A Performance Bond guarantees that a contractor will complete their work according to the terms of the contract. The terms and conditions provide for when the site will be built (and to what standards). The bond further protects the owner from a default on the part of the contractor due to a delay in construction or construction work that is substandard.

You can now apply online for a Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to gary@swiftbonds.com

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

How Do Performance Bonds Work in Construction?

Performance bonds make sure that a contractor will complete their work according to the contract that sets forth the construction terms. They protect the owner from a default on the part of the contractor due to a delay in construction or construction work that is substandard.

What is a performance bond?

A performance bond is a three party agreement. The main two parties are contractor and the owner of a project. The contractor agrees to provide a certain level of work in exchange for payment, while the owner agrees to pay if the work is completed satisfactorily and on time. The surety guarantees that the contractor will perform according to the terms of the construction agreement.

Swiftbonds offers competitive rates and quick service with no hidden fees or charges so you know exactly what you’re paying for upfront for your bond!

What is a Performance Bond in Construction?

The amount of a performance bond is set by the terms of the agreement. One party of a contract (the surety) provides as insurance against the contractor's failure to meet agreed obligations between the contractor and the owner. If the owner is unhappy about what has happened on the job site they can obviously go to the contractor. They can also go to the surety to make it right (called making a claim on the bond).

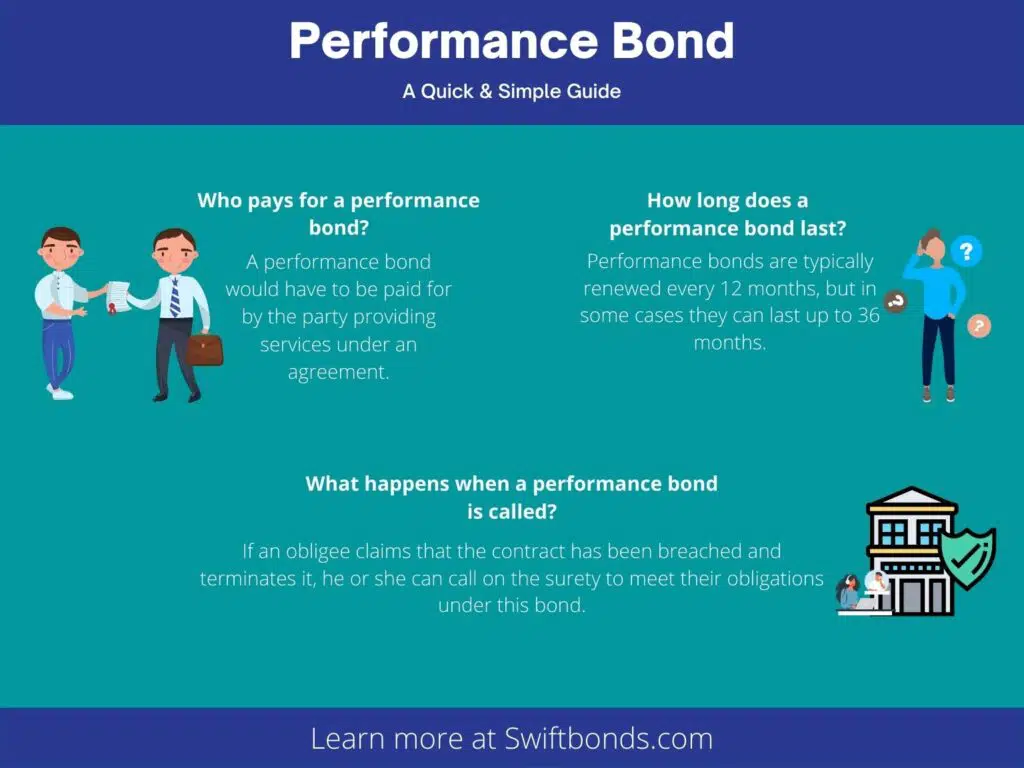

Who Pays for a Performance Bond?

Technically, the contractor pays for the performance bond as it is the contractor who works with the surety to get the bond. However, in reality it is the owner of the project that pays for the bond. That is because the contractor builds in the cost of the bond into the contract terms and pricing. For bid jobs, it is a part of the bid amount. For negotiated construction contracts, there is usually a line item for the cost of the construction bond.

How do you collect on a performance bond?

The process is fairly simple, just contact your bank or brokerage house to request a wire transfer of the money owed. You will likely need some sort of proof that you are authorized representatives before they can comply with this order. Get a Idaho Performance Bonds.

What are the three major types of construction bonds?

Three types of construction security bonds are bid bonds, performance, and payment surety bonds. These all have to do with how they will be paid for during the course of building a project such as schools or houses.

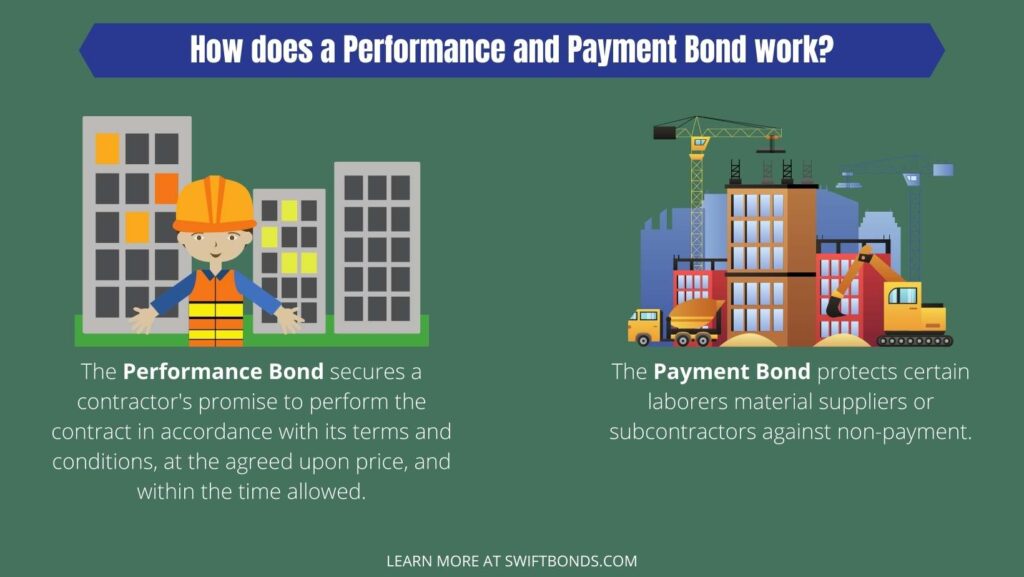

How does a performance and payment bond work?

A performance and payment bond is a legal agreement that protects the contractor's promise to perform, at agreed upon price, in accordance with the contract terms. They also protect laborers against non-payment from subcontractors or material suppliers.

What does it take to get a Performance Bond?

In order to get a performance and/or payment bond, contractors must usually pay a premium on the bond amount as well as interest on the bid. Again, depending on what kind of risk you present and how much money is required for your project's security in case something goes wrong with it.

What is the cost of a performance bond?

The cost of a performance bond is usually three percent (3%) or less, but may be more costly for those contractors with bad credit-worthiness. Labor and material payment bonds are companions to the performance bond and are included in that cost.

What happens when a performance bond is called?

When a performance bond is called, the surety pays any amounts due to protect the Obligee. If there ever comes a time where an agreement can't be fulfilled, it's up to you who steps in first: your principal or your guarantor. Need a Illinois Performance Bonds.

Do you get your money back on a performance bond?

Usually not, but there are circumstances where a full or partial refund may be available if the surety company is contacted within one year of cancellation.

When can you release a performance bond?

A performance bond is a deposit that guarantees the contractor will complete their work and do it well. Generally, as a rule, this type of bond stays in effect until either you've finished everything or made good on any mistakes with your project. You can get a release of the bond when completed and the Obligee sends the final approval to the surety. Sometimes a Consent of Surety form is provided when you finish up the job.

Is it hard to get a performance bond?

In most cases, you will first need to obtain a bid bond before bidding on a project. Only after winning the project would you be able to get the performance bond for that job. Surety bonds are never too difficult, and can even help build your professional history as long as they're handled with care!

How long does it take to get a performance bond?

It takes 24-72 hours to complete the performance bond process. This is a major factor in turnaround time so it's important that you make sure of this beforehand! Read our What does a Bid and Performance Bond cover?

What is the difference between a performance bond and a bank guarantee?

Construction performance bonds in foreign countries are actually bank guarantees. The right to claim under a guarantee is linked to non-performance of the underlying contract, but banks will pay on demand regardless of any other agreements if you have one in place with them.

What is a bonding rate?

Contract bonds are a type of loan that connects the lender with the contractor. Contract bond rates depend on many factors, including financial stability and experience as well as size of contract given to contractors. For example, if contractors qualify for up to $500K in contracts then their rate would be 3%.

How much is a performance guarantee?

Performance bonds are a type of guarantee that ensures the contractor will pay a predetermined sum in case they fail to meet their obligations. Performance bonds usually depend on 10-12% and replace bid bond payments after award of contract. For Indiana Performance Bonds.

How are performance bond prices calculated?

Bond prices for credit scores range from 1% to 15%. This is determined by your personal credit score. The higher the percentage, the more you will pay in bond costs. A $20,000 bond at a 10% rate would cost about 2 times as much as one with a 5% rate!

Why is a performance bond required?

Performance bonds are a surety bond that guarantees adequate completion of projects for contractors. They can be used in addition to the contractor's license bond and are required when the scope or timeframe is unknown, as they protect both parties involved by holding each accountable.

What is a 100 payment and performance bond?

A 100 payment and performance bond provides significant protection for a business. In most cases, the full contract value is available to cover any excess costs of completion as well as provide an additional hundred percent of coverage for subcontractors or suppliers that may not be paid under certain circumstances.

How much does a warranty bond cost?

What's the price of a warranty bond? Depending on your risk level, you can expect to pay anywhere from 1% up to as much as 15%. For example if you need a $10,000 surety bond and get quoted at 10%, that would cost $1,000.

What is a warranty bond?

When a construction project is completed, it's important to check for faults and defects. A warranty bond can protect against workmanship errors by covering the cost of any necessary repairs during the specified time period. Find a Iowa Performance Bonds.

How do you go after a contractors bond?

How do you go after a contractor's bond? It's similar to insurance - if the contractor fails to perform in any way, then you can file a claim against it. Depending on the dispute, you may also be able find relief by filing with your state licensing board.

What happens when a performance bond expires?

Expiration dates are a thing of the past. Performance bonds can expire as well, but unlike contracts they will not change anything about what happens to them when that date arrives. The bond is only valid for the duration of your contract and it's time-sensitive so don't waste any more valuable hours on this issue!

Be sure to check out more at Swiftbonds.com