Get An Instant Quote on Acworth, GA – Land Development Performance Bond Now

Introduction

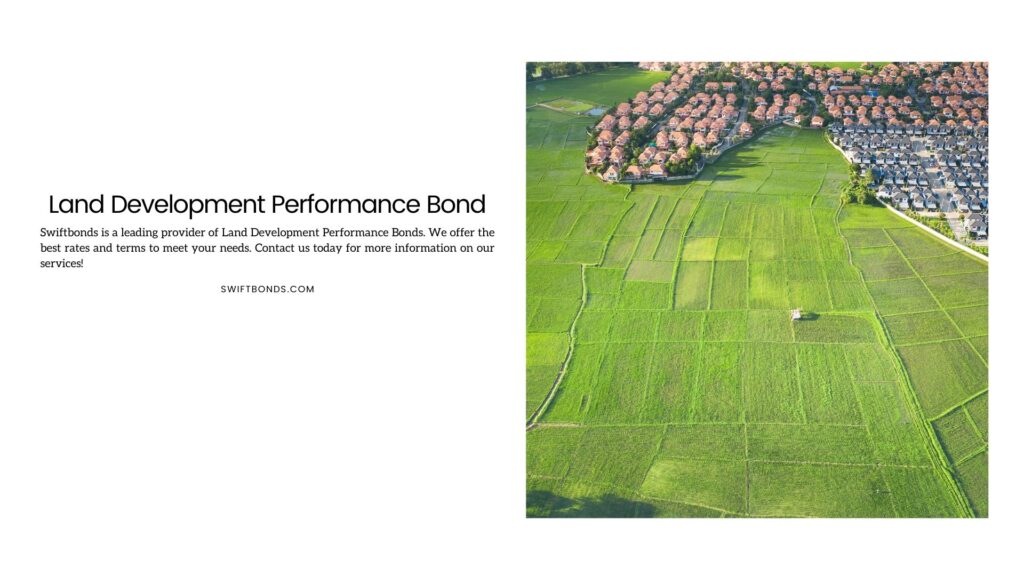

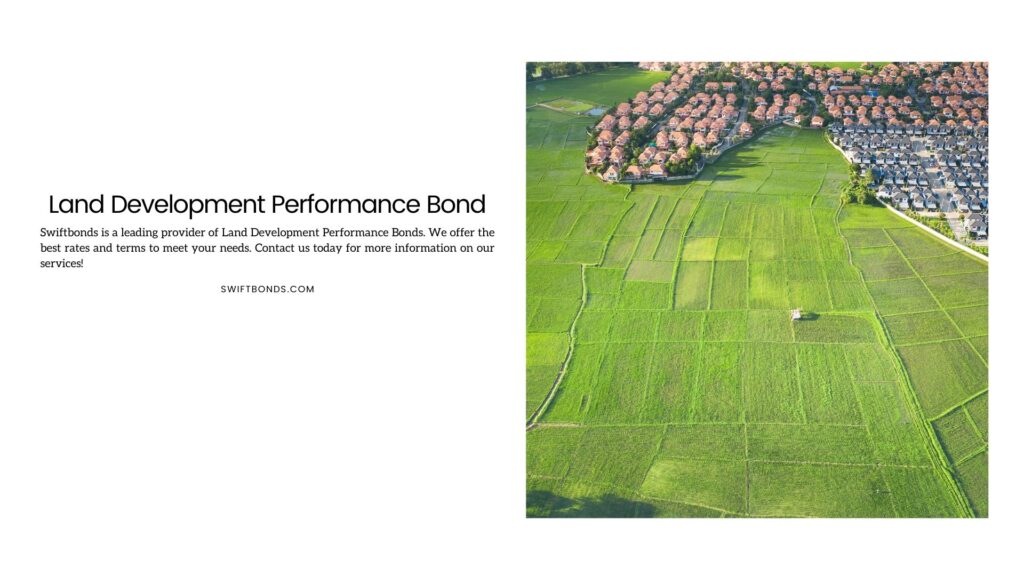

In Acworth, Georgia, the process of land development involves numerous steps and considerations to ensure that new developments meet regulatory standards and contribute positively to the community. As part of this process, developers may be required to obtain a Land Development Performance Bond. This bond serves as a financial guarantee, ensuring that developers fulfill their obligations related to infrastructure improvements and site development as outlined in approved plans. Understanding the purpose and implications of this bond is essential for developers and local authorities in Acworth.

Promoting Responsible Development

Land development projects have the potential to significantly impact communities, affecting everything from traffic flow to environmental sustainability. The Land Development Performance Bond plays a crucial role in promoting responsible development by holding developers accountable for their actions. By requiring bonding, Acworth ensures that developers adhere to approved plans and regulatory requirements, mitigating potential negative impacts on the community and safeguarding the long-term interests of residents.

Protecting Public Investments

Infrastructure improvements associated with land development projects often involve substantial investments of public funds. The Land Development Performance Bond provides an added layer of protection for these investments by ensuring that developers complete required improvements in a timely and satisfactory manner. In the event of developer default or non-compliance, the bond provides financial recourse for local authorities, helping to offset the costs of completing unfinished infrastructure work and protecting taxpayer dollars.

Fostering Community Trust

Effective land development requires collaboration and trust between developers, local authorities, and residents. The Land Development Performance Bond fosters community trust by ensuring that developers fulfill their obligations and deliver on their promises. By requiring bonding, Acworth demonstrates its commitment to responsible growth and development, instilling confidence in residents that new developments will enhance rather than detract from the community's quality of life.

Conclusion

The Acworth, GA – Land Development Performance Bond plays a vital role in ensuring that land development projects in Acworth adhere to approved plans and regulatory standards, ultimately contributing to the city's responsible growth and development. By understanding the purpose and significance of this bond, developers and local authorities can work together to create vibrant, sustainable communities that benefit residents for generations to come.

What is the Acworth, GA – Land Development Performance Bond?

The Acworth, GA – Land Development Performance Bond is a regulatory requirement imposed on developers undertaking land development projects within the city limits of Acworth, Georgia. This bond acts as a form of assurance, ensuring that developers complete required infrastructure improvements and site development in accordance with approved plans and regulatory standards. By obtaining this bond, developers demonstrate their financial responsibility and commitment to fulfilling their obligations, ultimately contributing to the responsible growth and development of Acworth.

Frequently Asked Questions

Can the Acworth, GA – Land Development Performance Bond cover liabilities arising from delays or disruptions in development projects caused by unforeseen environmental factors or natural disasters?

While the primary purpose of the bond is to ensure that developers fulfill their obligations related to infrastructure improvements and site development, questions may arise about its coverage for delays or disruptions caused by environmental factors or natural disasters. If unforeseen events such as soil contamination or severe weather events occur during the development process, resulting in project delays or additional costs, affected parties may seek recourse through the bond. However, the bond's applicability to such liabilities may depend on factors such as the terms of the bond agreement and the extent of the disruptions. Resolving disputes over coverage for environmental factors or natural disasters may require technical assessments and legal interpretation, involving coordination between developers, local authorities, and bonding authorities.

Are there provisions for extending the coverage of the Acworth, GA – Land Development Performance Bond for developers undertaking projects with innovative or experimental design features that may require specialized expertise or materials?

Some developers may undertake projects with innovative or experimental design features that push the boundaries of conventional construction practices. In such cases, extending the bond's coverage to encompass these projects may be necessary to ensure comprehensive protection for both developers and the community. However, determining the appropriate coverage for innovative design features may require technical evaluations and regulatory approvals, involving coordination between developers and bonding authorities to address any potential risks or uncertainties.

How does the Acworth, GA – Land Development Performance Bond address liabilities resulting from disputes over the interpretation or enforcement of zoning regulations or land use restrictions affecting development projects?

Disputes over the interpretation or enforcement of zoning regulations or land use restrictions may arise between developers, local authorities, and affected stakeholders, leading to potential financial liabilities or legal disputes. In such instances, the Acworth, GA – Land Development Performance Bond serves as a form of protection for all parties involved. Developers and local authorities can rely on the bond to seek compensation for financial harm resulting from disputes over zoning regulations or land use restrictions, ensuring fair resolution and upholding the integrity of land development processes in Acworth. Understanding the bond's role in mitigating liabilities underscores its importance in maintaining trust and accountability within the community.