You can now apply online for a North Dakota Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in North Dakota?

How do I get a Performance and Payment Bond in North Dakota?

We make it easy to get a contract performance bond. Just click here to get our North Dakota Performance Application. Fill it out and then email it and the North Dakota contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

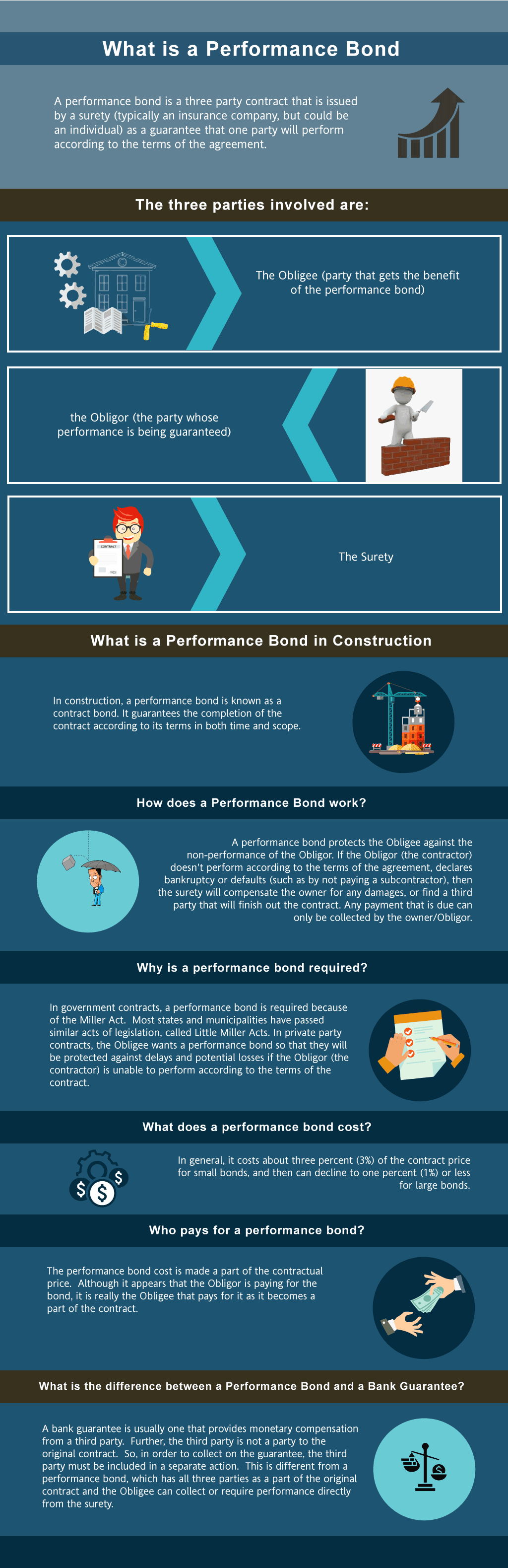

performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holding an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holding an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

Is performance bond refundable in North Dakota?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in ND?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of North Dakota. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in ND

Just call us. We’ll work with you to get the best North Dakota bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Barnes

Benson

Billings

Bottineau

Bowman

Burke

Burleigh

Cass

Cavalier

Dickey

Divide

Dunn

Eddy

Emmons

Foster

Golden Valley

Grand Forks

Grant

Griggs

Hettinger

Kidder

LaMoure

Logan

McHenry

McIntosh

McKenzie

McLean

Mercer

Morton

Mountrail

Nelson

Oliver

Pembina

Pierce

Ramsey

Ransom

Renville

Richland

Rolette

Sargent

Sheridan

Sioux

Slope

Stark

Steele

Stutsman

Towner

Traill

Walsh

Ward

Wells

Williams

And Cities:

Fargo

Bismarck

Grand Forks

Minot

Williston

Dickinson

Mandan

Devils Lake

West Fargo

Watford City

See our Ohio Performance Bond page here.

Exploring the Distinct Benefits: Why Performance Bonds Outshine Bank Letters of Credit

In our professional experience, the choice between performance bonds and bank letters of credit is a critical one for North Dakota contractors. Performance bonds, backed by a surety company, guarantee that a project will be completed as promised, providing peace of mind to project owners. On the other hand, bank letters of credit are primarily financial guarantees issued by banks to ensure payment. We’ve come to notice that while both options provide security, performance bonds offer a more comprehensive safeguard for the successful completion of construction projects, making them the preferred choice in many North Dakota contracts.

The Refund Dilemma in North Dakota: Can You Get a Refund on Performance Bond?

We’ve learned through experience that the notion of getting a refund on a performance bond is often misunderstood. In North Dakota, performance bonds are generally non-refundable, as the premium paid is the cost of transferring the project’s risk to the surety company. However, we’ve encountered rare instances where partial refunds were possible, particularly if the bond was canceled before any work began. From our perspective, it’s essential for contractors and project owners to clarify these terms with their surety provider at the outset to avoid any surprises later on.

The Claim Process Uncovered in North Dakota: What Happens When a Performance Bond is Triggered?

We’ve gained a lot from observing the process that unfolds when a claim is filed on a performance bond. This typically happens when a contractor fails to fulfill their contractual duties, prompting the project owner to seek compensation. In North Dakota, once a claim is made, the surety company conducts a thorough investigation to determine the claim's validity. If upheld, the surety may complete the project or compensate the owner. We’ve seen firsthand how this process protects project owners from financial setbacks, reinforcing the value of performance bonds in large-scale projects.

Crossing the Finish Line: How and When Performance Bonds Are Officially Released

Our experience has taught us that the release of a performance bond is a significant milestone in any construction project. In North Dakota, a bond is typically released only after the project has been fully completed and accepted by the project owner. This release indicates that all contractual obligations have been met, and no further claims can be filed against the bond. We’ve noticed in our work that understanding the conditions for bond release is crucial for contractors to ensure they meet all necessary requirements and avoid any delays.

Total Protection Guaranteed: The Strength of 100 Percent Performance and Payment Bonds

In our dealings with performance bonds, we’ve consistently observed that 100 percent performance and payment bonds provide unmatched security for high-stakes construction projects in North Dakota. These bonds guarantee not just the completion of the project, but also that all subcontractors and suppliers will be paid in full. We’ve come to appreciate that this comprehensive coverage is vital for protecting all parties involved, making it a standard requirement for large projects across the state.

The Waiting Game in North Dakota: How Long Does It Take to Secure a Performance Bond?

We’ve often found ourselves in situations where time is of the essence in securing a performance bond. In North Dakota, the timeline can vary, but we’ve generally seen that it takes anywhere from a few days to a few weeks, depending on the complexity of the project and the contractor’s financial standing. We’ve discovered through trial and error that being well-prepared with all required documentation can significantly speed up the process, ensuring that the bond is in place when it’s needed most.

Racing Against Time in North Dakota: The Consequences of Letting a Performance Bond Expire

We’ve often worked on projects where the expiration of a performance bond posed significant risks. In North Dakota, if a bond expires before the project is completed, it leaves the project owner without financial protection, which could lead to costly delays and legal disputes. We’ve been in positions where renewing the bond well before its expiration was critical to maintaining continuous coverage and ensuring the project’s successful completion. From our perspective, keeping track of bond expiration dates is essential for avoiding these potential pitfalls.

Navigating Performance Bonds in North Dakota: Final Thoughts and Key Takeaways

We’ve grown to understand that performance bonds are more than just a formality—they are a crucial part of the construction landscape in North Dakota. From our experience, these bonds provide essential protection for both contractors and project owners, ensuring that projects are completed as agreed upon and that all parties are paid. We’ve come to believe that by thoroughly understanding the nuances of performance bonds, stakeholders in North Dakota can better manage the risks associated with large construction projects, leading to smoother and more successful outcomes.

See more at our Ohio Performance Bond page.

Learn more on North Dakota surety bond.