What is a Collection Agency Bond?

Collection agencies, to protect their clients’ interests, require a bond payment in certain states as part of the bond requirement. These states, such as New Jersey, New York, Michigan, and Massachusetts, among others, require having a bond, or a form of before they are issued a license to collect funds from debtors in that state. These are also known as debt collector bonds. In states like North Carolina, New Mexico, California, Minnesota, Wisconsin, and Alaska, the bond amount differs based on the state’s legislation, thereby protecting all parties involved, including the .

Purpose and Requirements

A Collection Agency Bond is a type of surety bond that serves as a guarantee for the ethical and lawful conduct of collection agencies. Its primary purpose is to protect consumers and clients from potential misconduct by collection agencies. The bond ensures that collection agencies adhere to state regulations, handle client information with sensitivity, and maintain transparency in their debt collection practices.

The requirements for a Collection Agency Bond vary by state, but most states require collection agencies to obtain a surety bond before receiving a business license or registration. The bond amount and license requirements are subject to change, so it’s essential to check with the licensing authority for the most up-to-date information.

How Collection Agency Bonds Work

A Collection Agency Bond involves three parties: the principal (collection agency), the obligee (state), and the surety (bond provider). The principal is required to obtain a Collection Agency Bond, which guarantees adherence to state regulations and ethical conduct. The obligee requires the principal to obtain a Collection Agency Bond to ensure compliance with professional rules and regulations. The surety issues the Collection Agency Bond and provides initial payment for a claim against the bond.

If a claim is filed against a Collection Agency Bond, the surety company will investigate to determine its validity. If the claim is found to be valid, the surety company expects the collection agency to make good on the claim. If the collection agency fails to pay the claim, the surety company will pay it on their behalf and pursue reimbursement.

How do I get a Collection Agency Bond?

To get a Collection Agency Bond (also known as a payday loan bond, or payday lender bond), just click on the Apply Online image below. Choose your state and then the type of bond you need. Then email it to [email protected]

A Guide to Collection Agency Surety Bonds

A surety bond valued at $10,000, acting as a form of reimbursement, is a required bond for all debt collection agencies operating in certain states, such as Texas. However, the bond amount varies for agencies operating in states like New York, New Jersey, and Arkansas. If the agency fails to follow the law of their operating state, victims seeking monetary damages could pursue the Guaranty Bond firm in a state law court.

Lender Services Bond

We can secure you a bond for as little as $100, whether you're operating your business in Massachusetts, Michigan, New York, Wisconsin, Alaska or any other state. Just click on the application above, choose your state and collection agency bond and we'll get you a quote FAST!

How Much Does a Collection Agency Bond Cost?

This regulation was set up to shield customers, especially in states like Minnesota, California, and North Carolina from unethical financial obligation collection practices through the use of a debt collector bond. A supposed debtor who is a resident of these states along with those living in Wisconsin or Alaska can pursue monetary civil remedies against a third party debt collector’s guaranty bond.

Factors Affecting Bond Costs

The cost of a Collection Agency Bond is influenced by several factors, including:

-

The type of bond: Different types of bonds have varying costs.

-

State requirements: Bond amounts and license requirements vary by state.

-

Financial strength: The debt collector’s or collection agency’s financial strength affects the cost of the bond.

-

Track record: The debt collector’s or collection agency’s track record influences the cost of the bond.

-

Credit score: A good credit score can result in lower premium rates, while a bad credit score may lead to higher rates.

Consumer Installment Loan Bond (Consumer Loan Bond)

Most financial obligation collection agencies and debt collectors operate outside of their home state. For instance, an agency based in New Jersey might collect from debtors in New York, Massachusetts, Wisconsin, and Alaska. The state’s attorney general lacks jurisdiction in these cases, therefore, the right bond measures must be in place to protect all parties involved. Pursuing civil actions for residents can be a challenging and difficult process, as it would have to be conducted through the home state’s court system. Sometimes, these legal obligations are akin to a three-party agreement where the plaintiff, or creditor, demands assurance from the debtor, or principal, and the surety bond company acts as the guarantor.

Debt Settlement Bond (Sales Finance Bond)

Most financial obligation collection agencies operate outside of the State of Texas, where the the state's attorney general has no territory to go after criminal action. Seeking civil actions for Texas residents would be a difficult and difficult process, as it would have to be carried out in the home state of the financial obligation collection agency, through that certain state's court system.

Arizona Collection Agency Bond

Kansas City Wyandotte County Collection Agency Bond

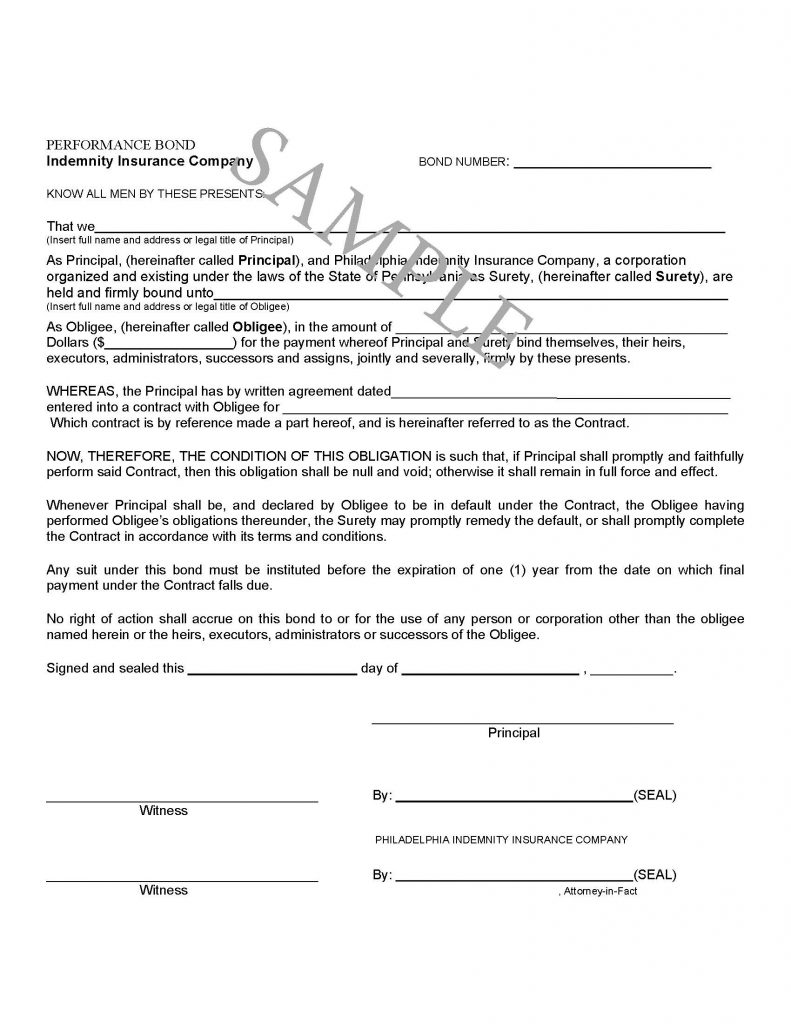

Collection Agency Sample Bond

ion Agency Bonds offer several benefits, including:

-

Protection for consumers and clients: The bond ensures that collection agencies adhere to state regulations and handle client information with sensitivity.

-

Financial security: The bond provides financial protection for clients in case of misconduct by the collection agency.

-

Compliance with professional rules and regulations: The bond guarantees adherence to state regulations and ethical conduct.

-

Reputation protection: A Collection Agency Bond can help protect the reputation of collection agencies by ensuring transparency and ethical debt collection practices.

Frequently Asked Questions (FAQs)

Question – How do I get a Collection Agency Bond from Swiftbonds? What’s the process? Answer – For a collection agency bond, we take some information about your company and the states that you need the bond for. In some cases, we can issue the bond super fast. In other cases, we actually do underwriting as the goal is to get you the cheapest bond possible across multiple states. We recently worked with a client that operated in all fifty states and was able to get a much better rate for them and saved them a substantial amount of money.

Question – Does Swiftbonds write NMLS bonds? Answer – Of course! We definitely have access to the NMLS system and can get the bond posted there for you.

Question – I Previously got My Collection Agency Bonds by Someone Else, Why should I switch to Swiftbonds for this now? Answer – Swiftbonds understands how the consumer loan industry works (one of our founders was previously the general counsel for a large finance company) and we understand how to work with you to get the best rate for collection agency bonds. We know that the consumer installment bond is dynamic and work within that to get the best bond rates out there. Finally, you don’t get an automated system, but instead someone that specializes in this marketplace and RETURNS YOUR CALLS and EMAILS promptly.

Question – What is required for Underwriting? Answer – Most surety bond companies request the following: the last three (3) years of corporate financial statements (Profit and Loss Statements and Balance Sheets), year-to-date financials, ownership structure and personal financial statement on the owners.

Question – How does a Collection Agency Bond help in collecting money? Answer – A Collection Agency Bond ensures that collection agencies adhere to regulations while collecting money, protecting consumers and ensuring that funds are properly remitted to clients.

See our License and Permit Bond page for more. Click here for more on bonds.