You can now apply online for a Montana Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to gary@swiftbonds.com

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Montana?

How do I get a Performance and Payment Bond in Montana?

We make it easy to get a contract performance bond. Just click here to get our Montana Performance Application. Fill it out and then email it and the Montana contract documents to gary@swiftbonds.com or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

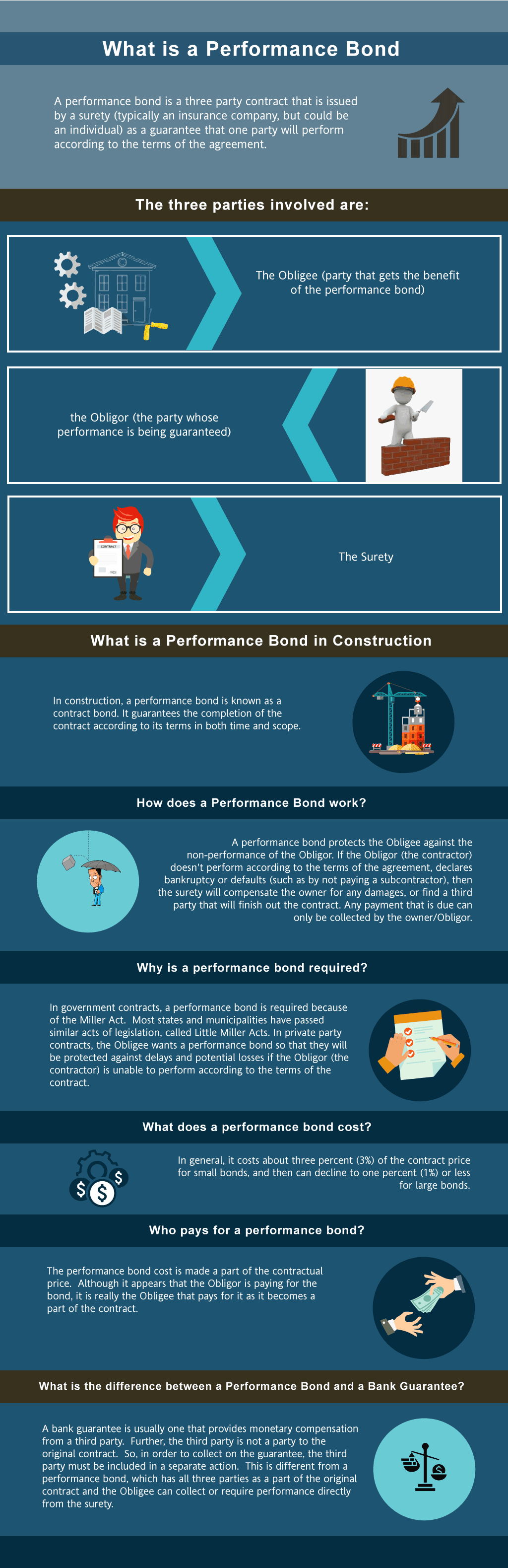

Define performance bond in Montana?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MT?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Montana. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to gary@swiftbonds.com

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in MT

Just call us. We’ll work with you to get the best Montana bond possible.

We provide performance and payment bonds in each of the following counties:

Beaverhead

Big Horn

Blaine

Broadwater

Carbon

Carter

Cascade

Chouteau

Custer

Daniels

Dawson

Deer Lodge

Fallon

Fergus

Flathead

Gallatin

Garfield

Glacier

Golden Valley

Granite

Hill

Jefferson

Judith Basin

Lake

Lewis And Clark

Liberty

Lincoln

Madison

McCone

Meagher

Mineral

Missoula

Musselshell

Park

Petroleum

Phillips

Pondera

Powder River

Powell

Prairie

Ravalli

Richland

Roosevelt

Rosebud

Sanders

Sheridan

Silver Bow

Stillwater

Sweet Grass

Teton

Toole

Treasure

Valley

Wheatland

Wibaux

Yellowstone

Yellowstone National Park

And Cities:

Billings

Missoula

Bozeman

Helena

Great Falls

Kalispell

Butte

Whitefish

Livingston

Havre

See our Nebraska Performance Bond page here.

The Hidden Differences Between Performance Bonds and Letters of Credit You Need to Know

From our perspective, knowing the nuanced differences between performance bonds and bank letters of credit is crucial, especially for Montana contractors. While both serve as financial safeguards, their roles diverge significantly. We’ve often noticed that performance bonds are tailored to ensure project completion according to the contract, offering extensive protection to project owners. In contrast, bank letters of credit primarily guarantee payment without ensuring the actual completion of the project. In our view, understanding these distinctions can help you make more informed decisions for your construction ventures.

Can You Get Your Money Back? The Truth About Performance Bond Refunds

We’ve consistently observed that many contractors in Montana are curious about whether performance bonds are refundable. In our experience, once a performance bond is issued, the premium is non-refundable, even if no claim is ever made. This non-refundable nature stems from the fact that the premium covers the surety company’s risk assessment and underwriting processes. We’ve realized that it’s essential to consider this non-refundable cost in your project’s budget planning.

Filing a Claim on a Performance Bond: What's Next?

We’ve found through experience that a claim on a performance bond can trigger a cascade of consequences for contractors in Montana. Once a claim is filed, the surety company conducts a thorough investigation. If the claim is validated, the surety compensates the project owner, but the contractor is then obligated to repay the surety. In our professional life, we’ve seen how this can severely impact a contractor’s ability to secure future bonds and maintain a solid reputation. We’ve learned that avoiding claims through diligent project management is crucial for long-term success.

Timing is Critical: When Your Performance Bond Gets Released?

We’ve come to understand that the release of a performance bond is a pivotal moment in any Montana construction project. From our perspective, the bond is typically released only after the project is completed to the owner’s satisfaction, all inspections are passed, and any contractual obligations are fulfilled. We’ve consistently observed that clear communication and thorough completion of tasks are key to ensuring a smooth bond release.

The Truth About the 100 Percent Performance and Payment Bonds

We’ve had firsthand experience with 100 percent performance and payment bonds in Montana, and their impact on project security is profound. These bonds guarantee that the contractor will both complete the project and pay all subcontractors and suppliers in full. In our line of work, we’ve seen how these bonds provide the highest level of protection for project owners, making them indispensable for large-scale construction projects.

Need a Performance Bond Quickly? Here’s What You Need to Know

We’ve often found ourselves in situations where the speed of securing a performance bond is critical to project timelines in Montana. Based on our experience, the time required to obtain a bond can range from a few days to several weeks, depending on the complexity of the project and the contractor’s financial standing. We’ve learned that starting the process early and having all necessary documentation prepared can significantly accelerate the bonding process.

Don’t Let Your Performance Bond Expire: Avoiding the Pitfalls

We’ve learned through doing that allowing a performance bond to expire before a project is complete can result in severe risks and complications. In our dealings with Montana projects, we’ve observed that an expired bond leaves the project owner vulnerable, potentially leading to disputes and financial losses. We’ve personally faced the challenges of managing bond expirations and strongly recommend proactive monitoring and timely renewal to maintain project protection.

See more at our Tennessee Performance Bond page.

Learn more about Montana surety bond.