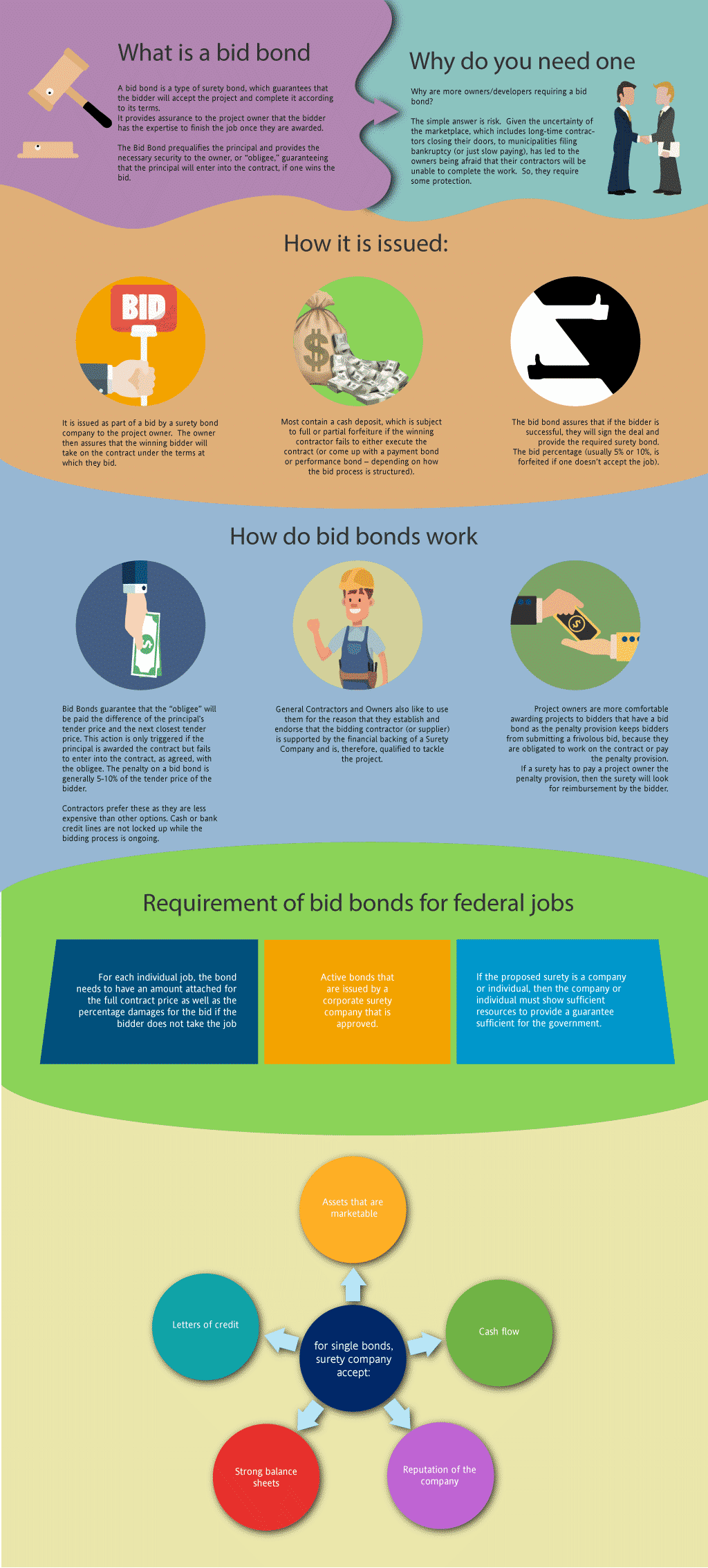

What is a Bid Bond?

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete it according to its terms, providing bid bond guarantees to the project owner. A bid bonds protects an owner, called an Obligee, from a loss if a contractor who is the lowest bidder fails to sign a contract (or later is unable to get a performance bond and payment bond.

Swiftbonds LLC is the leading provider of Bid Bonds in the nation. We say that with a bit of pride, and a bit of humility because we know that it’s really you, our customers, that make us who we are. We’ve worked tirelessly over the years to create a place where you can find the very best bid bonds for your projects. We’ve developed relationships with nearly every surety bond provider so that we can pick and choose the right party for you.

Why do you need a bid bond?

It provides assurance to the project owner that the bidder has the expertise and wherewithal to finish the job once you are selected after the bidding process. Bid bonds are a type of contract bonds that provide assurance to the project owner that the bidder has the expertise and wherewithal to finish the job once selected. The simple reason is that you need one in order to get the work. But the bigger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to the owners being afraid that their contractors will be unable to complete the work. So, they require some protection. It shows that you have the financial ability to do the job. A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assured that the winning bidder will take on the contract under the terms at which they bid. Most contain a cash deposit, which is subject to full or partial forfeiture if the winning contractor fails to either execute the contract (or come up with a payment bond or performance bond – depending on how the bid process is structured). The bid bond assures that, should the bidder be successful, they will sign the deal and provide the required surety bond. The bid percentage (usually five or ten percent 5, 10%, is forfeited if you don’t accept the job). The Bid Bond prequalifies the principal and provides the necessary security to the owner or general contractor, or “obligee,” guaranteeing that the principal will enter into the contract, if it is awarded.

How Do They Work?

A Bid Bonds guarantee that the “obligee” will be paid the difference of the principal's tender price and the next closest tender price. This action is only triggered should the principal be awarded the contract but fails to enter into the contract, as agreed, with the obligee. The penalty on a bid bond is generally ten percent of the tender price of the bidder. Contractors really prefer to use these as they are a less expensive option than others available. They also do not lock up cash or bank credit lines while the bidding process is ongoing. General Contractors and Owners also like to use them for the reason that they establish and endorse that the bidding contractor (or supplier) is supported by the financial backing of a Surety Company and is, therefore, qualified to tackle the project. Project owners are more comfortable awarding projects to bidders that have a bid bond as the penalty provision keeps bidders from submitting a frivolous bid, because they are obligated to work on the contract or pay the penalty provision. If a surety has to pay a project owner the penalty provision, then the surety will look for reimbursement by the bidder.

How Do I Get a Bid Bond?

You can get an application by going here:

Discover what is a bond for construction and secure your project's success today!

How much does a bid bond cost?

We do not charge for our bid bonds, except for FedEx fees if required. The reason for this is that we charge upon the award of the contract and issue a performance bond and you complete the project.

Requirements of Bid Bonds

The Miller Act governs all federal jobs and most states have passed similar statutes for local government work. Thus, bidders for a federal job are required to have a bid bond for their federal jobs. You need to know the ins and outs of the process so that you can bid properly and get the job and then start work. For bonds on federal jobs, this is what is normally needed:

- For each individual job, the bond needs to have an amount attached for the full contract price as well as the percentage damages for the bid if the bidder does not take the job

- Active bonds that are issued by a corporate surety company that is approved.

- If the proposed surety is a company or individual, then the company/individual must show sufficient resources to provide a guarantee sufficient for the government.

To support single bonds, surety companies accept:

- Letters of credit

- Assets that are marketable

- Cash flow

- Strong balance sheets

- Reputation of the company

What do Bid Bonds Cost?

We do not charge for a bid bond, except for any overnight fees to get you the original bid bond paperwork for the bid deadline. Many entities do not require the original bid bond paperwork and will accept the electronic copy (which you sign). The charge is only for the underlying performance bond.

Differences between Bid and Performance Surety Bonds

Understanding the difference between bid bonds and performance bonds is absolutely crucial to making the most out of your construction projects. Bid bonds and performance type bonds can have significant cost differences so when looking at the value of a bond it can be easy to be fooled when you don't consider the overall cost. The performance type generally include extra costs because much of the money is recouped if the contractor fails to actually complete a contract pursuant to the terms of that contract. With other types of bonds there is always a chance that a project might not be completed (or get changed enough that the bond is no longer valid) and you won't recoup the total cost of the bond that you've taken out.

Get a Bid bond – What is the cost?

These come with a guarantee from a special third-party guarantor, called the surety (usually an insurance company or a bank). This insurance policy insures that the owner will end up getting some type of payment if the contractor fails to fully complete the construction contract as outlined in the bond. These types of bonds are not to be considered the same as fidelity bonds, instead the guarantor will have to recover the funds. This can mean that the owner may not be able to recoup the funds immediately, which can lead to extra costs and a longer waiting time to recoup the owner's expenses.

Bid Bond and Performance Bonds

Federal and state jobs make sure that the bidding companies have a bid bond prior to even allowing the bid, and if the bidder is successful and wins the job, the next step is to be issued performance and payment bonds. On our Performance Bond page, we started explaining bonds, which we continued on our Contract Bond page. We are continuing from our earlier description of bond rejections. Prior Problems What is a Bid Bond Bank Guarantee? A bid surety bond/bank guarantee is another name for a surety bond known as a bid surety bond. This bond is required for many governmental contracts and then the high bidder will be required to get a performance bond. A performance bond is usually given to a construction company when they need to be bonded for a surety bond job. In addition, a performance bond is usually granted in conjunction with payment bond. A performance bond is required for any governmental contract as dictated by the Miller Act. Most states have also passed statutes that require a performance and payment bond in their own states and these laws are known as little miller acts. The bid/bank guarantee bond shows that the bank is providing the suretyship on behalf of the bidding company. This guarantee has several benefits to the bidding company, such as allowing them to bid on multiple contracts at the same time without having to place large amounts of funds into escrow. Otherwise, significant cash flow is used up in the bidding process, which is better utilized in the actual performance of the jobs.

Some Issues that Arise when Getting a Bid Bond

- Fraud/Theft and other Bad Acts. So how do we deal with prior problems? Especially those that deal with dishonesty or fraud? Well, we deal with this head on.

- Drugs, Alcohol and Gambling These are the typical vices that have ensnared many victims throughout the ages. In fact, many investigators state that when they find evidence of one of these vices, the others are sure to follow. So, let's disclose how damaging these are to the applicant.

- Large Debts and Living above your Means. We have found that our clients are extremely disturbed when they are turned down because their personal debt load is considered too high.

- Bad or nonexistent references. There are a variety of ways that bad or nonexistent references can hurt a principal. First, there are the references that are not able to be contacted. Their phone calls are not returned, emails are ignored, or the worst is if any mailing is returned. Obviously, this reference is stale – at best – or fictitious at worst. In either event, this type of reference will usually spell doom for any bond issuance.

- Social Media and Online Presence. You would be surprised by how many people are undone because their online presence reveals something negative about them.

- Rejection Explanation. We consistently ask our bond companies for the rationale behind why they decided against writing a bond. Because we do this consistently, they are not offended by the questions. We do this so that we can learn several things. First, we want to always keep a handle on what each particular bond company is doing. By asking for any rejection reasons, we keep a good pulse on them and whether they are tweaking their underwriting criteria. Next, we definitely want to have an answer when our clients come and ask us about why they didn't get a bond. Yes, we are super-successful in getting bonds placed. This sometimes leads to the perception that we are perfect and never get a bond rejected. We wish that were the case. Unfortunately, many times people are not quite so, ah, gracious, when their bond application is denied. Thus, they immediately start to accuse of bias and create an atmosphere of hostility. Principals are upset that they have to spend time and effort to get another bond. Employers are upset that their employees were rejected and, gasp, that they would have to find another employee (the effort for looking for another employee seems to outweigh the fact that the employee was unfit for the position). Finally, we know of many bond companies that get contacted by attorneys that are objecting to the rejection and seem to be saying “hey, I'm an attorney and I could sue, so please give them a bond.” Attorneys like this as they get paid good money, but I am unaware of a time when a bond company actually changed its mind after being contacted by an attorney.

What is a contract bid bond? For most occupations, including the likes of insurance agents, contractors, and any business that relates to bidding or labor forces, will require some type of surety bond. Even though there are many types of bonds available including, permit, licensing, contract bond, figuring out how all of these works, should give you a much better look at which bonds are going to be most effective for the business you own. Firstly, bonds are three way contracts made between the owner (known as the Obligee), the contractor (known as Principal) and the company doing the bonding (also known as Surety). The bonds are meant to signify the agreement that the contractor will perform the task promised to the owner, according to what's stated in the contract(s). If this ends up not happening, the surety company will be forced to compensate the owner for the contractor's damage. See more at our pages for California Bid Bond, Florida bid bond, Texas Bid Bond, bid bond in Ohio, and New York bid bond.

The interplay of contract law and construction law is critical in ensuring the smooth execution of public works projects. These legal frameworks govern agreements and obligations, ensuring compliance with regulations like the Federal Acquisition Regulation and the Miller Act, which mandates financial guarantees in federally funded projects. Tools such as maintenance bonds, fidelity bonds, and supply bonds are essential for mitigating risks and protecting the interests of all parties involved. These bonds, often issued as part of suretyship agreements, provide security for project performance and financial integrity in large-scale endeavors, including those in civil engineering.

In the realm of risk management, bank guarantees and bid bond insurance play vital roles in the public works projects sector. Contractors often utilize bid bonds to demonstrate their financial reliability during the procurement process. The bid bond premium, a cost associated with securing such a bond, is determined based on the scope and value of the project. Events like a bid bond refund or bid bond expiration are crucial to contractors' financial planning. Moreover, bid bond renewal may be necessary to maintain compliance and project eligibility. These transactions typically involve a surety bond company, which ensures that all parties adhere to the stipulated contract terms, thereby safeguarding project continuity and financial stability.

Claims Against Bid Bonds

While claims against bid bonds are relatively rare, they can occur under certain circumstances. If a contractor fails to enter into a contract with the project owner after being awarded the bid, the project owner has the right to claim the bid bond amount. Typically, this amount ranges from 5-10% of the total contract price. When a claim is made, the surety company will conduct a thorough investigation to determine its validity. If the claim is justified, the surety company may pay the project owner the claimed amount. However, this doesn’t mean the contractor is off the hook. The surety company may pursue legal action against the contractor to recover the costs incurred. This process underscores the importance of contractors fulfilling their obligations once they win a bid, as failing to do so can have significant financial and legal repercussions.

Can You Get a Bid Bond with Poor Credit?

Securing a construction bid bond with poor credit can be challenging, but it is not impossible. Surety companies view contractors with poor credit as higher risks, which often results in higher premiums or the need for additional collateral. Contractors with poor credit should be prepared to provide more comprehensive financial documentation and possibly offer personal or business assets as collateral. It’s crucial for these contractors to shop around and compare rates from different surety companies, as terms and conditions can vary significantly. By doing so, they can find a surety company willing to work with them despite their credit history. Additionally, improving financial practices and demonstrating a stable cash flow can help mitigate the perceived risk and potentially lower the cost of the bid bond.

Preventing Claims and Disputes

Preventing claims and disputes related to bid bonds starts with a thorough understanding of the bid bond requirements and the terms and conditions of the contract. Contractors should meticulously review all documents and ensure they have the necessary funds and resources to complete the project as bid. Open and transparent communication with the project owner and the surety company throughout the bidding process and the project duration is also essential. This proactive approach helps address any issues that may arise promptly and prevents misunderstandings. By maintaining a clear line of communication and being fully prepared, contractors can minimize the risk of claims and disputes, ensuring a smoother and more successful project outcome.

Conclusion

In conclusion, bid bonds play a crucial role in the construction industry, providing project owners with assurance that contractors will fulfill their obligations. Understanding how bid bonds work, the bid bond cost, and the bidding process is essential for contractors to succeed in the industry. By knowing the differences between bid bonds, payment bonds, and performance bonds, contractors can better navigate the complex world of construction bonding. Whether you’re a contractor or project owner, it’s essential to work with a reputable surety company to ensure that your project is protected. By doing so, you can minimize risks and ensure a successful project outcome.

Swiftbonds Contact Details:

Tel:(913) 214-8344, Fax:(866) 594-2771, E-mail: gary(at)swiftbonds.com