What is a Concessionaire Bond?

A concessionaire surety bond is a specialized type of non-construction contract bond designed to protect grantors and clients. This bond forms a tri-party agreement involving the concessionaire (principal), the grantor (obligee), and the surety bond company (surety). Essentially, it guarantees that the concessionaire will adhere to the terms outlined in the concession agreements. By securing a concessionaire surety bond, clients are safeguarded against dishonest business practices, and it ensures that the concessionaire will fulfill their financial obligations, such as paying rent and other dues, while operating within the grantor’s premises.

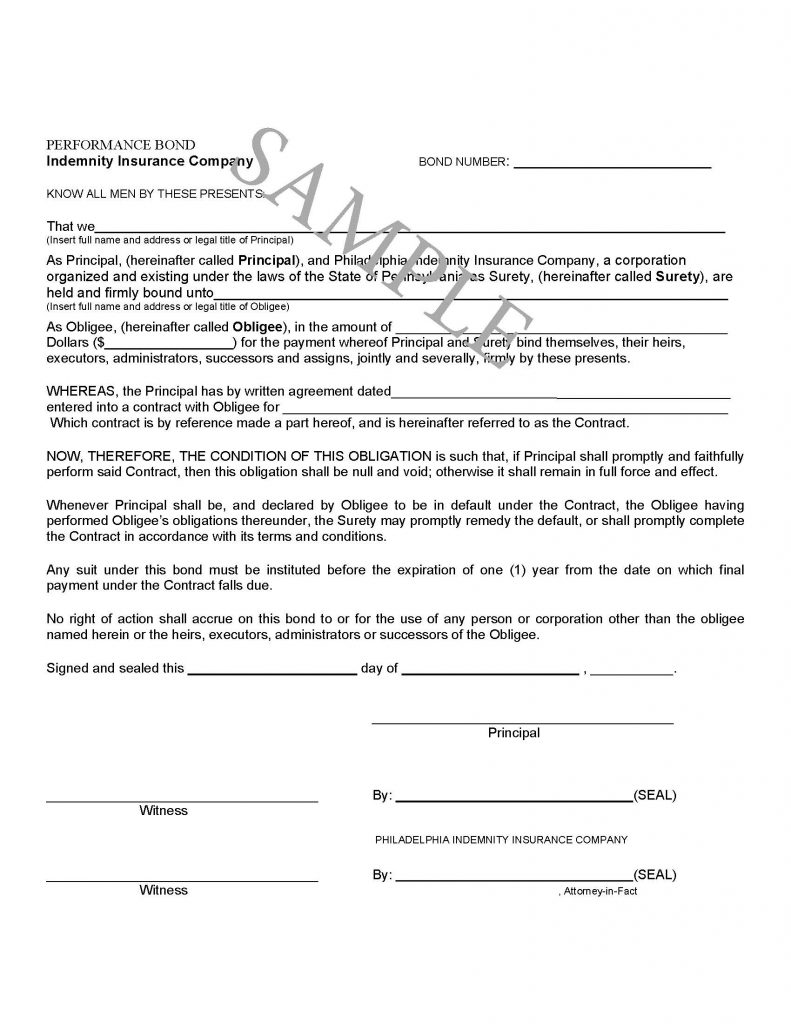

To get a Concessionaire Bond, just click on the Apply Online image below. Choose your state and then the type of bond you need.

Why is a Concessionaire Bond Required?

A concessionaire bond is essential for protecting the property owner (grantor) from potential financial losses that may arise if a concessionaire fails to comply with the concession agreement. This bond acts as a financial guarantee, ensuring that the concessionaire will pay all required fees, including rent and other payments. The surety company provides this guarantee, covering financial damages up to the bond amount, also known as the penal sum. If the concessionaire violates the terms of the agreement, the surety bond compensates the grantor, and the concessionaire must reimburse the surety company for any payments made. This requirement ensures that concessionaires are accountable for their actions and provides a layer of financial security for the grantor.

Concessionaire Bond Requirements

The requirements for obtaining a concessionaire bond can vary based on state and municipal regulations. Generally, these bonding requirements stipulate that the principal must pay all fees owed to the grantor, including rent and other payments. The bond amount is determined by the municipality and is typically based on the estimated income from the concessionaire’s business. The surety company sets the bond premium, which is usually a small percentage of the bond amount and is charged annually until the bond is released by the municipality. To secure a concessionaire bond, applicants need to complete an online application and provide the concessionaire agreement. An agent will then review the application and either provide a quote or request additional information required by the underwriters.

Click for surety bond application

Kansas City – Sign Hanger Bond

See our License and Permit Bond page for more.

Click here for more on bonds.