You can now apply online for a Rhode Island Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

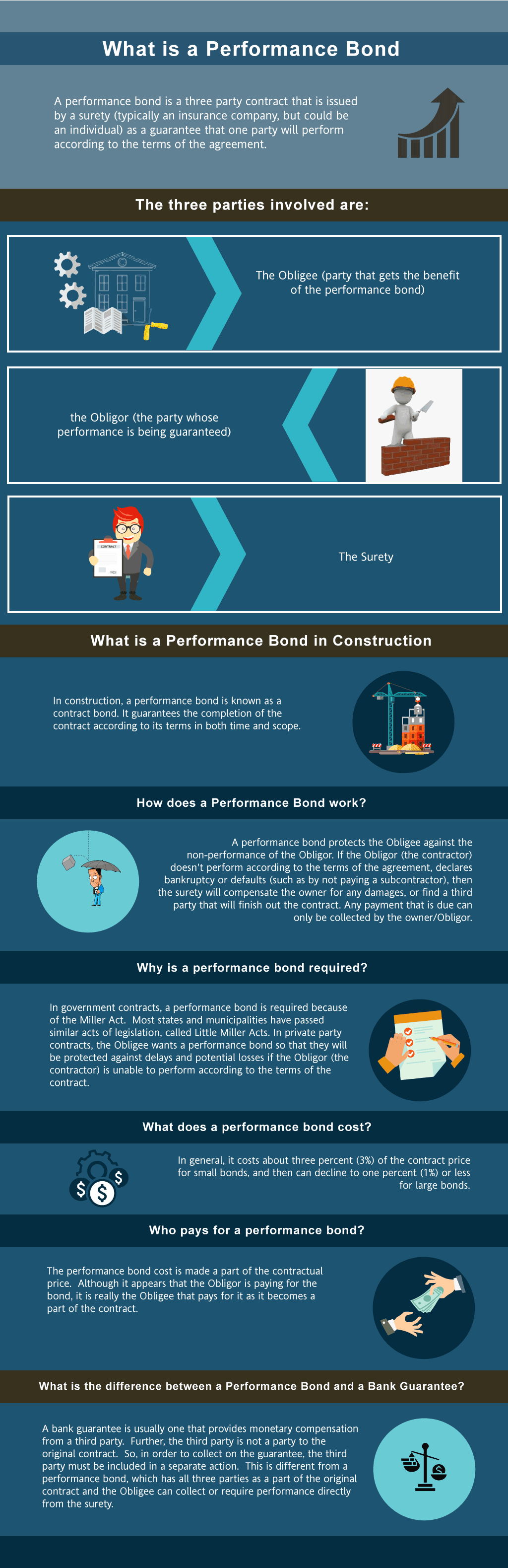

What is a Performance Bond in Rhode Island?

How do I get a Performance and Payment Bond in Rhode Island?

We make it easy to get a contract performance bond. Just click here to get our Rhode Island Performance Application. Fill it out and then email it and the Rhode Island contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How Much Does a Performance Bond Cost in Rhode Island?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in RI?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Rhode Island. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in RI

Just call us. We’ll work with you to get the best Rhode Island bond possible.

We provide performance and payment bonds in each of the following counties:

Bristol

Kent

Newport

Providence

Washington

And Cities:

Providence

Newport

Warwick

Cranston

Pawtucket

See our South Carolina Performance Bond page here.

Differences Between Performance Bonds and Bank Letters of Credit in Rhode Island

From our perspective, one of the most notable distinctions between performance bonds and bank letters of credit in Rhode Island is the type of protection they offer. Performance bonds, backed by surety companies, ensure that contractors complete their projects according to contract specifications. In contrast, we’ve encountered that bank letters of credit primarily guarantee financial payment if the contractor fails. What we’ve discovered is that performance bonds offer a broader scope, covering both performance and potential losses, whereas bank letters of credit only safeguard payments, leaving performance issues unresolved.

A Firm Decision: Performance Bonds Are Non-Refundable in Rhode Island

In our dealings with contractors and surety providers in Rhode Island, we’ve found that performance bonds are generally non-refundable once issued. Based on our experience, the premium is earned when the bond is executed, regardless of whether the project proceeds or the bond is used. However, we’ve personally witnessed situations where project cancellations led to partial refunds, though these cases are exceptions. In Rhode Island, it’s essential to read the terms carefully to understand when, if ever, a refund could apply.

The Legal Ramifications: The Effects of Performance Bond Claims

We’ve had firsthand experience with the aftermath of claims filed on performance bonds in Rhode Island, and the results can be costly. Once a claim is made, the surety typically steps in to either complete the project or compensate the project owner for financial losses. In our view, contractors remain liable for reimbursing the surety for its expenses. We’ve come across cases where repeated claims or claims deemed valid could affect a contractor’s ability to secure future bonds in Rhode Island, and in some cases, a more thorough background check is required for bond renewals or future projects.

The End of the Line: When Are Performance Bonds Released in Rhode Island?

We’ve noticed through our work in Rhode Island that performance bonds are typically released once the project owner has confirmed that all contract terms are met. We’ve come to appreciate that this process involves thorough inspections and final approvals from the owner to ensure every aspect of the project is completed. In our professional life, we’ve often been involved in projects where bond releases are delayed due to unfinished work or unmet contract requirements, emphasizing the need for contractors to stay on track.

Dual Protection: Performance and Payment

We’ve gathered that 100 percent performance and payment bonds are particularly valued in Rhode Island construction projects. These bonds provide dual protection by ensuring the contractor performs their obligations and that payments are made to subcontractors and suppliers. We’ve consistently observed that this type of bond offers peace of mind to project owners, reducing the risk of work being left incomplete or suppliers not receiving their payments, thereby fostering smoother project workflows.

Preparation is Key: Avoiding Delays

We’ve had the privilege to assist contractors in obtaining performance bonds in Rhode Island, and the timeline can vary depending on factors like the size of the bond and the contractor’s financial history. In our observation, smaller bonds can be secured in a matter of days, while larger, more complex bonds may take several weeks due to the need for financial documentation and background checks. We’ve often found ourselves reminding contractors that preparation is key to avoiding delays in the bonding process.

What Happens If a Rhode Island Performance Bond Expires Before Project Completion?

We’ve personally dealt with cases in Rhode Island where contractors faced serious issues when their performance bonds expired before project completion. In our view, it’s crucial for contractors to ensure their bond’s validity throughout the entire project to avoid potential claims or legal complications. We’ve learned through our own efforts that renewing the bond before its expiration is the safest course of action, as project owners may otherwise consider the contractor in default, leading to costly disputes and project delays.

See more at our New Jersey Performance Bond page.

Contact us for Rhode Island surety bond.