You can now apply online for a Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

How do you fill out a Performance Bond?

First, write the name of the obligor or project owner on line preceded by "are held and firmly bonded to." Then write down how much money is at issue in this bond. Once that's done sign your signature where requested with a notary public present who will then make sure it was signed legally.

Do you need to complete a Public Performance Bond form?

SwiftBonds is the leading provider of public performance bonds for construction contractors. We offer fast, reliable service and competitive rates for all your needs. Our team has decades of experience in this industry and we’re always happy to help!

Fill out our quick online form today and get started on your project! You can also call us at (913) 214-8344 or email us at [email protected] with any questions you may have about completing a bond application.

What is a performance bond form?

Performance bonds are three-party guarantees between a surety, an obligee and the principal. The contractor providing the bond must complete it according to contract terms or pay penalties for violating them.

What is required to get a performance bond?

In order to get a performance bond, contractors must usually pay a premium on the bond amount as well as interest on the bid. Again, this depends heavily on how much money they are willing to risk and their creditworthiness. In most cases you will need first place in an auction for your desired project before being allowed it go ahead with construction or decoration work (depending).

Do payment and performance bonds need to be notarized?

Bonds are a way of preventing the company you work for from going bankrupt if they fail to perform their obligations. The signature of the person signing as the Authorized Signature must be notarized, and so does your Attorney-in-Fact signature in order to bind them both together with authority.

What is a P&P Bond?

A P&P Bond is a type of bonding that protects both the contractor and project owner. The payment bond guarantees that all suppliers, subcontractors, or laborers will be paid for their work on the construction site. On top of this guarantee to pay-out these parties at completion; there also exists an obligation by contractors to perform required work as specified in any contract they sign with owners using such bonds.

What does a performance bond cost?

A performance bond is a type of guarantee that the contractor will complete their work on time and according to specifications. The cost varies depending on what you're building, how much it costs, or who's paying for it.

For example: Nowadays if your project doesn't fit into one of those categories they'll charge something like 1% but in general it's around about 1%. Get a How much should i pay for a Performance Bond in Construction?

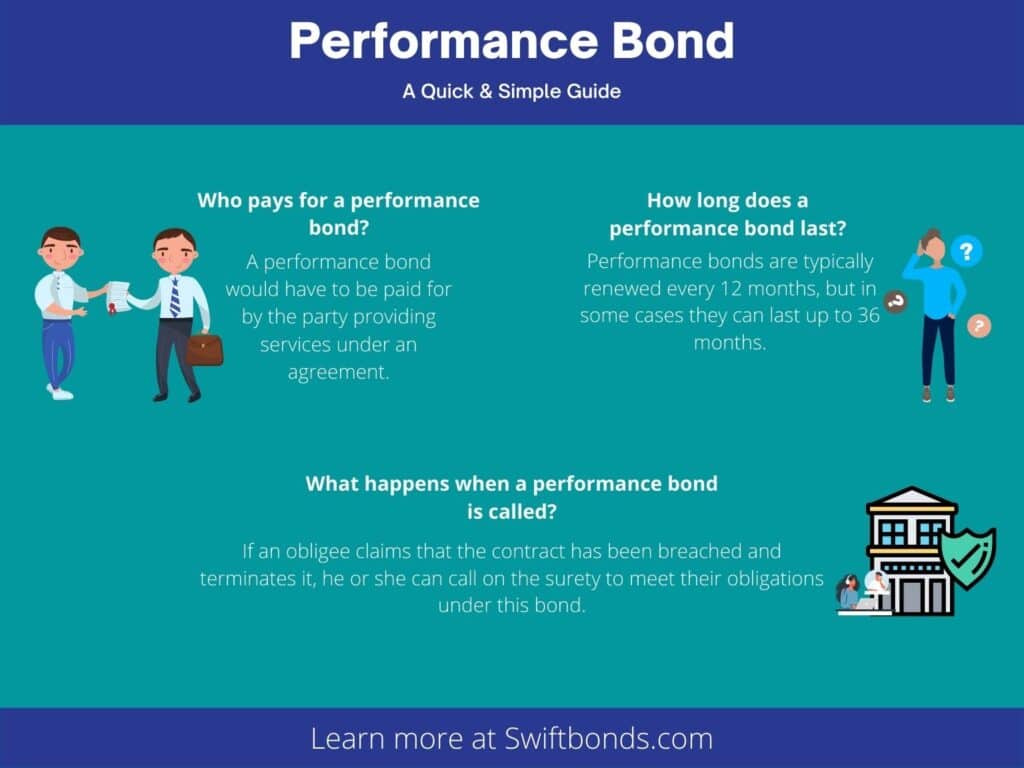

How long does a performance bond last?

A question that comes up often. Performance bonds are usually renewed one year after purchase, but depending on the type of bond and term length it could be anywhere from 2-3 years or never renew at all. Some bonds offer lower rates upon renewal so make sure to ask your agent for more information!

Should I get a performance bond?

A performance bond offers plenty of advantages to all interested groups. A contractor becomes a marketable company and the bonds issuer gains new clients while also giving contractors peace-of-mind from possible lawsuits stemming from faulty construction work. You may want to consider getting one if you're in need of bonding during this busy season!

When can you release a performance bond?

Performance bonds generally remain in force until the stated discharge date, which is usually after completing the work or fixing any problems. Read a How much does a Construction Performance Bond cost?

Who does a performance bond protect?

A performance bond is a guarantee of quality workmanship for the contractor. If they don't deliver, you'll be protected because your project will get completed on time and without any hassle!

What happens when a performance bond is called?

A performance bond provides assurance that the obligee will be protected if the principal fails to perform. If you declare a default and terminate your contract, then it may call on surety for aid in meeting their obligations under its bonding agreement with them.

Who are the three parties to a performance bond?

There are three parties to a performance bond. The principal is the primary person or business entity who will be performing their contractual obligation, and they hire the obligee (the recipient of an obligation) as well as surety that ensures obligations will be performed for them if needed.

How do performance guarantees work?

Performance guarantees are agreements that guarantee contractors will perform according to the terms of a contract. If they cannot find another contractor, then the Obligor is liable for damages owed to their Obligee. See our Swiftbonds.

Who pays for a performance guarantee?

Sometimes, a Contractor might not be able to finish their job. But with this Performance Guarantee in place, the Employer can call on the Insurer and receive money from them so that they are able to find another contractor who is willing to do what needs done.

Is a performance guarantee a contract?

Performance Guarantees are legally binding promises to fulfill the obligations of another person. Performance guarantees can be in place for contracts that obligate one party to design, develop, manufacture or construct a product and may also include obligation on behalf of other types such as payments from an employer with respect to employee benefits plans. Here's How should a Performance Bond be reflected in a Project Bid?

How to fill out a Performance Bond application?

To help you fill out a performance bond application, write the name of the obligor or project owner on line one. Fill in a number that represents how much money is at issue below this section and sign your signature before proceeding to have it notarized by a local county clerk.

Discover what are performance bonds and why they're essential for safeguarding project completion—empower your understanding today!

What is a Performance Bond?

A performance bond is an agreement between the contractor and the owner of a project that ensures completion of work. It’s often required before construction begins on large projects, such as bridges or buildings.

If you need help filling out your application for a performance bond, Swiftbonds can help! We offer free assistance with all types of bonds including bid bonds, payment bonds, contract bonds, and more!

Contact us today at (913) 214-8344 or fill out our contact form online for more information about how we can help you get started with your next project!

Is it hard to get a performance bond?

It's not too hard to get a performance bond. Even though all the information may sound complicated, surety bonds are easy enough if you know what you're doing. The process works like this- first find out how much money is needed for your bid and then talk with an agent at one of our branches in order to secure the appropriate paperwork before bidding on any project that interests you. Here's a Bank Guarantee Cost.

Who issues a performance bond?

A performance bond is a type of insurance issued by either an insurance company or bank to guarantee that the project will be completed satisfactorily. The term can also refer to collateral money, such as good faith deposits on futures contracts, typically known as margin.

What is a performance bond example?

A performance bond is a contract that guarantees the contractor will follow the agreed specifications in constructing whatever project they have been tasked with. If not, then the client receives monetary compensation for any losses or damages incurred by this breach of agreement.

How many percent is the performance bond?

The performance bond is 15% and covers the contractor's obligations to its workers, subcontractors, and suppliers. Read about Getting Bonded for Small Business.

What is a performance bond and how does it work?

A performance bond is a guarantee for the satisfactory completion of a project. Your collateral property or investment will back up your promise with an agency, who then issues you this type of surety bond.

Who pays for a performance bond?

A performance bond is a type of insurance that protects the owner against financial losses incurred due to non-performance by someone who was contracted to provide services. Performance bonds are usually paid for by one party in exchange for another's agreement to complete specific work or not perform certain things as required under an agreement.

How do I get a performance bond?

Performance bonds are among the most common construction bonds in today's industry. To get a free, no-obligation quote for your performance bond, apply online or give one of our experts a call.

How long does a performance bond last?

It all depends on the type of bond you purchase, as well as how much time is left. Some bonds do not renew at all and in some cases you can get a lower rate for your bond when it does come up again to renewal.

When do you release a performance bond?

A Performance Bond remains in force until the stated discharge date, which is usually either after practical completion of the works or after making good any defects. See our Obligee Bond.

How much is a performance guarantee?

A performance bond ensures payment of a sum (not exceeding a stated maximum) of money in case the contractor fails to perform at an agreed level. These bonds usually cover 10-12.5% and replace bid bonds on awarding the contract, which are often 1%.

What happens when a performance bond is called?

When a performance bond is called, the obligee can call on their surety to meet obligations. If not met within 30 days of being served by written notice, legal proceedings may ensue against the principal and/or its guarantors as well.

Do you get your money back on a performance bond?

If the performer never submits their bond and sends it to the Obligee/State, they will not be refunded. However, if there was an issue with submitting or cancelling their original contract before its expiration date - prorated refunds can usually be expected!

Should I get a Performance Bond?

A contractor becomes marketable with one, the contractor is safe and secure in the deal. In construction season it may be time for you to invest in Performance Bonds. Need a Payment Bond or Performance Bond Claims.

What happens when a performance bond expires?

Performance bonds are not renewed. They will expire at the same time as your contract, so it's always important to tie up loose ends and ensure that you're aware of any upcoming changes in a contract before their expiration date arrives.

Be sure to check out more at Swiftbonds.com