You can now apply online for a Vermont Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

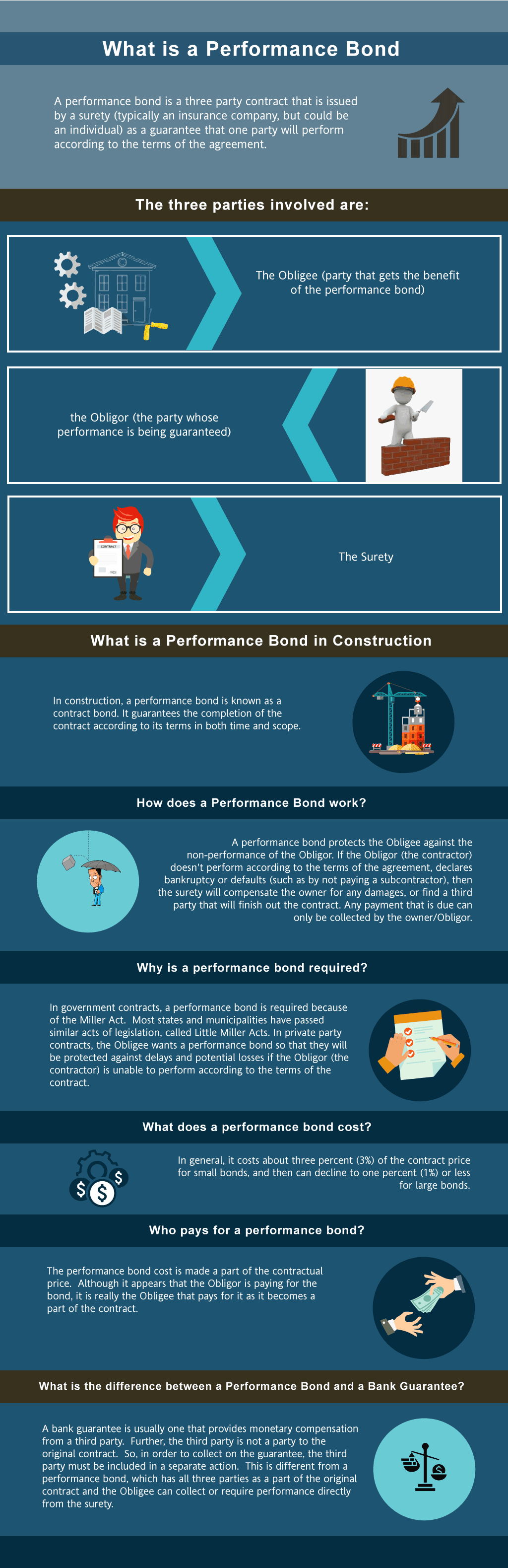

What is a Performance Bond in Vermont?

How do I get a Performance and Payment Bond in Vermont?

We make it easy to get a contract performance bond. Just click here to get our Vermont Performance Application. Fill it out and then email it and the Vermont contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How Much Does a Performance Bond Cost in Vermont?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in VT?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Vermont. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in VT

Just call us. We’ll work with you to get the best Vermont bond possible.

We provide performance and payment bonds in each of the following counties:

Addison

Bennington

Caledonia

Chittenden

Essex

Franklin

Grand Isle

Lamoille

Orange

Orleans

Rutland

Washington

Windham

Windsor

And Cities:

Burlington

Rutland City

Stowe

Brattleboro

Bennington

Middlebury

Killington

Montpelier

South Burlington

Essex

See our Virginia Performance Bond page here.

How Performance Bonds Stack Up Against Bank Letters of Credit

From our perspective, performance bonds and bank letters of credit may seem similar, but they serve distinct purposes in construction and contracting. The purpose of a performance bond guarantees that the contractor will complete the project as agreed, while a bank letter of credit ensures that payment is made to the project owner if the contractor defaults. We’ve observed that performance bonds offer better protection to project owners because they cover the cost of completing the work, whereas letters of credit merely guarantee compensation. This makes performance bonds a more comprehensive solution for eligible construction projects in Vermont.

Performance Bonds: What Happens After Payment?

We’ve discovered that performance bonds are typically non-refundable. In our experience, the bond premium is paid to the surety for the risk they take on when issuing the bond, and that premium is considered earned once the bond is issued. However, we’ve learned that if a project is canceled before it begins, some surety companies may consider a partial refund, though this is uncommon. From what we’ve seen, it’s crucial to clarify refund policies upfront to avoid misunderstandings.

Filing a Claim on a Performance Bond: What Should You Expect After?

In our dealings with performance bonds, we’ve come to understand that filing a claim can be a complex process. When a claim is made, the surety will investigate whether the contractor has failed to meet their obligations. If the claim is valid, the surety will either compensate the project owner for the financial loss or arrange for the project to be completed. We’ve encountered situations where claims were filed, and in our observation, it can lead to serious financial and reputational repercussions for the contractor, highlighting the importance of fulfilling contractual duties.

Performance Bond Release: The Final Step in Contract Fulfillment

We’ve often noticed that performance bonds are not released until the project is completed and all contractual obligations are met. In our practice, we’ve found that bonds are typically held until final inspections, any necessary corrections are made, and the project owner signs off on the work. Based on our experience, this ensures that both parties are fully satisfied before the bond is released, minimizing disputes over unfinished or substandard work.

100 Percent Performance and Payment Bonds and the Complete Protection it Offers

In our professional life, we’ve encountered 100 percent performance and payment bonds frequently, especially in large construction projects. These bonds cover the full value of the contract, guaranteeing that the contractor will complete the work and pay all laborers, subcontractors, and suppliers. We’ve consistently found that project owners prefer this type of bond because it provides complete financial security, ensuring that both the project and the payments are fully protected from start to finish.

How Long Should You Expect to Wait for a Performance Bond?

What we’ve experienced is that obtaining a performance bond can vary depending on the scope of the project and the contractor’s financial history. In our observation, smaller, less complex projects can have bonds issued within a few days, while larger projects with more risks may take several weeks as the surety evaluates the contractor’s eligibility and financial standing. We’ve found that providing complete and accurate documentation from the outset can significantly speed up the process.

Don’t Let Your Performance Bond Expire

We’ve often found ourselves in situations where contractors or project owners are concerned about bond expiration. If a performance bond expires before the project is completed, it leaves the project owner vulnerable. In our view, allowing a bond to expire can lead to the surety being released from their obligations, leaving the project without the necessary financial protection. We’ve learned from our mistakes that renewing or extending the bond on time is crucial to ensuring continued coverage and avoiding potential financial exposure.

In conclusion, our experience tells us that performance bonds are essential for securing successful project completion in Vermont. By understanding these key aspects, project owners and contractors alike can navigate the bond process with confidence, ensuring both financial protection and peace of mind.

See more at our Washington Performance Bond page.