You can now apply online for a Maryland Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

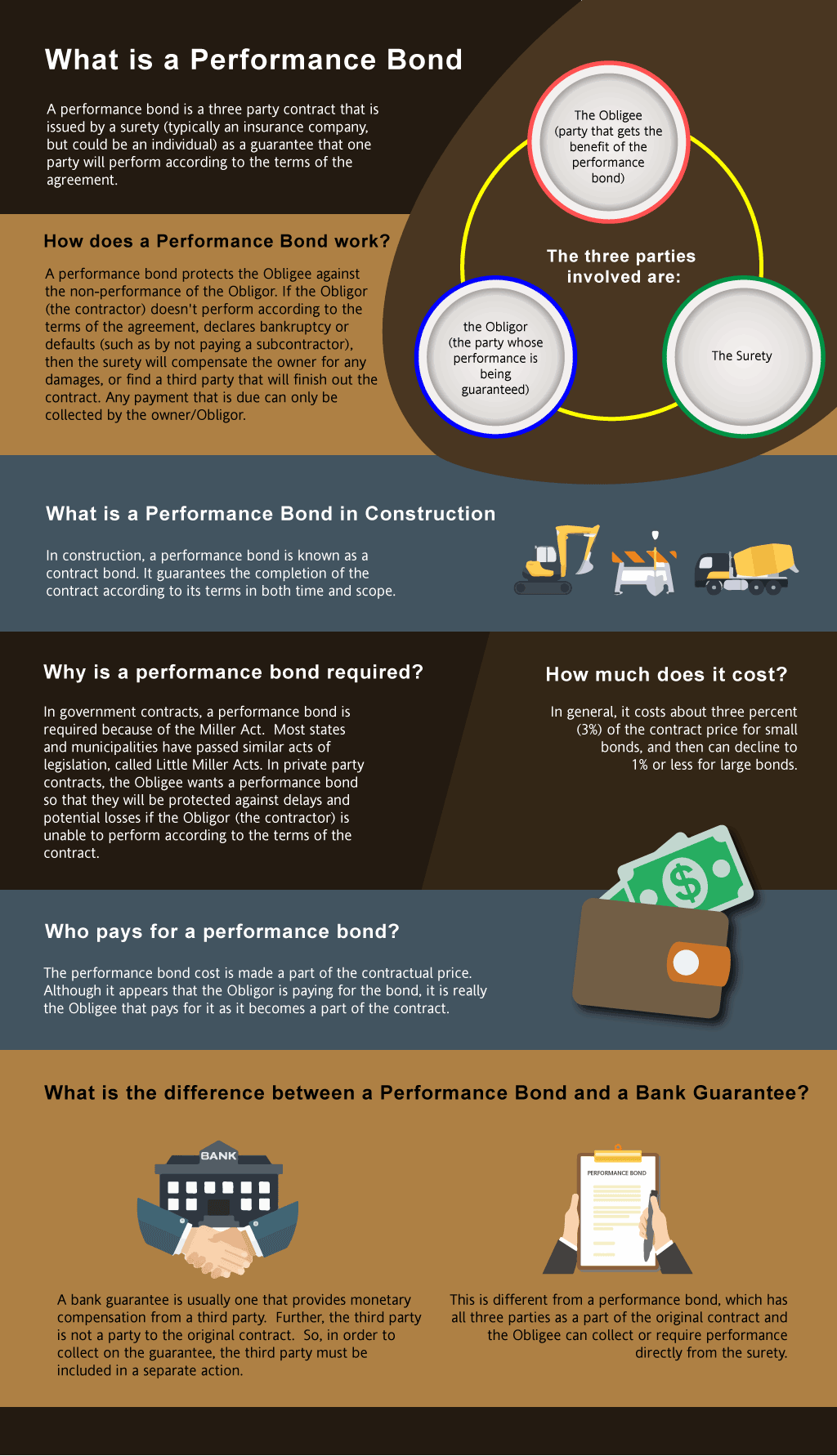

What is a Performance Bond in Maryland?

How do I get a Performance and Payment Bond in Maryland?

We make it easy to get a contract performance bond. Just click here to get our Maryland Performance Application. Fill it out and then email it and the Maryland contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in Maryland?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MD?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Maryland. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Secure your project's success today with a performance bond contractor!

How to Get a Performance Bond in MD

Just call us. We’ll work with you to get the best Maryland bond possible.

We provide performance and payment bonds in each of the following counties:

Allegany

Anne Arundel

Baltimore

Baltimore City

Calvert

Caroline

Carroll

Cecil

Charles

Dorchester

Frederick

Garrett

Harford

Howard

Kent

Montgomery

Prince George’s

Queen Anne’s

St. Mary’s

Somerset

Talbot

Washington

Wicomico

Worcester

And Cities:

Baltimore

Frederick

Annapolis

Rockville

Ocean City

Silver Spring

Hagerstown

Gaithersburg

Laurel

Bowie

See our Massachusetts Performance Bond page here.

The Intricacies of Performance Bonds in Maryland: A Deep Dive

The Intricacies of Performance Bonds in Maryland: A Deep Dive

In the United States Performance bonds are used as a cornerstone of the construction industry, ensuring that contractors fulfill their contractual obligations. When it comes to securing these bonds in Maryland, understanding the nuances can make a significant difference in managing risks and securing projects. Here’s a detailed look at various aspects of performance bonds in Maryland, focusing on some of the most important considerations.

Unpacking the Distinctions: Performance Bonds vs. Bank Letters of Credit in Maryland Construction

In our experience, one of the most critical distinctions in the world of construction finance is between performance bonds and bank letters of credit (LOCs). We’ve found that while both instruments provide financial assurance, their mechanisms and benefits differ significantly.

In our experience, one of the most critical distinctions in the world of construction finance is between performance bonds and bank letters of credit (LOCs). We’ve found that while both instruments provide financial assurance, their mechanisms and benefits differ significantly.

Performance bonds, issued by surety companies, guarantee the completion of a project, while bank LOCs merely ensure payment. In Maryland’s competitive construction market, choosing the right option can affect project outcomes, timelines, and financial stability.

The Non-Refundable Nature of Performance Bonds in Maryland: What You Need to Know

We’ve consistently observed that once a performance bond is issued, the premium paid is non-refundable. This aspect is crucial for contractors in Maryland to understand, as it underscores the commitment required when entering into a bonded project.

We’ve consistently observed that once a performance bond is issued, the premium paid is non-refundable. This aspect is crucial for contractors in Maryland to understand, as it underscores the commitment required when entering into a bonded project.

The surety company fully earns the premium once the bond is in place, regardless of whether the project is completed or not. From our perspective, this non-refundable nature reflects the risk the surety assumes and highlights the importance of thoroughly assessing project feasibility before securing a bond.

Exploring the Claims Process: What Happens When a Performance Bond is Called

We’ve had numerous experiences with the claims process on performance bonds, and it’s a situation every contractor hopes to avoid. When a claim is filed, the surety company steps in to investigate the validity of the claim. If substantiated, the surety may either complete the project themselves or compensate the project owner financially. We’ve observed that claims can lead to severe consequences, including legal battles and difficulties in obtaining future bonds. For Maryland contractors, understanding the claims process is vital to maintaining a strong business reputation.

We’ve had numerous experiences with the claims process on performance bonds, and it’s a situation every contractor hopes to avoid. When a claim is filed, the surety company steps in to investigate the validity of the claim. If substantiated, the surety may either complete the project themselves or compensate the project owner financially. We’ve observed that claims can lead to severe consequences, including legal battles and difficulties in obtaining future bonds. For Maryland contractors, understanding the claims process is vital to maintaining a strong business reputation.

Timing is Everything: When Performance Bonds Are Released

In our dealings with performance bonds in Maryland, we’ve come to recognize the importance of the bond release process. The release typically occurs after the project is completed and has passed a thorough inspection. We’ve noticed that even minor issues can delay this release, affecting final payments and project closeout. Contractors must ensure all contractual obligations are met to expedite the release process, allowing for smoother project completion and financial settlement.

Total Protection: Unraveling the 100% Performance and Payment Bond for Maryland Projects

We’ve been fortunate to work on projects requiring 100 percent performance and payment bonds, and we’ve come to appreciate their value. These bonds provide full coverage for the contract value, ensuring not only project completion but also that all subcontractors and suppliers are paid. In Maryland, where large-scale construction projects are common, this level of coverage offers peace of mind to project owners and contractors alike. It’s an essential tool for mitigating risk and ensuring project success.

The Waiting Game: How Long It Takes to Secure a Performance Bond

In our professional life, we’ve observed that the timeline for securing a performance bond can vary significantly. In Maryland, factors such as the contractor’s financial standing, project complexity, and previous bonding history play a crucial role. While some bonds can be secured within days, others may take weeks. We’ve found that proactive preparation and maintaining a strong financial profile can expedite the process, allowing contractors to move forward with their projects without unnecessary delays.

The Risks of Expiration: What Happens When a Performance Bond Lapses

We’ve come across situations where a performance bond expired before a project’s completion, and the consequences were far-reaching. An expired bond in Maryland can lead to project delays, financial penalties, and even legal disputes. We’ve learned through doing that it’s essential for contractors to monitor expiration dates closely and renew bonds as needed. Proactive management of bond timelines ensures continuous coverage and protects against potential disruptions, safeguarding both the contractor and the project owner.

Final Thoughts: Mastering Performance Bonds for Success in Maryland Construction

Performance bonds are a critical element of construction projects in Maryland, offering protection and assurance to all parties involved. Through our extensive experience, we’ve gained insights into the complexities of these bonds, from their differences with bank LOCs to the importance of timely renewals. Understanding these elements is key to navigating the Maryland construction landscape successfully and ensuring that projects are completed on time, within budget, and to the highest standards.

See more at our Colorado Performance Bond page.

1. What are the performance bond requirements under Maryland’s Little Miller Act?

The Maryland Little Miller Act (Md. Code, State Finance & Procurement § 17-101 et seq.) requires contractors to furnish performance bonds and payment bonds for public works contracts exceeding $100,000. These bonds ensure that contractors complete the project as agreed and pay all subcontractors and suppliers.

- The performance bond make sure completion according to contract terms.

- The payment bond ensures subcontractors, laborers, and suppliers are paid.

2. How does Maryland’s procurement process handle performance bonds for city contracts?

Local governments in Maryland, including Baltimore and other municipalities, follow procurement guidelines similar to state regulations. Performance bonds are typically required for public works projects over a certain threshold (e.g., $100,000). Contractors bidding on city contracts must review local procurement guidelines to confirm specific bonding requirements.

For example:

- Baltimore City Bureau of Procurement may require performance bonds per city ordinances.

- Montgomery County Procurement Office follows state bonding rules but may have additional compliance steps.

3. What government agencies regulate performance bonds for construction projects in Maryland?

The key agencies overseeing performance bonds in Maryland include:

- Maryland Board of Public Works (BPW) – Approves large public contracts and ensures compliance with bonding requirements.

- Maryland Department of General Services (DGS) – Manages state construction projects and enforces performance bond rules.

- Maryland State Treasurer’s Office – Handles financial security related to state procurement.

- Local procurement offices – County and city agencies enforce bonding requirements for municipal projects.

4. In the state of Maryland is it required to have performance bonds for subcontractors?

Subcontractors are not automatically required to furnish performance bonds under the Maryland Little Miller Act. However:

- Prime contractors may require their subcontractors to obtain bonds as a condition of work.

- Some local government contracts may impose bonding requirements on subcontractors.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond in Maryland:

- Contact the Bonding Company – The surety issuing the bond can confirm its validity.

- Check with the Contracting Agency – The state or local government agency managing the project maintains records of required bonds.

- Review Maryland Public Records – Some procurement agencies publish awarded contracts and bonding details.