What is a Tax Preparer Bond?

Tax preparers, like H&R Block or Liberty Tax, have to become bonded, and in California, this is specifically referred to as a California tax preparer bond. Most states require these bonds now, which is an outgrowth of the tax fraud cases of several years ago (not against H&R Block, though) where tax preparers were filing returns that they knew were improper.

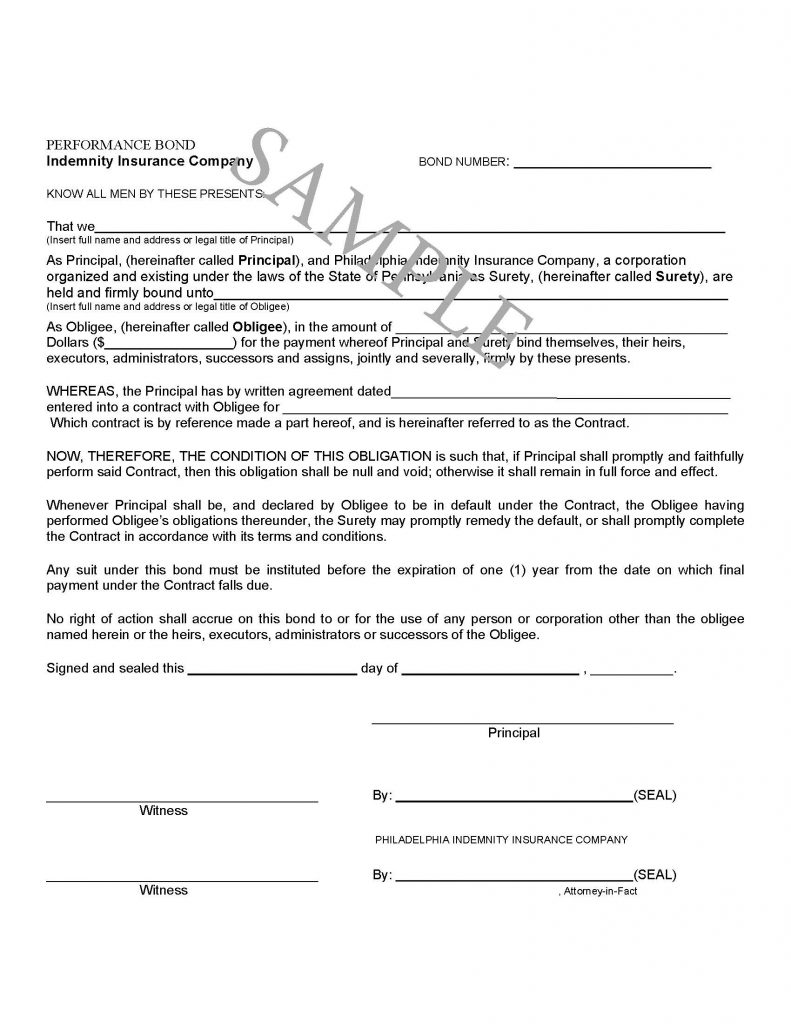

To get a Tax Preparer Bond, just click on the Apply Online image below. Choose your state and then the type of bond you need.

Who Needs a Tax Preparation Bond?

In California, a tax preparation bond is a must-have for anyone who charges a fee to prepare or assist in preparing state or federal tax returns. This requirement applies to both independent tax preparers and those working for tax preparation companies. However, there are notable exceptions. Enrolled agents (EAs), California certified public accountants (CPAs), attorneys who are members of the California state bar, and certain bank or trust officials are exempt from needing a tax preparation bond. These professionals are already subject to stringent regulatory standards, which provide a level of assurance similar to that of a bond.

How to Get a Tax Preparation Bond

Obtaining a tax preparation bond is a straightforward process. You can purchase one from a surety company licensed to issue bonds in California. The steps typically involve filling out an application, providing some basic information, and paying the bond premium. For California tax preparers, the required bond amount is $5,000. Once you have secured the bond, you will receive the bond documents, which you need to submit to the California Tax Education Council (CTEC) as part of your registration application. This ensures that you are compliant with state regulations and can legally offer tax preparation services.

Bond Cost and Term Options

The cost of a tax preparation bond in California is generally affordable, with a typical rate of $16 per year for a 5-year term, totaling $80 for the full term. However, the actual cost can vary based on the surety company and the applicant’s creditworthiness. Some surety companies may offer discounts for longer-term bonds or for applicants with excellent credit. It’s advisable to shop around and compare prices from different surety companies to ensure you get the best deal for your tax preparation bond.

Benefits of a Tax Preparation Bond

A tax preparation bond offers numerous benefits for both tax preparers and their clients. For tax preparers, having a bond demonstrates a commitment to professionalism and ethical conduct. It also provides a safeguard against claims of misconduct or negligence. For clients, a tax preparation bond offers a layer of financial protection in case the tax preparer makes an error or engages in unethical behavior. This bond can help clients recover damages if they suffer financial loss due to the tax preparer’s actions, thereby fostering trust and confidence in the tax preparation services provided.

See our License and Permit Bond page for more. Click here for more on bonds.