You can now apply online for a Massachusetts Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

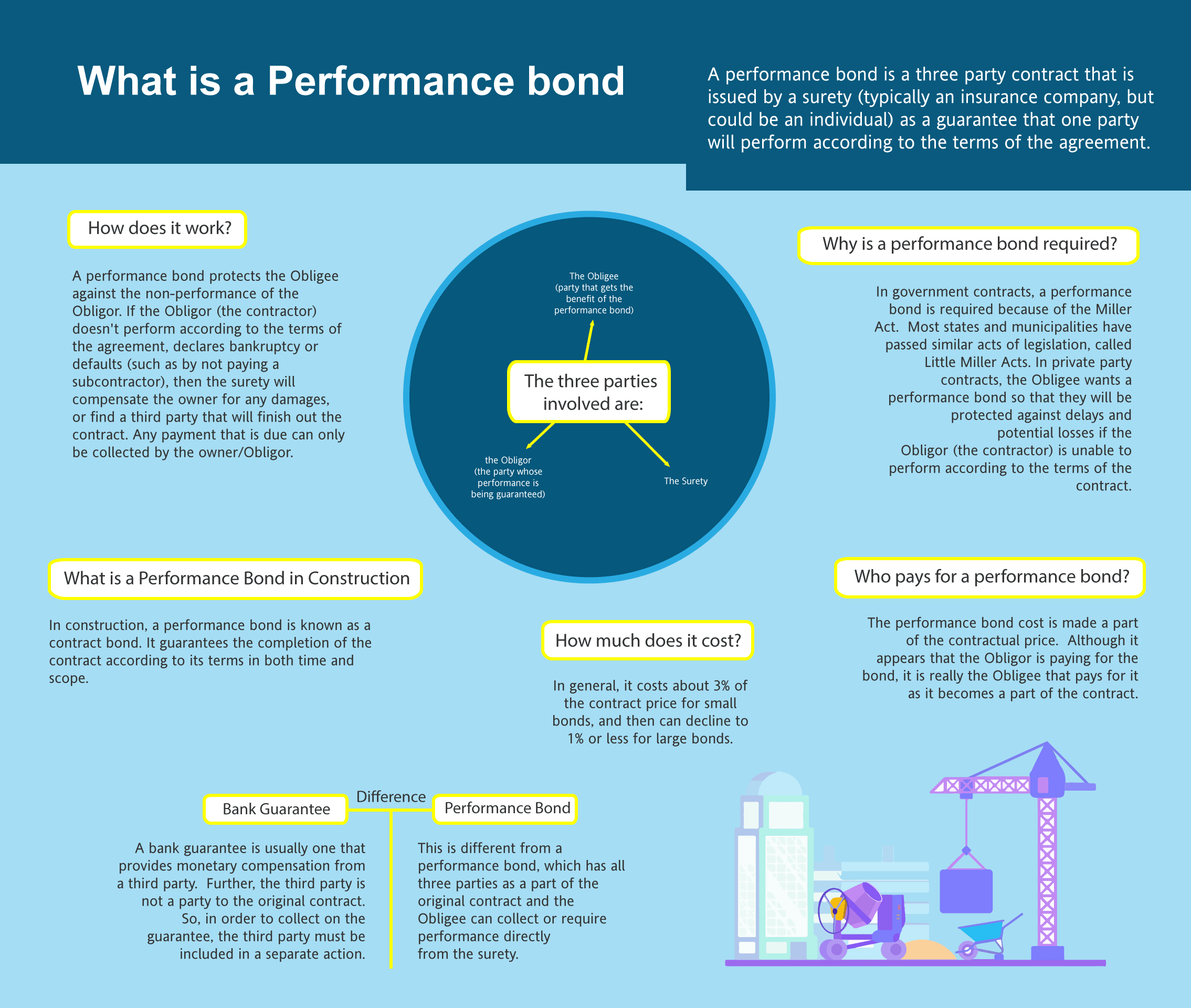

What is a Performance Bond in Massachusetts?

How do I get a Performance and Payment Bond in Massachusetts?

We make it easy to get a contract performance bond. Just click here to get our Massachusetts Performance Application. Fill it out and then email it and the Massachusetts contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Discover who is involved in a performance bond and ensure your project’s success today!

Performance bonds in construction in Massachusetts?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MA?

How much do bonds cost in MA?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Massachusetts. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in MA

Just call us. We’ll work with you to get the best Massachusetts bond possible.

We provide performance and payment bonds in each of the following counties:

Barnstable

Berkshire

Bristol

Dukes

Essex

Franklin

Hampden

Hampshire

Middlesex

Nantucket

Norfolk

Plymouth

Suffolk

Worcester

And Cities:

Boston

Cambridge

Worcester

Springfield

Salem

Lowell

Plymouth

Quincy

Waltham

Framingham

See our Michigan Performance Bond page here.

Understanding Performance Bonds in Massachusetts: Key Insights

When navigating the landscape of performance bonds in Massachusetts, it’s essential to understand their purpose, function, and the specific scenarios they address. Performance bonds are crucial in various industries, particularly construction, to ensure that contractual obligations are met. This article explores the key aspects of performance bonds, differentiating them from other financial instruments, and addressing common questions surrounding their usage.

Performance Bonds vs. Bank Letters of Credit: Unraveling the Key Differences in Massachusetts

From our perspective, the fundamental difference between performance bonds and bank letters of credit lies in their function and the parties they protect. Performance bonds, issued by a surety company, primarily protect the project owner by ensuring the contractor fulfills their obligations. We’ve noticed that performance bonds are generally preferred in Massachusetts construction projects because they cover both financial and performance risks, unlike bank letters of credit, which are more suited for financial guarantees.

Refundable or Not? Understanding the Refund Policy of Performance Bonds in Massachusetts

In our opinion, performance bonds in Massachusetts are generally non-refundable once issued. The premium paid to secure the bond covers the risk assumed by the surety company during the bond’s term. We’ve found that most sureties in Massachusetts do not refund premiums, even if the bond is not needed or if the project concludes earlier than expected. However, in some cases, a partial refund may be possible if the bond is canceled before the project starts or within a very short period after issuance.

Filing a Claim on a Performance Bond in Massachusetts: What You Need to Know

What we’ve discovered is that when a claim is filed on a performance bond in Massachusetts, the surety company steps in to investigate the validity of the claim. If the claim is valid, the surety may either pay the claim up to the bond amount or ensure the project is completed by hiring a new contractor. We’ve learned that this process can be lengthy and may involve negotiations between the surety, the project owner, and the contractor to resolve the issue amicably before it escalates further.

When and How Are Performance Bonds Released in Massachusetts? Key Timelines and Triggers

Based on our experience, performance bonds in Massachusetts are typically released once the project is completed to the satisfaction of the project owner and all contractual obligations have been met. We’ve come to understand that the release of a performance bond is contingent upon a final inspection, approval of the work, and sometimes a specified warranty period. If any issues arise during this period, the bond may remain active until they are resolved.

100 Percent Performance and Payment Bonds in Massachusetts: Full Coverage Explained

In our observation, a 100 percent performance and payment bond in Massachusetts is a surety bond that covers both the performance of the contract and payment to all subcontractors, laborers, and suppliers involved in the project. We’ve encountered that this bond type is commonly required in public construction projects in Massachusetts to ensure that the contractor completes the work and that everyone involved in the project is paid in full. The “100 percent” aspect means the bond covers the full contract amount.

How Long Does It Take to Secure a Performance Bond in Massachusetts? Timing and Process Breakdown

We’ve personally witnessed that obtaining a performance bond in Massachusetts can vary in duration depending on the contractor’s financial stability, the complexity of the project, and the surety’s requirements.

We’ve personally witnessed that obtaining a performance bond in Massachusetts can vary in duration depending on the contractor’s financial stability, the complexity of the project, and the surety’s requirements.

We’ve been through scenarios where the process can take anywhere from a few days to several weeks. The contractor must provide detailed financial information, a project timeline, and sometimes references, which the surety will assess before issuing the bond.

What Happens if a Performance Bond Expires in Massachusetts? Managing Risks and Renewals

We’ve been able to determine that if a performance bond expires before the project is completed, it can leave the project owner vulnerable to risks. Our experience has shown us that in such cases, it is crucial to renew the bond or secure a new one to ensure continued protection. The expiration of a performance bond does not absolve the contractor of their obligations, but it can complicate matters if claims arise after the bond’s expiration.

Conclusion: Mastering Performance Bonds in Massachusetts for Successful Project Outcomes

We’ve concluded that understanding performance bonds is vital for anyone involved in Massachusetts construction projects or similar ventures. These bonds not only protect project owners but also ensure that contractors are held accountable for their work. By knowing the ins and outs of performance bonds, including how they differ from other financial instruments and what happens if claims are filed, stakeholders can make informed decisions and navigate their projects with confidence.

See more at our Arkansas Performance Bond page.

Contact us for Massachusetts Surety Bond.

1. What are the performance bond requirements under Massachusetts’s Little Miller Act?

-

Massachusetts’s Little Miller Act (M.G.L. Chapter 149, § 29) requires that contractors awarded public works contracts exceeding $25,000 provide both performance and payment bonds.

-

The performance bond ensures completion of the project as per contract terms, while the payment bond guarantees subcontractors, laborers, and suppliers receive payment.

2. How does Massachusetts’s procurement process handle performance bonds for city contracts?

-

For state and municipal projects, procurement is governed by M.G.L. Chapter 30, § 39M, which requires contractors to submit performance bonds before work begins.

-

Local municipalities may have additional procurement guidelines. Contractors should check with the Massachusetts Department of Capital Asset Management and Maintenance (DCAMM) and pertinent municipal procurement offices.

3. What government agencies regulate performance bonds for construction projects in Massachusetts?

-

The Massachusetts Division of Capital Asset Management and Maintenance (DCAMM) oversees state-funded projects.

-

The Office of the Inspector General of Massachusetts keep track of procurement integrity.

-

Local municipalities regulate performance bonds for city-funded projects.

4. Are subcontractors required to carry performance bonds in Massachusetts?

-

Massachusetts law does not generally require subcontractors to carry performance bonds. However, general contractors may require subcontractors to obtain performance bonds as part of private contract agreements.

5. How can I verify a performance bond’s validity for a public project?

-

Contractors and project owners can verify performance bonds by:

-

Checking with the Massachusetts Attorney General’s Office or the public contracting agency handling the project.

-

Requesting documentation from the surety company issuing the bond.

-

Reviewing public records of procurement contracts.

-