Get an Instant Quote on Utility Deposit Bond

Introduction

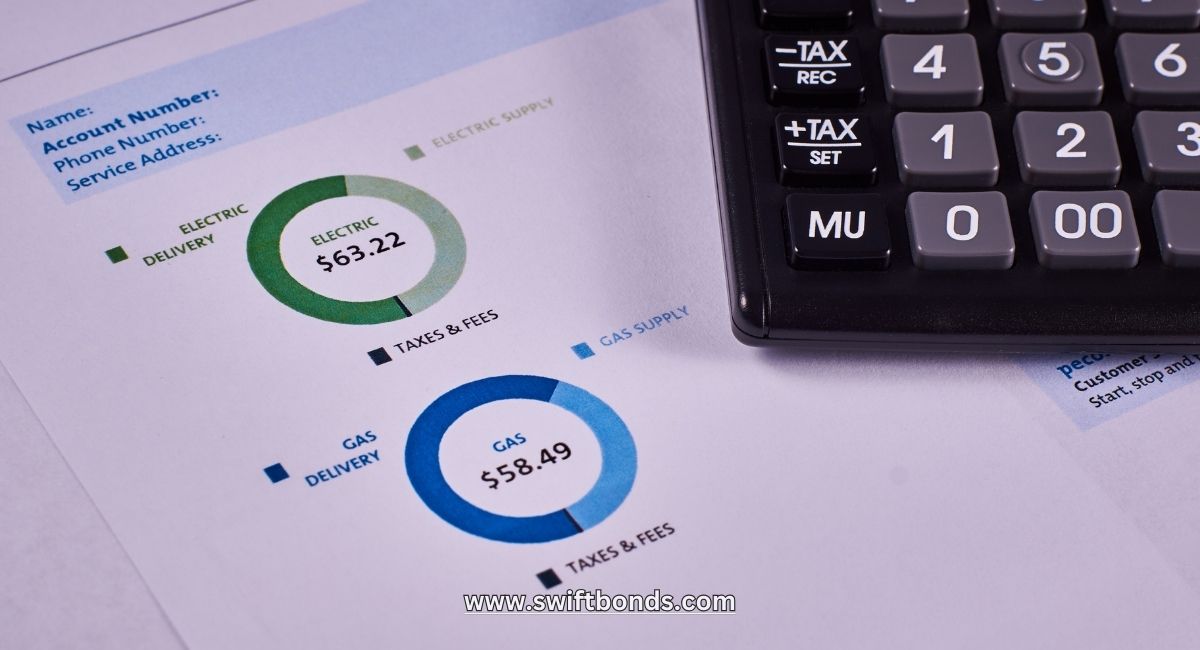

From our perspective, businesses and commercial property owners in Portland seeking to establish utility services often encounter unexpected requirements. One such requirement is the Portland General Electric Company - Utility Deposit Bond, which acts as a financial guarantee to ensure timely payment of utility bills. This bond protects Portland General Electric (PGE) by providing financial security if a customer fails to fulfill their payment obligations.

This bond serves as an alternative to a cash deposit, offering a cost-effective solution for businesses looking to conserve capital. Similar to the MaineCare - DME License ($50,000) Bond, which ensures compliance with healthcare regulations, the Utility Deposit Bond safeguards public resources by guaranteeing payment to the utility provider. Without this bond, businesses may face delays in service initiation or be required to pay a large cash deposit upfront.

Common Misunderstandings About the Utility Deposit Bond

We’ve noticed that many business owners misunderstand the role of the Portland General Electric Company - Utility Deposit Bond. Some believe that the bond directly covers their utility payments. In reality, the bond serves as a backup that guarantees PGE receives compensation if the customer defaults on payments. If the bond is triggered, the surety company compensates the utility provider and seeks reimbursement from the bonded business.

Another misconception is that the bond is optional. In cases where a customer has insufficient credit history or demonstrates a higher risk of nonpayment, PGE may require a Utility Deposit Bond as a condition for initiating or maintaining service. This is similar to the Maine - Combat Sports Authority of Maine (CSAM) Bond, which ensures that combat sports promoters meet financial obligations related to event operations.

Swiftbonds: Providing Expert Bond Solutions for Portland Businesses

Based on our experience, Swiftbonds simplifies the process of securing a Portland General Electric Company - Utility Deposit Bond. Swiftbonds works closely with businesses to assess their bond needs and offer tailored solutions that meet PGE’s requirements.

Swiftbonds’ team of experts guides businesses through the application and approval process, helping them secure the bond efficiently. Whether obtaining a MaineCare - DME License ($50,000) Bond or fulfilling utility deposit requirements in Portland, Swiftbonds ensures that clients meet their obligations with ease.

Steps to Obtain a Utility Deposit Bond for PGE

What we’ve discovered is that following a structured approach makes it easier for businesses to obtain a Portland General Electric Company - Utility Deposit Bond. The steps include:

-

Assess Bond Requirement – Determine whether PGE requires a Utility Deposit Bond as a condition for initiating or maintaining service.

-

Complete the Bond Application – Provide business information, including company name, address, and ownership details.

-

Receive a Bond Quote – Swiftbonds evaluates the application and offers a competitive bond quote based on the business’s risk profile.

-

Pay the Bond Premium – Upon acceptance of the quote, the bond premium is paid, and the bond is issued.

-

Submit the Bond to PGE – File the bond with PGE to satisfy the deposit requirement and activate utility services.

Swiftbonds streamlines this process, ensuring that businesses secure their Utility Deposit Bond with minimal hassle.

Risks of Operating Without a Utility Deposit Bond

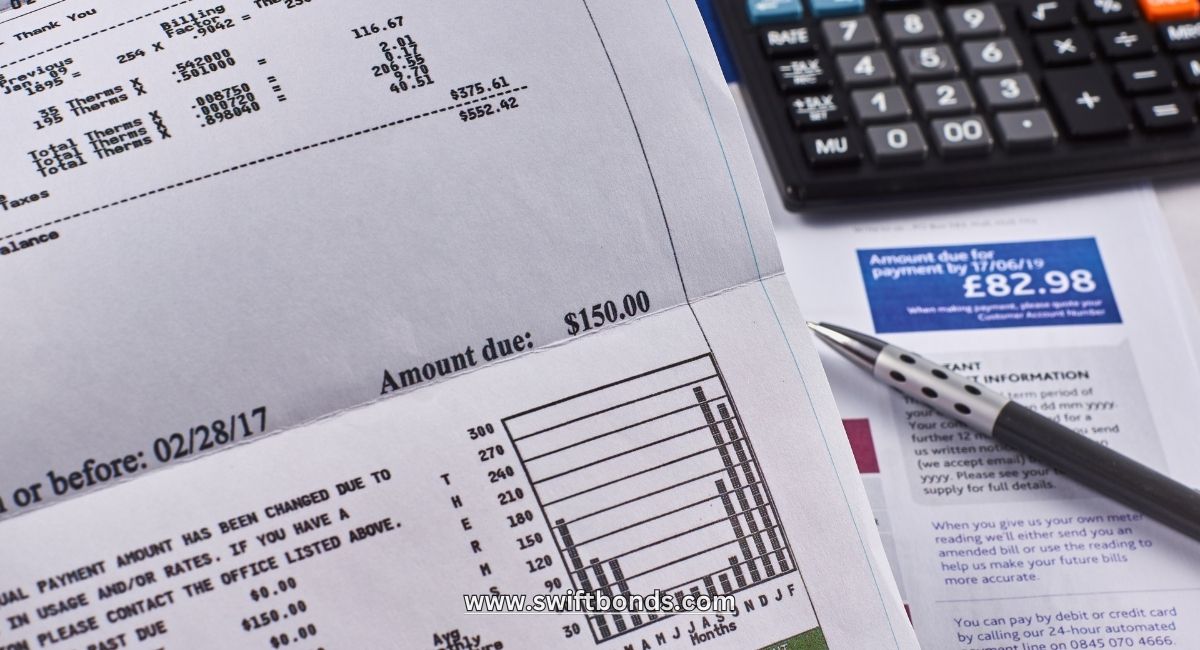

In our observation, failing to secure a Portland General Electric Company - Utility Deposit Bond when required can lead to significant disruptions for businesses. Without this bond, PGE may deny service initiation or terminate existing services due to perceived financial risks.

Operating without the required bond exposes businesses to potential service interruptions and financial penalties. Similar to the Maine - Combat Sports Authority of Maine (CSAM) Bond, which protects event participants by ensuring promoter compliance, the Utility Deposit Bond safeguards PGE’s interests by ensuring consistent payment of utility obligations.

Advantages of Obtaining a Utility Deposit Bond

We’ve learned that securing a Portland General Electric Company - Utility Deposit Bond provides multiple benefits for businesses. These include:

-

Financial Flexibility – Reduces the need for a large upfront cash deposit, allowing businesses to allocate capital to other operational needs.

-

Faster Service Initiation – Ensures that utility services can be activated promptly, minimizing delays in business operations.

-

Enhanced Credibility with PGE – Demonstrates a commitment to fulfilling payment obligations, building trust with the utility provider.

Similar to how the MaineCare - DME License ($50,000) Bond fosters trust between healthcare providers and regulators, the Utility Deposit Bond reassures PGE that customers will meet their financial commitments.

Regulatory Requirements and Compliance

The Portland General Electric Company - Utility Deposit Bond is mandated by PGE in cases where a customer’s credit history or financial standing suggests a higher risk of nonpayment. This bond ensures compliance with PGE’s deposit policies, safeguarding the utility provider against financial losses.

Just as the Maine - Combat Sports Authority of Maine (CSAM) Bond ensures compliance with combat sports regulations, the Utility Deposit Bond aligns with PGE’s requirements, ensuring that utility services remain uninterrupted for customers who meet their obligations.

Conclusion

We’ve come to appreciate that obtaining a Portland General Electric Company - Utility Deposit Bond is a smart move for businesses that want to secure utility services without tying up valuable capital. This bond protects PGE by ensuring that payment obligations are met while offering businesses financial flexibility and operational efficiency.

Swiftbonds simplifies the bonding process by offering expert guidance, competitive rates, and exceptional service. Whether securing a MaineCare - DME License ($50,000) Bond or meeting PGE’s deposit requirements, Swiftbonds ensures that clients fulfill their obligations with confidence. By partnering with Swiftbonds, businesses can focus on their growth while meeting regulatory and financial requirements.

Frequently Asked Questions

Why is this bond required?

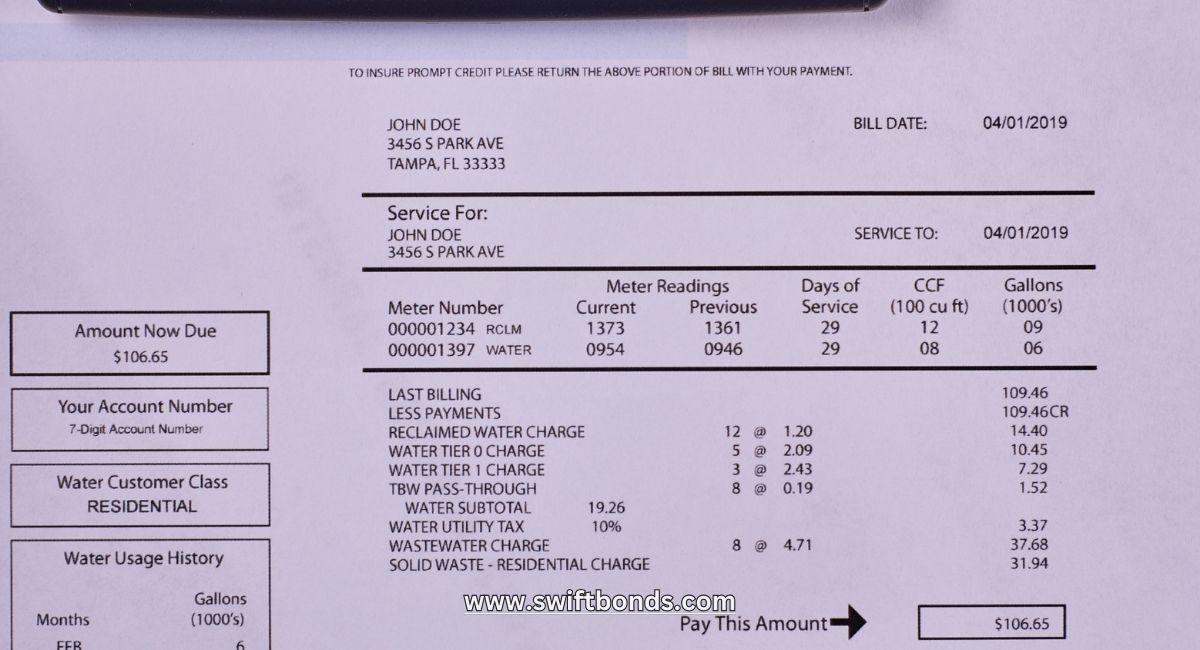

The bond protects Portland General Electric by ensuring that utility payments are made on time. It acts as a financial guarantee that compensates PGE if a customer defaults on their payment obligations.

Does the bond pay for my utility bills?

No. The bond does not pay the customer’s utility bills. It provides compensation to PGE if the customer defaults on payments. If the bond is used, the surety company seeks reimbursement from the bonded business.

Can I provide a cash deposit instead of a bond?

Yes. Businesses can provide a cash deposit as an alternative to the bond. However, many choose the bond option to preserve working capital and avoid tying up large sums of money.

How often does this bond need to be renewed?

The Portland General Electric Company - Utility Deposit Bond typically requires annual renewal. Swiftbonds provides timely renewal reminders to ensure continuous compliance with PGE’s requirements.

What happens if I fail to obtain the bond?

Failure to secure the bond when required can result in denial of service initiation or termination of existing services. PGE may suspend or terminate services if a bond is not provided as required.