You can now apply online for a Maine Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Maine?

How do I get a Performance and Payment Bond in Maine?

We make it easy to get a contract performance bond. Just click here to get our Maine Performance Application. Fill it out and then email it and the Maine contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

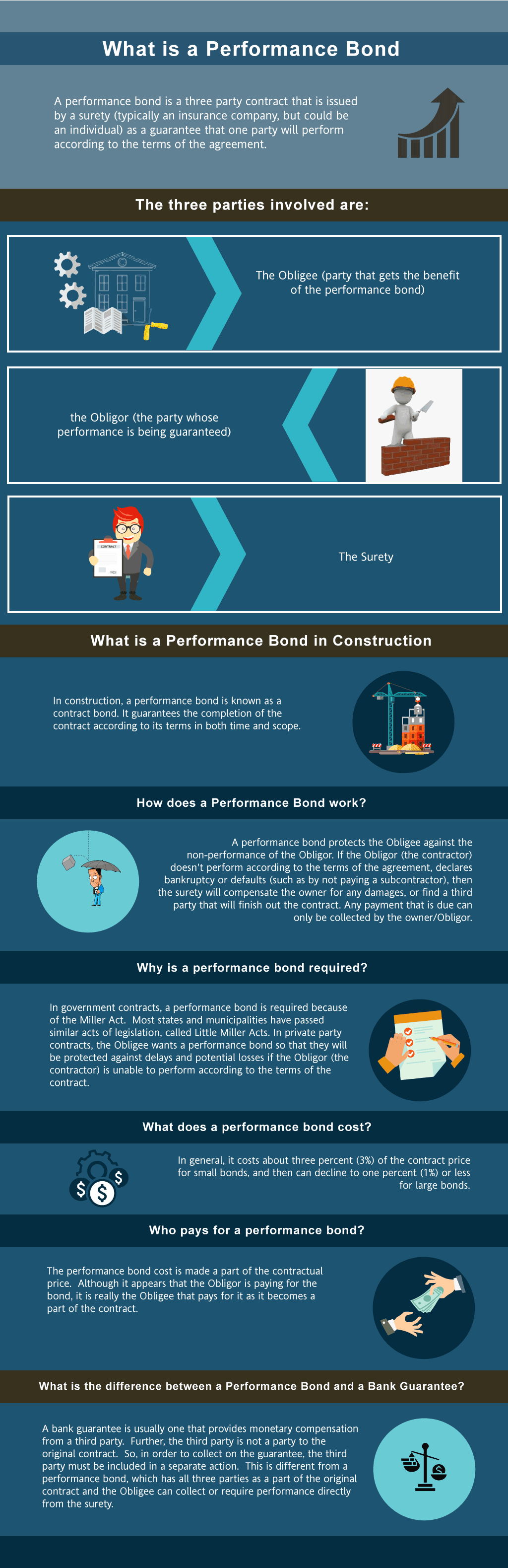

a performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holding an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

a performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holding an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

Performance bonds insurance in Maine?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in ME?

How much do bonds cost in ME?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Maine. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in ME

Just call us. We’ll work with you to get the best Maine bond possible.

We provide performance and payment bonds in each of the following counties:

Androscoggin

Aroostook

Cumberland

Franklin

Hancock

Kennebec

Knox

Lincoln

Oxford

Penobscot

Piscataquis

Sagadahoc

Somerset

Waldo

Washington

York

And Cities:

Portland

Bangor

Augusta

Lewiston

Waterville

South Portland

Bar Harbor

Biddeford

Rockland

Saco

See our Maryland Performance Bond page here.

What Is The Rate Of A Performance Bond In Alabama?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect the rate are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Discover how do bonds work in construction and enhance your understanding today!

Distinguishing Between Performance Bonds and Bank Letters of Credit

In our experience, many people confuse performance bonds with bank letters of credit, but they serve different purposes. Performance bonds are surety bonds that ensure a contractor fulfills their contractual obligations, providing a guarantee to the project owner. On the other hand, bank letters of credit are financial instruments issued by a bank that act as a payment guarantee, not tied directly to a contractor's performance. We’ve often noticed that while both offer financial security, performance bonds specifically cover the risk of non-completion of a project, making them a more targeted form of protection for project owners.

Unraveling the Refund Policy of Performance Bonds

We’ve learned that the refundability of performance bonds is a common question among contractors. Unlike insurance premiums, performance bonds are generally non-refundable once issued. This is because the bond premium is considered fully earned once the bond is in effect. However, in our view, certain cases might allow for partial refunds if the bond is canceled before the project begins, but this is rare and typically at the discretion of the surety company.

The Consequences of Filing a Claim on a Performance Bond

From our perspective, filing a claim on a performance bond is a serious matter that can have lasting implications. When a claim is filed, the surety company steps in to investigate the validity of the claim. If the claim is valid, the surety will pay the project owner up to the bond amount. However, we’ve come to recognize that the contractor is ultimately responsible for reimbursing the surety for any payouts made, which can lead to significant financial strain and potential damage to the contractor’s reputation.

Understanding the Release Process of Performance Bonds

We’ve been in situations where understanding when a performance bond is released is crucial. Performance bonds are typically released once the project is completed to the satisfaction of the project owner and any required warranty period has passed. We’ve consistently found that the release process can be delayed if there are outstanding claims or if the project has not been completed according to the contract terms, making it essential for contractors to ensure all obligations are met before expecting bond release.

The Significance of a 100 Percent Performance and Payment Bond

In our line of work, we’ve often noticed that a 100 percent performance and payment bond is a powerful tool in project management. This type of bond covers the entire value of the contract, ensuring that both the project will be completed and that all subcontractors and suppliers will be paid. We’ve found that this dual protection is highly valued by project owners, as it mitigates the risk of financial loss due to contractor default or unpaid project participants.

The Timeline for Securing a Performance Bond in Maine

We’ve observed that the time it takes to secure a performance bond can vary based on several factors. Generally, we’ve seen firsthand that it can take anywhere from a few days to a few weeks to obtain a performance bond. The timeline is influenced by the complexity of the project, the contractor’s financial standing, and the responsiveness of the surety company. We’ve learned that providing complete and accurate information upfront can significantly expedite the process.

Expiration of a Performance Bond: What You Need to Know?

In our dealings with performance bonds, we’ve come across instances where bond expiration has caused confusion. If a performance bond expires before the project is completed, the contractor may be required to renew the bond or obtain a new one. We’ve consistently observed that allowing a bond to expire can jeopardize the project’s completion and potentially lead to legal and financial consequences. Therefore, maintaining active bonds throughout the project’s duration is critical to avoid complications.

See more at our Connecticut Performance Bond page.

Learn more on Maine surety bond.

1. What are the performance bond requirements under Maine’s Little Miller Act?

Maine's Public Works Contractors' Surety Bond Law of 1971, often referred to as the state's Little Miller Act, mandates that contractors awarded public construction contracts exceeding $125,000 must furnish:

-

A performance bond equal to the full contract amount, ensuring faithful execution of the contract in line with its terms and conditions.

-

A payment bond equal to the full contract amount, protecting suppliers and subcontractors by guaranteeing payment for labor and materials provided.

2. How does Maine’s procurement process handle performance bonds for city contracts?

Maine's procurement procedures for municipal contracts follow to the same bonding requirements as state contracts:

-

For contracts exceeding $125,000, both performance and payment bonds are required, each covering 100% of the contract value.

-

The bonds must be issued by sureties authorized in Maine.

Municipalities may have additional procurement guidelines, so it's advisable to consult local procurement offices for specific requirements.

3. What government agencies regulate performance bonds for construction projects in Maine?

In Maine, performance bonds for construction projects are regulated by:

-

Maine Department of Administrative and Financial Services: Oversees state procurement and contracting processes.

-

Maine Bureau of General Services: Manages state property and construction projects, ensuring compliance with bonding requirements.

-

Local Municipal Procurement Offices: Handle procurement and bonding for city and county projects.

4. Are subcontractors required to carry performance bonds in Maine?

Maine law does not generally require subcontractors to produce performance bonds. However, prime contractors may, at their discretion, require subcontractors to furnish bonds to mitigate risks associated with subcontracted work.

5. How can I verify a performance bond’s validity for a public project?

To verify the validity of a performance bond in Maine:

-

Obtain a Copy: Request a copy of the bond from the contractor or the project owner.

-

Verify the Surety: Ensure the bond is issued by a surety company authorized to operate in Maine. This information can be confirmed through the Maine Bureau of Insurance.

-

Consult Contracting Agency: Contact the public entity overseeing the project to confirm the bond's legitimacy and adequacy.