(for Federal level bonds, search here: nationwide search)

Georgia Bond Applications:

Georgia probate bond application

Georgia ERISA Pension Plan Fidelity Bond Application

Georgia Court Bond Application

Georgia Janitorial Services Bond Application

| Acworth, GA – Land Development Performance Bond |

Albany, GA – Utility Deposit Bond |

Alpharetta, GA-Landscaping Bond |

Athens-Clarke, GA – County Building Relocation Bond |

Atlanta, GA – Contractor's License Permit Bond |

| Augusta, GA-Burglar Alarm Installer ($1,000) Bond |

Blue Ridge Mountain EMC Utility Deposit Bond |

Braselton, GA – Peddler $1,000 Bond |

Buford, GA Subdivision Bond |

Byron, GA – Liquor License $1,000 Bond |

| Cairo, GA – Gas Fitter $1,000 Bond |

Canton, GA – Landscape Establishment Bond |

City of Augusta, GA – Tree Establishment Bond |

City of Calhoun, GA Utility Deposit Bond |

City of East Point, GA – General Contractor ($25,000) Bond |

| City of Harlem, GA – Contractor License ($1,000) Bond |

City of West Point, GA – Malt Beverage Distilled Spirits License ($500) Bond |

Clayton County, GA-Contractor Code Compliance ($10,000) Bond |

Cobb County Water System Utility Deposit Bond |

Cordele, GA – Building Contractor $5,000 Bond |

| Covington, GA – Tree Maintenance Bond |

ERISA Bond Policy – Georgia |

Fayetteville, GA – Small Loan Company $2,000 Bond |

Forsyth, GA – Alcohol Beverage – Liquor-Package – $7,000 Bond |

Fulton County, GA – Maintenance Bond |

| GA – Appraisal Management Company $20,000 Bond |

GA – Auctioneers and Apprentice Auctioneers $20,000 Bond |

GA – Auctioneers and Apprentice Auctioneers $5,000 Bond |

GA – Augusta-Richmond – Dry Cleaner Bond |

GA – Bait Dealer Forfeiture $2,000 Bond |

| GA – Dealer in Agricultural Products Bond |

GA – Distilled Spirits- Resident Representative $10,000 Bond |

GA – DUI, Alcohol or Drug Use Risk Reduction Program $10,000 Bond |

GA – Employee Leasing Company Bond |

GA – Environmental Drillers or Contractors – $10,000 Bond |

| GA – Grain Dealer Bond |

GA – GreyStone Power Corporation Utility Deposit Bond |

GA – Health Spa Account Bond |

GA – Ignition Interlock Provider Center $10,000 Bond |

GA – Immigration Assistance Provider $5,000 Bond |

| GA – Insurance Broker $2,500 Bond |

GA – Insurance Counselor $5,000 Bond |

GA – Insurance Premium Finance Company $25,000 Bond |

GA – Itinerant Vendor Bond |

GA – Liquor Broker Tax $2,500 Bond |

| GA – Liquor Wholesalers Tax $5,000 Bond |

GA – Livestock Dealer, Broker or Packer Bond |

GA – Long-Term Care Facility Resident's Fund Bond |

GA – Lumber Liquidators Inc. Installation Provider Bond |

GA – Malt Beverage Importer Performance and Tax Liability $5,000 Bond |

| Georgia – Liquor Importer ($5,000) Bond |

Georgia – Liquor Manufacturer and Distillery ($10,000) Bond |

Georgia – Lottery Retailer Bond |

Georgia – Money Transmitter – NMLS Bond |

Georgia – Mortgage Loan Originator Bond |

| Georgia – Nonpublic Postsecondary Educational Institution Bond |

Georgia – Private Detective & Security Agencies ($25,000) Bond |

Georgia – Right of Way Performance Bond |

Georgia – Third Party Administrator ($100,000) Bond |

Georgia – Trauma Scene Waste Management Practitioner $25,000 Bond |

| Georgia Charter Schools Bond |

Georgia General Contractor Bond |

Georgia Motor Fuel Distributor Bond |

Georgia Process Server Bond ($25,000) |

Georgia Public Adjuster Bond ($5,000) |

| Georgia Used Motor Vehicle Dealer Bond ($35,000) |

Georgia Winery Manufacturer Broker Importer Tax Bond ($5,000) |

Gordon County, GA – Salvage Yard Restoration – $1,000 Bond |

Gwinnett County, GA – Contractor's Building Code Compliance – $25,000 Bond |

Hall County, GA-Mobile Home Set Up Contractor ($10,000) Bond |

| Hancock County, GA-Septic Installer and Repair ($10,000) Bond |

Henry County, GA – Land Development Bond |

Houston County, GA – Beer and Wine Retail Sales $750 Bond |

Jackson County, GA – Soil Erosion and Sedimentation Control Bond |

Jasper County, GA – Install or Repair Septic Tanks and Grease Traps $10,000 Bond |

| Kennesaw, GA-Erosion and Sediment Control Bond |

Lake City, GA – Itinerant Vendor Bond |

Macon, GA-Plumbing Bond ($25,000) |

Madison County, GA-Timber Harvesting ($5,000) Bond |

Manchester, GA – Retailers and Consumption on Premises Beer & Malt Beverage License $2,000 Bond |

| Marietta, GA – Board of Lights and Water Utility Deposit Bond |

Milton, GA – Landscaping Performance Bond |

Monroe County, GA – Septic Tank Contractor ($10,000) Bond |

Oglethorpe, GA – Sale of Wine, Malt Beverages and Distilled Spirits $2,000 Bond |

Putnam County, GA – Retail Malt Beverages and/or Wine License ($300) Bond |

| Savannah, GA – Electric and Power Company Utility Deposit Bond |

Smyrna, GA – Contractor Code Compliance $15,000 Bond |

Statesboro, GA – License or Permit Bond |

Telfair County, GA – Logging Operation Right of Way Permit Bond |

Thomasville, GA – License Permit $1,000 Bond |

| Tifton, GA – License Permit Bond |

Toccoa, GA-Retailers & Consumption on Premises Liquor License ($5,000) Bond |

Valdosta, GA – Plumber ($2,000) Bond |

Walker County, GA-Timber Harvesting Bond ($20,000) |

Walton Electric Membership Corporation Utility Deposit Bond |

| Ware County, GA – Logging Operation Right of Way Permit Bond |

Washington County, GA-Septic Tank Grease Trap Install and Repair ($3,000) Bond |

Wheeler County, GA – Logging Operation Right of Way Permit ($5,000) Bond |

White County, GA-Septic Tank Grease Trap Install and Repair ($10,000) Bond |

Wilkinson County, GA-On-Site Sewage Management Systems ($10,000) Bond |

| Atlanta, GA – Erosion Control Performance Bond |

Atlanta, GA – Gas Light Company Utility Deposit Bond |

Atlanta, GA – Right of Way Performance and Completion Bond |

Augusta, GA-Demolition Contractor ($1,000) Bond |

Augusta, GA-Electrical Wiring and Electrical Work ($1,000) Bond |

| Augusta, GA-General Contracting, Plumbing, Electrical or Gas Fitting ($20,000) Bond |

Augusta, GA-Heating and Air Conditioning Work ($1,000) Bond |

Augusta, GA-Richmond County Contractor License Bond |

Augusta, GA – Secondhand Dealer and Pawnbroker Bond |

Augusta, GA-Sign Contractor ($5,000) Bond |

| Cairo, GA – Utility Deposit Bond |

City of Pooler, GA – Landscape Maintenance and Warranty Bond

|

Clayton County, GA-Pawn Shop Bond

|

Cordele, GA – Building Mover $5,000 Bond |

Cordele, GA – Master Electrician $5,000 Bond

|

| Cordele, GA – Master Plumber $5,000 Bond |

Cordele, GA – Mechanical $5,000.00 Bond

|

Forsyth, GA – Alcohol Beverage – Liquor-Pouring – $5,000 Bond |

Forsyth, GA – Alcohol Beverage – Malt Beverages-Retailer-Package – $1,000 Bond

|

Forsyth, GA – Alcohol Beverage – Malt Beverages-Retailer-Pouring – $1,000 Bond

|

| Forsyth, Ga – Alcohol Beverage – Wine-Package – $1,000 Bond |

Fulton County, GA – Solid Waste Collection and Disposal Performance – $10,000 Bond

|

GA – Augusta-Richmond – Transient Merchant Bond

|

GA – Baldwin County – Install or Repair Septic Tanks or Grease Traps $3,000 Bond |

GA – Bartow County – Erosion and Sedimentation Control Measures Bond |

GA – Beauty Pageant Operator $10,000 Bond

|

GA – Bibb County – Erosion and Sedimentation Control and Road Improvements Bond

|

GA – Boxing Promoter's License $10,000 Bond |

GA – Brewpub License Performance and Tax Liability $20,000 Bond |

GA – Buying Service or Club Membership $25,000 Bond |

| GA – Carpenters Local Union No. 225 Wage and Welfare $10,000 Bond |

GA – Cemetery Merchandise Dealer $10,000 Bond

|

GA – Cemetery Merchandise Dealer $25,000 Bond

|

GA – City of Douglasville – Contractor's Code Compliance Bond |

GA – City of Kingsland – Utility Deposit Bond |

| GA – Cobb County – Contractor Code Compliance $10,000 Bond |

GA – Cobb County – Electric Membership Corporation Utility Deposit Bond

|

GA – Cobb County – Landscape Maintenance Bond

|

GA – Cobb County – Stormwater Management Performance Bond

|

GA – Cobb County – Utility Accommodation Performance Bond |

| GA – Collection Agent $35,000 Bond |

GA – Columbia County – Commercial Builder $20,000 Bond

|

GA – Columbia County – License Permit Bond |

GA – Commercial Driver Training School $10,000 Bond

|

GA – Commercial Fisherman Forfeiture Bond

|

| GA – Commercial Third Party Tester $10,000 Bond |

GA – Dealer Direct Consignment Agreement Bond |

GA – Dougherty County – Sewage Installation or Repair Bond |

GA – Douglasville – Douglas County Water & Sewer Authority Performance Bond |

GA – Driver Improvement Clinic $10,000 Bond |

| GA – Electronic Consumer Products or Home Warranty – $100,000 Bond |

GA – Employer's Reimbursement in Lieu of Contributions Bond |

GA – Fitzgerald Water, Light & Bond Commission Utility Deposit |

GA – Installation Made Easy Inc (IME) IME Affiliate Bond |

GA – Jefferson Energy Cooperative Utility Deposit Bond |

| GA – Match Event Permit $10,000 Bond |

GA – McDuffie County – License and Permit Bond

|

GA – MEMO Financial Services, Inc Bond |

GA – Motor Carrier Fuel Tax Bond |

GA – Motor Carriers C.O.D. $2,000 Bond |

| GA – Motor Carriers C.O.D. $5,000 Bond |

GA – Motor Fuel Distributor Excluding Gasoline Bond |

GA – Motor Vehicle Certificate of Title Bond |

GA – Newton County – License Permit Bond |

GA – Nonpublic Postsecondary Educational Institute Bond

|

| GA – Nonresident Contractor's Performance Tax Bond |

GA – Non-Resident Insurance Agent $500 – NC only Bond

|

GA – Nonresident Subcontractor Sales and Use Tax Bond

|

GA – Oconee County – Solid Waste Hauler License Bond

|

GA – Pesticide Contractor Bond |

| GA – Pike County – Logger Pulpwooder Temporary Facility Encroachment Bond |

GA – Pike County – Logging and Pulpwood Operations – $2,500 Bond |

GA – Power Company Utility Deposit Bond

|

GA – Proprietary School Bond |

GA – Registered Producers License Tax Liability – Distilled Spirits $10,000 Bond

|

| GA – Registered Serviceman or Service Agency of Weighing and Measuring Devices $1,000 Bond |

GA – Resident Fur Dealer Forfeiture $5,000 Bond

|

GA – Retailer's Malt Beverage $500 Bond |

GA – Retailer's Wine $500 Bond

|

GA – Sale of Payment Instruments or Money Transmission Bond |

| GA – Sale of Small Firearms $1,000 Bond |

GA – Scrap Tire Carrier Bond |

GA – Securities Dealer $25,000 Bond

|

GA – Securities Issuer $25,000 Bond |

GA – Securities Salesman $2,500 Bond

|

| GA – Snapping Shoals Electric Membership Company Utility Deposit Bond |

GA – Special License Plate Sponsor $50,000 Bond |

GA – Subcontractor Sales and Use Tax Bond |

GA – Surplus Lines Broker $50,000 Bond |

GA – Surplus Lines Broker $50,000 Bond |

| GA – Thomas County – Electrical Contractor $5,000 Bond |

GA – Thomas County – Heating and Air Contractor $5,000 Bond |

GA – Tobacco Distributors Tax Stamp Bond |

GA – Toombs County – Right of Way Bond |

GA – Transient Merchant Bond |

| GA – Twiggs County – Manufactured Home Installer $5,000 Bond |

GA – Utility Deposit – Diverse Power Inc Bond |

GA – Utility Services Infrastructure Agreement Bond |

Georgia – Athlete Agent $10,000 Bond |

Hall County, GA-Septic Tank Contractor ($10,000) Bond |

| Lumpkin, GA-Towing or Hauling Long and Wide Loads Permit ($5,000) Bond |

Macon, GA-Transient Vendor ($5,000) Bond |

Madison, GA – Beer and Wine Retail Sales Bond |

Madison, GA – Distilled Spirits – Consumption on Premises Bond |

Milton, GA – Land Disturbing Activity Bond |

| Savannah, GA-Detective or Alarm Company ($1,000) Bond |

Savannah, GA – Escorts and Escort Services $5,000 Bond |

Savannah, GA – License Permit $2,000 Bond |

Savannah, GA – Precious Metals Dealer or Pawnbroker Precious Metals Dealer $10,000 Bond |

Thomasville, GA – Utility Deposit Bond |

| Valdosta, GA – Auto Sprinkler Contractor ($2,000) Bond |

Valdosta, GA – Electrician ($2,000) Bond |

Valdosta, GA -Low Voltage Contractor ($2,000) Bond |

Valdosta, GA -Mechanical Contractor ($2,000) Bond |

|

The Crucial Role of License and Permit Bonds in Georgia's Business World

From our perspective, license and permit bonds are vital for any business operating in Georgia. They ensure that businesses comply with state regulations, safeguarding both the public and the industry. These bonds serve as a financial safety net, offering protection while building trust between business owners, consumers, and the government.

Unpacking License and Permit Bonds: What Every Georgia Business Should Know

We’ve noticed that many business owners aren’t fully aware of what license and permit bonds actually entail. In simple terms, these bonds are a legal agreement between a business, a surety, and the government. They guarantee that if a business fails to follow regulations, the bond will cover any damages, ensuring financial security for all parties involved.

Why Are License and Permit Bonds a Must-Have for Georgia Businesses?

In our experience, the benefits of license and permit bonds can’t be overstated. Here’s why businesses need them:

- Legal Compliance: They ensure businesses follow local laws.

- Financial Security: They protect the public from financial loss due to non-compliance.

- Trust Building: They foster confidence with customers and government agencies.

- Accountability: They hold businesses to higher ethical standards.

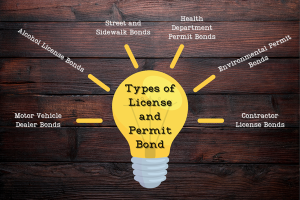

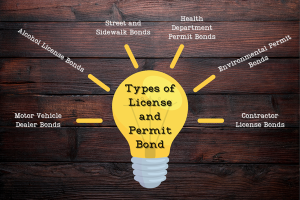

Discover Different Types of License and Permit Bonds in Georgia

We’ve consistently found that different industries in Georgia require specific types of license and permit bonds. Whether you’re in construction, automotive, or financial services, there’s a bond tailored to your needs. Some of the most common types include:

- Contractor License Bonds

- Motor Vehicle Dealer Bonds

- Health Department Permit Bonds

- Insurance Bonds for professionals in the financial sector

Steps to Securing License and Permit Bonds in Georgia

Based on our experience, the process of applying for a license and permit bond is straightforward but requires careful attention. We’ve found that businesses need to prepare financial documents, meet eligibility requirements, and work with a reputable bond provider to ensure smooth approval. Following these steps can help avoid unnecessary delays and complications.

Top Benefits of License and Permit Bonds for Georgia Businesses

In our professional dealings, we’ve identified several advantages of securing license and permit bonds:

- Compliance Assurance: Businesses stay on the right side of the law.

- Reputation Boost: Bonds show that a business is credible and trustworthy.

- Consumer Protection: Bonds offer financial recourse for customers.

- Easy Permit Approval: Bonds make it easier to obtain the necessary permits.

Best Practices for Securing License and Permit Bonds in Georgia

We’ve learned over the years that following certain best practices can ensure a smooth bonding process:

- Know the Required Bond Amount: Check local regulations for specifics.

- Submit Accurate Applications: Ensure all documents are in order.

- Stay on Top of Renewal Dates: Avoid lapses in bond coverage.

- Choose the Right Provider: Work with a reputable bond company for the best rates and support.

Conclusion: License and Permit Bonds as a Cornerstone of Business Success in Georgia

We’ve come to realize that license and permit bonds aren’t just regulatory requirements—they’re essential tools for business success. In our view, securing the right bond helps businesses operate legally, gain consumer trust, and build a reputation for integrity. In Georgia’s competitive business landscape, these bonds are a critical part of achieving long-term success.

Georgia Sample Bond Forms:

Sample Wage and Welfare Bond Georgia

See more about Swiftbonds at our home page.