(for Federal level bonds, search here: nationwide search)

California Bond Applications:

To get a California Performance Bond go here.

California probate bond application

California ERISA Pension Plan Fidelity Bond Application

California Court Bond Application

California Janitorial Services Bond Application

License and Permit Bonds: A Crucial Component in California’s Bonding Process

The Vital Role of License and Permit Bonds in California

The Vital Role of License and Permit Bonds in California

From our perspective, understanding the importance of license and permit bonds is essential for anyone engaging in California’s regulated industries. These bonds are not just a formality; they play a pivotal role in ensuring businesses comply with local, state, and federal regulations. Without these bonds, contractors, brokers, and service providers could face significant legal and financial obstacles. We’ve often noticed that obtaining the right bond is the key to legally operating within California’s complex regulatory environment.

Defining License and Permit Bonds: What They Mean for You

We’ve learned that many individuals misunderstand what license and permit bonds truly are. These bonds serve as a financial guarantee that a business will comply with specific laws and regulations. If a business fails to meet these standards, the bond ensures compensation for any damages or losses incurred. In California, we’ve encountered various industries that require these bonds, from construction to food services, emphasizing their widespread necessity.

Why License and Permit Bonds Matter: Key Purposes

Why License and Permit Bonds Matter: Key Purposes

In our observation, license and permit bonds serve multiple crucial purposes. These can be summarized as follows:

- Protection for the Public: Ensures businesses operate ethically, safeguarding consumers.

- Legal Compliance: Guarantees that a business adheres to industry regulations.

- Financial Security: Provides a financial fallback in case a business fails to meet its obligations.

- Trust and Credibility: Enhances a business’s reputation, as being insured and bonded assures clients of professionalism and responsibility.

We’ve come to appreciate that these bonds offer much more than compliance; they build trust between businesses and their communities.

Diverse Types of License and Permit Bonds Available

What we’ve discovered is that license and permit bonds come in various forms, each tailored to specific industries:

- Contractor License Bonds: Required for contractors to secure their licenses.

- Auto Dealer Bonds: Protects consumers from fraudulent practices by auto dealers.

- Professional License Bonds: Needed by various professionals, such as brokers and notaries.

- Environmental Permit Bonds: Ensures compliance with environmental regulations during operations.

Each type of bond is designed to address the unique risks and requirements of specific industries, which we’ve consistently found to be vital for smooth business operations in California.

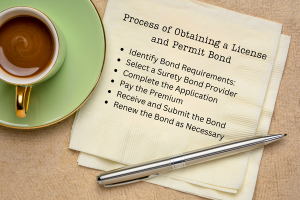

How to Apply for a License and Permit Bond: A Step-by-Step Guide

We’ve often worked with businesses navigating the application process for these bonds, and we’ve noticed it involves several key steps:

- Determine Bond Requirements: Verify the bond amount and type required by local or state authorities.

- Select a Reputable Surety Company: Choose a surety company that specializes in your industry.

- Complete the Application: Provide business and financial details to the surety company.

- Undergo a Credit Check: A strong credit history will improve approval chances and lower premiums.

- Submit and Pay Premium: After approval, pay the bond premium and receive your bond certificate.

Based on our experience, this process is streamlined when businesses are prepared with accurate information and select a reliable surety provider.

Why License and Permit Bonds are Beneficial for Businesses?

We’ve been able to identify several key benefits of license and permit bonds, which include:

- Enhancing Trust: Clients feel more secure knowing your business is bonded.

- Meeting Legal Requirements: Avoid fines or business closures by staying compliant.

- Providing Financial Protection: Ensures compensation if contractual obligations are not met.

- Boosting Business Credibility: Sets you apart as a responsible and reliable business.

From what we’ve seen, having these bonds not only protects your business but also enhances your professional reputation.

Critical Insights for License and Permit Bond Holders

We’ve observed that there are a few key points to remember when dealing with license and permit bonds:

- Ensure you renew your bond before it expires to avoid lapses in compliance.

- Keep an open line of communication with your surety provider to address any issues.

- Regularly review your bond requirements, as state regulations can change.

In our opinion, staying proactive and informed is crucial for maintaining good standing with regulatory bodies.

Final Thoughts: License and Permit Bonds as a Business Essential

Final Thoughts: License and Permit Bonds as a Business Essential

We’ve consistently found that license and permit bonds are not just bureaucratic necessities but vital tools for business growth and credibility in California. They provide the framework for legal operation, financial protection, and consumer trust. In our professional life, we’ve seen firsthand how having the right bond makes all the difference in the success and reputation of a business. For any business looking to thrive in a regulated industry, these bonds are non-negotiable.

By recognizing the value of license and permit bonds and staying informed about the application process, you can ensure that your business is set up for success in California’s competitive market.

California Sample Bond Forms:

Sample Wage and Welfare Bond Form

See more about Swiftbonds at our home page.