You can now apply online for an Oklahoma Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

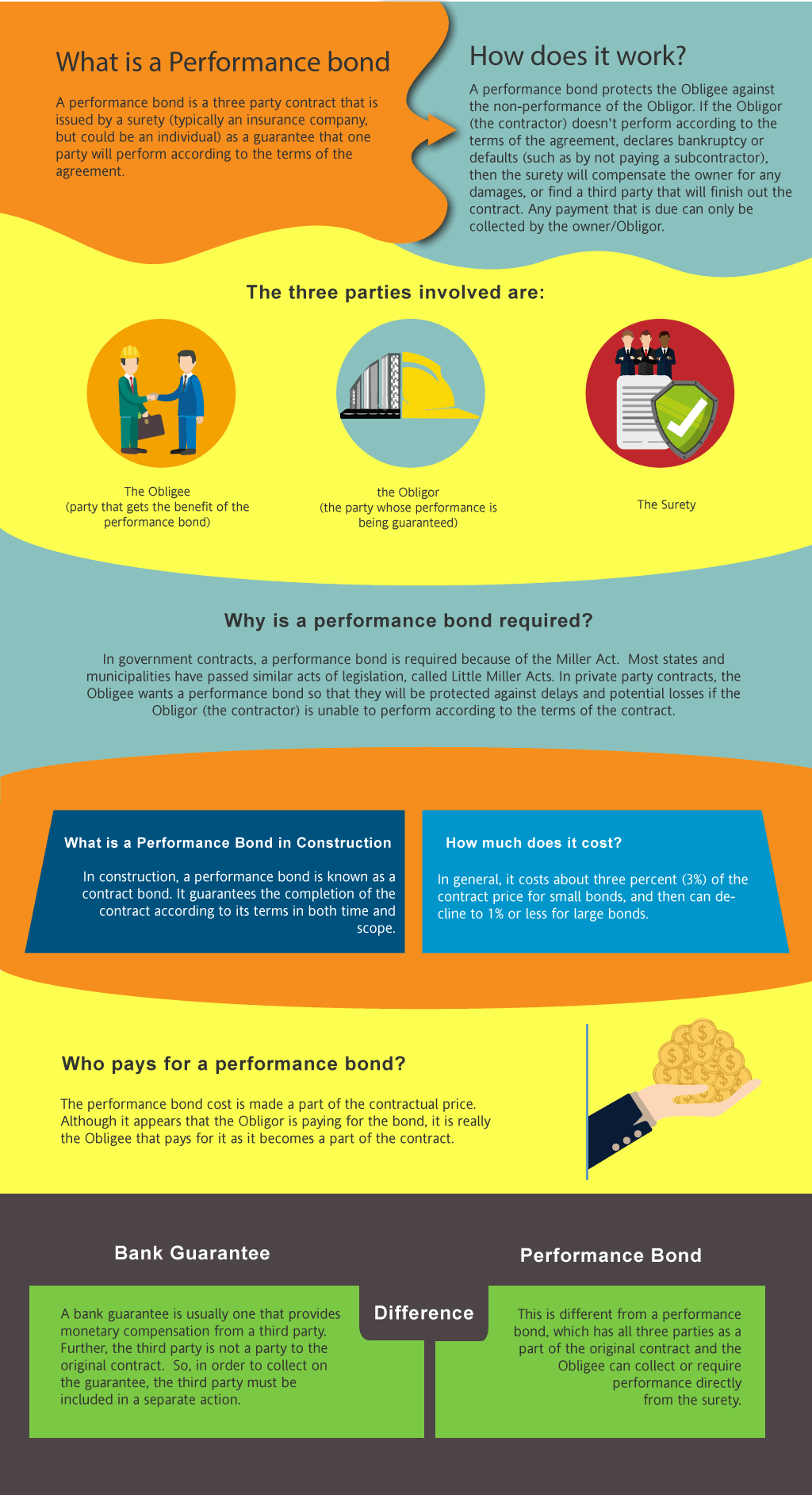

What is a Performance Bond in Oklahoma?

How do I get a Performance and Payment Bond in Oklahoma?

We make it easy to get a contract performance bond. Just click here to get our Oklahoma Performance Application. Fill it out and then email it and the Oklahoma contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Performance insurance bond in Oklahoma?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in OK?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Oklahoma. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Secure your project's success with a reliable contractor's performance bond today!

How to Get a Performance Bond in OK

Just call us. We’ll work with you to get the best Oklahoma bond possible.

We provide performance and payment bonds in each of the following counties:

Adair

Alfalfa

Atoka

Beaver

Beckham

Blaine

Bryan

Caddo

Canadian

Carter

Cherokee

Choctaw

Cimarron

Cleveland

Coal

Comanche

Cotton

Craig

Creek

Custer

Delaware

Dewey

Ellis

Garfield

Garvin

Grady

Grant

Greer

Harmon

Harper

Haskell

Hughes

Jackson

Jefferson

Johnston

Kay

Kingfisher

Kiowa

Latimer

Le Flore

Lincoln

Logan

Love

McClain

McCurtain

McIntosh

Major

Marshall

Mayes

Murray

Muskogee

Noble

Nowata

Okfuskee

Oklahoma

Okmulgee

Osage

Ottawa

Pawnee

Payne

Pittsburg

Pontotoc

Pottawatomie

Pushmataha

Roger Mills

Rogers

Seminole

Sequoyah

Stephens

Texas

Tillman

Tulsa

Wagoner

Washington

Washita

Woods

Woodward

And Cities:

Tulsa

Oklahoma City

Norman

Edmond

Lawton

Stillwater

Broken Arrow

Enid

Moore

Muskogee

See our Oregon Performance Bond page here.

Making an Informed Decision: Performance Bonds vs. Bank Letters of Credit

In our observation, performance bonds and bank letters of credit often get mistaken for one another. However, we’ve found through experience that while both guarantee obligations, they serve different functions. A performance bond, typically issued by a surety company, guarantees that the contractor will fulfill their contractual duties. On the other hand, a bank letter of credit is a financial instrument where the bank guarantees payment to the beneficiary if the principal defaults. From what we’ve seen, performance bonds offer more security to project owners because they not only ensure completion but also include the backing of a third party, unlike a letter of credit that focuses solely on payment.

A Binding Agreement: The Non-Refundable Nature of Performance Bonds

We’ve often noticed that one common misconception about performance bonds is that they might be refundable. In our professional life, we’ve learned that once a bond is issued and the premium is paid, it is generally non-refundable. This is because the surety has already taken on the risk by issuing the bond, whether or not claims are made or the project finishes early. In our experience, it’s crucial for contractors and project owners alike to be aware of this before entering into a bonding agreement.

The Impact of Claims: The Financial and Reputational Risks of Performance Bond Claims

What we’ve discovered is that when a claim is filed on a performance bond, it sets off a process that can significantly impact both the contractor and the project owner. We’ve personally witnessed how the surety company steps in to investigate the claim. If the contractor has indeed failed to meet their obligations, the surety either arranges for the completion of the project or provides compensation to the project owner. In our dealings with such cases, we’ve found that while performance bonds protect the owner, they can lead to financial and reputational consequences for the contractor involved.

A Crucial Event: Understanding Performance Bond Release

We’ve come to understand that performance bonds are released once the project has been satisfactorily completed and accepted by the owner. In our experience, we’ve consistently observed that project owners tend to release the bond only after the final inspection and when no outstanding issues remain. However, we’ve noticed through our work that in some cases, bonds might not be released until a maintenance period has passed, ensuring no post-completion defects arise.

Beyond Completion: The Advantages of 100 Percent Performance and Payment Bonds

In our view, a 100 percent performance and payment bond provides maximum protection for both the project owner and any subcontractors involved. We’ve been fortunate enough to work on projects that required these bonds, and we’ve consistently found that they guarantee the full completion of the project as well as ensure that all subcontractors and suppliers are paid. This comprehensive coverage mitigates risks for all parties and is particularly important in large-scale construction projects where financial and contractual obligations can be complex.

A Timely Process: Understanding the Time to Obtain a Performance Bond

From our perspective, the process of securing a performance bond can vary depending on several factors, including the contractor’s financial standing and the project size. In our dealings with contractors, we’ve found that for straightforward projects, it may take just a few days to get the bond issued. However, more complex projects or those requiring additional paperwork can extend the timeline to a few weeks. What we’ve experienced is that contractors with a solid track record and credit history typically face fewer delays.

Avoiding Legal Pitfalls: The Dangers of Lapsed Performance Bonds

In our practice, we’ve encountered situations where a performance bond expired before the project was completed, leading to significant challenges. We’ve learned over the years that when a bond expires, it can cause the contractor to be in breach of contract, which might lead to penalties or even legal action. We’ve personally faced instances where project owners had to demand bond renewals or replacements to ensure the project’s protection remained intact. In our view, managing bond expiration dates is crucial to avoiding unnecessary complications.

Don't Let Unforeseen Circumstances Ruin Your Project: Invest in Performance Bonds

In conclusion, understanding performance bonds—from how they differ from other financial guarantees to the process of securing them—ensures that both contractors and project owners are prepared for their obligations. Performance bonds offer a layer of security that, when managed properly, can prevent disputes and ensure project success in Oklahoma’s construction landscape.

See more at our New York Performance Bond page.