You can now apply online for a Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

How do you price a Performance Bond?

The cost of a surety performance bond usually is less than 3% of the contract fee. However, if the debt is under $1 million, then it may run between 2%. Bonds can be even more costly depending on how credit-worthy your contractor is.

Do you need a performance bond?

Swiftbonds is the leading provider of performance bonds. We offer competitive rates and fast service, so that you can get back to your business as quickly as possible.

If you are looking for a reliable company with decades of experience in this field, then look no further than Swiftbonds! Contact us today!

How does a performance bond work?

A performance bond surety is issued by one party to contract to the other. It’s meant as a sort of insurance policy, in case either side doesn’t uphold their obligations under an agreement or fails to deliver on what was promised at the beginning.

What is a performance bond in construction?

The performance bond in construction is an arrangement to provide financial security for the employer if a contractor fails to perform its obligations. This provides peace of mind because it ensures that work will be completed on time and within budget, as well as providing protection against unforeseen events.

How do you fill out a performance bond?

You need to fill out a performance bond, but how? You write the name of the obligor on that line and for an amount. Sign it in front of someone who can attest you are indeed signing this document and have them notarize it as well.

Do you get your money back on a performance bond?

How do you get your money back on a performance bond? If you never submitted the bond to the Obligee/State and can send it back, then sometimes there will be some kind of refund. However if after cancelling before term 1 has passed or paying for renewal terms, this is when prorated refunds come in handy

Who issues a performance bond?

The typical performance bond issuer is a bank or an insurance company. Sellers are often required to provide one in order to reassure buyers if the commodity being sold does not arrive as expected. Here’s Kansas Performance Bonds.

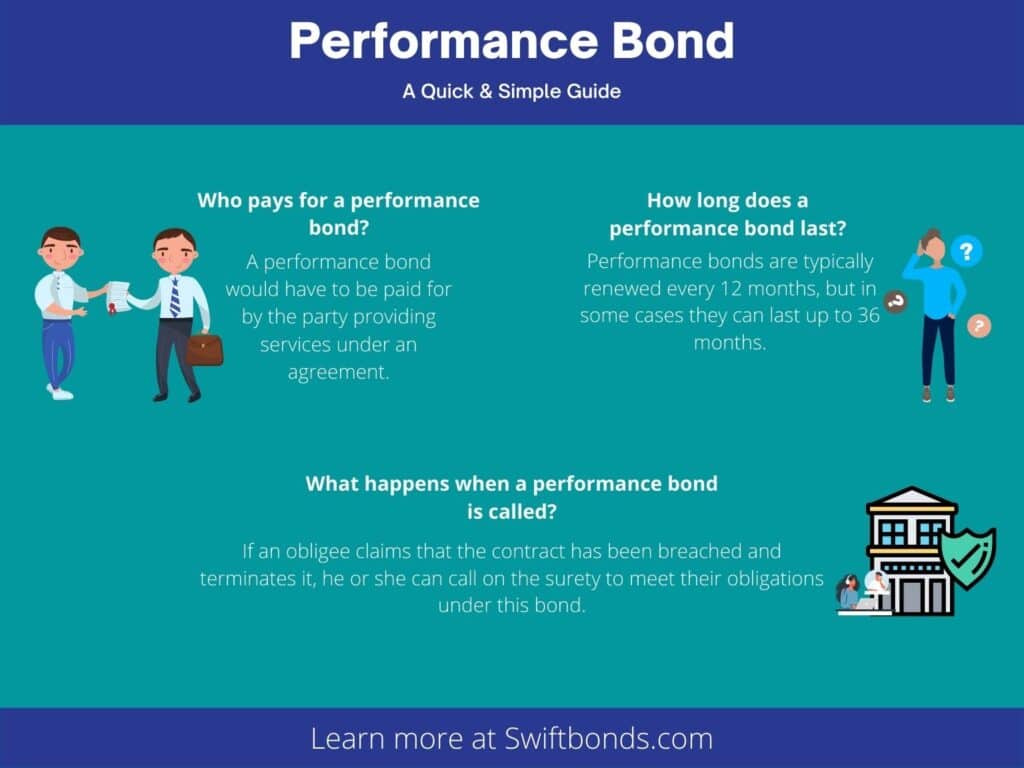

How long does a performance bond last?

Performance bonds are a type of surety bond. Performance bonds typically expire after one year, but not all performance bonding is equal and the duration can range from six months to two years or more depending on the project’s requirements.

Should I get a performance bond?

Performance bonds are a great option for companies that want to avoid potential legal battles. It’s the best way to ensure your company is safe and secure in any deals you make, while at the same time gaining new clients from bond issuers who see your company as marketable.

What are the three major types of construction bonds?

The three main types of construction surety contract bonds are bid, performance, and payment security bonds. Construction bond holders get paid when the contractor finishes a project or stops paying at all!

Who pays for a performance bond?

The process can be complicated and often the contractor is required to pay out of pocket. You’ll first need to obtain a bid bond before bidding on your project, then you must usually also cover some sort of premium with whatever amount they decide upon as well as interest rates (again depending on what risk level).

What happens when a performance bond is called?

A performance bond is like insurance. If the obligee declares that you are in default and terminates your contract, they can call on a surety to meet their obligations under the bonded contract.

Can a performance bond be Cancelled?

Unlike a car insurance policy, performance bonds can’t be cancelled just because you lost the policy receipt. Performance bonds are required by an obligee — like a court or municipality that requires companies to carry them as condition of their license. See our Kentucky Performance Bonds.

Who pays bond cancellation?

Banks are now charging all bond sellers with a 90 day early termination charge if the seller wishes to cancel their contract before it’s term is complete. However, this has not been enforced by law and there have only been two cases where courts ruled in favor of banks that terminated bonds without penalty.

How much does it cost to cancel a bond?

What are the financial implications if I cancel my bond early? If you choose to get out of your property purchase before the first year or two, most banks and bond originators will charge a 1% penalty. That means that for every $1 in outstanding balance on the contract they would subtract an additional dollar from your sales price when it is time to sell.

How does a performance guarantee work?

A performance bond can be put in place to ensure that any costs incurred as a result of the contractor’s failure will not come out of your pocket. The surety company would then reimburse you, and hopefully get work done by another provider after they have been paid for their troubles!

What is a bonding rate?

A contract bond costs between 1% and 3% of the total amount. The size, experience, financial stability and reputation determine where on this range they fall at. Contractors that qualify for amounts up to $500K pay an average fee of 2%. Read our Louisiana Performance Bonds.

Where can I get a performance bond?

Performance bonds are usually issued by a bank or an insurance company. These companies act as “sureties” and provide the bond to guarantee that work will be completed on time, without any interruption in service from your contractors.

How do I get a performance bank guarantee?

To request a performance bank guarantee, the account holder contacts their bank and fills out an application that identifies the amount of and reasons for the assurance. Typical applications stipulate a specific period of time during which payment should be made or any special conditions regarding this process.

How are bond settlements calculated?

The process of calculating the amount is not complicated at all. First, you must add back any interest accrued on the clean price then multiply by face value to get your total payment. The number rounded off will be in krona and happen two business days after trade date- just as soon as it’s due!

What is the meaning of performance guarantee?

A Performance Guarantee is a contractor’s promise to complete the project undertaken. A bank or insurance company issues this guarantee on behalf of contractors, ensuring that they will perform as agreed in their contract with an employer. Get a Kansas Performance Bonds.

What is a reasonable guarantee fee?

A reasonable guarantee fee should be between 1 -2% of the outstanding loan balance. The amount changes yearly, and it also varies if your balance fluctuates from year to year.

What is a performance warranty?

It’s when the contractor guarantees some parts of your project for overall performance. In comparison to a materials and workmanship warranty, it assigns more responsibility on contractors and is usually longer.

Be sure to check out more at Swiftbonds.com