You can now apply online for a Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

Who Holds a Payment and Performance Bond for a Project?

In general, the Obligee (i.e., the owner or General Contractor) would hold the bond. For Federal work under the Miller Act, it would be the federal government.

Do you need a payment or performance bond?

Swiftbonds provides payment and performance bond working agreements for contractors, subcontractors, suppliers, and other parties in the construction industry. We offer competitive rates on all of our services to help keep your projects moving forward.

Our team is always available to answer any questions you may have about our products or how they work. You can reach us by phone at (913) 214-8344 or email at [email protected]. Get started today!

This agreement also ensures that if any of those involved in building are not paid for their services, they can make claims against the company with this insurance coverage.

Who issues a performance bond?

Typically, a performance bond is issued by an insurance company or bank. In the event that someone does not deliver on their promise in selling your product for you (a seller), this guarantees to pay the buyer back for what they lost.

Who issues a payment bond?

The payment security guarantee bond is issued by a third party and forms the three-way contract between an owner, contractor, and surety. The agreement ensures that contractors will be paid for work on projects leaving them lien free at completion of said project. Get a Massachusetts Performance Bonds.

Who pays for a performance bond?

Performance bonds are typically provided by a financial institution such as an insurance company. The party providing the services under the agreement is responsible to pay for it, which makes sense considering they’re ultimately securing their own investment.

Who pays for a payment bond?

A payment bond is a type of surety bond that guarantees subcontractors and suppliers will be paid for their work on the project. Payment bonds are often required in conjunction with performance bonds, but they must meet contract requirements before being issued ($35,000 or more)

How much does a payment and performance bond cost?

A rate of 1.5% to 3.5% is commonly seen on projects, with the price variation depending on how strong your finances are- not all contractors will qualify for bonds at any given price point.

How do I get a payment and performance bond?

A contractor will often purchase a payment and performance bond in one package. The contractor might apply for both surety bonds through a broker or directly with the company that issued them. Read our Michigan Performance Bonds.

What is a 100 payment and performance bond?

A 100 payment and performance bond can provide significant protection. The full contract value is available to cover the excess costs of contract completion, with an additional one hundred percent used for paying subcontractors or suppliers if they are owed money on a project that goes over-budget.

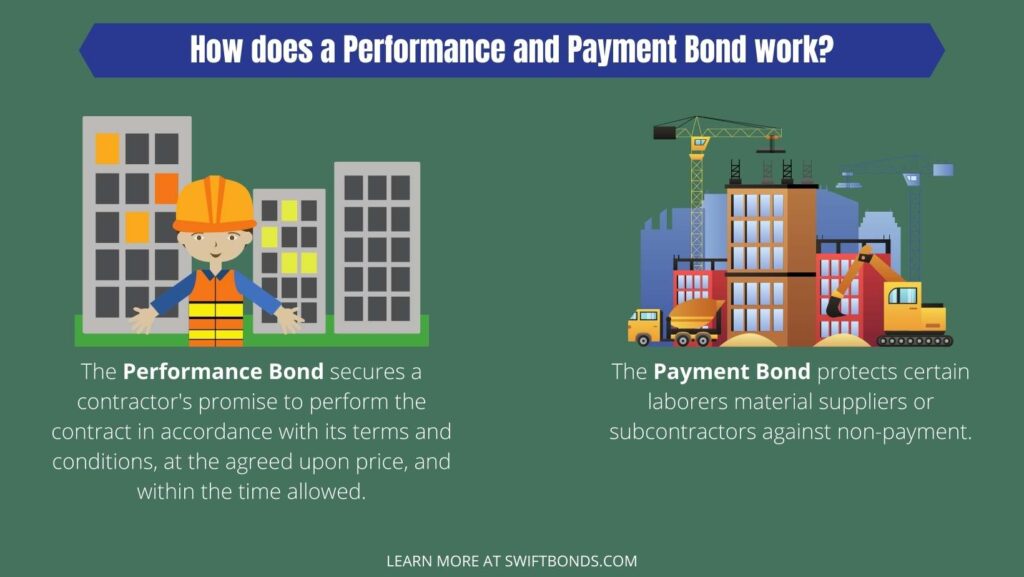

How does a performance and payment bond work?

Performance bonds are used to guarantee that the contractor will be able to successfully complete its contracted duties, while payments guarantee subcontractors get paid on time.

How does a payment bond work?

A payment bond is a surety bond that ensures subcontractors and material suppliers are paid according to contract. For jobs on public property where mechanic’s liens (security interests) cannot be used, these bonds are critical. Here’s Minnesota Performance Bonds.

How does a performance bond work?

A performance bond guarantees that a contractor will complete the work they are hired for. The bank or insurance company has to pay up if you don’t, which means it’s in their best interest to make sure you do your part of the agreement too!

Who is protected by payment and performance bonds?

A performance and payment bond will ensure that your contractor is honest, reliable, trustworthy.

The Performance Bond secures the contractor’s promise to perform under their contract in accordance with its terms and conditions at an agreed upon price within a set time frame while the Payment Bond protects certain laborers from non-payment by guaranteeing they are paid for work performed on site.

Who is protected by a payment bond?

Your subcontractors, material suppliers and laborers are protected by a payment bond. Under the Miller Act, this includes second-tier contractors who work with first tier companies on state projects. Payment bonds are also necessary for most jobs in states like yours that require them per law. Looking for Virginia Performance Bonds.

Who is protected by a performance bond?

Performance bonds are a precautionary measure that protects real estate owners and investors from the low-quality work of contractors. Performance bonds provide assurance in case unfortunate events such as bankruptcy or insolvency happen to come up for contractors during their job.

What party or parties are given the most protection by a performance bond by a payment bond?

Did you know that the most protected party by a performance bond is usually the contractor? The owner or obligee, not so much. With payment bonds for construction projects in place, they are given more protection against contractors who do not perform to specifications and don’t finish tasks on time.

Be sure to check out more at Swiftbonds.com