You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to gary@swiftbonds.

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in California?

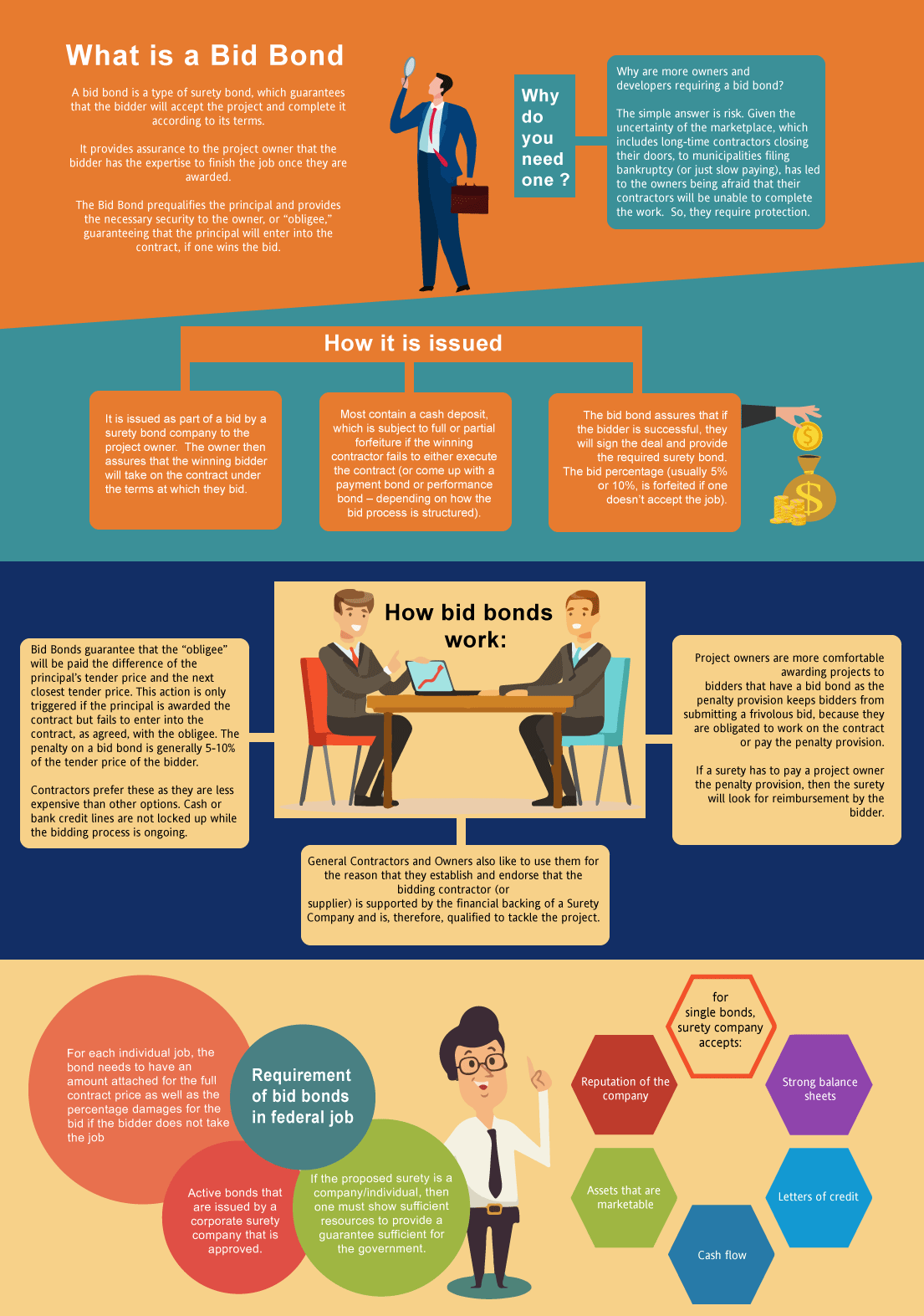

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the expertise and wherewithal to finish the job once the bidder is selected after winning the bidding process. The basic reason is that you need one so that you get the work. However, the larger question is why are more owners/developers requiring a bid bond in the first place? The basic answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our California Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in California?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the underlying contract.

How much do bonds cost in CA?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of California. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in California?

We make it easy to get a contract bid bond. Just click here to get our California Bid Bond Application. Fill it out and then email it and the California bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review all applications for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your contract. We have a high success rate in getting our clients surety bid bonds at the best rates possible.

What is a California Bid Bond?

A bid bond is a bond that assures that you will accept the work if you win the contract. The bid fee (usually five or ten percent) is a fine that is paid when you win the bid, but then back out of doing the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is risk security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the company that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it's the general contractor that has to apply for the bond and be underwritten before the bond is written by the surety. This is also known as bonding a business.

We provide bid bonds in each of the following counties:

Alameda

Alpine

Amador

Butte

Calaveras

Colusa

Contra Costa

Del Norte

El Dorado

Fresno

Glenn

Humboldt

Imperial

Inyo

Kern

Kings

Lake

Lassen

Los Angeles

Madera

Marin

Mariposa

Mendocino

Merced

Modoc

Mono

Monterey

Napa

Nevada

Orange

Placer

Plumas

Riverside

Sacramento

San Benito

San Bernardino

San Diego

San Francisco

San Joaquin

San Luis Obispo

San Mateo

Santa Barbara

Santa Clara

Santa Cruz

Shasta

Sierra

Siskiyou

Solano

Sonoma

Stanislaus

Sutter

Tehama

Trinity

Tulare

Tuolumne

Ventura

Yolo

Yuba

And Cities:

Los Angeles

San Francisco

San Diego

Sacramento

San Jose

Santa Barbara

Oakland

Beverly Hills

Santa Monica

Palm Springs

Long Beach

Santa Cruz

Malibu

Anaheim

See our Colorado Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Clear-Cut Recommendations When Looking At Bid Bonds

You will need to understand that a Surety Bid Bond is vital to any person, but it is quite complicated if you don't have any knowledge relating to this. This isn't an insurance claim because this is a type of guarantee that the principal will effectively complete the task. You have to know that some jobs will require you to get a specific bond before they actually opt for your services because it will probably be a type of guarantee to them. They need this kind of thing from you so you need to look for an insurance company that may offer this to you. If you genuinely wish to consider a bid bond for your company, you have to understand what it means.

The Significance Of A Surety Bid Bond

Bid Bonds will always be in demand to protect the public because it is a kind of assurance that your obligations and duties will be complete. You should get a Surety Bid Bond to be sure that your company will adhere to the laws and you typically obtain a contract bond to guarantee that a public project will be completed. A bid bond is intended for the obliged since they are actually the ones that need protection, but it can also benefit you because the clients will trust you if you have this. There are thousands of bonds today and the kind of bond that you are trying to find would depend upon your situation.

The Work Of A Surety Bid Bond

Bid Bonds are regarded as a three-party agreement between the principal, the obliged and the surety company. The obliged is the project owner while the principal is the employer or company that will perform the work. Construction organizations will almost always be required by the law to get bid bonds when they are employed for a public project. The government will actually demand a construction company secure a bond before they work on a certain project. The bond will guarantee that the sub-contractors and the other workers can be paid even if the contractor will default. The contractor will cover the losses, but as soon as they reached their limit, the duty will fall to the surety company.

Applying For A Surety Bid Bond

Insurance businesses often provide bid bonds, but there are some standalone surety companies that focus on these products. Surety companies will usually be licensed by a state Department of Insurance so just be sure you check first before you avail. It will not be simple to apply for a bond because the applications will need to proceed through checking before it's approved. The bond underwriters will first review the financial history of the candidates, credit profile and other key factors.

The Cost Of A Surety Bid Bond

You can expect that a surety bid bond won't have a fixed cost as it will depend upon different reasons such as bond type, bond amount, where the bond will likely be issued, contractual risk, the credit history of the applicant and a lot more.

There are thousands of bonds available today and the cost will depend upon the kind of bond that you want to obtain. The amount of the bond will also be an issue because you may need a $10,000 bond or a $25,000 bond.

In case you have a credit score of above or near 700, you'll be eligible for the standard bonding market and you'll only pay a premium that's 1 to 4 percent of the surety bid bond amount. If you are going to get a $10,000 bond, it will cost around $100 to $400.

Your Application Might Be Denied

There's a chance that your bid bond request will be refused by the surety company underwriters because it will depend on the things that they will get from the background check. If the surety company thinks that it will likely be a large risk to offer you a bid bond, they will deny your application. Your credit rating is one of the most important factors to be accepted for a bid bond because if you have a bad credit rating, it will likely be difficult to get bonded.

If you can qualify for a surety bid bond even with a bad credit history, you'll most likely pay an interest rate of 10 to 20 percent.

If you intend to apply for a bid bond, ensure that you know what it can entail prior to deciding. It will not be a simple task to be approved for this, but if you know how it works, you will also have a better chance of getting bonded.