(for Federal level bonds, search here: nationwide search)

Illinois Bond Applications:

Illinois probate bond application

Illinois ERISA Pension Plan Fidelity Bond Application

Illinois Court Bond Application

Illinois Janitorial Services Bond Application

The Vital Role of License and Permit Bonds in Illinois

In our dealings with bonds across various industries in Illinois, license and permit bonds consistently play a crucial role. They ensure that businesses and contractors comply with state regulations, acting as a protective mechanism for both the public and the authorities. As part of the broader process of obtaining bonds, understanding the specifics of license and permit bonds is essential. Let’s dive into how these bonds work and their importance within Illinois' framework.

The Purpose Behind License and Permit Bonds: What We’ve Discovered

From what we’ve seen, license and permit bonds are designed to hold businesses accountable and to protect public interest. They ensure that the licensed business or contractor follows the applicable laws and regulations, such as safety standards, ethical business practices, and consumer protection laws. If these obligations aren’t met, the bond provides a financial remedy to those who have been harmed.

We’ve discovered that this safeguard is especially important in industries where consumers rely heavily on professionals, like contractors, auto dealers, or health-related services. In these cases, the public depends on the government to enforce proper conduct, and the bond is a tool to ensure this. The purpose, then, is twofold: to maintain public trust and to guarantee that businesses remain accountable for their actions.

Key Purposes of License and Permit Bonds:

- Consumer Protection: In our view, the most important function of these bonds is ensuring that if a business fails to meet its obligations, customers have a recourse for financial compensation.

- Regulatory Compliance: From our perspective, these bonds encourage businesses to comply with local, state, or federal regulations, as failure to do so could result in penalties or loss of the bond.

- Risk Mitigation: We’ve come to see that bonds help reduce the risk to consumers and governing bodies by guaranteeing that businesses will operate ethically and legally.

- Public Trust: Holding a bond signals that the business is committed to upholding the law, which enhances trust between the company and its clients.

Benefits of License and Permit Bonds: What We’ve Experienced

In our line of work, we’ve consistently found that license and permit bonds provide multiple advantages for both businesses and consumers. These benefits go beyond simple compliance, impacting reputation, credibility, and legal standing.

Key Benefits of License and Permit Bonds:

- Legal Protection: We’ve realized that businesses operating with a bond are protected from potential legal disputes. Should issues arise, the bond provides financial protection to cover legal claims or penalties.

- Boosting Business Credibility: Businesses that are “licensed, bonded, and insured” send a powerful message of reliability and professionalism. We’ve consistently found that clients and customers prefer to work with companies that demonstrate this level of responsibility.

- Securing Trust: Being bonded gives customers peace of mind. We’ve noticed through our work that when a business is bonded, clients feel more secure knowing that there’s financial backing if things go wrong.

- Market Competitiveness: We’ve often observed that having the proper bonds gives businesses a competitive edge, as it shows they are compliant with regulations, enhancing their marketability.

- Financial Security for Consumers: From our experience, we’ve seen that when businesses are bonded, consumers have a direct path to compensation if the business fails to meet its obligations, which fosters public confidence.

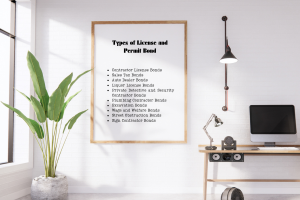

Types of License and Permit Bonds in Illinois

In our observation, there are several types of license and permit bonds required across different industries in Illinois. Each bond type is designed to address specific legal and regulatory needs.

Common Types of License and Permit Bonds:

1. Contractor License Bonds

Contractors in various fields such as roofing, electrical work, plumbing, and general construction often need to secure a license bond to operate legally. These bonds ensure that contractors comply with local building codes and regulations.

- Illinois Roofing Contractor Bond ($25,000): Required for roofing contractors to ensure they follow state guidelines.

- Electrical Contractor Bond: Ensures that electricians adhere to safety codes and licensing requirements.

2. Sales Tax Bonds

Businesses involved in the sale of goods and services may be required to post a bond that ensures they properly report and pay sales taxes to the state.

- Illinois Sales Tax Bond: Guarantees that businesses collect and remit sales tax in accordance with state laws.

3. Auto Dealer Bonds

Car dealerships must secure these bonds to ensure compliance with state laws governing the sale of new and used vehicles.

- Illinois Motor Vehicle Dealer Bond: This bond protects consumers from fraudulent activities by car dealerships.

4. Liquor License Bonds

Businesses that sell or distribute alcohol are often required to secure a liquor license bond to ensure compliance with state regulations related to alcohol sales.

- Illinois Liquor License Bond: Ensures that liquor sellers comply with state liquor laws and remit taxes on alcohol sales.

5. Private Detective and Security Contractor Bonds

Private investigators and security companies must obtain bonds to protect the public from unethical practices or failure to comply with state regulations.

- Illinois Private Detective Bond: Required for private investigators and agencies to ensure compliance with state licensing laws.

6. Plumbing Contractor Bonds

Plumbing contractors need this bond to operate legally in Illinois, ensuring they follow local regulations and building codes.

- Illinois Plumbing Contractor Bond: Protects clients and municipalities from potential damages due to non-compliance with plumbing codes.

7. Excavation Bonds

Excavation contractors must obtain bonds to guarantee that their work meets safety and regulatory standards, particularly when performing work on public property.

- Excavation Permit Bond: Ensures compliance with local regulations when excavating public streets or property.

8. Wage and Welfare Bonds

These bonds are required by unions to ensure that employers pay wages and provide benefits to their workers as agreed in collective bargaining agreements.

- Illinois Sheet Metal Workers Union #73 Wage and Welfare Bond: Protects workers by ensuring proper compensation and benefits are paid.

9. Street Obstruction Bonds

Contractors working on public streets or sidewalks must secure bonds to cover potential damage or violations of city ordinances.

- Street Obstruction Bond: Ensures the contractor properly restores public property after performing work.

10. Sign Contractor Bonds

Businesses or individuals involved in constructing and installing signs must obtain bonds to ensure they adhere to local regulations and safety codes.

- Sign Removal or Construction Bond: Ensures compliance with laws related to sign installation and removal in various municipalities.

Each of these bonds is designed to protect the public and ensure compliance with Illinois laws. They play a critical role in maintaining trust between businesses and the community.

The Application Process for License and Permit Bonds: A Step-by-Step Guide

We’ve been involved in helping businesses through the application process for license and permit bonds in Illinois, and it’s essential to understand the key steps involved. While the process is generally straightforward, it does require attention to detail.

Step 1: Determine the Bond Requirement

- What we’ve found through experience is that the first step is identifying the exact type and amount of bond required by the state or municipality. Different industries have different requirements, so it’s important to verify the exact bond you need.

Step 2: Select a Surety Bond Provider

- We’ve had firsthand experience with the importance of choosing a reputable surety bond company. The provider will evaluate your credit score, financial background, and the details of the bond you’re applying for. Selecting the right provider can help expedite the process and ensure that you get favorable rates.

Step 3: Complete the Application

- Through our own efforts, we’ve learned that the application process usually involves submitting personal and business information, such as tax returns, financial statements, and legal documents. Make sure all information is accurate to avoid delays.

Step 4: Undergo Credit Check and Evaluation

- The surety company will perform a credit check and assess your financial stability. From what we’ve seen, a good credit score typically results in lower bond premiums, while a poor score could mean higher rates.

Step 5: Obtain and Submit the Bond

- Once the surety approves your application, you’ll pay the bond premium, receive the bond document, and submit it to the relevant authority as part of your licensing or permit application.

Step 6: Renewal

- We’ve come across that most bonds require annual renewal. It’s important to stay on top of this requirement to avoid lapses in coverage, which could lead to fines or loss of your license.

Why Being Licensed, Bonded, and Insured Matters

We’ve been fortunate to work with many businesses that are licensed, bonded, and insured, and in our view, this is an important distinction that sets them apart. Being bonded means that businesses take an additional step to protect their clients from financial harm, while insurance covers other forms of liability. Together, these three components build a solid foundation of trust and professionalism.

Concluding Thoughts: The Importance of License and Permit Bonds

In our professional life, we’ve come to appreciate how license and permit bonds are a critical aspect of doing business in Illinois. These bonds not only ensure regulatory compliance but also help build consumer trust and provide legal protection.

From what we’ve observed, securing the appropriate bonds is a key step for businesses looking to succeed in Illinois. Being licensed bonded and insured sets businesses apart in the marketplace, ensuring that both they and their clients are protected from financial and legal risks.

Illinois Sample Bond Forms:

Sample Wage and Welfare Bond Illinois

See more about Swiftbonds at our home page.