Apply online for a Performance Bond – it only takes three (3) minutes! (We timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

Definition and Purpose of a Performance Bond

A performance bond is a type of surety bond that guarantees a contractor will complete a project according to the terms outlined in a contract. The primary purpose of a performance bond is to protect the project owner from financial loss if the contractor fails to fulfill their obligations. This type of bond is commonly required for construction projects, ensuring that the contractor completes the work as specified. Additionally, performance bonds can be mandated for service contracts, providing similar assurances for non-construction-related services. By securing a performance bond, project owners can mitigate the risks associated with contractor defaults and ensure project completion.

Types of Performance Bonds

There are several types of performance bonds, each serving a specific purpose:

- Construction Performance Bonds: These bonds are essential for construction projects, guaranteeing that the contractor will complete the project according to the contract terms. They provide financial protection to the project owner if the contractor fails to deliver.

- Service Performance Bonds: Required for service contracts, these bonds ensure that the contractor will perform the service as agreed upon in the contract. They offer a safety net for project owners against non-performance.

- Payment and Performance Bonds: Combining the features of both payment bonds and performance bonds, these bonds guarantee that the contractor will complete the project and pay all subcontractors and suppliers. This dual protection is crucial for comprehensive project security.

- Bid Bonds: These bonds guarantee that a contractor will enter into a contract if awarded a bid. They are often a prerequisite for participating in the bidding process, ensuring that only serious and financially stable contractors are considered.

Performance bonds are often legally required for certain types of projects, such as government construction projects exceeding $100,000. They can also be customized to meet the specific needs of a project, with the cost of a performance bond varying based on the project’s scope and the contractor’s credit score. By understanding the different types of performance bonds, project owners can choose the right bond to secure their investments and ensure successful project completion.

How long is the validity of the Performance Bond?

The duration of a performance bond guarantee in construction varies. They can last until practical completion, or they could be terminated at the request of either party.

What is the coverage under performance bond?

A performance bond guarantees that if the company does not fulfill its obligations, it will pay damages to the other party in order to make up for any losses incurred as a result. If the contractor fails to fulfill their obligations, the project owner can file a performance bond claim to seek compensation.

If you want more information about this topic? We have all sorts of resources available for you!

here to learn more about performance and payment bond costs!

How long is your performance bond good for?

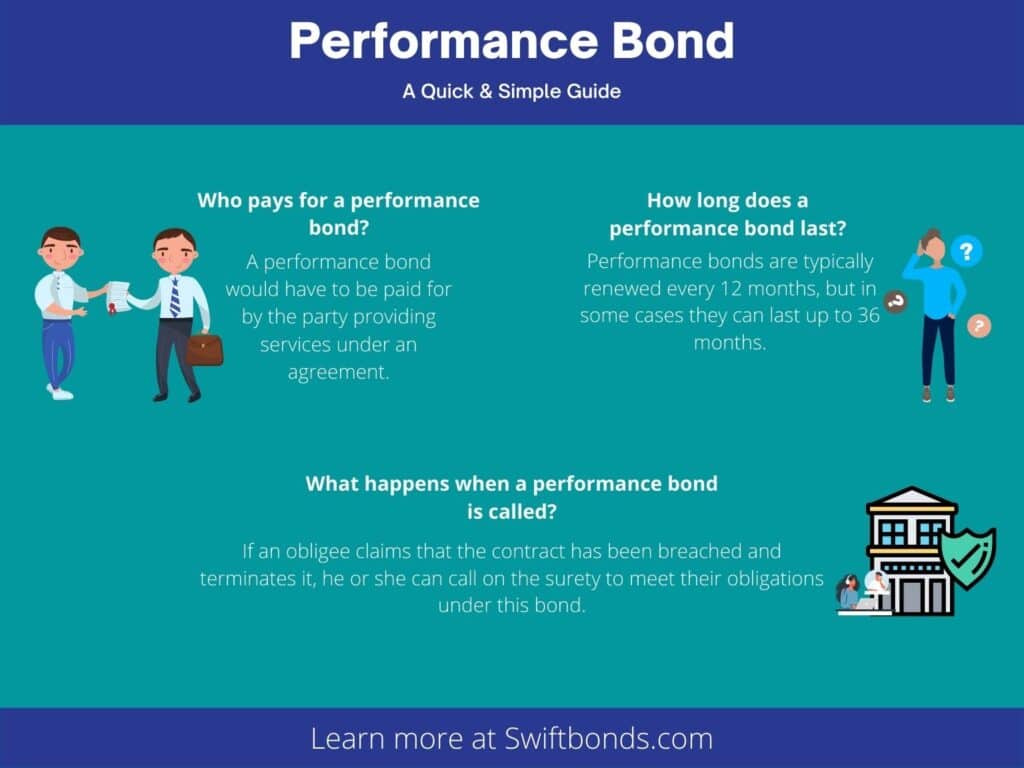

Performance bonds are usually good until the end of a year. But, it varies depending on what type and term you have purchased; sometimes they last two or three years! If that’s not right for you though there may be other options at renewal to reduce rates.

How does a bond work?

A performance bond is a contract security bond that guarantees one party to the other against failure or underperformance. To understand how performance bonds work, they serve as a financial guarantee ensuring contractors fulfill their contract obligations in construction projects. It’s issued by parties in contractual agreements as an assurance of fulfillment for both sides and can be used when initiating payment, establishing milestones, guaranteeing property ownership transfers, among many different purposes.

What happens when a performance bond is called?

A performance bond is a financial agreement that provides assurance to the obligee, who can declare contract default and terminate it if they’re not satisfied.

Why is a performance bond required?

Companies use performance bonds to make sure contractors have the financial backing necessary for completion. The bond amount affects the cost and the underwriting process of obtaining a performance bond, as higher bond amounts can complicate a contractor’s eligibility due to increased risk for the surety. This guarantees that a contractor will be able to complete designated projects on time and within budget, so it’s crucial they understand this bond before getting started.

What happens when a performance bond expires?

Performance bonds are not like other types of contracts, as they do not expire with the contract. As a result, when one expires you will still be liable for it even if your company has gone bankrupt or dissolved. Have a Oklahoma Performance Bonds.

What is a performance bond in tender?

In order to ensure that the contractor fulfils their contract obligations, a performance bond is required. The main purpose of this financial guarantee is so both parties are confident in each other’s ability and commitment for project completion.

Who does a performance bond protect?

A performance bond is a contract that protects the owner against possible losses in case of contractor failure to perform or inability to deliver as per established and agreed upon provisions. For Ohio Performance Bonds.

How do you collect on a performance bond?

What are some ways to collect on a performance bond? You can either get the money in cash, or you could ask for it by wire transfer.

Who issues a performance bond?

A performance bond is a surety bond issued by surety bond companies or banks to guarantee satisfactory completion of your project. These companies assess the financial and professional capability of contractors before issuing performance bonds, ensuring that contractors can fulfill their contractual obligations, particularly in government projects. The term can also be used when referring to the collateral deposit that secures a futures contract, which we know as margin.

Do you get your money back on a performance bond?

Sometimes if the original is submitted before its due date and it never gets returned, then there’s a chance that some or all of your funds will be refunded. Read about Pennsylvania Performance Bonds.

How much is a performance guarantee?

A performance bond ensures payment of a sum (not exceeding the stated maximum) in case you fail to fulfil your obligation. Usually, they cover 10-12% and replace bid bonds on contract award.

Is it hard to get a performance bond?

For most construction projects, you will first need to obtain a bid bond before bidding on the project. Only after winning the contract would you then be eligible for getting your performance bond approved and ready to start work within weeks of signing paperwork. This is not too complicated!

How does a performance guarantee work?

A performance bond ensures payment of a sum of money (not exceeding the agreed-upon maximum amount) in case the contractor fails to perform their job. Need a Rhode Island Performance Bonds.

How do I get a performance bank guarantee?

Getting a performance bank guarantee is an easy process! Simply contact your banking institution, fill out the application and identify how much you need guaranteed. They will then either give it to you or tell what needs to be added for them to approve your request.

Who pays for a performance guarantee?

The Owner/Employer of a project is responsible for any costs incurred should the Contractor default. This includes paying an agreed-upon performance guarantee to find a new contractor and complete their work on time.

How long is a Payment and Performance Bond good for?

The answer is usually one year, but the timeframe can depend on a few factors. Some bonds never need renewal because they cover such short spans of time; others may last for years or decades after purchase before requiring an upgrade.

You might be able to save money by upgrading at annual intervals instead of waiting until expiration–but it’s always best if you discuss this with your financial advisor first!

Do you need to know how long a Performance and Payment Bond lasts?

A Performance and Payment security Bond is an insurance policy that guarantees the performance of a contractor or subcontractor, as well as payment for any work performed. This bond protects the owner from losses due to non-performance or late completion of construction projects.

If you’re looking for more information about how long a Performance and Payment Bond lasts, You’ll find all the answers you need!

What is the difference between a performance bond and a payment bond?

A performance bond secures the contractor’s promise to perform a contract in exchange for money while payment bonds protect laborers, suppliers and subcontractors from nonpayment. Payment bond guarantees ensure that all subcontractors, suppliers, and laborers are compensated for their work on a project.

How long is the validity of the performance bond?

Generally, a performance bond remains in force until the specified discharge date which is usually either after practical completion of the project or making good any defects.

What happens when a performance bond expires?

Performance bonds are bound to contracts, so they expire when the contract timeframe ends. They only exist as long as the contract is in effect and disappear when it expires – which can be for any number of reasons including breaking up a team or company!

Do payment bonds expire?

Do payment bonds expire? That depends on the bond type and term. Renewal time is usually one year after purchase, but it may vary depending on what you purchased your bond for in the first place. Some don’t renew at all though!

Do you get performance bond money back?

In general – no. No, you do not get any money back.

How does a payment bond work?

A payment bond is needed for public jobs that require material suppliers and subcontractors to be paid. This guarantees all parties are properly compensated, regardless of what happens with mechanic’s liens (security interests). Read a New York Performance Bonds.

Secure your project’s success with a performance bond for contractor today!

How do you release a performance bond?

You may want to release a performance bond for an event that has concluded. Follow these steps: call your bonding company or the broker or agent who arranged the bond, inform them of your intention and fill out the request form they provide you with.

Does a bond expire?

Savings bonds may last up to 30 years with an original maturity date. Keep in mind that the length of time you can keep your bond depends on its series and issue date; Treasury extended some dates from their original duration. See our New Mexico Performance Bonds.

Do construction bonds expire?

The majority of surety bonds last for a set period known as the “surety bond term,” after which they must be renewed or extended, otherwise they will expire. Bonds may also renew multiple years at once if premium payments are made up front in advance.

What happens when a performance bond is called?

If an obligee declares the principal in default and terminates a contract, it can call on the surety to meet their obligations under that bond.

Can a performance bond be Cancelled?

In the event that an obligee is requesting a performance bond, it cannot be cancelled through lost policy receipts. Bonds are required by governments to ensure compliance with requirements like paying taxes on time. Have a North Carolina Performance Bonds.

Can a payment bond be Cancelled?

The bond can only be terminated with the written consent of both parties. The right of the surety is limited to demanding payment from unpaid premiums, or when a project is abandoned before it has been completed.

Who is protected by a payment bond?

The payment bond protects the subcontractors, material suppliers and laborers of a contractor. This protection includes second-tier contractors that work with first tier contracted companies on state projects. Get a North Dakota Performance Bonds.

Who is protected by a performance bond?

Performance bonds protect owners and investors from having to repair any low-quality work that may be caused by unfortunate events such as bankruptcy or insolvency of the contractor.

Who are the parties to a performance bond?

Three party agreements as outlined below: The Principal – usually the primary person or business entity who will be performing contractual obligations. The Obligee, typically someone who is receiving and owes an obligation like providing goods in return for something they’ve agreed to do on behalf of another (like paying rent). A surety company assesses the risk of contractors, ensuring they are financially capable of fulfilling contr

act obligations. And finally, we have our Surety-who ensures that their promise gets upheld with guarantees if needed so everyone’s successful!

The parties of a payment bond are the contractor, subcontractors and suppliers. If you work on one project for an extended period of time without being paid in full, all your hard work will go to waste!

Who are the parties to a payment bond?

The parties of a payment bond are the contractor, subcontractors and suppliers. If you work on one project for an extended period of time without being paid in full, all your hard work will go to waste!

Be sure to check out more at Swiftbonds.com