You can now apply online for a Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

How can you release a Performance Bond?

To get your money, call the bonding company that arranged it for you. Fill out and return their form so they know to cancel any residual obligations on your behalf. You will still owe them some fees when this is done (usually through an escrow account), but at least now there won’t be anything stopping anyone from paying those fees!

If you're looking for a performance bond release, we can help.

Performance bond insurance is often required by clients to ensure that the contractor will complete their work on time and within budget. Payment and performance bonds are often required in both public and private construction projects to ensure financial security and contract fulfillment. When the contract is completed, it’s important to know how to get your money back from the client.

Swiftbonds provides professional advice on how to be released from a performance bond so you don’t have any worries about getting paid at the end of a project.

Understanding Performance Bonds

A performance bond is a type of surety bond that guarantees a contractor will satisfactorily complete a construction project according to the terms of the contract. It provides financial assurance to the project owner that the contractor will meet their obligations, including completing the project on time, within budget, and to the required standards. Performance bonds are commonly required on public construction projects funded by government agencies, as well as on large-scale private projects.

When can you release a performance bond?

Generally, as with any construction guarantee agreement, if there is no stated discharge date or making good any defects clause in your contract then you should expect to wait until after practical completion of works before receiving payment. In addition to performance bonds, a payment bond may also be required to ensure that all subcontractors and suppliers are paid. Find a How does Plumbing service Performance Bond work?

Who issues a performance bond?

A performance bond, also known as a contract bond, is a issued by an insurance company or bank to guarantee satisfactory completion of the project. The term can denote collateral that secures futures contracts - commonly referred to as margin.

Can a performance bond be Cancelled?

A performance bond cannot be cancelled by any means. Before a performance bond can be cancelled, certain performance bond requirements must be met, including the completion of the project and fulfillment of all contractual obligations. It is required for a number of reasons, and the obligee has to find out why their principal needs it before they can cancel it. Need a How does Payment and Performance Bond work?

Discover what happens once you've approved for a construction bond and unlock the pathway to realizing your project's full potential today!

Do you get your performance bond money back?

If a person or business violates the contract of a bond, they are unlikely to receive any funds for that particular payment. Payment bonds are also crucial in ensuring that subcontractors and suppliers are paid, protecting project owners from financial risks. If an obligee fails to complete their end of the deal as agreed upon by both parties, then it is likely that this will fall on the surety and not them.

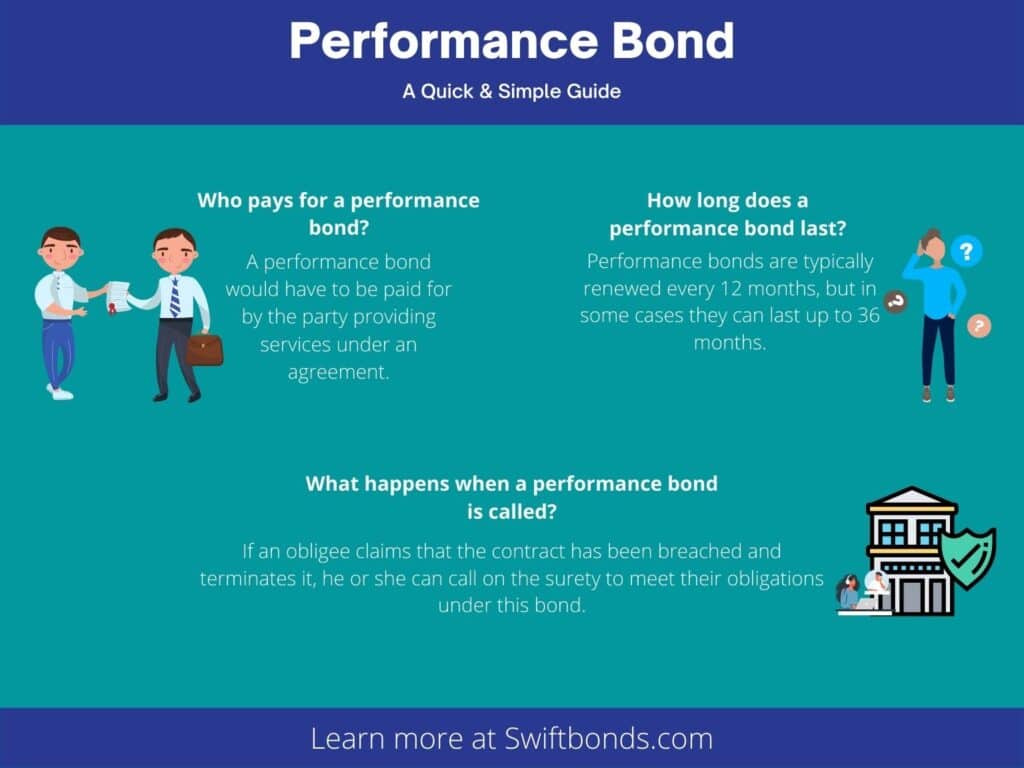

What happens when a performance bond is called?

A performance bond provides assurance that the obligee will be protected if the principal fails to perform. When a performance bond claim is made, the surety company will investigate the claim to determine its validity and take appropriate action. If they call on their surety for help with meeting obligations, then it can provide financial backing so that both parties in a contract are satisfied and have been given adequate protection.

How does a performance bond work?

So, how does a performance surety bond work? A performance surety bond is issued by one party to contract the other as an assurance against them failing their obligations under the agreement or delivering on the level of standards in place. Read a How does a Performance Bond work in Construction?

It is important to have a performance bond before you can proceed with your new construction project. Surety companies assess the risk and determine the cost of performance bonds based on various factors, including the contractor's financial stability and project scope. Interest rates and the amount of money required for this type of protection are influenced by risk, so make sure that you’ve considered these factors when deciding on pricing.

How long is a bond good for?

There are many different types of bonds, and some don't have renewal periods. If you're looking for a bond that renews every year or two, be sure to double-check the details before purchasing!

What happens when a performance bond expires?

Performance bonds expire when the contract expires. However, a performance bond cannot be renewed or changed by the changes in contracts. They are only good for one use and will not affect any future contracts with that client if it expires before its time has come to an end.

What does a performance bond cover?

Performance bonds provide a safety net to ensure that contractors fulfill their obligations should they be unable to deliver the project. Here's a How do you set a Performance Bond amount.

Be sure to check out more at Swiftbonds.com

Claiming Against a Performance Bond

If a contractor fails to meet their contractual obligations, the project owner can make a claim against the performance bond. To do so, the owner must provide documentation showing how the contractor has defaulted on their obligations, including failure to complete the project on time, failure to meet quality standards, or abandonment of the project. The surety company will then investigate the claim and take action to resolve the issue, which may include hiring a replacement contractor to complete the project or providing financial compensation to the owner.

Factors Affecting Release

The release of a performance bond is typically dependent on the completion of the project and the satisfaction of the project owner. The surety company may retain a small percentage of the bond value to cover any warranty obligations by the contractor after substantial completion. The release of the bond may also be affected by factors such as changes to the project scope, delays, or disputes between the contractor and the project owner.

Importance of Performance Bonds

Performance bonds play a vital role in the construction industry by providing financial security and minimizing risk for project owners. They ensure that contractors are held accountable for their work and that projects are completed to the required standards. Performance bonds also provide a level of protection for subcontractors and suppliers, as they guarantee payment for work completed and materials supplied. By requiring performance bonds, project owners can reduce the risk of contractor default and ensure that their projects are completed on time, within budget, and to the required quality standards.