(for Federal level bonds, search here: nationwide search)

Colorado Bond Applications:

Colorado probate bond application

Colorado ERISA Pension Plan Fidelity Bond Application

Colorado Court Bond Application

Colorado Janitorial Services Bond Application

Unlocking the Power of License and Permit Bonds for Colorado Businesses

In our professional life, we’ve often noticed that License and Permit Bonds play a pivotal role in safeguarding businesses, governments, and consumers. These bonds offer more than just compliance—they provide a layer of financial protection and trust that enhances business credibility. For Colorado businesses to be fully licensed and bonded means they’re equipped to meet regulatory requirements while protecting their clients and the public from potential risks.

Beyond Compliance: Understanding the Importance of License and Permit Bonds

We’ve come to realize that License and Permit Bonds are a fundamental requirement for businesses operating in regulated industries across Colorado. In our view, these bonds ensure that companies comply with local, state, or federal laws, acting as a safety net for the public. We’ve often noticed that being bonded offers peace of mind to consumers by guaranteeing that the business will follow through on its promises.

Building Public Trust: The Purpose of License and Permit Bonds

In our observation, License and Permit Bonds serve a critical role in fostering trust between businesses and the public. What we’ve discovered is that these bonds protect the public from business misconduct, providing a financial safeguard in case the bondholder fails to comply with regulatory standards. Through our own experience, we’ve seen firsthand how these bonds boost business reputation by demonstrating a commitment to accountability and professionalism.

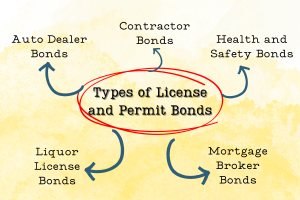

Diverse Solutions: Types of License and Permit Bonds for Colorado

We’ve identified that businesses in Colorado may require different types of License and Permit Bonds depending on their industry. From our perspective, understanding the specific bond type that applies to your business is crucial. Some common types include:

- General Contractor License Bonds – Required for construction-related businesses.

- Environmental Permit Bonds – Ensuring compliance with environmental laws.

- Motor Vehicle Dealer Bonds – Vital for auto dealerships.

- Alcohol License Bonds – For businesses that distribute or sell alcohol.

- Health Department Permit Bonds – Essential for food and beverage establishments.

From what we’ve seen, each bond type serves a distinct purpose, ensuring that businesses meet their legal obligations while protecting consumers.

Streamlining the Process: How to Apply for License and Permit Bonds in Colorado

We’ve often worked with businesses to simplify the License and Permit Bond application process. Based on our experience, the process involves several key steps that help ensure a smooth transition from unlicensed to licensed and bonded status:

- Determine Your Bond Type: Research the bond type specific to your business.

- Understand Bond Amounts: Each bond has a different financial threshold.

- Choose a Surety Company: Partner with a reliable surety provider.

- Complete an Application: Provide relevant business and financial details.

- Make Payment: Pay the bond premium, which is typically based on risk factors.

We’ve observed that businesses that follow these steps diligently often avoid delays in becoming licensed and bonded.

Gaining a Competitive Edge: Benefits of License and Permit Bonds

We’ve found through experience that License and Permit Bonds offer several key benefits for Colorado businesses, including:

- Consumer Protection

- Increased Credibility

- Compliance with Legal Obligations

- Protection for Government Entities

- Enhanced Reputation

In our dealings with bonded businesses, we’ve consistently found that these advantages are crucial for building trust with clients and regulators.

Essential Strategies: Key Considerations for Managing Your Bonds

We’ve come to appreciate that managing License and Permit Bonds requires attention to detail and adherence to best practices. We’ve identified several key considerations for business owners:

- Maintain a Healthy Credit Score: A strong credit profile can reduce bond costs.

- Renew Bonds on Time: Late renewals can result in penalties or lapses in coverage.

- Understand Your Responsibilities: Failing to meet bond conditions could lead to legal action.

In our view, taking these proactive measures ensures that businesses remain compliant and maintain their licensed and bonded status.

Final Thoughts: The Value of License and Permit Bonds in Colorado

We’ve grown to understand that License and Permit Bonds are essential for operating a business legally and responsibly in Colorado. Being licensed and bonded offers businesses a competitive advantage by protecting consumers, building trust, and demonstrating commitment to industry standards. In our experience, following the proper application process and adhering to best practices allows businesses to thrive in a regulated environment, ensuring long-term success and compliance.

Colorado Sample Bond Forms:

Sample Wage and Welfare Bond Form

See more about Swiftbonds at our home page.