Get an Instant Quote on Wage & Fringe Benefits Bond

Introduction

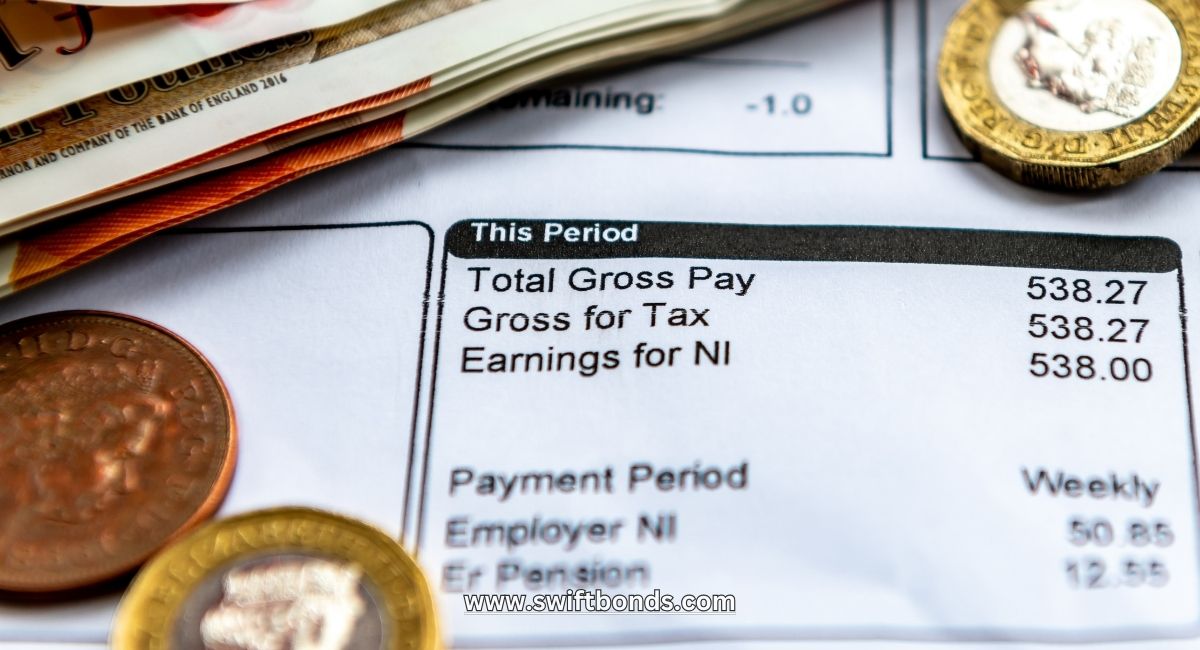

From our perspective, contractors and subcontractors in Illinois working under union agreements must meet specific financial obligations to their workers. One of the requirements for those affiliated with Operative Plasters and Cement Masons Local Union No. 90 is the Wage & Fringe Benefits ($25,000) Bond.

Like the Mid-America Carpenters Regional Council - Wage & Fringe Benefit Bond and the City of Batavia, IL - Contractor License ($10,000) Bond, this bond serves as a guarantee that employers will properly pay wages, benefits, and other financial obligations outlined in their collective bargaining agreements. Without it, contractors cannot legally engage in work covered by the union contract, which can lead to delays, penalties, and possible legal action.

Understanding the Misconceptions About Wage & Fringe Benefits Bonds

We’ve noticed that many contractors assume this bond functions like insurance, covering them in case of financial losses. In reality, it protects employees and the union from non-payment or underpayment of wages and benefits.

Here’s how it differs from insurance:

- The Wage & Fringe Benefits Bond ensures workers receive what they are owed. If a contractor fails to pay as agreed, the union or affected employees can file a claim against the bond.

- The contractor remains financially responsible. If the surety pays a claim, the contractor must repay the full amount.

This bond is not an optional expense—it is a requirement for union-affiliated contractors and demonstrates financial responsibility and credibility.

How the Operative Plasters and Cement Masons Local Union No. 90 - Wage & Fringe Benefits Bond Works

Based on our experience, this bond acts as a financial safeguard that benefits workers, unions, and businesses. It involves three parties:

- The contractor or employer (principal) – The business required to post the bond.

- The union (obligee) – Operative Plasters and Cement Masons Local Union No. 90, which enforces the financial obligations.

- The surety provider – A company like Swiftbonds, which guarantees the bond and steps in if obligations are not met.

If a contractor fails to pay the required wages or benefits, the union can file a claim against the bond. If the claim is valid, the surety pays the amount owed—but the contractor must reimburse the surety in full.

The Advantages of Having a Wage & Fringe Benefits Bond

What we’ve discovered is that this bond provides several key benefits:

- Legal Compliance – Contractors must meet union requirements to operate legally.

- Financial Security – Ensures that wages and benefits are paid in full and on time.

- Improved Reputation – Demonstrates financial responsibility, which can lead to better job opportunities.

- Stronger Business Relationships – Helps maintain positive working relationships with unions, employees, and project owners.

Steps to Secure the Operative Plasters and Cement Masons Local Union No. 90 Bond

What we’ve discovered is that obtaining this bond is a straightforward process with Swiftbonds:

- Determine bond requirements – Check with Operative Plasters and Cement Masons Local Union No. 90 for the specific bond amount and terms.

- Complete an application – Submit basic business and financial information to a surety bond provider.

- Receive a bond quote – The surety evaluates the application and provides a rate based on the contractor’s credit and financial standing.

- Purchase the bond – Once payment is made, the bond is issued.

- Submit to the union – The contractor must file the bond with the union before starting any covered work.

What Happens if a Contractor Fails to Obtain the Bond?

In our observation, failing to secure this bond can lead to:

- Union penalties, including suspension from working under the agreement.

- Loss of project opportunities, as many union-covered jobs require this bond before work begins.

- Financial liabilities, including potential legal action and unpaid wage claims.

This bond is not just a formality—it is a necessary safeguard for workers, the union, and the contractors themselves.

Why Unions Require This Bond

We’ve learned that unions like Operative Plasters and Cement Masons Local Union No. 90 enforce this bond to:

- Protect workers from wage theft or unpaid benefits.

- Ensure financial responsibility among contractors.

- Support fair labor practices in the construction industry.

By requiring this bond, unions maintain financial stability for their members and reduce disputes related to payment obligations.

Conclusion

The Operative Plasters and Cement Masons Local Union No. 90 - Wage & Fringe Benefits ($25,000) Bond is a critical requirement for contractors working under this union.

By securing this bond through Swiftbonds, contractors can meet their financial obligations, stay compliant, and maintain strong relationships with the union and their workers.

Frequently Asked Questions

Who needs the Operative Plasters and Cement Masons Local Union No. 90 - Wage & Fringe Benefits Bond?

Any contractor working under the union’s collective bargaining agreement must obtain this bond.

How much does this bond cost?

Bond costs vary based on the contractor’s credit, financial history, and business size.

What happens if a claim is filed against the bond?

If a contractor fails to pay wages or benefits, the union can file a claim. If the surety pays, the contractor must repay the full amount.

How long does it take to get bonded?

Most contractors receive bond approval within 24 hours with Swiftbonds.

How long is the bond valid?

The bond is typically valid for one year and must be renewed before expiration.