What is a Private Detective (Investigator) Bond?

This is similar to the bond required for an entire agency. Single agents also need a bond for their personal license. This is a great example of a fidelity bond.

To get a Private Detective Bond for your state, just click on the appropriate Purchase Now button in the table below to see the premium for the bond and on-line application form.

Definition of a Private Investigator Bond

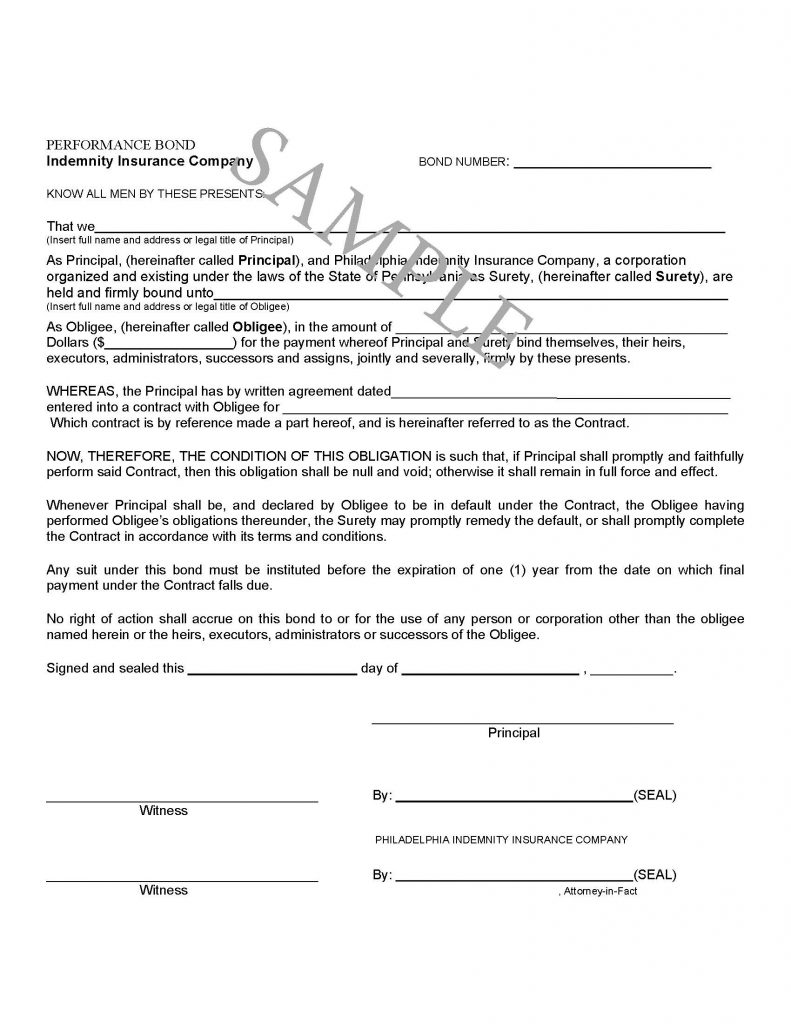

A private investigator bond is a type of surety bond that private investigators must obtain to secure a license to operate within their state or locality. This bond forms a contractual agreement between three key parties: the private investigator (principal), the local or state authority (obligee), and the surety (bond underwriter). The primary function of this bond is to ensure that the private investigator adheres to all relevant laws and regulations, conducting their business in an ethical and professional manner.

The private investigator bond acts as a safeguard for the public, offering protection against any potential harm or damages resulting from the investigator’s actions. It also ensures that the private investigator will cooperate with law enforcement agencies and other authorities as required by law. Should the private investigator fail to comply with the bond’s terms, the surety will cover any damages or losses up to the bond’s amount, thereby providing a financial safety net.

Arizona Private Investigator’s License Bond

Kansas – Detective or Detective Agency Bond

What is a Private Investigator Bond?

A private investigator bond is a type of surety bond required for private investigators to obtain a license to operate in their state or locality. This bond is a contractual agreement involving three parties: the private investigator (principal), the local or state authority (obligee), and the surety (bond underwriter). The primary purpose of the bond is to ensure that the private investigator adheres to all relevant laws and regulations, conducting their business ethically and professionally. Private investigation agencies, alongside other professions such as security guards, must adhere to these legal obligations to ensure customer protection and compliance with statute regulations.

The bond serves as a protective measure for clients, offering a safety net in case of any misconduct or unethical behavior by the private investigator. Should a claim arise, the surety will compensate the client up to the bond’s penal sum, and the private investigator will be responsible for reimbursing the surety for any costs and damages incurred. This system helps maintain trust and accountability within the private investigation industry.

How to Obtain a Private Investigator Bond

Securing a private investigator bond is a straightforward process that involves several key steps:

- Determine the Bond Amount: The required bond amount varies by state or locality. Check with the relevant authorities to ascertain the specific bond amount needed for your area.

- Choose a Surety: Select a surety company that is licensed to issue private investigator bonds in your state or locality. It’s important to choose a reputable surety to ensure a smooth process.

- Apply for the Bond: Complete an application for the bond, which typically requires information about your business and personal credit history. This step is crucial as it helps the surety assess the risk involved.

- Pay the Premium: Once your application is approved, you will need to pay the bond premium. The premium amount depends on the bond amount and your credit history.

- Receive the Bond: After paying the premium, the surety will issue the bond and send it to you. You can then submit the bond to the relevant licensing authority to complete your licensure process.

By following these steps, you can obtain a private investigator bond and ensure compliance with state or local regulations.

Why Do You Need a Private Investigator?

Private detectives are mandated to secure a private investigator bond as a prerequisite for licensure in many states. This requirement is designed to safeguard the public and regulatory bodies from potential harm or misconduct by private investigators. By enforcing a bond requirement, local and state authorities can ensure that private investigators uphold high standards of professionalism and ethics.

A private investigator bond is a legal assurance involving a private investigator or detective agency, confirming their compliance with laws and regulations related to private investigations.

Private investigations require private investigators to secure a bond as a prerequisite for licensure in many states. This requirement is designed to safeguard the public and regulatory bodies from potential harm or misconduct by private investigators. By enforcing a bond requirement, local and state authorities can ensure that private investigators uphold high standards of professionalism and ethics.

Beyond being a licensure requirement, a private investigator bond offers several advantages for private investigators. It helps establish credibility and trust with clients, providing a competitive edge in the marketplace. Additionally, the bond offers financial protection in the event of a claim, mitigating the risk of significant financial loss. This dual benefit of compliance and protection makes the private investigator bond an essential component of the profession.

Private Investigator Bonds: Cost and Premiums

The cost of a private investigator bond can vary based on several factors, including the bond amount and your credit history. Typically, the bond premium is a percentage of the bond amount, ranging from 1% to 5% or more.

Several factors influence the cost of a private investigator bond:

- Bond Amount: Higher bond amounts generally result in higher premiums.

- Credit History: A good credit history can qualify you for a lower premium, while a poor credit history may lead to a higher premium.

- Business Experience: Extensive experience in the private investigation industry can help lower your premium.

- State or Locality: The cost of a private investigator bond can vary depending on the state or locality in which you operate.

To find the best rate for your private investigator bond, it’s advisable to shop around and compare prices from different surety companies. This approach ensures you get the most competitive rate while securing the necessary bond for your private investigation business.

Benefits of Private Investigator Bonds for Clients

Private investigator bonds offer numerous benefits for clients, including:

- Protection from any wrongdoing or unethical behavior by the private investigator

- A financial safety net in case of losses or damages

- Assurance that the private investigator is licensed and regulated by the state or locality

- Confidence in the private investigator’s commitment to ethical and professional conduct

- A clear means of recourse in the event of a dispute or claim

A private detective bond is a mandatory requirement for individuals applying for private detective licenses in states like Massachusetts and Pennsylvania. A private investigator surety bond protects clients from potential misconduct by private investigators and outlines the legal requirements for obtaining such a bond, including cost considerations and the impact of credit history on premium rates.

Overall, private investigator bonds are crucial in protecting the public and regulatory bodies while also providing significant benefits for private investigators and their clients. By mandating bonds, local and state authorities help ensure that private investigators maintain high standards of professionalism and ethics, thereby safeguarding clients from potential harm or misconduct. Private investigator surety bonds hold private investigators accountable for misconduct and demonstrate the bond's importance for both regulatory compliance and financial security.

See our License and Permit Bond page for more.

Learn more on private detective Dothan Alabama.

Click here for more on bonds.