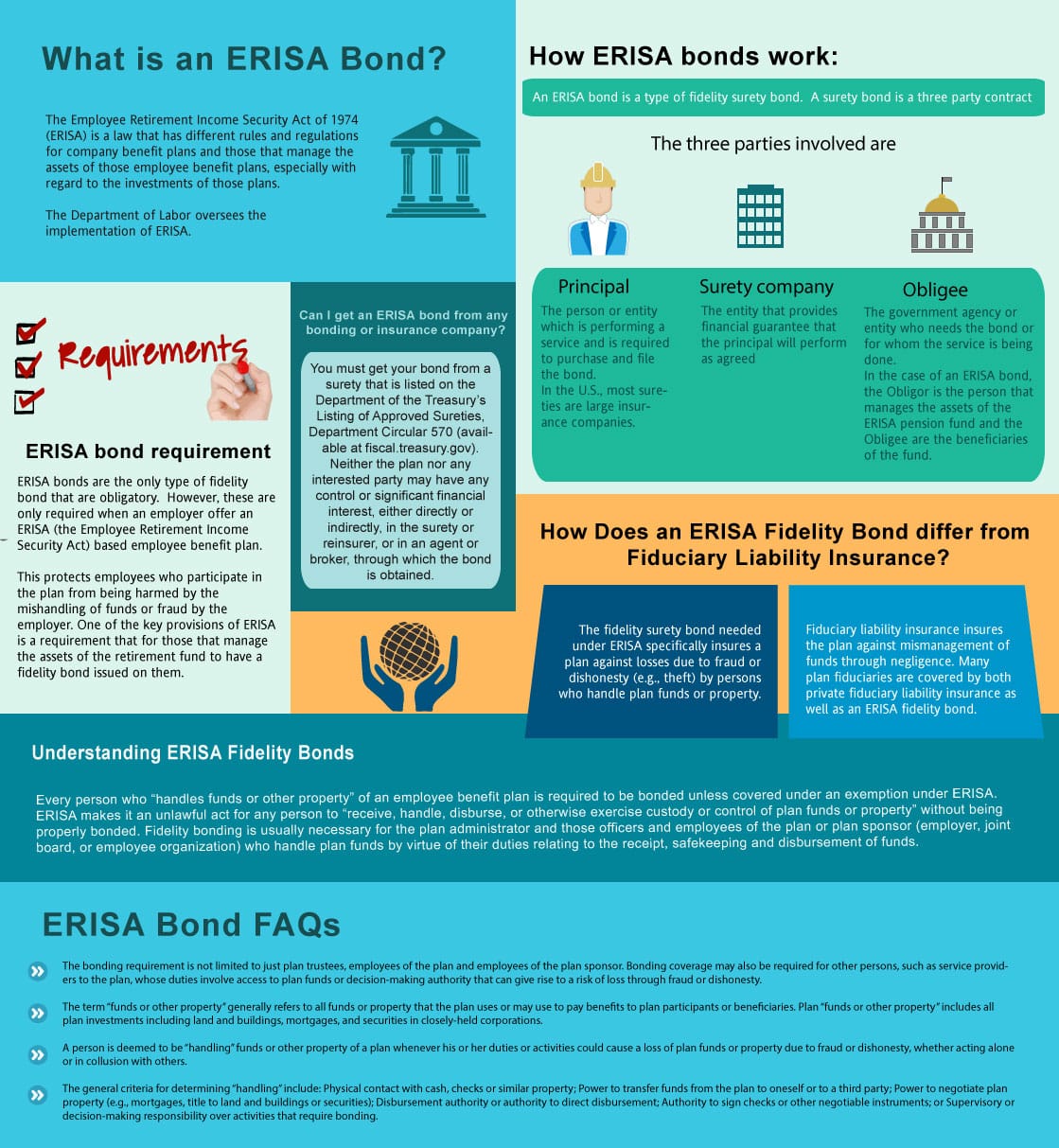

The Employee Retirement Income Security Act of 1974 (ERISA) is a law that has different rules and regulations for company benefit plans and those that manage the assets of those employee benefit plans, especially with regard to the investments of those plans. ERISA bonds are an integral component of the company's services in extending the right retirement plans for its employees. These bonds, required by the Employee Retirement Income Security Act (ERISA) of 1974, offer a layer of security to protect the plan from losses due to fraud or dishonesty. There are various types of ERISA bonds, including fidelity bonds, fiduciary liability insurance, and crime insurance.

The requirements for ERISA bonds can vary depending on the intricacy and complexity of the employee benefit plan. Broker services play a significant role in ensuring anyone who handles plan funds or other property is appropriately covered by a fidelity bond. In addition, fiduciaries who hold discretionary power over the plan's assets must also hold a fiduciary liability insurance policy. Crime insurance is another kind of ERISA bond that provides a safety net against losses stemming from theft or fraud by third parties. It is paramount to understand the prerequisites for each type of bond to ensure compliance with ERISA stipulations.

ERISA Fidelity Bond Quote

| Federal ERISA Bond |   |

ERISA Compliance

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for retirement and health benefit plans in private industry to provide protection for individuals in these plans. Compliance with ERISA is crucial for plan sponsors and fiduciaries, as it ensures the integrity and security of employee benefit plans. ERISA compliance involves adhering to various provisions, including fiduciary responsibilities, reporting and disclosure requirements, and participation and vesting standards. Non-compliance can result in significant penalties and legal consequences. To maintain compliance, plan administrators must be diligent in their oversight and management of benefit plans, ensuring that all activities align with ERISA's stringent requirements.

ERISA Fidelity Bond Requirements

One of the critical components of ERISA compliance is the fidelity bond requirement. ERISA mandates that every person handling funds or other property of an employee benefit plan must be bonded. This ERISA fidelity bond is designed to protect the plan against losses caused by acts of fraud or dishonesty. The minimum bond amount is generally 10% of the amount of funds handled, with a minimum bond of $1,000 and a maximum of $500,000 per plan (or $1 million for plans that hold employer securities). The fidelity bond must be issued by a surety company or reinsurer that is named on the Department of the Treasury’s Listing of Approved Sureties. Ensuring the correct bond amount and securing it from an approved provider are crucial steps in meeting ERISA’s fidelity bond requirements.

ERISA Plan

An ERISA plan refers to any employee benefit plan established or maintained by an employer or employee organization that provides retirement income or other welfare benefits to employees. These plans include defined benefit plans, defined contribution plans, and various types of welfare plans such as health insurance, life insurance, and disability insurance. ERISA plans are designed to provide financial security and healthcare benefits to employees, ensuring that their needs are met during and after their employment. The management and operation of these plans must comply with ERISA standards, which include providing participants with plan information, establishing a claims and appeals process, and upholding fiduciary duties to act in the best interests of the plan participants.

ERISA Regulations

ERISA regulations are comprehensive and detailed, providing the framework within which employee benefit plans must operate. These regulations cover a wide range of areas including fiduciary responsibilities, reporting and disclosure requirements, and participation and vesting standards. Fiduciaries are required to act prudently and in the best interest of the plan participants and beneficiaries. They must diversify plan investments to minimize the risk of large losses and follow the plan documents insofar as they comply with ERISA. The regulations also require that plans provide participants with important information about plan features and funding, and ensure that plan participants have a process to claim benefits and appeal denied claims. Adherence to ERISA regulations is essential for maintaining the integrity and reliability of employee benefit plans.

ERISA Section 412

ERISA Section 412 specifically addresses the bonding requirement for fiduciaries and other individuals who handle plan funds. This section mandates that every fiduciary of an employee benefit plan and every person who handles funds or other property of such a plan must be bonded. The bond is intended to protect the plan against losses due to fraud or dishonesty by the bonded individuals. The required bond amount must be at least 10% of the amount of the funds handled, with a minimum bond of $1,000 and a maximum of $500,000 per plan (or $1 million for plans that hold employer securities). The bond must be obtained from a surety or reinsurer that is approved by the Department of the Treasury. Compliance with Section 412 is a critical aspect of fiduciary responsibility under ERISA.

ERISA Title I

ERISA Title I sets forth the basic regulatory framework for employee benefit plans. This title establishes the minimum standards for participation, vesting, benefit accrual, and funding. It also outlines the fiduciary responsibilities of those who manage and control plan assets. Title I requires plans to provide participants with important information about plan features and funding, and it establishes a claims process for participants to receive their benefits. Additionally, Title I includes provisions for the enforcement of fiduciary standards, allowing participants to sue for benefits and breaches of fiduciary duty. Ensuring compliance with Title I is essential for protecting the rights and benefits of plan participants and for maintaining the integrity of employee benefit plans.

Pension Benefit Guaranty Corporation (PBGC)

The Pension Benefit Guaranty Corporation (PBGC) is a federal agency created by ERISA to protect the retirement incomes of American workers in private-sector defined benefit pension plans. PBGC ensures that participants in these plans receive their vested benefits if their plans terminate without sufficient assets to pay all benefits. The agency operates two insurance programs: the single-employer program and the multiemployer program. The single-employer program covers plans sponsored by individual companies, while the multiemployer program covers collectively bargained plans sponsored by multiple employers. PBGC is funded by insurance premiums paid by plan sponsors, as well as by the assets and recoveries from failed plans. The agency plays a critical role in the ERISA framework, providing a safety net for millions of American workers and retirees.

Benefits of ERISA Bonds

ERISA bonds offer a range of benefits to employers and plan sponsors. Here are some of the most important ones:

- Protection Against Fraud and Dishonesty

A key benefit of ERISA bonds lies in their protection against fraud and dishonesty. They ensure that every fiduciary of an employee benefit plan and every person who handles funds or other property of the plan is bonded. Consequently, if an employee or other plan participant contravenes the codes and steals or misuses plan funds, the bond will cover the loss, up to the amount of the bond. ERISA bonds, therefore, play a significant role in safeguarding plan participants against financial losses arising from fraudulent or dishonest actions.

- Compliance with Federal Law

Another important benefit of ERISA bonds is that they help employers and plan sponsors comply with federal law. ERISA necessitates that employee benefit plans be bonded to shield plan participants from losses due to fraud or dishonesty. Failure to adhere to this requirement can invite severe penalties and legal liability. Thus, obtaining an ERISA bond enables employers and plan sponsors to comply with federal law and stave off the chance of penalties and legal action.

- Financial Security for Plan Participants

Lastly, ERISA bonds also offer financial security for plan participants. They protect the assets against fraud and dishonesty, ensuring a safety net for the retirement savings of the participants. This coverage provides a sense of peace to the plan participants, knowing their savings are secure, and they are less likely to encounter financial losses due to fraudulent or dishonest behaviour.

Overall, ERISA bonds offer a range of important benefits to employers, plan sponsors, and plan participants. By providing protection against fraud and dishonesty, ensuring compliance with federal law, and providing financial security for plan participants, ERISA bonds help to ensure the integrity and stability of employee benefit plans. These vital protections include fidelity bond coverage, which is one of the key fidelity bond requirements under ERISA, helping to safeguard the content of the plan's assets.

ERISA bonds are an essential requirement for employee benefit plans. They protect the plan from losses due to fraud or dishonest acts committed by plan fiduciaries, and ensure the reliable distribution of funds to participants. The cost of ERISA bonds varies depending on several factors. In this section, we will discuss the premium rates, factors influencing cost, and ways to reduce the cost of ERISA bonds, including a thorough audit of the plan's financial practices.

Cost of ERISA Bonds

The premium rates for ERISA bonds are typically 0.1% to 1% of the bond amount. For example, if the bond amount is $100,000, the premium rate may range from $100 to $1,000. The actual rate depends on the surety company, the bond amount, and the risk involved, sometimes informed by an audit of the plan's accounts.

- Premium Rates

Ways to Reduce Cost

- Factors Influencing Cost

- Several factors influence the cost of ERISA bonds. The primary factor is the bond amount. The higher the bond amount, the higher the premium rate. Other factors that may affect the cost include:

- The type of plan: Some types of plans, such as those that hold employer securities, may require a higher bond amount, resulting in a higher premium rate.

- The number of fiduciaries covered: A bond covering more than one fiduciary may require a higher bond amount, resulting in a higher premium rate.

- The fiduciaries' experience and qualifications: Fiduciaries with a history of fraud or dishonesty may increase the risk and, therefore, the premium rate.

ERISA bonds are an essential requirement for employee benefit plans. The cost of ERISA bonds varies depending on several factors, including the bond amount, type of plan, and number of fiduciaries covered. Employers can reduce the cost by shopping around, improving fiduciary qualifications, and increasing the deductible amount. By obtaining an endorsement that modifies or enhances coverage, employers can often secure more favorable bond terms.

- Employers can take several steps to reduce the cost of ERISA bonds. These include:

- Shop around: Employers should compare premium rates from different surety companies to find the best deal.

- Improve fiduciary qualifications: Employers can reduce the risk by ensuring that their fiduciaries have the necessary experience and qualifications to manage the plan.

- Increase deductible: Employers can reduce the premium rate by increasing the deductible amount. This means that the employer will pay a certain amount of the loss before the bond coverage kicks in.

Performance bond – Sample document of a performance bond on a white-colored paper. The contents of this document are often paramount during audits.

ERISA Bond Facts

An ERISA bond is a type of surety bond that is required by the Employee Retirement Income Security Act (ERISA) of 1974.

- The purpose of the ERISA bond is to protect employee benefit plans from misappropriation of funds by plan fiduciaries.

The ERISA bond must be purchased from a surety company that is licensed to do business in the state where the plan is located.

- The amount of the ERISA bond must be at least 10% of the plan’s total assets, up to a maximum of $500,000.

- The ERISA bond must be renewed annually and the surety company must be notified of any changes to the plan’s assets.

- The ERISA bond does not provide coverage for any liability or losses incurred by the plan.

- The ERISA bond does not cover any claims made by the plan’s participants or beneficiaries.

The bonding requirement is not limited to just plan trustees, employees of the plan and employees of the plan sponsor. Bonding coverage may also be required for other persons, such as service providers to the plan, whose duties involve access to plan funds or decision-making authority that can give rise to a risk of loss through fraud or dishonesty. Where a plan administrator, service provider, or other person who must be bonded is an entity, such as a corporation or association, ERISA’s bonding requirements apply to the natural persons or person who “handles” the funds.

The term “funds or other property” generally refers to all funds or property that the plan uses or may use to pay benefits to plan participants or beneficiaries. Plan “funds or other property” includes all plan investments including land and buildings, mortgages, and securities in closely-held corporations. It also includes contributions from any source, such as employers, employees, and employee organizations that are received by the plan, and cash, checks and other property held for the purpose of making distributions to plan participants or beneficiaries. A person is deemed to be “handling” funds or other property of a plan whenever his or her duties or activities could cause a loss of plan funds or property due to fraud or dishonesty, whether acting alone or in collusion with others. The general criteria for determining “handling” include: Physical contact with cash, checks or similar property; Power to transfer funds from the plan to oneself or to a third party; Power to negotiate plan property (e.g., mortgages, title to land and buildings or securities); Disbursement authority or authority to direct disbursement; Authority to sign checks or other negotiable instruments; or Supervisory or decision-making responsibility over activities that require bonding.

Some Interesting Statistics on ERISA Bonds:

1. The Employee Retirement Income Security Act (ERISA) requires employers to purchase ERISA bonds to protect employee benefit plans from fraud or mismanagement.

2. The ERISA bond must be in the amount of 10% of the plan’s assets, up to a maximum of $500,000.

3. According to the U.S. Department of Labor, there are over 690,000 ERISA-covered plans in the United States, with total assets of over $7.3 trillion.

4. As of 2019, the average ERISA bond cost was approximately $1,500 per year.

5. The most common type of ERISA bond is a fidelity bond, which is designed to protect employers from employee dishonesty.

6. Approximately 82% of ERISA-covered plans are self-insured, meaning they are not covered by an insurance company.