Get a BMC-84 Bond – ICC Broker Bond Instantly!

What is a freight broker bond?

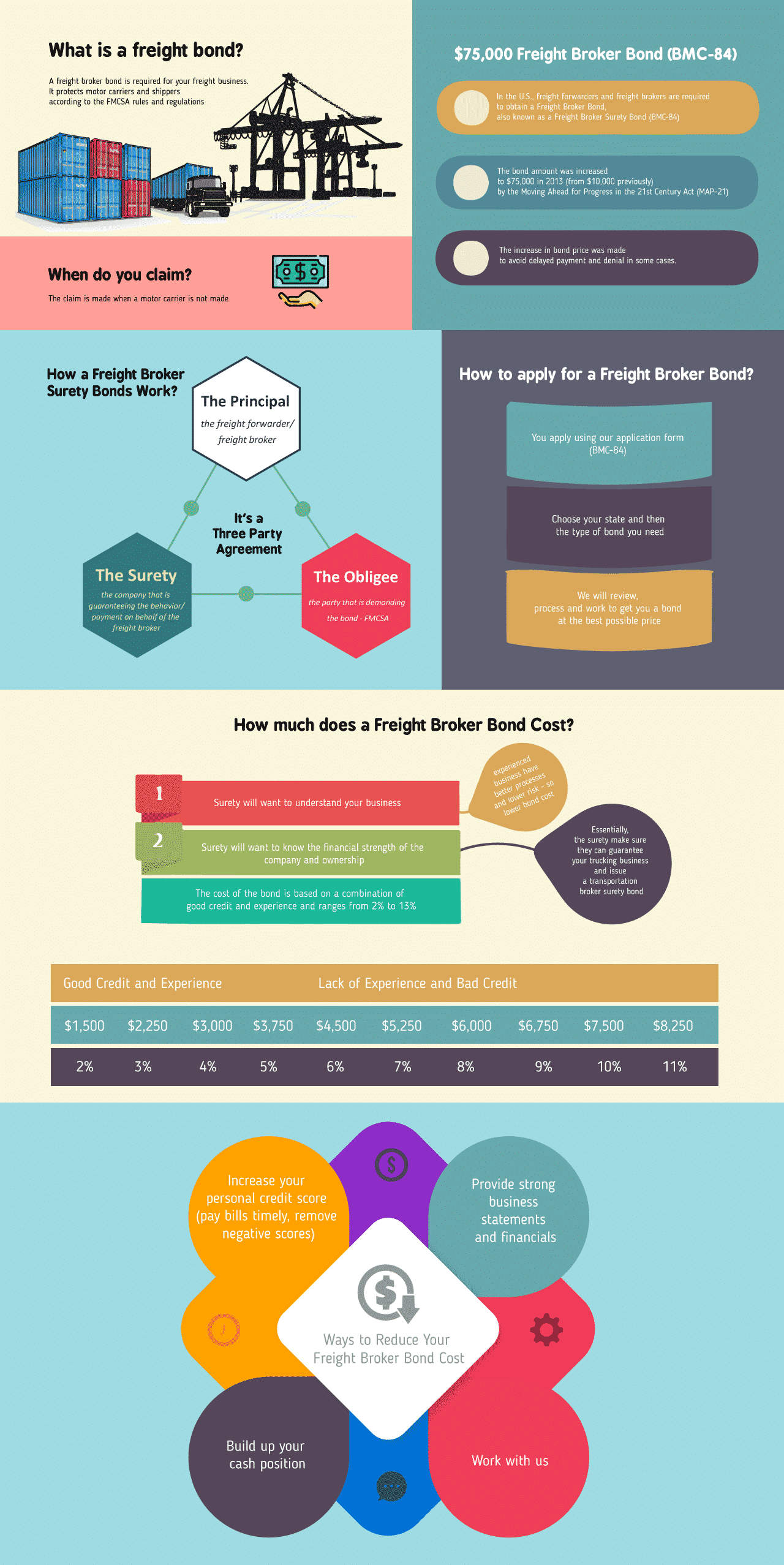

A freight broker bond is a foundational ingredient required to operate your freight business in a legitimate order. To legally operate, freight brokers must obtain a freight broker license, which includes securing a freight broker bond. It stands as an option to provide assurance to your clients, while also ensuring that you meet the necessary requirements of freight brokerage to protect motor carriers and shippers in accordance with the FMCSA rules and regulations. This notice is for all applicants desiring to step into the business! The typical claim is made when a motor carrier is not paid, and these claims are generally handled by companies such as ours that specialize in BMC-85 type bonds.

$75,000 Freight Broker Bond (BMC-84)

The process to receive a Freight Broker Bond (BMC-84) is fairly straightforward. You as an applicant just need to use our application and we’ll work to get you a bond at the best possible bond premium rate. Pretty easy, right? See our PODS Freight Broker Bond page for more info.

Freight Broker Bond Process

The process to receive a Freight Broker Bond (BMC-84) is fairly straightforward. Working with reputable surety bond companies can simplify the process and ensure you get the best rates. You apply using our application and we’ll work to get you a bond at the best possible price. Pretty easy, right? See our PODS Freight Broker Bond page for more info.

How Freight Broker Surety Bonds Work (our really short Freight Brokers Bond Guide)

The cost of the bond depends on several factors. Choosing a reputable bond company is crucial as they handle claims and ensure the interests of all parties are protected. First, the surety will want to understand your business, as more experienced businesses typically have better processes in place to reduce risk, which lowers the bond cost. Lower risk companies often secure better rates on their insurance premiums. Second, the surety will seek approval regarding the financial health of your business from an authority figure, perhaps an overseer or a financial analyst. They will also be interested in the personal credit history and financial strength of the owner. Given that the standard BMC-84 (Freight Broker Surety Bond) is offered without collateral, the surety is probing for financial stability and experience from the company and ownership. This is to ensure protection and coverage against potential liability. Security is paramount to the surety as it wants to be certain that they can aptly guarantee your trucking business to issue a trucking surety bond (or transportation broker surety bond).

Carrier Safety Administration (FMCSA) Regulations

The Federal Motor Carrier Safety Administration (FMCSA) plays a crucial role in regulating the freight brokerage industry. To ensure compliance with federal regulations, the FMCSA mandates that all freight brokers and freight forwarders obtain a surety bond, commonly known as a BMC-84 bond. This bond amount is set at $75,000 and serves as a financial guarantee to protect the interests of shippers and motor carriers.

Under FMCSA regulations, freight brokers are required to:

- Obtain a freight broker surety bond (BMC-84) or a trust fund agreement (BMC-85).

- Register with the FMCSA and obtain a motor carrier number (MC number).

- Maintain accurate records of their business operations.

- Comply with federal regulations regarding safety, insurance, and financial responsibility.

- Pay motor carriers in a timely manner.

Failure to adhere to these regulations can result in severe penalties, fines, and even the revocation of the freight broker’s license. By following FMCSA guidelines, freight brokers can ensure they operate legally and maintain a good standing in the industry.

How much does a Freight Broker Bond Cost?

How Much Will a $75K Bond Cost Me?

The cost of the bond is determined by the conjunction of good credit and experience, generally ranging from < 2% to 13%. The cost can vary depending on the surety company you choose, as different companies offer varying rates and terms. This rate, though, can fluctuate depending on several factors including the degree of liability coverage and protection measures in place. Seeking contract approval from authorities could also play a role.

Take the next step and apply for a Federal Motor Carrier Safety Bond (BMC-84) using our form, above. Not only will we assess your application for accuracy, but we’ll also expedite the approval process ensuring timely shipping of your bond. We will review and process your freight broker bonds application, providing compensation for our drivers’ efforts promptly.

The cost of the bond is based on a combination of good credit and experience and ranges from < 2% to 13%.

| Good Credit and Experience | Lack of Experience à Bad Credit | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| $937.50 | $2,250 | $3,000 | $3,750 | $4,500 | $5,250 | $6,000 | $6,750 | $7,500 | $8,250 |

| 1.25% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% |

Benefits of a Freight Broker Bond

A freight broker bond offers numerous benefits to freight brokers, shippers, and motor carriers. Here are some of the key advantages:

- Ensures Compliance with FMCSA Regulations: Having a freight broker bond ensures that brokers meet all federal requirements, helping them avoid legal issues.

- Protects Shippers and Motor Carriers: The bond provides a financial safety net, protecting shippers and motor carriers from potential losses due to non-payment or other issues.

- Promotes Credibility and Trust: A bonded freight broker is seen as more reliable and trustworthy, which can attract more business.

- Provides a Financial Guarantee: The bond guarantees that freight brokers will pay motor carriers, fostering a more secure business environment.

- Prevents Fraud and Unethical Practices: By requiring a bond, the industry reduces the risk of fraudulent activities and promotes ethical behavior.

- Cost-Effective Alternative to a Trust Fund Agreement: Compared to setting up a trust fund agreement, obtaining a bond is often more affordable and less cumbersome.

- Focus on Business Operations: With the financial risks mitigated, freight brokers can concentrate on growing their business without worrying about potential liabilities.

Overall, a freight broker bond is an essential requirement for freight brokers to operate legally and maintain a good reputation in the industry. It not only ensures compliance but also builds trust and credibility, making it a valuable asset for any freight brokerage.

How do I apply for a Freight Broker Bond?

Apply for a Federal Motor Carrier Safety Bond (BMC-84) using our form, above. As a licensed freight broker, you must secure a BMC-84 bond to comply with FMCSA regulations. We will review and process this promptly.

Reduce Your Freight Broker Surety Bond Cost

See our License and Permit Bond page for more on benefits and compensation plans for your drivers. Learn the basics and beyond about acquiring approval for your bonds. Reducing the cost of your property broker bond can be achieved by improving your credit score and financial statements.

- Increase your personal credit score (pay bills timely, remove negative scores)

- Provide strong business statements and financials

- Build up your cash position

- Work with us

See our License and Permit Bond page for more. Click here for more on bonds.