What is a Roofers License Surety Bond?

Roofing companies, in some states, are required to obtain a bond prior to getting a home improvement/installation license. A surety bond is typically provided by an insurance company, which guarantees the contractor’s obligations.

Benefits of Working with a Bonded Roofing Contractor

Working with a bonded roofing contractor provides numerous benefits to homeowners and property owners. A bonded roofing contractor has obtained a surety bond, which guarantees that they will fulfill their contractual obligations and complete the project according to the agreed-upon terms. This provides added protection and peace of mind to the customer, as they can be assured that the contractor will complete the work as promised.

Some of the benefits of working with a bonded roofing contractor include:

- Financial Protection: A surety bond provides financial protection to the customer in case the contractor fails to complete the project or incurs damages. This means that if the roofing contractor fails to deliver on their promises, the customer can file a claim against the bond to recover their losses.

- Increased Accountability: A bonded roofing contractor is more likely to be accountable for their work, as they have a financial incentive to complete the project according to the agreed-upon terms. The surety bond acts as a form of insurance, ensuring that the contractor is held responsible for their actions.

- Better Work Quality: A bonded roofing contractor is more likely to provide high-quality work, as they have a reputation to uphold and a financial incentive to complete the project successfully. This means that customers can expect a higher standard of workmanship and professionalism.

- Compliance with Regulations: A bonded roofing contractor is more likely to comply with local and state regulations, as they have a financial incentive to do so. This ensures that the project is completed in accordance with all relevant laws and regulations, reducing the risk of legal issues.

How Does a Roofer Bond Work?

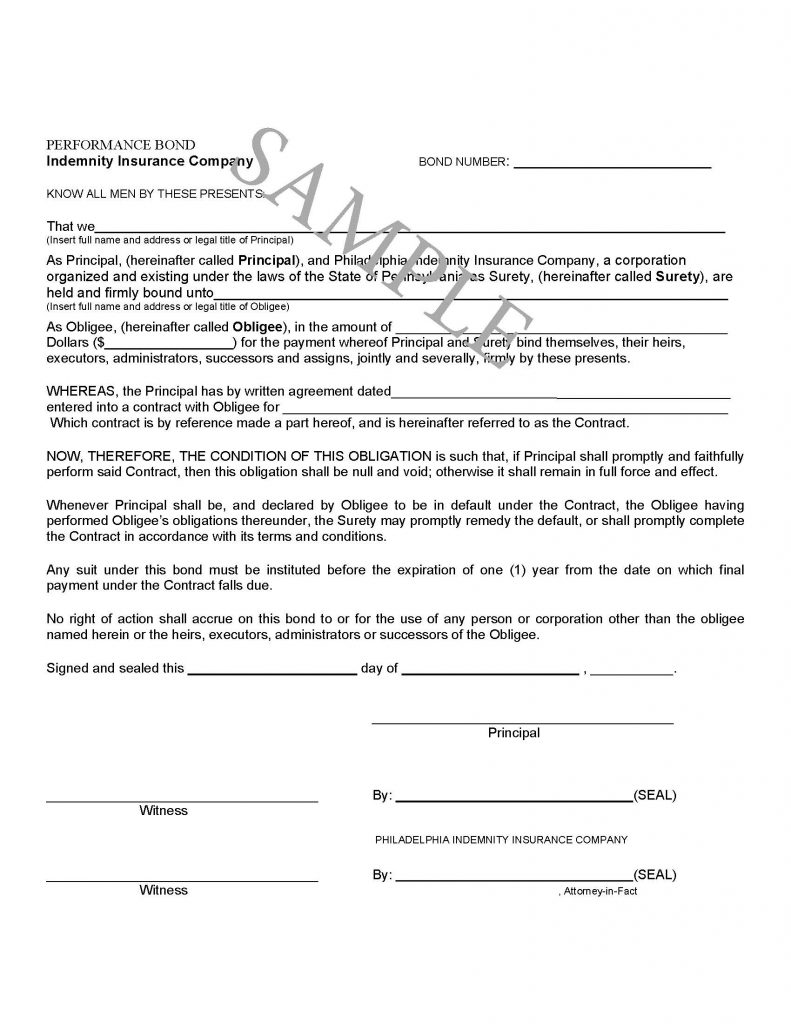

A roofer bond, also known as a surety bond, is a type of insurance policy that protects the customer in case the contractor fails to complete the project or incurs damages. The bond involves three parties: the roofer, the customer, and the surety company.

Here’s how it works:

- Roofer Purchases the Bond: The roofer purchases a surety bond from a surety company, which guarantees that they will complete the project according to the agreed-upon terms. This bond acts as a financial guarantee that the roofer will fulfill their contractual obligations.

- Customer Pays for the Work: The customer pays the roofer for the work, and the roofer is responsible for completing the project. The surety bond provides assurance to the customer that the roofer will deliver on their promises.

- Claim Against the Bond: If the roofer fails to complete the project or incurs damages, the customer can make a claim against the surety bond. This claim is a formal request for compensation due to the roofer’s failure to meet their obligations.

- Surety Company Investigates: The surety company will investigate the claim and pay the customer up to the bond’s full value if they find in favor of the customer. This ensures that the customer is compensated for any losses incurred due to the roofer’s failure.

- Repayment from the Roofer: The surety company will then seek repayment from the roofer. This means that the roofer is ultimately responsible for reimbursing the surety company for any claims paid out.

Types of Bonds for Roofing Contractors

There are several types of bonds that roofing contractors may need to obtain, depending on the project and the location. Some of the most common types of bonds for roofing contractors include:

- Performance Bonds: These bonds guarantee that the contractor will complete the project according to the agreed-upon terms. Performance bonds provide assurance to the customer that the project will be finished as specified in the contract.

- Payment Bonds: These bonds guarantee that the contractor will pay all subcontractors and suppliers for their work. Payment bonds protect against the risk of non-payment, ensuring that everyone involved in the project is compensated.

- Bid Bonds: These bonds guarantee that the contractor will sign a contract for their specified bid price if they are the low bidder. Bid bonds provide assurance that the contractor will honor their bid and enter into a contract if selected.

- Contract Bonds: These bonds guarantee that the contractor will fulfill the terms of the contract. Contract bonds provide a financial guarantee that the contractor will adhere to the contractual obligations.

- Construction Bonds: These bonds are used in construction projects, including roofing projects, to protect property owners from monetary loss. Construction bonds provide a broad range of protections, ensuring that the project is completed as agreed.

How to Get a Roofer Bond

Getting a roofer bond is a relatively straightforward process. Here are the steps to follow:

- Determine the Type of Bond Needed: Depending on the project and the location, you may need a performance bond, payment bond, bid bond, contract bond, or construction bond. Identifying the correct type of bond is the first step in the process.

- Choose a Surety Company: Research and choose a reputable surety company that offers the type of bond you need. It’s important to select a bonding company with a strong track record and good customer reviews.

- Apply for the Bond: Complete the application form and provide the required documentation, including business financials, credit reports, and project details. The application process helps the surety company assess the risk and determine the bond amount.

- Pay the Premium: Pay the premium for the bond, which is typically a percentage of the bond’s value. The premium is the cost of obtaining the bond and is usually based on the bond value and the contractor’s financial standing.

- Receive the Bond: Once the application is approved, you will receive the bond, which you can then provide to the customer. The bond serves as a guarantee that the contractor will fulfill their contractual obligations.

Cost of a Roofer Bond

The cost of a roofer bond varies depending on the type of bond, the bond’s value, and the surety company. Here are some general estimates:

- Performance Bonds: 1-3% of the bond’s value. Performance bonds are typically priced based on the total value of the project and the contractor’s financial stability.

- Payment Bonds: 1-3% of the bond’s value. Payment bonds ensure that subcontractors and suppliers are paid, and their cost is usually a percentage of the bond amount.

- Bid Bonds: 1-5% of the bond’s value. Bid bonds are priced based on the bid amount and provide assurance that the contractor will enter into a contract if selected.

- Contract Bonds: 1-5% of the bond’s value. Contract bonds guarantee the fulfillment of contractual obligations and are priced based on the contract value.

- Construction Bonds: 1-5% of the bond’s value. Construction bonds provide broad protection for construction projects and are priced based on the project value and risk assessment.

It’s worth noting that the cost of the bond is typically passed on to the customer, so it’s essential to factor this into your pricing. By understanding the cost structure, contractors can accurately estimate project expenses and ensure they are adequately covered.

See our License and Permit Bond page for more. Click here for more on bonds.