(for Federal level bonds, search here: nationwide search)

Arkansas Bond Applications:

Arkansas probate bond application

Arkansas ERISA Pension Plan Fidelity Bond Application

Arkansas Court Bond Application

Arkansas Janitorial Services Bond Application

Navigating License and Permit Bonds in Arkansas: A Comprehensive Guide

Understanding the Role of License and Permit Bonds

In our line of work, we’ve consistently found that license and permit bonds play a crucial role in various industries across Arkansas. Whether you’re a contractor, a business owner, or a professional seeking specific licenses, these bonds are often a requirement before conducting lawful operations. Essentially, they guarantee that individuals or companies will comply with local laws and regulations. But beyond legal compliance, there’s much more to understand about their purpose and importance.

License and Permit Bonds: A Key Component for Business Compliance

From what we’ve seen, license and permit bonds ensure that businesses and individuals abide by the regulations set forth by government authorities. These bonds serve as a financial guarantee that, in the event of non-compliance, funds will be available to compensate the affected parties. Businesses that are bonded and insured are more attractive to clients, as these credentials provide a sense of security, demonstrating a commitment to financial responsibility and trustworthiness.

Why do Arkansas Businesses Need License and Permit Bonds?

We’ve come to understand that the purpose of license and permit bonds goes beyond just legal formalities. In Arkansas, these bonds provide a layer of financial security and trust between businesses and their clients. For example, contractors must secure these bonds to protect homeowners from unfinished or improperly executed work. Essentially, the bond guarantees that, should the contractor fail to meet obligations, financial restitution will be provided.

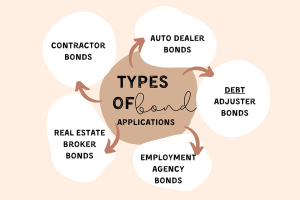

Different Types of License and Permit Bonds in Arkansas

In our experience, Arkansas offers various types of license and permit bonds depending on the industry. We’ve observed over time that understanding each type is essential for staying compliant and ensuring smooth business operations. Below is a breakdown of the most common types:

- Contractor License Bonds

These are required for professionals in construction, electrical, plumbing, and other trades. We’ve often found ourselves working with contractors who use these bonds to guarantee compliance with industry regulations and protect consumers from potential risks. - Motor Vehicle Dealer Bonds

In our practice, we’ve come to see that car dealerships, both new and used, must secure these bonds. They ensure that dealers comply with the state’s motor vehicle regulations and protect buyers from fraud or financial harm. - Health Department Permit Bonds

Based on our experience, businesses in the food and health industry often require these bonds. They ensure compliance with health codes and sanitation standards, providing an additional level of trust between businesses and the public. - Alcohol and Beverage License Bonds

We’ve worked with businesses requiring bonds for selling alcohol, which guarantees that they will adhere to state laws surrounding the sale and distribution of alcohol.

The Step-by-Step Application Process for License and Permit Bonds

We’ve had firsthand experience with the application process for license and permit bonds in Arkansas, and we’ve found it to be straightforward, although it requires attention to detail. Here’s what you can expect:

- Determine the Bond Type and Amount

We’ve come across businesses that need help identifying the right type of bond. The first step is to verify which bond is required for your specific license or permit and how much coverage is needed. - Complete the Bond Application

In our dealings with various clients, we’ve noticed that bond providers will request detailed information such as business structure, financial status, and credit score. Accurate documentation is essential during this step. - Underwriting and Approval

We’ve personally witnessed the underwriting process where the bond provider evaluates the applicant’s financial standing, including their credit history and business performance. Higher risk applicants may be required to pay higher premiums or provide additional documentation. - Pay the Bond Premium

Once approved, businesses must pay the premium. We’ve often observed that bond premiums vary based on the bond amount, business type, and financial risk. - Receive and Submit the Bond

We’ve learned through our experience that after payment, you’ll receive the bond, which must then be submitted to the appropriate government agency to finalize your licensing or permit approval.

The Benefits of Securing a License and Permit Bond

We’ve often observed that securing a license and permit bond provides several benefits beyond regulatory compliance. It helps build trust with clients and government authorities, demonstrating a business’s commitment to ethical practices. Being bonded and insured adds an extra layer of credibility, which is crucial for standing out in competitive industries. In our dealings with various professionals, we’ve seen firsthand how these bonds act as a financial safety net, ensuring that in cases of malpractice or failure to meet obligations, the clients or the state aren’t left uncompensated.

Closing Thoughts: The Importance of Bonds in Arkansas

From our perspective, license and permit bonds are an essential component of doing business in Arkansas. They safeguard both the public and businesses, ensuring everyone operates within a framework of accountability. We’ve consistently observed that businesses that prioritize securing the correct bonds not only stay compliant but also build stronger, more trustworthy reputations in their industries.

In conclusion, understanding the various facets of license and permit bonds and navigating their application process can save businesses from potential legal issues while fostering consumer trust. Arkansas has made it clear: bonds are not just a formality—they’re a guarantee of responsibility and professionalism.

Arkansas Sample Bond Forms:

Sample Wage and Welfare Bond Form

See more about Swiftbonds at our home page.