You can now apply online for an Ohio Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Ohio?

How do I get a Performance and Payment Bond in Ohio?

We make it easy to get a contract performance bond. Just click here to get our Ohio Performance Application. Fill it out and then email it and the Ohio contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Learn the essential definition and significance of a performance bond definition in construction industry to safeguard your project's success.

Deposit performance bond in Ohio?

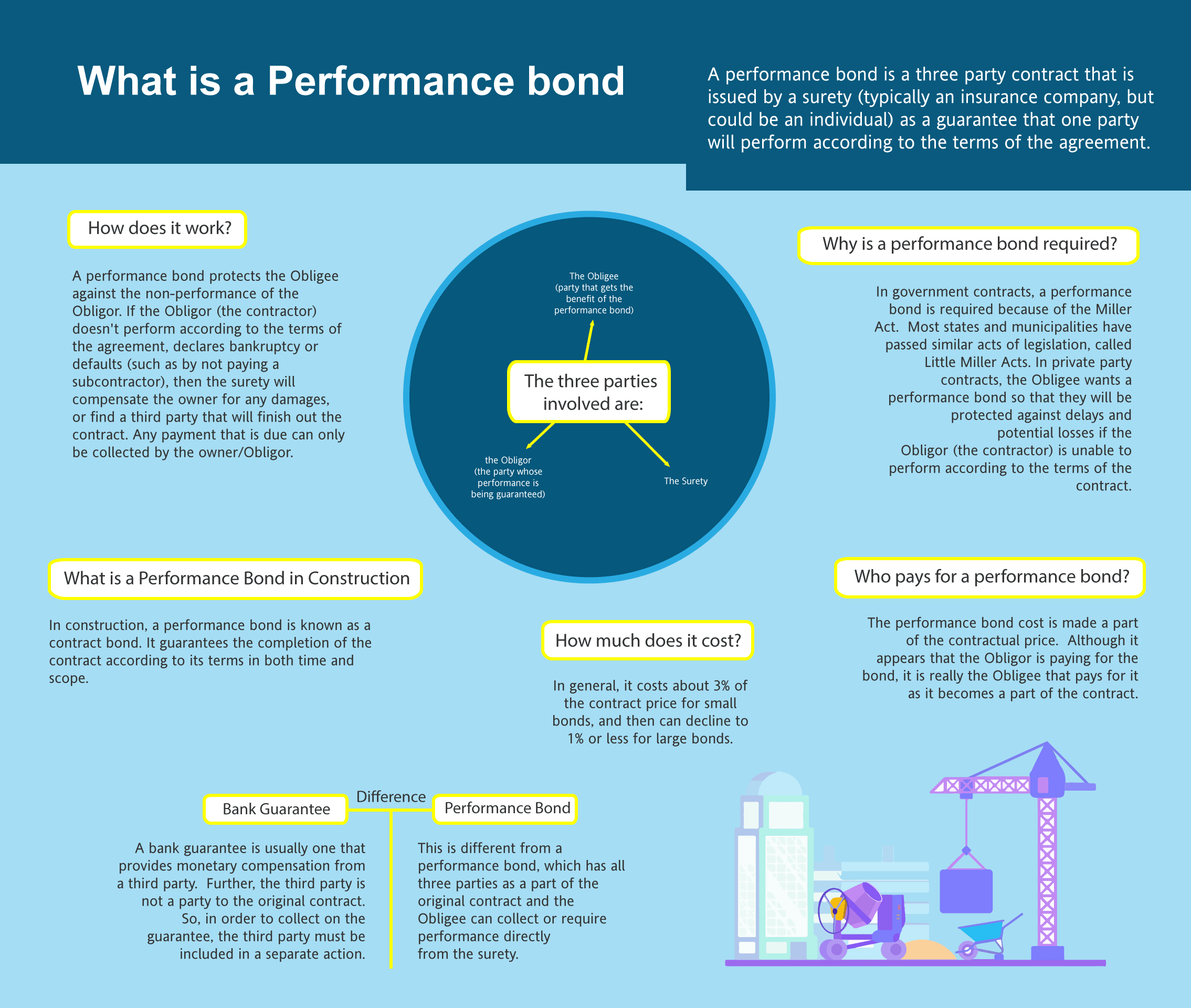

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in OH?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Ohio. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in OH

Just call us. We’ll work with you to get the best Ohio bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Allen

Ashland

Ashtabula

Athens

Auglaize

Belmont

Brown

Butler

Carroll

Champaign

Clark

Clermont

Clinton

Columbiana

Coshocton

Crawford

Cuyahoga

Darke

Defiance

Delaware

Erie

Fairfield

Fayette

Franklin

Fulton

Gallia

Geauga

Greene

Guernsey

Hamilton

Hancock

Hardin

Harrison

Henry

Highland

Hocking

Holmes

Huron

Jackson

Jefferson

Knox

Lake

Lawrence

Licking

Logan

Lorain

Lucas

Madison

Mahoning

Marion

Medina

Meigs

Mercer

Miami

Monroe

Montgomery

Morgan

Morrow

Muskingum

Noble

Ottawa

Paulding

Perry

Pickaway

Pike

Portage

Preble

Putnam

Richland

Ross

Sandusky

Scioto

Seneca

Shelby

Stark

Summit

Trumbull

Tuscarawas

Union

Van Wert

Vinton

Warren

Washington

Wayne

Williams

Wood

Wyandot

And Cities:

Columbus

Cleveland

Cincinnati

Dayton

Toledo

Akron

Youngstown

Findlay

Zanesville

Westerville

See our Oklahoma Performance Bond page here.

A Crucial Tool for Project Success: Performance Bonds

Comparing Apples to Oranges: Performance Bonds vs. Bank Letters of Credit

While both performance bonds and bank letters of credit serve as financial guarantees, they operate differently. A performance bond ensures project completion, while a bank letter of credit guarantees payment. In most cases, performance bonds offer a more comprehensive protection mechanism due to the surety's involvement in finding a replacement contractor if needed.

Performance Bonds: Non-Refundable Commitment

Once issued, performance bonds are generally non-refundable, regardless of project completion status. This is because the surety company assumes the risk of ensuring project completion. It's essential to understand this upfront to avoid misunderstandings.

A Financial and Reputational Risk: The Impact of Performance Bond Claims

Filing a claim on a performance bond can have significant consequences for contractors. If a claim is valid, the surety company will investigate and may pay for project completion or compensate the claimant. This can be financially and reputationally damaging for contractors, as the surety will seek reimbursement.

A Critical Milestone: Understanding Performance Bond Release

Performance bonds are typically released upon satisfactory project completion, often after final inspection and client acceptance. However, maintenance periods may exist, requiring the bond to remain in effect. Understanding release conditions is crucial to avoid delays.

Protecting All Parties: The Benefits of 100 Percent Performance and Payment Bonds

100 percent performance and payment bonds offer maximum security by guaranteeing both project completion and payment to all parties involved. This reduces financial risk and ensures accountability.

The Timeframe for Obtaining a Performance Bond

The time to obtain a performance bond varies based on factors like project complexity and the contractor's financial standing. Well-prepared contractors with good credit may secure bonds within a few days, while more complex cases or additional documentation can extend the process.

A Financial Risk: The Consequences of Lapsed Performance Bonds

If a performance bond expires before project completion, it can lead to complications for both contractors and clients. Contractors may need to secure new bonds to avoid breaching contract terms. Proper management of bond renewals and extensions is essential to prevent delays and disputes.

Safeguard Your Project: Ensure Adequate Performance Bond Coverage

Performance bonds play a crucial role in contract security, protecting clients and contractors alike. Understanding key aspects of performance bonds, such as their non-refundable nature, claim procedures, and release timing, can help contractors effectively manage their projects.

See more at our North Carolina Performance Bond page.