You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Texas?

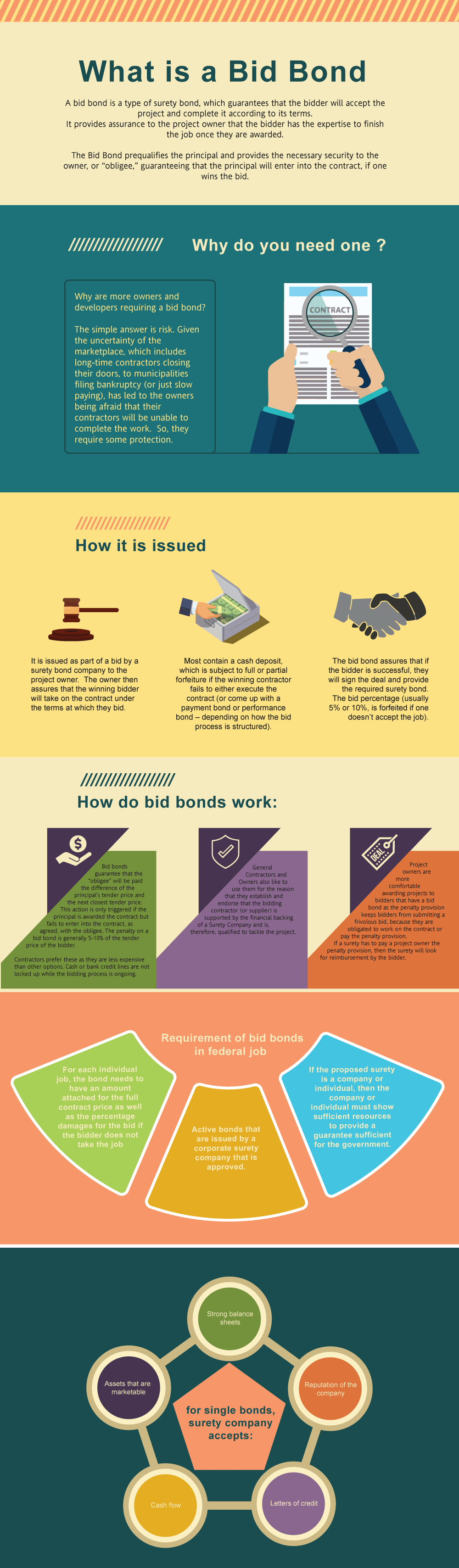

A bid bond is one of the types of surety bonds, which guarantees that the bidder will enter into the contract and complete the agreement according to its terms. It provides assurance to the project owner that the bidder has the ability and capability to complete the job once you are selected after the bidding process. The basic reason is that you need one to get the job. However, the larger question is why are more owners/developers requiring a bid bond in the first place? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Texas Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Texas?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the contract bond if you win the contract. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract (very rare).

How much do bonds cost in TX?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Texas. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Texas?

We make it easy to get a contract bid bond. Just click here to get our Texas Bid Bond Application. Fill it out and then email it and the Texas bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We review each application for surety bonds and then submit it to the surety that we believe will provide the best surety bid bond for your contract. We have a excellent success rate in getting our clients bid and P&P bonds at the best rates possible.

Why Texas Bid Bonds Are Crucial for Contractors

In our observation, a Texas bid bond is a vital requirement in public and private construction projects across the state. It ensures that a contractor, upon winning a bid, will honor their commitment to execute the contract. Bid bonds protect project owners from contractors who might submit a low bid but are unable to follow through with the project’s demands. From our perspective, having this bond in place establishes trust between contractors and project owners, ensuring financial security during the bidding phase.

How to Find the Perfect Bid Bond Provider in Texas

We’ve often noticed that one of the most common concerns for contractors is finding the right bid bond provider. In Texas, numerous agencies offer these bonds, but it’s important to select a provider with a solid track record. In our professional life, we’ve found that working with a local agency familiar with Texas regulations can streamline the application process.

When searching online, using terms like “bid bond Texas” or “performance bond Texas” can help locate reputable providers quickly. These terms will connect you with surety bond companies that offer not only bid bonds but also other essential bonds like performance bonds. Researching online or contacting industry associations can help contractors find reputable surety companies that offer bid bonds and other necessary bonds for large projects in Texas.

Who Needs Bid Bonds? A Texas Contractor’s Guide

Based on our experience, bid bonds in Texas are typically required by project owners for contractors bidding on public projects, although private sector projects may also call for them. The project owner, also known as the obligee, is the one who demands the bond to protect their interests. We’ve come to understand that contractors benefit from this arrangement by building credibility and showcasing their reliability to project owners.

Who Specifically Needs Bid Bonds in Texas?

We’ve observed that several types of contractors and businesses in Texas commonly require bid bonds:

- General Contractors: Contractors bidding on large construction projects, especially for public infrastructure like roads, schools, or government buildings.

- Subcontractors: When subcontractors are involved in bidding for specific parts of a larger project, especially if requested by the general contractor.

- Public Project Bidders: Any contractor bidding on federal, state, or municipal projects is often required to have a bid bond.

- Private Project Bidders: Some private-sector construction projects also require bid bonds to ensure financial security.

- Suppliers for Large Contracts: In some cases, suppliers providing materials for extensive projects may be asked to provide bid bonds if the project owner demands it.

We’ve consistently observed that ensuring a bid bond is in place for these types of contracts helps secure the bidding process, providing both protection for project owners and enhanced credibility for contractors.

We provide bid bonds in each of the following counties:

Anderson

Andrews

Angelina

Aransas

Archer

Armstrong

Atascosa

Austin

Bailey

Bandera

Bastrop

Baylor

Bee

Bell

Bexar

Blanco

Borden

Bosque

Bowie

Brazoria

Brazos

Brewster

Briscoe

Brooks

Brown

Burleson

Burnet

Caldwell

Calhoun

Callahan

Cameron

Camp

Carson

Cass

Castro

Chambers

Cherokee

Childress

Clay

Cochran

Coke

Coleman

Collin

Collingsworth

Colorado

Comal

Comanche

Concho

Cooke

Coryell

Cottle

Crane

Crockett

Crosby

Culberson

Dallam

Dallas

Dawson

Deaf Smith

Delta

Denton

DeWitt

Dickens

Dimmit

Donley

Duval

Eastland

Ector

Edwards

Ellis

El Paso

Erath

Falls

Fannin

Fayette

Fisher

Floyd

Foard

Fort Bend

Franklin

Freestone

Frio

Gaines

Galveston

Garza

Gillespie

Glasscock

Goliad

Gonzales

Gray

Grayson

Gregg

Grimes

Guadalupe

Hale

Hall

Hamilton

Hansford

Hardeman

Hardin

Harris

Harrison

Hartley

Haskell

Hays

Hemphill

Henderson

Hidalgo

Hill

Hockley

Hood

Hopkins

Houston

Howard

Hudspeth

Hunt

Hutchinson

Irion

Jack

Jackson

Jasper

Jeff Davis

Jefferson

Jim Hogg

Jim Wells

Johnson

Jones

Karnes

Kaufman

Kendall

Kenedy

Kent

Kerr

Kimble

King

Kinney

Kleberg

Knox

Lamar

Lamb

Lampasas

La Salle

Lavaca

Lee

Leon

Liberty

Limestone

Lipscomb

Live Oak

Llano

Loving

Lubbock

Lynn

McCulloch

McLennan

McMullen

Madison

Marion

Martin

Mason

Matagorda

Maverick

Medina

Menard

Midland

Milam

Mills

Mitchell

Montague

Montgomery

Moore

Morris

Motley

Nacogdoches

Navarro

Newton

Nolan

Nueces

Ochiltree

Oldham

Orange

Palo Pinto

Panola

Parker

Parmer

Pecos

Polk

Potter

Presidio

Rains

Randall

Reagan

Real

Red River

Reeves

Refugio

Roberts

Robertson

Rockwall

Runnels

Rusk

Sabine

San Augustine

San Jacinto

San Patricio

San Saba

Schleicher

Scurry

Shackelford

Shelby

Sherman

Smith

Somervell

Starr

Stephens

Sterling

Stonewall

Sutton

Swisher

Tarrant

Taylor

Terrell

Terry

Throckmorton

Titus

Tom Green

Travis

Trinity

Tyler

Upshur

Upton

Uvalde

Val Verde

Van Zandt

Victoria

Walker

Waller

Ward

Washington

Webb

Wharton

Wheeler

Wichita

Wilbarger

Willacy

Williamson

Wilson

Winkler

Wise

Wood

Yoakum

Young

Zapata

Zavala

And Cities:

Houston

Dallas

Austin

San Antonio

Forth Worth

El Paso

Arlington

Waco

Corpus Christi

Lubbock

College Station

See our Utah Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Essential Factors to Keep in Mind Before Applying for a Bid Bond

From our perspective, contractors should carefully evaluate their financial standing before applying for a bid bond. One of the key aspects surety companies review is the contractor’s ability to meet the contractual obligations if they win the bid. We’ve consistently found that well-prepared contractors who maintain strong financial records are more likely to secure approval for a bid bond. It’s crucial to ensure that you meet the bond’s requirements to avoid delays or potential denials.

Key Areas to Consider for Bid Bond Success

We’ve come across specific items that are often reviewed when pursuing a bid bond:

- Credit Score: Sureties evaluate the contractor’s credit history. Keeping a good credit score will increase approval chances.

- Financial Stability: Contractors need to provide updated financial statements to demonstrate their ability to support project costs.

- Experience Level: Sureties often look at the contractor’s past project performance, including the scope and scale of projects handled.

- Bonding Capacity: Surety companies determine how much bonding capacity a contractor can take on, based on their current financial standing.

The Power of Surety Bid Bonds: A Safety Net for Project Owners

We’ve gained insight into the importance of understanding how surety bid bonds function. A surety bid bond is essentially a three-party agreement between the project owner, the contractor, and the surety company. The surety company guarantees that the contractor will honor the terms of their bid, offering a form of insurance to the project owner. Our experience tells us that this guarantee can be a game-changer, giving project owners confidence in the bidding process.

How Bid Bonds Work: Protecting Your Bid and Reputation

We’ve found through experience that the way a bid bond works is straightforward but crucial. The contractor obtains the bond from a surety company, which then becomes responsible for compensating the project owner if the contractor fails to execute the contract. We’ve seen firsthand how this mechanism ensures that only serious and capable contractors take part in the bidding process, reducing the risk of project failure.

Step-by-Step: Applying for a Texas Bid Bond Made Easy

We’ve had the opportunity to work with many contractors who were applying for bid bonds in Texas. The process generally involves submitting an application that includes financial statements, project history, and credit checks. In our experience, surety companies use this information to evaluate the contractor’s ability to fulfill the contract. We’ve noticed that preparation and organization play a huge role in speeding up the approval process, helping contractors secure the bond with minimal hassle.

Step-by-Step Application Process for a Texas Bid Bond

We’ve come to notice that the bid bond application process is best approached in the following steps:

- Collect Financial Documents: Ensure your company’s financial statements, tax returns, and cash flow reports are up-to-date.

- Prepare Project Details: Gather detailed information on the project you are bidding for, including scope and estimated costs.

- Submit the Application: Complete the bid bond application form from a chosen surety provider, providing all required documents.

- Undergo Credit Check: Be prepared for the surety company to evaluate your personal and business credit history.

- Wait for Approval: The surety will review your application and determine whether you qualify for the bid bond.

How Much Does a Texas Bid Bond Really Cost?

In our dealings with surety companies, we’ve noticed that the cost of a bid bond is typically a small percentage of the total project value. For instance, it may range from 1% to 5% of the bid amount. While this might seem minor, we’ve found it useful to remind contractors that failing to obtain a bid bond could lead to disqualification from bidding altogether. The upfront cost is a small investment to secure much larger project opportunities.

Common Reasons for Bid Bond Denial and How to Avoid Them

From our own observations, we’ve learned that not every contractor gets approved for a bid bond. The denial could be due to poor credit history, insufficient financial backing, or a lack of project experience. We’ve come across instances where contractors were denied due to incomplete documentation or weak financials. However, we’ve consistently found that with the right financial management and preparation, contractors can greatly improve their chances of securing a bid bond.

How to Avoid Bid Bond Denial

We’ve worked closely with contractors and observed these steps to improve your chances of bid bond approval:

- Maintain a Good Credit History: A solid personal and business credit score can enhance your application’s success.

- Strengthen Your Financial Standing: Ensure your financial records are accurate and demonstrate financial stability.

- Gain Experience: Take on smaller projects to build a successful track record, especially if you’re a new contractor.

- Be Thorough in Documentation: Ensure all required documents are complete and accurate before submitting the application.

- Work with a Reputable Surety Provider: Choose a provider with experience and understanding of the Texas bid bond process.

Final Thoughts: Why Bid Bonds Matter in Texas Construction

In our view, bid bonds are an essential part of the construction landscape in Texas. They provide both financial protection for project owners and credibility for contractors. We’ve been fortunate to work with contractors who successfully navigated the bid bond process, and it’s clear that the right preparation, provider, and financial understanding can make all the difference. By being proactive, contractors can secure their bids and build strong reputations within the industry.

Learn more about texasbid com.