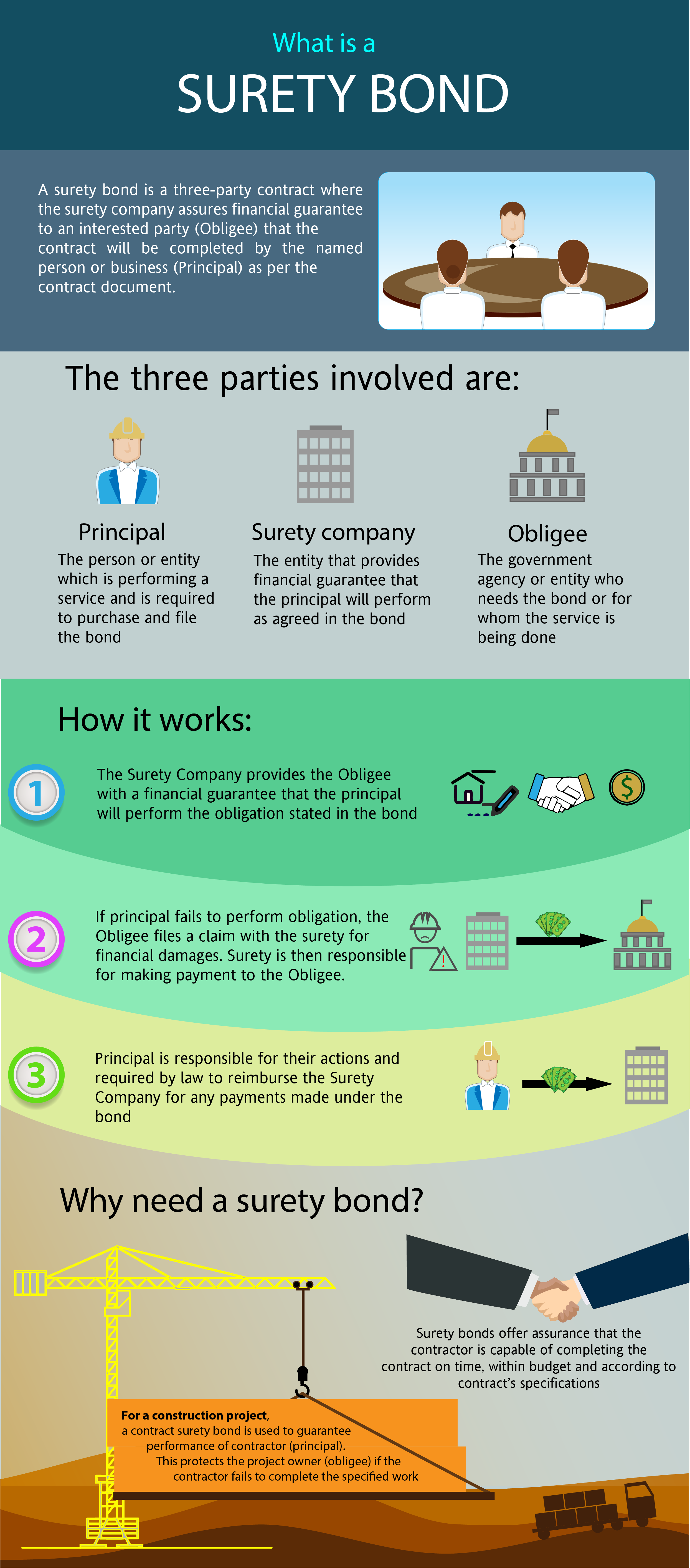

A surety bond is a legally binding agreement. It involves three parties: 1) the principal, 2) the obligee, and 3) the surety. The Principal is the party that purchases the bond and promises to fulfill a specific obligation. This obligation could be a contract, a law, or a regulation. The Obligee is the party that requires the bond. They are the ones protected if the principal fails to meet the obligation. The Surety is the insurance company that backs the bond. They guarantee that the obligee will be compensated if the principal fails to fulfill the obligation.

In essence, a surety bond serves as a form of financial protection. It ensures compliance with laws and regulations. Here are some key points to remember:

- They are not insurance policies. The principal must repay the commercial surety if a claim is paid.

- They are in many industries, especially construction.

- They can be used to guarantee performance, payment, or compliance with laws.

- The cost of a surety bond depends on the principal’s creditworthiness and the risk of the obligation.

- A claim against a surety bond can have serious financial consequences for the principal.

- The bond covers the obligee against losses and guarantees performance in contractual obligations.

What is the Definition of a Surety Bond?

A surety bond is a promise or agreement made by one party to assume responsibility for the financial obligations of another if they default. Essentially, it acts as a financial safety net, ensuring that debts and obligations will be met even if the original party fails to do so. The party that guarantees the debt is known as the surety or guarantor. They are legal contracts that obligate one party to pay if the other fails to live up to the agreement. This mechanism is crucial in various industries, providing a layer of financial security and trust.

The Three-Party Agreement: Principal, Obligee, and Surety

The principal, obligee, and surety each play a unique role in a surety bond agreement. Understanding these roles is crucial to grasp the concept.

The principal is the party that needs the bond. They are responsible for fulfilling the obligation outlined in the bond. If they fail, they must compensate the surety for any claims paid.

The obligee is the party that requires the bond. They are the beneficiary if the principal fails to meet the obligation. The bond protects them from financial loss.

The surety is the insurance company that issues the bond. They guarantee payment of the principal’s obligation to the obligee. If the principal fails, the surety pays the obligee and then seeks reimbursement from the principal. This three-party agreement forms the basis of all surety bonds.

How Surety Bonds Work

A surety bond operates through a three-party written agreement, where one party (the commercial surety) guarantees another party (the obligee) that a third party (the principal) will fulfill their obligations. This type of bond is akin to an insurance policy that protects the obligee by ensuring performance or payment if the principal defaults. The commercial surety, typically an insurance company, provides the bond, while the obligee can be a government agency, private developer, or any other entity requiring protection. The principal is the contractor or business bound by the contract or obligation. This structure ensures that the obligee is safeguarded against financial loss, promoting trust and reliability in contractual relationships.

Types of Surety Bonds

Bonds in the United States come in various types, each serving a unique purpose. The type of bond required depends on the specific obligation and the industry involved.

Contract bonds, commercial bonds, court bonds, and bail bonds are the most common types. Each of these bonds provides a different kind of guarantee.

- Contract Bonds: These bonds ensure the performance of a contract.

- Commercial Bonds: These bonds guarantee compliance with laws and regulations.

- Court Bonds: These bonds are required in certain legal proceedings.

- Bail Bonds: These bonds ensure a defendant’s appearance in court.

- Miscellaneous Bonds: These bonds cover various specialized bonds that do not fit into standard categories.

Contract Bonds

Contract bonds are common in the construction industry. They guarantee that a contractor will fulfill their obligations under a contract and fulfill their financial responsibilities.

If the contractor fails to meet these obligations, the surety will compensate the project owner. This provides financial protection for the project owner. Government agencies often require contract bonds to ensure project completion and protect taxpayer interests.

Commercial Bonds

Commercial bonds, also known as license and permit bonds, are required for certain businesses. They ensure compliance with laws, regulations, and industry standards.

For example, a car dealership might need a motor vehicle dealer bond. This bond protects customers from fraudulent practices.

Court Bonds

Court bonds are required in certain legal proceedings. They ensure the fulfillment of a duty or obligation ordered by the court.

For instance, an executor bond guarantees the faithful performance of a deceased person's will.

The Process of Obtaining a Surety Bond

Obtaining a surety bond involves several steps. First, the principal must apply with a surety company or broker.

Surety companies then evaluate the applicant’s creditworthiness and financial stability. This process is known as underwriting.

If approved, the principal pays a premium to the surety company. The bond is then issued and becomes effective.

In Our Observation, Not Having a Surety Bond Can Lead to Serious Consequences

In our observation, businesses that fail to secure the appropriate bond often face significant consequences, both financially and legally. Without a surety bond, you may not be able to obtain necessary licenses or permits, and this could prevent you from operating your business. Worse, if you enter into a contract and fail to fulfill your obligations, you could be subject to fines, lawsuits, or loss of reputation. The federal government and various state agencies often require them to minimize public liability and ensure compliance with regulations.

Imagine bidding on a construction project only to find out later that you can’t be awarded the contract because you don’t have the required bond. Or, worse, imagine being in the middle of a project and facing legal action because you didn’t meet the bond’s conditions. These are the kinds of problems that can be avoided with the right bond in place.

We've Learned That Success Comes From Being Informed and Prepared

We've learned that businesses and individuals who are proactive in securing these bonds position themselves for success. Having the right bond in place not only fulfills legal requirements but also builds trust with clients and partners. It shows that you're serious about your responsibilities and that you have the financial backing to meet them.

At Swiftbonds, we're committed to helping you take the necessary steps to protect your business and meet your obligations. Whether you're navigating your first bond or looking to renew, we're here to make the process as seamless as possible.

At Swiftbonds, we're committed to helping you take the necessary steps to protect your business and meet your obligations. Whether you're navigating your first bond or looking to renew, we're here to make the process as seamless as possible.

Frequently Asked Questions

How long does it take to get a surety bond?

We've seen that the process can vary, but it's often quite fast. With the right information on hand, you can secure your bond within a few days.

What happens if a claim is made against my bond?

If a valid claim is made, the surety company will pay the obligee up to the bond amount. You, as the principal, are then required to reimburse the surety for the amount paid.

Do I need a different bond for each project or obligation?

In many cases, yes. Different projects or business activities may require different types of bonds. But we're here to help you figure out exactly which bonds you need for your specific situation.

We've Come to Appreciate the Value of Being Protected

We’ve come to appreciate that securing the right surety bond is more than just a legal requirement—it’s a smart business decision that protects both you and your clients. With a surety bond, you’re showing that you’re committed to meeting your obligations, and you’re providing peace of mind to everyone involved. They protect tax dollars by ensuring that government agencies do not bear the financial burden in the event of contractor failure.

At Swiftbonds, we’re ready to guide you through the bonding process, answer any questions you have, and make sure you’re fully protected. If you’re ready to take the next step or need more information, don’t hesitate to get in touch.

Conclusion

In conclusion, surety bonds are a vital tool for ensuring financial obligations are met and providing peace of mind to all parties involved. They play a crucial role in various industries by offering financial protection, ensuring compliance with regulations, and building trust. At Swiftbonds, we are dedicated to helping you navigate the complexities, ensuring you have the right protection in place. Whether you are new to surety and contract bonds or looking to renew, we are here to make the process as smooth and straightforward as possible. Secure your business’s future with the right surety bond today.

Types of Surety Bonds

A bid bond guarantees that the bonding company (“surety”) will provide a performance and payment surety bond on behalf of the principal once the principal is awarded the contract. A claim can be filed against the surety if they refuse to write the performance bond—an action that would typically involve their insurance company.

Performance Bond

A bid bond, another form of contractor bond, guarantees that the bonding company (“surety”) will provide a performance and payment bond on behalf of the principal once the principal is awarded the contract. A claim can be filed against the surety if they refuse to write the performance bond—an action that would typically involve their insurance company.

In the event of non-compliance, states may claim recourse through the contractor license bond. A performance and payment bond is the contract surety bond that is used once the contract is awarded. A performance bond protects the owner from financial loss in the event that the contractor fails to perform the contract in accordance with its terms and conditions. Most performance bonds include a provision that covers the workmanship and quality of the project for one year after completion, serving as an indemnity for the project owner against any faulty work done by the contractor or subcontractor. A performance bond usually includes a payment bond as part of the P&P bond being provided. It is, in a way, the surety's approach of meeting its contractor's obligations, duties, and costs laid out in the agreement. This process affords numerous benefits to all parties involved in a construction project.

Payment Bond – A payment bond, also known as a material and labor bond, protects certain specified tiers of subcontractors, material suppliers, and laborers against the contractor not paying. In general, these claimants have a tendency to look to get paid directly by the surety company pursuant to the terms of the payment bond. This bond, presented with the contractor's logo, is an essential element of business, especially when dealing with significant construction projects.

What does the term “bond” really mean? Unfortunately, there are a lot of bonds out there – from surety bonds to treasury bonds to other bonds, James Bonds. This is a simple explanation of a surety bond, which might help answer your questions. A guarantee bond or surety is a promise to pay someone, called the obligee, a specific dollar amount if someone else, called the principal, fails to comply with some commitment. These commitments are typically something that is specified in a contract and are especially common in construction bond contracts. The surety bond safeguards the obligee against losses arising from the principal's failure to comply with the commitment, it's a key ingredient for a smooth business transaction.

Fidelity Bonds - Another Type of Surety Bonds

A few examples of this type of contract bond arrangement include liability insurance contracts such as health care provider malpractice coverage and automobile lien holder bonds which protect you even though we do not know who may ultimately cause harm against someone else - like car accidents often result in financial damages inflicted on people, posing a significant risk to the overall investment and market value.

Bonds Guarantee Performance or Repayment

The surety bond is an agreement that one party (the surety) will be liable for the debt, default, or failure of another. It's a three-party contract between third parties where there are two different aspects: The obligee agrees to accept protection from the obligation and responsibility owed by the principal in exchange for being appropriately compensated when things go wrong; meanwhile, it also stipulates how much money should be paid if something does happen with said obligations. Every bond is seen through by underwriters, ensuring that the applicant's credit is suitable for a contractor license.

Benefits of Surety Bonds

They offer numerous benefits that make them indispensable in various industries. Firstly, they provide financial protection by ensuring that obligations will be met, which is particularly crucial in high-stakes sectors like construction. Secondly, they help businesses comply with legal and regulatory requirements, which can be essential for obtaining licenses and permits. Thirdly, they build trust with clients and partners by demonstrating a commitment to fulfilling obligations. This trust can lead to more business opportunities and a stronger reputation. Overall, they provide a safety net that mitigates financial risk and promotes confidence in business transactions.