You can now apply online for a Virginia Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Virginia?

How do I get a Performance and Payment Bond in Virginia?

We make it easy to get a contract performance bond. Just click here to get our Virginia Performance Application. Fill it out and then email it and the Virginia contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

A performance bond in Virginia?

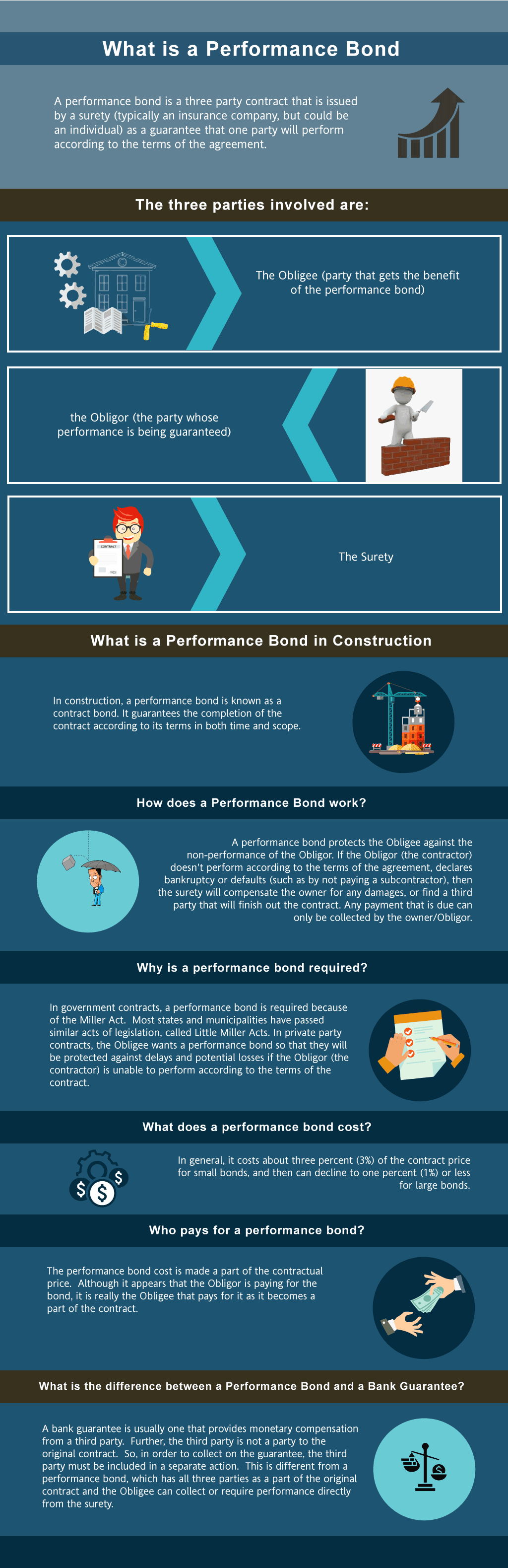

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in VA?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Virginia. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in VA

Just call us. We’ll work with you to get the best Virginia bond possible.

We provide performance and payment bonds in each of the following counties:

Accomack

Albemarle

Alleghany

Amelia

Amherst

Appomattox

Arlington

Augusta

Bath

Bedford

Bland

Botetourt

Brunswick

Buchanan

Buckingham

Campbell

Caroline

Carroll

Charles City

Charlotte

Chesterfield

Clarke

Craig

Culpeper

Cumberland

Dickenson

Dinwiddie

Essex

Fairfax

Fauquier

Floyd

Fluvanna

Franklin

Frederick

Giles

Gloucester

Goochland

Grayson

Greene

Greensville

Halifax

Hanover

Henrico

Henry

Highland

Isle of Wight

James City

King and Queen

King George

King William

Lancaster

Lee

Loudoun

Louisa

Lunenburg

Madison

Mathews

Mecklenburg

Middlesex

Montgomery

Nelson

New Kent

Northampton

Northumberland

Nottoway

Orange

Page

Patrick

Pittsylvania

Powhatan

Prince Edward

Prince George

Prince William

Pulaski

Rappahannock

Richmond

Roanoke

Rockbridge

Rockingham

Russell

Scott

Shenandoah

Smyth

Southampton

Spotsylvania

Stafford

Surry

Sussex

Tazewell

Warren

Washington

Westmoreland

Wise

Wythe

York

And Cities:

Chesterfield

Roanoke

Alexandria

Charlottesville

Richmond

Virginia Beach

Norfolk

Williamsburg

Lynchburg

Fredericksburg

Chesapeake

Fairfax

Newport News

Hampton

Winchester

See our Washington Performance Bond page here.

Discover how do construction bonds work and safeguard your project's success today!

Performance Bonds vs. Letters of Credit: Distinctions You Should Know

From our perspective, the most significant difference between performance bonds and bank letters of credit lies in the type of protection each offers. A performance bond ensures that the contractor fulfills their obligations under the contract, while a letter of credit guarantees that funds are available if the contractor defaults. In our observation, performance bonds provide more comprehensive protection because they cover the cost of completing the project, whereas letters of credit simply ensure compensation. This makes performance bonds the preferred option for many construction projects in Virginia.

Why Contractors Shouldn’t Expect a Performance Bond Refund?

We’ve found that performance bonds are typically non-refundable. This is because the bond premium, which is paid upfront, compensates the surety company for the risk they assume. Once the bond is issued, the premium is earned, even if the project is completed early. However, based on our experience, in rare cases where a project is canceled before work begins, some sureties may offer a partial refund. In our opinion, understanding the refund policies in advance can help avoid unexpected costs down the road.

The Process When a Claim is Made on a Performance Bond

In our dealings with performance bonds, we’ve encountered situations where claims were filed due to a contractor's failure to meet their contractual obligations. When a valid claim is made, the surety investigates and determines the best course of action. We’ve learned that, depending on the situation, the surety might pay the project owner to cover damages or hire another contractor to complete the work. In our observation, the claims process can significantly impact the contractor's reputation and future bonding capacity.

Steps to Ensure a Timely Performance Bond Release

We’ve often noticed that performance bonds are not released until the project is fully completed and all contractual obligations are met. In our practice, bonds are typically held until the final inspections and any necessary corrections are made. We’ve had the opportunity to work on projects where bond release was delayed due to minor issues, so we’ve consistently found that completing everything to the project owner's satisfaction is key to a timely release. In our view, this ensures that the project is done right before any financial guarantees are lifted.

Why 100 Percent Performance and Payment Bonds is a Must in Any Project?

In our experience, 100 percent performance and payment bonds are widely used in large construction projects to provide complete coverage. These bonds guarantee that the contractor will complete the project and pay all laborers and suppliers involved. We’ve consistently observed that this type of bond offers peace of mind to project owners, as it ensures that both the completion of the project and the payment of all parties are secured. In our professional life, we’ve worked closely with such bonds, and they are often considered the gold standard in project security.

Performance Bond Timing: How Fast Can You Secure One?

From what we’ve seen, the time it takes to obtain a performance bond can vary. For smaller, less complex projects, it may only take a few days, especially if the contractor has a strong financial standing. However, we’ve learned that for larger or more high-risk projects, the process can take several weeks as the surety performs a thorough review of the contractor's financial background and eligibility. In our experience, having all the necessary documents ready can significantly speed up the approval process.

Why Should You Never Let a Performance Bond Lapse?

We’ve personally witnessed the consequences of a performance bond expiring before the project is completed. In our view, allowing a bond to expire creates a significant risk for the project owner, as it leaves them unprotected. When a bond expires, the surety is no longer obligated to cover any issues or claims that arise. We’ve come to realize that it’s crucial to ensure that bonds are renewed or extended before their expiration date to maintain continuous coverage and avoid potential legal and financial complications.

In conclusion, our experience has shown us that performance bonds are a vital tool in the construction industry in Virginia, offering protection to both project owners and contractors. By understanding the nuances of these bonds, stakeholders can navigate the process more effectively, ensuring successful project completion and financial security.

See more at our Alabama Performance Bond page.

Contact us for how to get a Performance Bond with bad credit.