You can now apply online for a Wisconsin Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

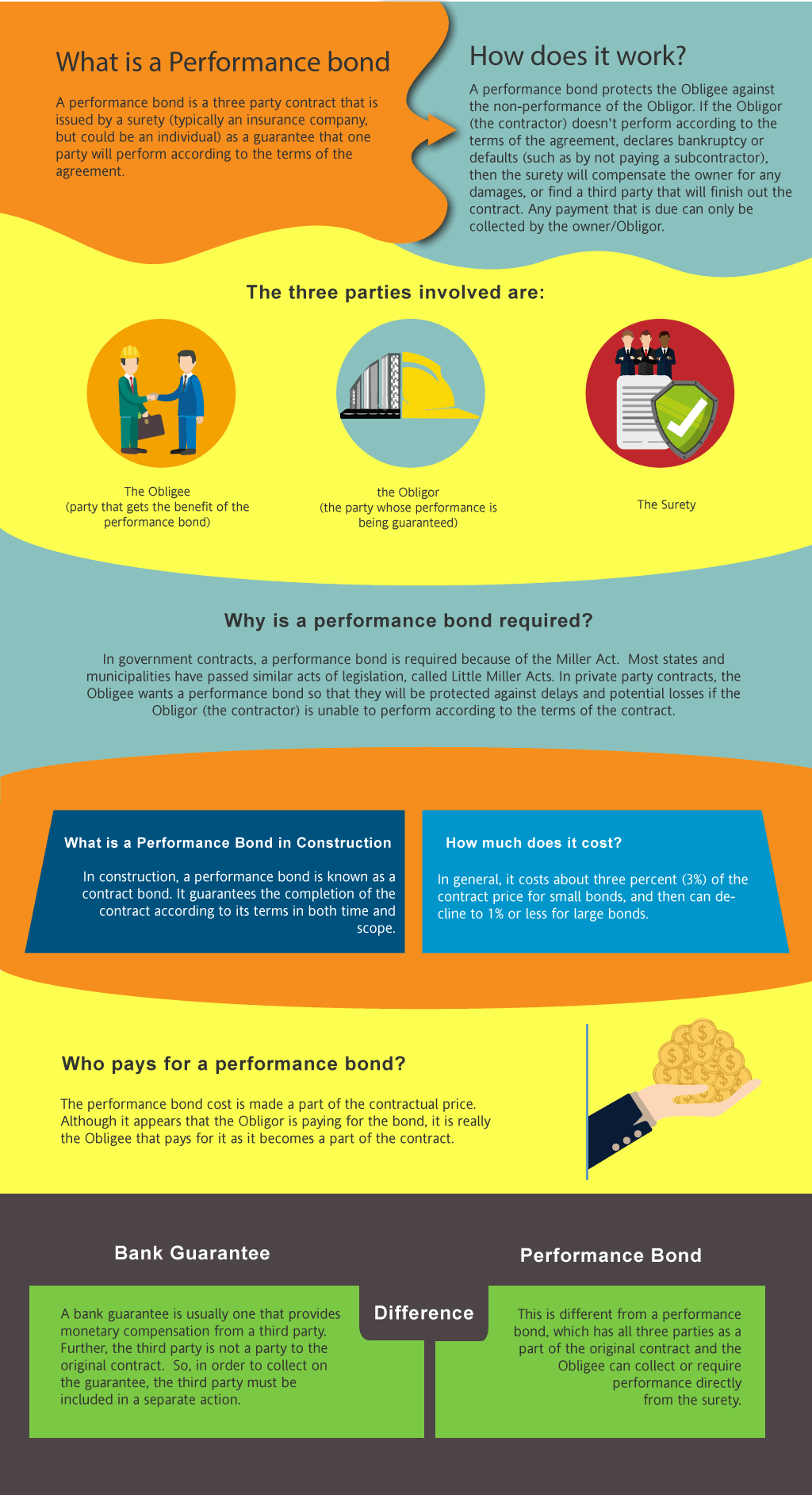

What is a Performance Bond in Wisconsin?

How do I get a Performance and Payment Bond in Wisconsin?

We make it easy to get a contract performance bond. Just click here to get our Wisconsin Performance Application. Fill it out and then email it and the Wisconsin contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Insurance performance bonds in Wisconsin?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in WI?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Wisconsin. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in WI

Just call us. We’ll work with you to get the best Wisconsin bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Ashland

Barron

Bayfield

Brown

Buffalo

Burnett

Calumet

Chippewa

Clark

Columbia

Crawford

Dane

Dodge

Door

Douglas

Dunn

Eau Claire

Florence

Fond Du Lac

Forest

Grant

Green

Green Lake

Iowa

Iron

Jackson

Jefferson

Juneau

Kenosha

Kewaunee

La Crosse

Lafayette

Langlade

Lincoln

Manitowoc

Marathon

Marinette

Marquette

Menominee

Milwaukee

Monroe

Oconto

Oneida

Outagamie

Ozaukee

Pepin

Pierce

Polk

Portage

Price

Racine

Richland

Rock

Rusk

St. Croix

Sauk

Sawyer

Shawano

Sheboygan

Taylor

Trempealeau

Vernon

Vilas

Walworth

Washburn

Washington

Waukesha

Waupaca

Waushara

Winnebago

Wood

And Cities:

Madison

Milwaukee

Green Bay

Appleton

Eau Claire

La Crosse

Racine

Kenosha

Janesville

Wausau

See our Wyoming Performance Bond page here.

Discover how does a bond work in construction projects to safeguard your investments and ensure project completion.

Why Performance Bonds and Letters of Credit Aren’t Interchangeable?

From our perspective, the primary difference between performance bonds and bank letters of credit (LOC) lies in the protection they offer. We’ve noticed that performance bonds specifically protect project owners from contractor non-performance, while LOCs ensure funds are available but don't guarantee project completion. Performance bonds tend to focus on ensuring that work is completed according to the contract, while LOCs serve as a financial safety net in a variety of situations, including project delays or other disruptions.

Refund Policies Revealed: Can You Get Your Money Back?

In our experience, performance bonds are generally non-refundable. What we’ve discovered is that the premiums paid for these bonds are considered earned once the bond is issued, even if the project finishes ahead of schedule. This is because the premium covers the risk assumed by the surety throughout the project. Therefore, we’ve realized that the answer to whether performance bonds are refundable is almost always no, offering clarity for those entering long-term construction agreements.

What Filing a Claim Means for Your Performance Bond

We’ve come to understand that filing a claim on a performance bond can trigger a detailed investigation by the surety. In our dealings with such situations, we’ve found that if the claim is justified, the surety either pays for completing the project or compensates the owner. Contractors should be aware that they remain responsible for reimbursing the surety for any payments made, as we’ve often noticed that this can significantly impact a contractor’s financial standing if not managed properly.

The Journey to Releasing a Performance Bond

We’ve often found that the release of a performance bond occurs once all contract obligations are met and the project owner is satisfied with the results. From our own observations, we’ve seen that this generally happens after the final project inspection, and sometimes there’s a maintenance period to ensure the project’s long-term success. Contractors should always confirm with the project owner when they expect the bond to be released, as we’ve been involved in situations where misunderstandings caused delays.

Breaking Down the 100 Percent Performance and Payment Bond Requirement

In our line of work, we’ve consistently observed that 100 percent performance and payment bonds are critical for larger projects. These bonds guarantee the full contract amount, covering both performance obligations and payments to subcontractors. We’ve noticed through our work that this dual coverage provides project owners with maximum security, ensuring that the contractor fulfills all aspects of the contract, including supplier payments.

Getting a Performance Bond: The Timeline Explained

Based on our experience, obtaining a performance bond is not an instantaneous process, but it doesn’t have to be a lengthy one either. We’ve observed over time that factors such as the contractor’s credit history, financial stability, and the bond amount all contribute to how quickly the bond can be secured. On average, we’ve learned that it takes a few days to a few weeks, depending on the complexity of the project and the contractor’s qualifications.

Avoiding Costly Delays: What Happens If a Performance Bond Lapses?

We’ve often experienced scenarios where contractors face the expiration of a performance bond mid-project. In our view, the expiration of a bond can lead to serious project delays or even contract termination if not addressed immediately. We’ve found that renewing the bond before it expires is crucial, as failure to maintain valid coverage can jeopardize the entire project and lead to significant financial penalties.

See more at our Utah Performance Bond page.