What is a Wholesale Distribution of Fuel (non-retail) Bond?

Wholesale distributors are required to put up a bond to make sure that all applicable laws are being followed and that taxes on motor fuel, whether produced within the state or imported, are being withheld and paid properly.

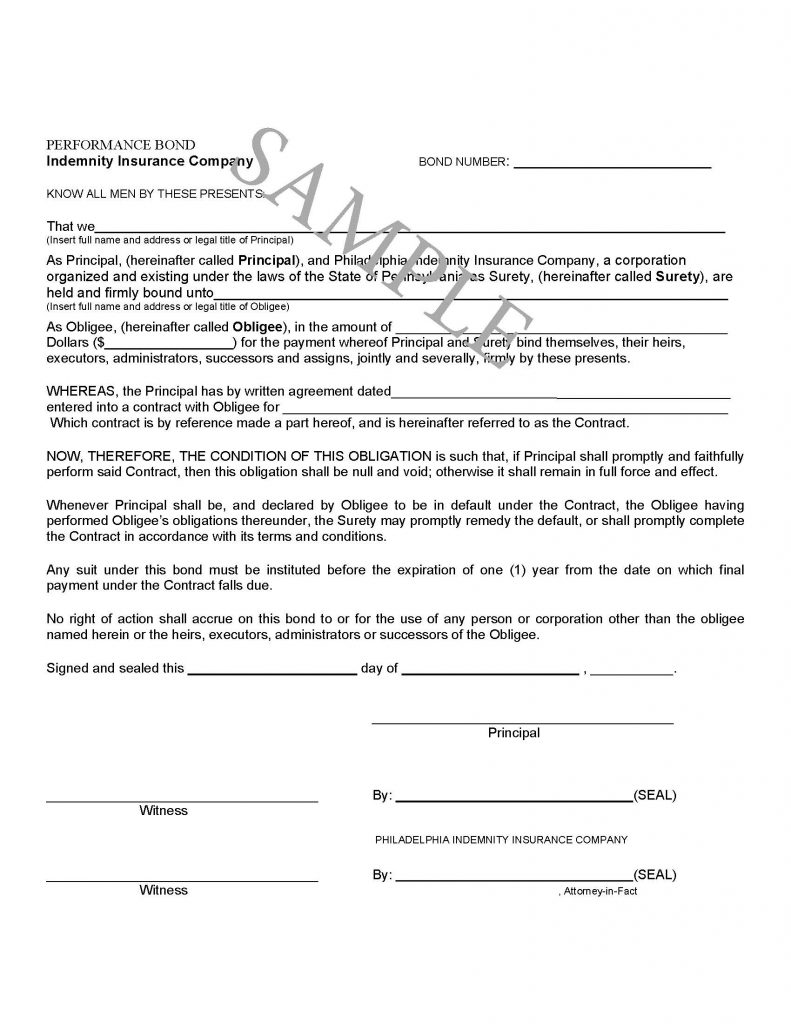

To get a Wholesale Distribution of Fuel Bond, just click on the Apply Online image below. Choose your state and then the type of bond you need.

Click for surety bond applicationArizona Motor Vehicle Dealer (Wholesale Motor Vehicle Dealer) BondArizona Motor Vehicle Dealer (Wholesale Auto Auction Dealer) BondAlabama Motor Vehicle Wholesaler BondKansas Wholesale Cigarette Dealers Bond

Licensing and Registration Requirements for Wholesale Distributors

Wholesale distributors of motor fuel, including gasoline, diesel, jet fuel, and aviation gasoline, must navigate a series of licensing and registration requirements to operate legally. The first step is to obtain a license from the state’s department of revenue or motor vehicles. This process typically involves submitting a detailed application, paying a requisite fee, and providing necessary documentation such as proof of insurance and a surety bond.

In addition to licensing, wholesale distributors must register with the state’s tax authority to obtain a tax identification number. This registration is crucial for filing tax returns and ensuring compliance with state tax laws. Terminal operators and other businesses involved in the distribution of motor fuel may also need to secure specific licenses and register with the state.

It’s important to note that licensing and registration requirements can vary significantly from state to state. Therefore, wholesale distributors must check with the relevant state authorities to understand the specific requirements applicable to their operations. Compliance with all applicable laws and regulations, including those related to the storage and distribution of motor fuel, is essential.

Persons involved in the wholesale distribution of motor fuel must ensure they have the necessary licenses and registrations to operate legally. This diligence helps avoid legal complications and ensures smooth business operations.

Tax Obligations and Compliance

Wholesale distributors of motor fuel are subject to a range of tax obligations, including excise taxes on gasoline, diesel, and other fuels. These tax rates and filing requirements can vary by state, making it imperative for wholesale distributors to stay informed and compliant with the tax laws in the states where they operate.

Timely filing of tax returns and payment of taxes is crucial to avoid penalties and interest. Wholesale distributors must file returns for motor fuel taxes, sales taxes, and potentially other taxes, depending on their operations. Compliance with federal tax laws and regulations, particularly those related to the importation and distribution of motor fuel, is also necessary.

Many states require wholesale distributors to file reports and pay taxes electronically, streamlining the process but also necessitating accurate and up-to-date systems for managing tax obligations. Maintaining precise records of tax liabilities and payments is essential to ensure compliance and avoid any legal issues.

Failure to comply with tax obligations can result in severe consequences, including penalties, fines, and even the revocation of licenses and registrations. Therefore, wholesale distributors must have robust systems and processes in place to manage their tax obligations effectively.

Given the complexity and variability of tax obligations depending on the type of fuel, the state, and the business’s tax liability, consulting with a tax professional is highly recommended. This ensures that wholesale distributors remain compliant with all applicable laws and regulations, safeguarding their business operations.

Arizona Motor Vehicle Dealer (Wholesale Motor Vehicle Dealer) Bond

Arizona Motor Vehicle Dealer (Wholesale Auto Auction Dealer) Bond

Alabama Motor Vehicle Wholesaler Bond

Kansas Wholesale Cigarette Dealers Bond

See our License and Permit Bond page for more.

Click here for more on bonds.