You can now apply online for an Utah Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

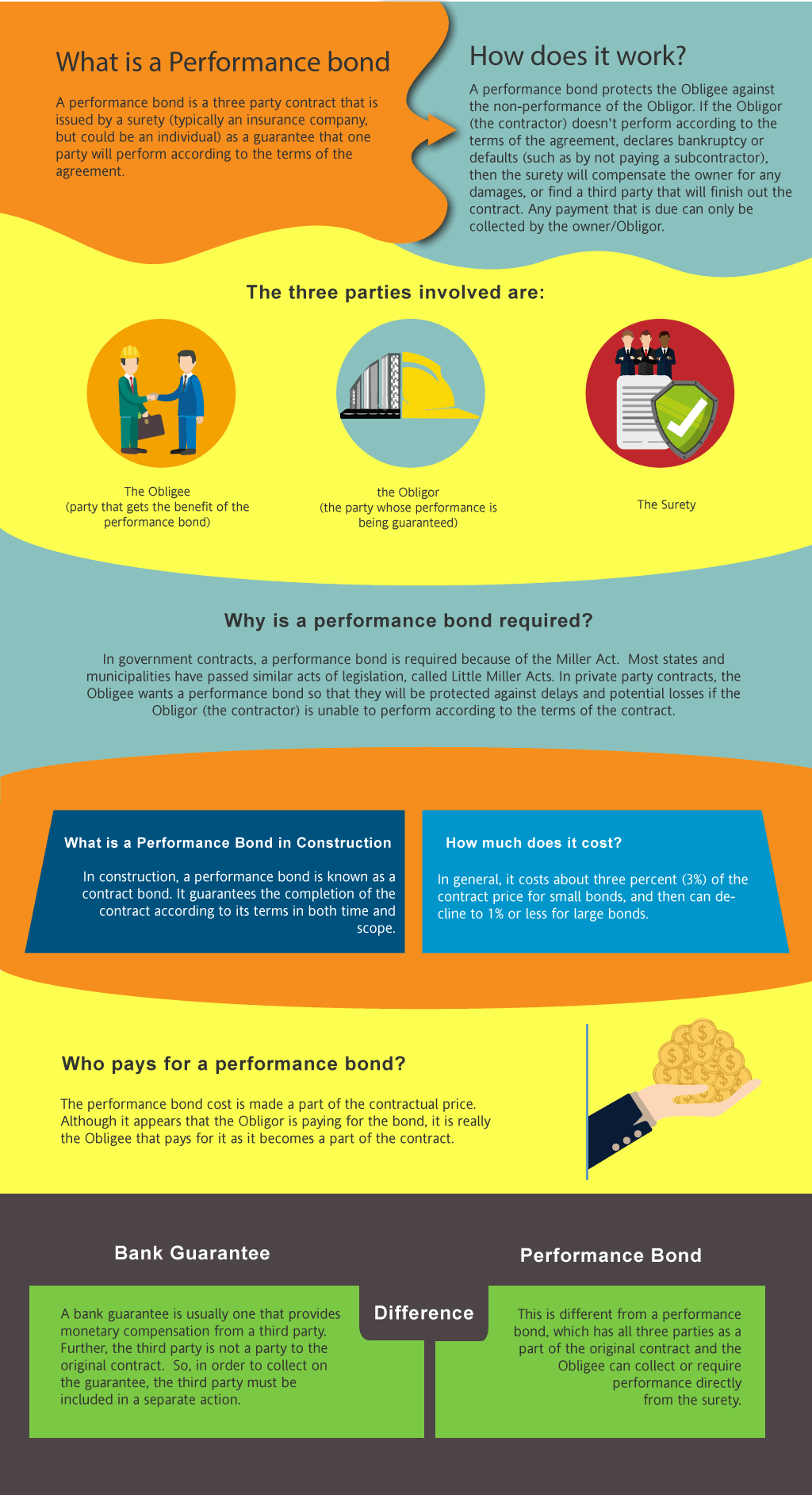

What is a Performance Bond in Utah?

How do I get a Performance and Payment Bond in Utah?

We make it easy to get a contract performance bond. Just click here to get our Utah Performance Application. Fill it out and then email it and the Utah contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in Utah?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in UT?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Utah. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover how to get a bond for construction and embark confidently on your project today!

How to Get a Performance Bond in UT

Just call us. We’ll work with you to get the best Utah bond possible.

We provide performance and payment bonds in each of the following counties:

Beaver

Box Elder

Cache

Carbon

Daggett

Davis

Duchesne

Emery

Garfield

Grand

Iron

Juab

Kane

Millard

Morgan

Piute

Rich

Salt Lake

San Juan

Sanpete

Sevier

Summit

Tooele

Uintah

Utah

Wasatch

Washington

Wayne

Weber

And Cities:

Salt Lake City

St. George

Ogden

Provo

Park City

Logan

Sandy

Orem

Moab

Layton

See our Vermont Performance Bond page here.

Exploring the World of Performance Bonds: Essential Information

Performance Bonds or LOCs: Which One Should You Choose?

From our perspective, performance bonds and bank letters of credit serve different purposes despite both offering financial security. Performance guarantee insurance provides assurance that the completion of a project according to contractual obligations, ensuring the principal performs as agreed. In contrast, a bank letter of credit acts as a financial guarantee, providing funds if the buyer defaults on payment. We've found that performance bonds are more suitable for construction projects, while letters of credit tend to be more versatile for financial transactions. Each serves its own unique role depending on the nature of the agreement.

Is There A Way to Refund The Performance Bond in Utah?

We’ve noticed that one common question is whether performance bonds are refundable. Typically, performance bonds are non-refundable once issued. This is because the bond premium compensates the surety company for the risk they undertake. In our observation, the premium is paid for the bond term, regardless of whether the project is completed early or not. However, if a project is canceled before work begins, we’ve learned that some sureties might offer partial refunds, but this is rare and depends on the specific terms of the bond.

What Happens if a Claim is Filed on a Performance Bond in Utah?

Based on our experience, when a claim is filed on a performance bond, the process is initiated to assess whether the principal (the party required to perform the contract) has indeed failed to meet the contractual terms. If the claim is valid, the surety company is responsible for ensuring the project is completed—either by paying the project owner the bond amount or by hiring another contractor to finish the work. We’ve personally witnessed that claims can lead to significant financial and reputational damage for the principal, making it crucial to avoid breaches of contract.

Performance Bond Release: The Things You Need to Know

We’ve come to understand that performance bonds are generally released upon the successful completion of the project, as verified by the project owner. In our dealings with various contracts, we’ve found that bonds are usually held until any final inspections or corrections have been made. This ensures the project owner is fully satisfied with the results. From what we’ve seen, the release of a bond typically signifies the fulfillment of all obligations under the contract, including addressing any potential warranty issues.

Reasons Why Contractors Need a 100 Percent Performance and Payment Bond

We’ve often encountered the term "100 percent performance and payment bond," and it refers to a bond that covers the entire contract value. In our professional life, we’ve seen this bond used in large construction projects to provide assurance that not only will the project be completed, but all subcontractors and suppliers will also be paid in full. It offers comprehensive protection, safeguarding both the project owner and those involved in the supply chain.

Performance Bond Approval Time: What to Anticipate

We’ve consistently observed that the time it takes to obtain a performance bond can vary depending on several factors, such as the complexity of the project and the financial standing of the principal. In our experience, smaller projects with straightforward requirements can receive approval within a few days. However, for larger projects with higher risk, we’ve realized through our work that the underwriting process may take several weeks, as sureties require extensive documentation and evaluation before issuing the bond.

What Contractors Should Know About Lapsed Performance Bond

In our view, allowing a performance bond to expire before project completion can lead to serious complications. We’ve been in situations where expired bonds have created gaps in coverage, leaving the project owner vulnerable. If a bond expires, we’ve found that the surety company will no longer be obligated to cover any issues or claims arising after the expiration date. To avoid this, it’s crucial to renew or extend the bond until the project is completed and fully accepted by the project owner.

Through our own efforts, we've gained valuable insights into the critical role performance bonds play in securing the interests of both project owners and contractors. By understanding the nuances of performance bonds, contractors can protect their businesses and ensure project success.

See more at our Minnesota Performance Bond page.

Contact us for the Utah surety bond.