You can now apply online for a Pennsylvania Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Pennsylvania?

How do I get a Performance and Payment Bond in Pennsylvania?

We make it easy to get a contract performance bond. Just click here to get our Pennsylvania Performance Application. Fill it out and then email it and the Pennsylvania contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

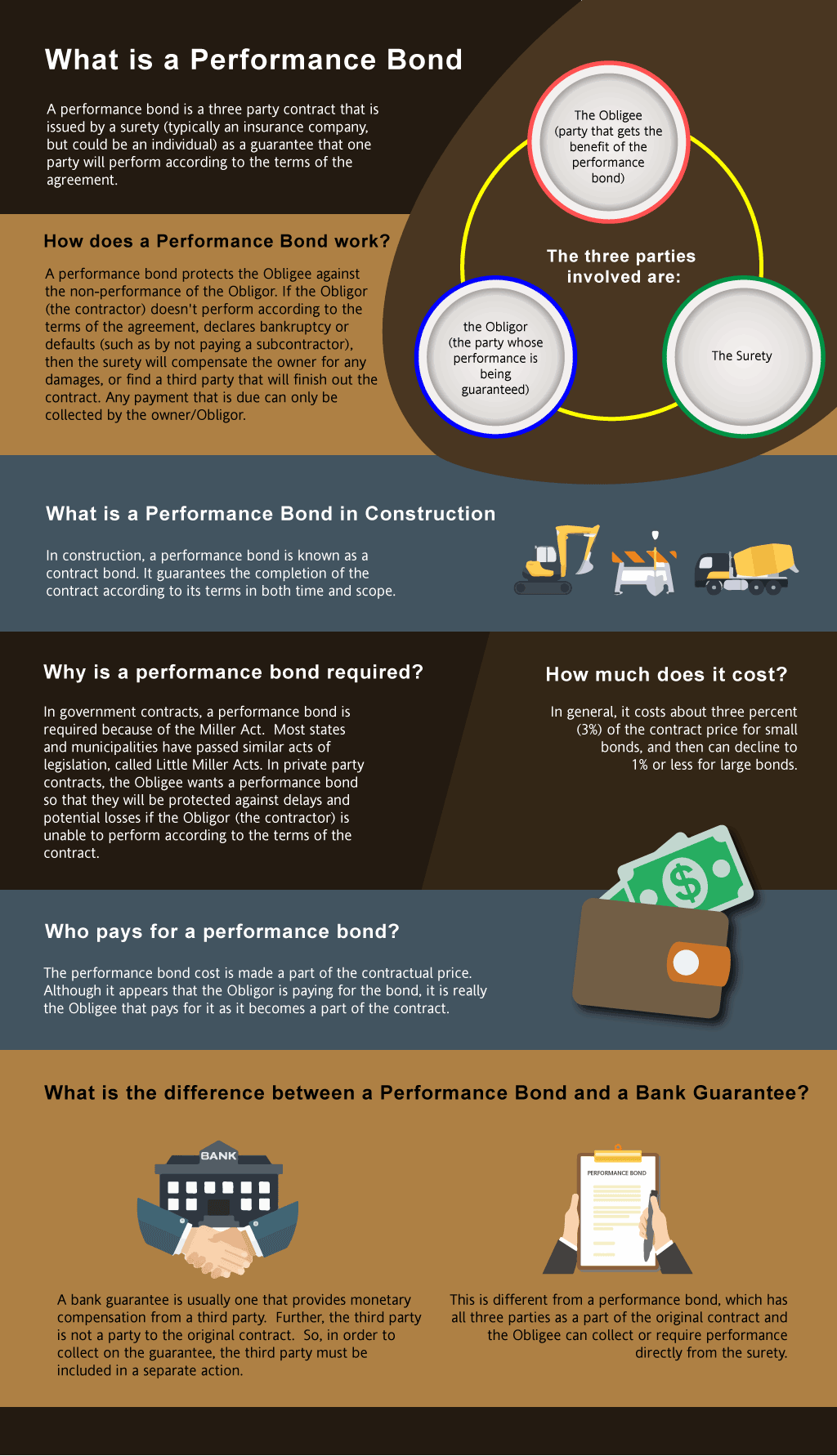

performance bond? This infographic shows a logo of construction equipments, wallet and a dollar, two person shaking hands at the front of a bank, and performance bond contract with a multi colored background." width="1024" height="1782" />

performance bond? This infographic shows a logo of construction equipments, wallet and a dollar, two person shaking hands at the front of a bank, and performance bond contract with a multi colored background." width="1024" height="1782" />

Performance bond quote in Pennsylvania?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in PA?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Pennsylvania. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Ready to secure your project? Discover when you need a performance bond today!

How to Get a Performance Bond in PA

Just call us. We’ll work with you to get the best Pennsylvania bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Allegheny

Armstrong

Beaver

Bedford

Berks

Blair

Bradford

Bucks

Butler

Cambria

Cameron

Carbon

Centre

Chester

Clarion

Clearfield

Clinton

Columbia

Crawford

Cumberland

Dauphin

Delaware

Elk

Erie

Fayette

Forest

Franklin

Fulton

Greene

Huntingdon

Indiana

Jefferson

Juniata

Lackawanna

Lancaster

Lawrence

Lebanon

Lehigh

Luzerne

Lycoming

McKean

Mercer

Mifflin

Monroe

Montgomery

Montour

Northampton

Northumberland

Perry

Philadelphia

Pike

Potter

Schuylkill

Snyder

Somerset

Sullivan

Susquehanna

Tioga

Union

Venango

Warren

Washington

Wayne

Westmoreland

Wyoming

York

And Cities:

Philadelphia

Pittsburgh

Harrisburg

Lancaster

Erie

Allentown

Scranton

Bethlehem

Wilkes-Barre

State College

See our Rhode Island Performance Bond page here.

Beyond the Basics: Learning the Differences Between Performance Bonds and Bank Letters of Credit

From our perspective, understanding the differences between performance bonds and bank letters of credit (LoC) is crucial for anyone involved in large-scale construction projects. While both serve as financial guarantees, we’ve come to understand that performance bonds offer a more comprehensive level of protection. A performance bond, provided by a surety company, guarantees the project’s completion according to the contract terms, while a bank letter of credit is simply a financial backup that releases funds if the contractor fails to perform. In our observation, performance bonds involve an investigation by the surety in case of a claim, offering a higher level of scrutiny, whereas an LoC merely activates the release of funds with fewer checks.

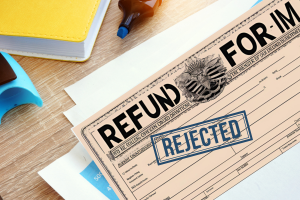

Refund Policies: Are Performance Bonds in Pennsylvania Reimbursable?

We’ve noticed that a common misconception is that performance bonds are refundable, but this is rarely the case. Once a performance bond is issued and the premium is paid, the surety has fulfilled its obligation, meaning the premium is non-refundable. In our opinion, this is similar to other types of insurance—once the policy term starts, the cost is considered earned. That said, we’ve come across cases where partial refunds may be possible if the bond is canceled before the project starts, but such scenarios are rare and typically require negotiation.

What Happens After a Claim is Filed on Performance Bond in Pennsylvania? The Steps and Stakes

Based on our experience, the process of filing a claim on a performance bond can be complicated, but it is structured to ensure fairness for all parties involved. When a claim is made, the surety company launches an investigation to verify its validity. If the claim holds, the surety has a few options: they can fund the project’s completion, find a new contractor, or pay out damages to the obligee. In our dealings with claims, we’ve observed that this can delay the project, but it ultimately protects the obligee. What we’ve learned is that contractors are responsible for reimbursing the surety for any payments made, which can affect their ability to obtain future bonds.

Timing the Release of Performance Bonds in Pennsylvania: When Can They Be Closed?

In our observation, performance bonds are typically released once the project has been completed to the satisfaction of the obligee and all contractual obligations have been met. However, we’ve realized that the release doesn’t always happen right away; some contracts have a maintenance period, during which the bond remains active to cover any post-completion issues, such as defects or repairs. We’ve personally witnessed instances where the bond remains in place for months after the project’s completion, making it essential for contractors to understand the terms of the bond and the conditions for its release.

A Powerful Tool: The Benefits of 100 Percent Performance and Payment Bonds in Pennsylvania

We’ve had firsthand experience with 100 percent performance and payment bonds, which offer comprehensive coverage for both the project’s completion and payment of subcontractors, suppliers, and laborers. From what we’ve seen, these bonds provide a strong security net, ensuring that all financial obligations are met. For larger projects, our experience tells us that these bonds are often preferred by project owners as they mitigate both performance risk and financial risk. We’ve consistently found that this dual-layer protection can prevent disputes and financial complications, making the project smoother for all involved.

How Long Does It Take to Secure a Performance Bond in Pennsylvania? The Timeline Explained

We’ve gained insight into the timeline for obtaining a performance bond, and it can vary based on the size of the project and the contractor’s financial history. For smaller projects, we’ve often noticed that performance bonds can be secured within a few days if the contractor has a solid financial background. Larger or more complex projects may require more time as surety companies conduct thorough evaluations of the contractor’s finances, experience, and the project’s details. We’ve come across cases where this process takes weeks, especially if the surety requires additional information or documentation.

What Happens if a Performance Bond Expires in Pennsylvania?: The Fact You Should Know

We’ve been involved in situations where performance bonds expired before the project was completed, and the consequences can be severe. We’ve found through experience that if a bond expires, the contractor may be in breach of contract, which could halt the project and lead to financial penalties. From our perspective, contractors must monitor their bond expiration dates closely to avoid disruptions. In cases where the bond expires without renewal, the project owner may demand a new bond, which could delay the work and create additional costs. We’ve realized through our work that maintaining bond validity is crucial for smooth project progression.

In conclusion, we’ve come to the conclusion that understanding the nuances of performance bonds—how they work, when they’re released, and what happens if a claim is filed or the bond expires—can make a significant difference in project management. Whether you're a contractor or a project owner, being well-informed about these aspects ensures smoother operations and fewer surprises along the way.

See more at our New Mexico Performance Bond page.