Get an Instant Quote on Utility Deposit Bond

Introduction

From our perspective, business owners and contractors across Louisiana want a simple way to start service with Entergy Louisiana without tying up large amounts of cash. Whether powering a new build, a commercial space, or expanding service to a second location, many are surprised to learn that Entergy may require a security deposit. That’s where the Entergy Louisiana - Utility Deposit Bond comes in.

This bond serves as a financial guarantee to Entergy Louisiana in place of a cash deposit. Instead of paying a large upfront amount to activate service, a utility deposit bond allows the business to keep its working capital while still meeting the utility’s financial security requirements. The bond assures Entergy that payment obligations will be fulfilled—even if the account holder fails to pay on time.

This is especially helpful for construction companies starting temporary power or fitness franchises needing quick power turn-on for gym buildouts. Bonds like the Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond and the Entergy deposit bond both serve different purposes, but they share one key advantage—protecting funds and providing proof of financial responsibility.

Misunderstandings Can Lead to Service Delays

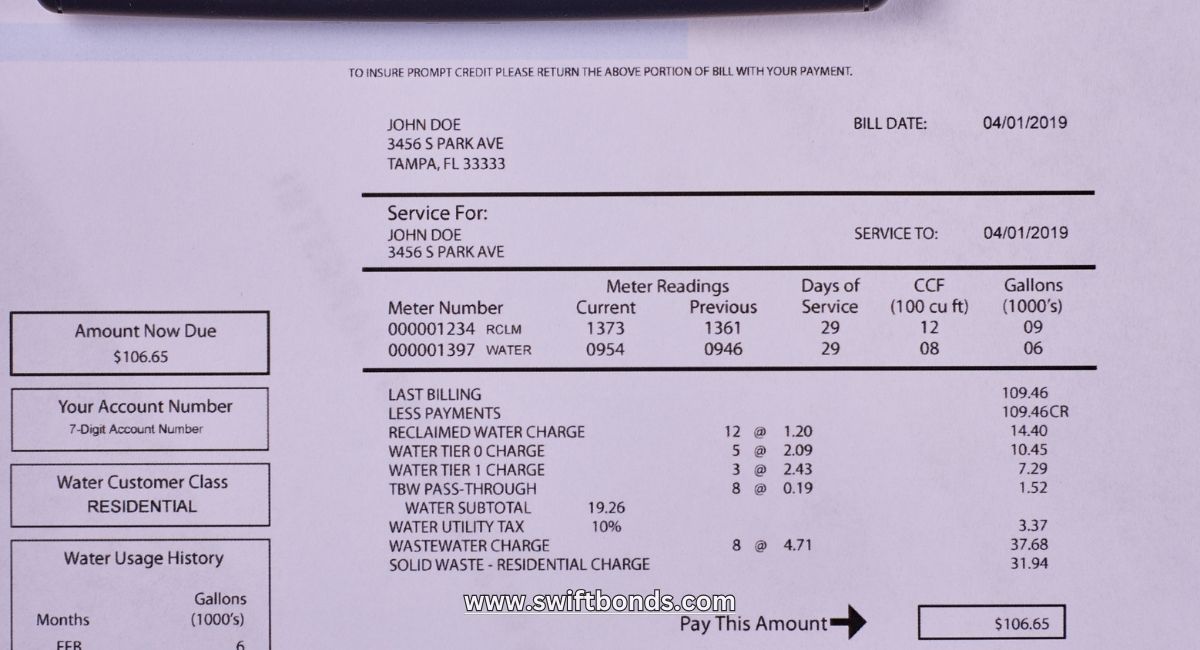

We’ve noticed that many customers assume the only way to get utility service started is by paying a large deposit. Others think the utility deposit bond is the same as a performance bond, or that it somehow protects the customer. These ideas often lead to delays, confusion, or denied service activation.

The Entergy Louisiana - Utility Deposit Bond is not insurance. It does not cover equipment or protect the customer in any way. It simply guarantees that Entergy will be paid if the customer doesn’t meet its billing obligations. If the bond is in place and payment isn’t made, the utility can file a claim against the bond to recover the amount owed—up to the bond’s limit.

This is entirely different from license bonds required by cities. For example, the City of Sulphur, LA - Contractor License ($15,000) Bond guarantees that contractors follow city codes. Meanwhile, utility deposit bonds focus only on payment for electric service.

Failing to understand these differences—or not knowing a bond is even an option—can hold up projects and increase costs unnecessarily.

Bond Experts Offer Clear Guidance

Based on our experience, Entergy customers just want fast answers and an easy way to meet deposit requirements. Swiftbonds specializes in helping businesses across Louisiana replace utility deposits with low-cost surety bonds.

Whether someone is powering a commercial development, a warehouse, or a fitness franchise location, Swiftbonds helps simplify the process. Every bond is written to meet Entergy Louisiana’s specific language and filing standards. That means no rejections and no confusion about whether the bond meets utility expectations.

Swiftbonds works daily with business owners who also need other bonds, such as the Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond or the City of Sulphur, LA - Contractor License ($15,000) Bond. Having a single source to manage all bonding needs reduces paperwork and saves valuable time.

Simple Steps to Get the Bond

What we’ve discovered is that securing a utility deposit bond through Swiftbonds takes only a few easy steps:

-

Apply Online – Submit business information and your Entergy Louisiana account details.

-

Get a Quote – Bond rates are based on credit, but most customers qualify for competitive pricing.

-

Receive the Bond Same Day – After approval and payment, the bond is issued and delivered directly to Entergy or to the customer for submission.

No waiting, no extra paperwork, and no need to call the utility multiple times. Whether you’re opening a new gym with a Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond or starting service for a new build, Swiftbonds makes sure the deposit bond is ready when it’s needed.

Meeting Bond Requirements Builds Trust

We’ve found that providing a deposit bond instead of cash shows Entergy that the business is financially stable and professional. It avoids tying up money that could be used for equipment, staffing, or marketing—and helps new businesses start strong without dipping into reserves.

The same is true for contractors who submit the City of Sulphur, LA - Contractor License ($15,000) Bond to meet licensing rules. Both types of bonds communicate accountability. For Entergy customers, a deposit bond tells the utility, “We’re reliable, and we’re ready.”

Getting bonded upfront can also speed up service activation, avoid billing delays, and improve coordination on job sites. When temporary power is needed during construction, contractors can’t afford a slow start. This bond helps them get moving.

Failure To Secure the Right Bond Can Delay Power

In our observation, projects stall when customers don’t know about the bond or fail to get it approved in time. Entergy Louisiana requires the bond to be submitted before connecting service. If the bond isn’t filed correctly—or isn’t accepted—service will be delayed until payment is secured.

Cash deposits can be thousands of dollars. If that money isn’t available, project timelines can get pushed back, inspections can fail, and utility deadlines can be missed. And unlike license bonds or health club compliance bonds, utility deposit bonds are often needed fast.

Customers who confuse this bond with another type—like the Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond—may submit the wrong paperwork. When that happens, the delay can be longer than expected.

Swiftbonds avoids all of that by verifying the bond form, the coverage amount, and the proper submission method.

Deposit Bonds Help Keep Projects On Track

We’ve learned that when contractors and business owners use deposit bonds, they preserve working capital, avoid last-minute fees, and move forward without disruption. The Entergy Louisiana - Utility Deposit Bond is a flexible tool that helps both startups and established firms manage electric service needs efficiently.

Whether powering a new Anytime Fitness location or getting licensed in Sulphur with the City of Sulphur, LA - Contractor License ($15,000) Bond, business owners benefit from having a single bonding partner who understands Louisiana requirements.

With Swiftbonds, the entire process is digital, fast, and accurate. That means fewer forms, fewer calls, and no second-guessing. When time matters—and in construction or retail, it always does—this level of support makes all the difference.

Louisiana Construction Bonding Compliance

Contractors working on public construction in Louisiana may also need to comply with the Louisiana Little Miller Act (La. Rev. Stat. § 38:2241). This statute requires performance and payment bonds for public works projects valued over $25,000.

Though the Entergy Louisiana - Utility Deposit Bond is not related to construction performance, business owners working in both sectors often need multiple bonds. Contractors may need a license bond (like the City of Sulphur, LA - Contractor License ($15,000) Bond) for local compliance and a utility deposit bond for electric service.

To verify regulations or access official state information, use the following sources:

Conclusion

We’ve come to appreciate that energy access is a top priority for Louisiana businesses. The Entergy Louisiana - Utility Deposit Bond offers a way to start service quickly without locking up capital that could be used elsewhere. It's a smart option for growing businesses, busy contractors, and franchise owners alike.

Swiftbonds makes the process quick, simple, and affordable. Whether someone is starting a new project, opening a gym that requires a Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond, or applying for a license that needs a City of Sulphur, LA - Contractor License ($15,000) Bond, everything can be done in one place—with total accuracy and full support.

Power should never be the delay. With Swiftbonds, it won’t be.

Frequently Asked Questions

What does the Entergy Louisiana utility deposit bond cover?

We’ve often noticed customers asking this. The bond guarantees that Entergy will be paid for electric service if the account holder fails to pay. It does not protect the customer—it protects the utility.

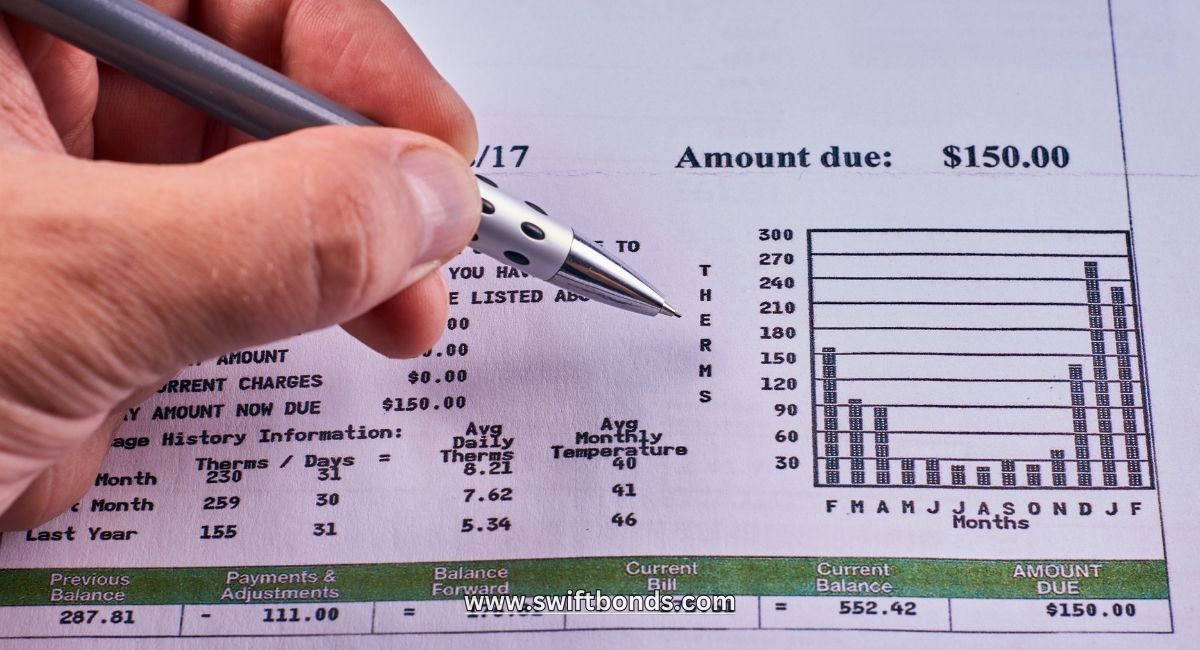

How much does the utility deposit bond cost?

We’ve often noticed confusion about pricing. Costs vary based on the bond amount and credit standing but are typically more affordable than the full cash deposit.

Is this bond the same as the license bond in Sulphur?

We’ve often noticed customers confuse the two. No. The City of Sulphur, LA - Contractor License ($15,000) Bond covers licensing compliance. The Entergy bond covers utility payment obligations.

Can this bond replace a deposit for a franchise location?

We’ve often noticed fitness franchise owners asking this. Yes. If Entergy requires a deposit to start electric service at a gym or health club, this bond can satisfy that requirement—just like the Louisiana - Anytime Fitness Franchise Health Club ($25,000) Bond satisfies regulatory conditions.

How long does the bond last?

We’ve often noticed customers wondering about bond terms. The bond typically remains active until Entergy no longer requires financial security—usually after a history of timely payments or account closure.