You can now apply online for a Texas Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Texas?

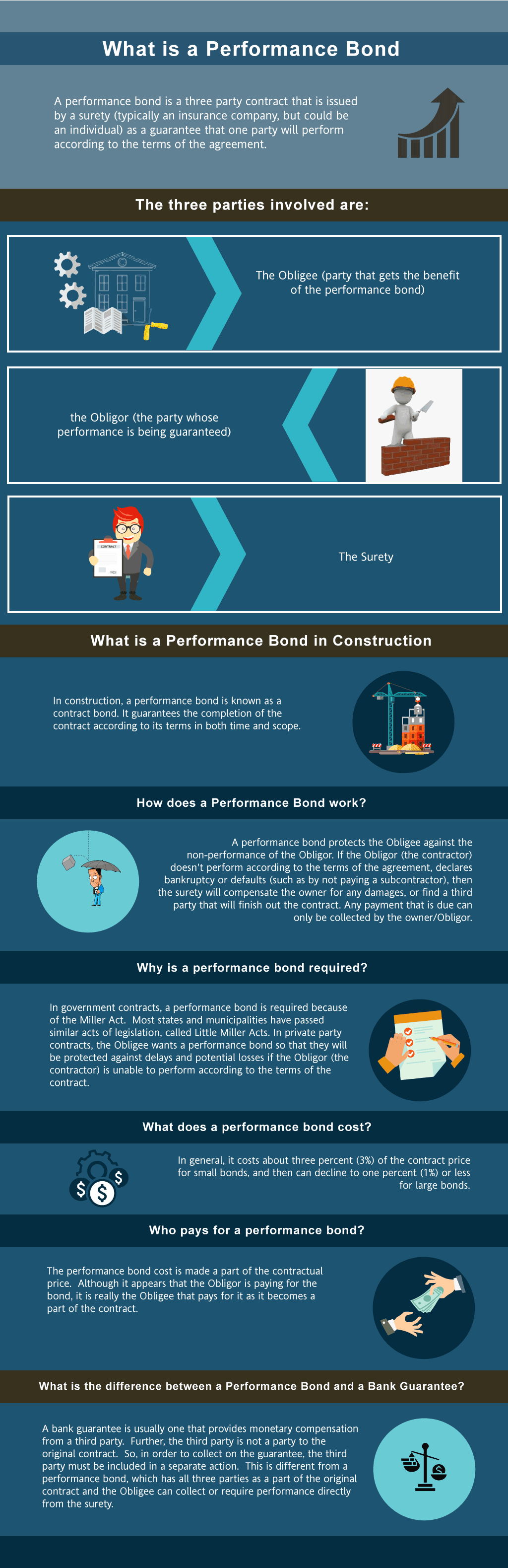

A performance bond is a three party contract that is issued by a surety (typically an insurance company, but could be an individual) as a guarantee that one party will perform according to the terms of the contract.

How do I get a Performance and Payment Bond in Texas?

We make it easy to get a contract performance bond. Just click here to get our Texas Performance Application. Fill it out and then email it and the Texas contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

P&P Bonds in Texas?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond prices fluctuate based on the job size. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Texas. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in TX

Just call us. We’ll work with you to get the best Texas bond possible.

We provide performance and payment bonds in each of the following counties:

Anderson

Andrews

Angelina

Aransas

Archer

Armstrong

Atascosa

Austin

Bailey

Bandera

Bastrop

Baylor

Bee

Bell

Bexar

Blanco

Borden

Bosque

Bowie

Brazoria

Brazos

Brewster

Briscoe

Brooks

Brown

Burleson

Burnet

Caldwell

Calhoun

Callahan

Cameron

Camp

Carson

Cass

Castro

Chambers

Cherokee

Childress

Clay

Cochran

Coke

Coleman

Collin

Collingsworth

Colorado

Comal

Comanche

Concho

Cooke

Coryell

Cottle

Crane

Crockett

Crosby

Culberson

Dallam

Dallas

Dawson

Deaf Smith

Delta

Denton

DeWitt

Dickens

Dimmit

Donley

Duval

Eastland

Ector

Edwards

Ellis

El Paso

Erath

Falls

Fannin

Fayette

Fisher

Floyd

Foard

Fort Bend

Franklin

Freestone

Frio

Gaines

Galveston

Garza

Gillespie

Glasscock

Goliad

Gonzales

Gray

Grayson

Gregg

Grimes

Guadalupe

Hale

Hall

Hamilton

Hansford

Hardeman

Hardin

Harris

Harrison

Hartley

Haskell

Hays

Hemphill

Henderson

Hidalgo

Hill

Hockley

Hood

Hopkins

Houston

Howard

Hudspeth

Hunt

Hutchinson

Irion

Jack

Jackson

Jasper

Jeff Davis

Jefferson

Jim Hogg

Jim Wells

Johnson

Jones

Karnes

Kaufman

Kendall

Kenedy

Kent

Kerr

Kimble

King

Kinney

Kleberg

Knox

Lamar

Lamb

Lampasas

La Salle

Lavaca

Lee

Leon

Liberty

Limestone

Lipscomb

Live Oak

Llano

Loving

Lubbock

Lynn

McCulloch

McLennan

McMullen

Madison

Marion

Martin

Mason

Matagorda

Maverick

Medina

Menard

Midland

Milam

Mills

Mitchell

Montague

Montgomery

Moore

Morris

Motley

Nacogdoches

Navarro

Newton

Nolan

Nueces

Ochiltree

Oldham

Orange

Palo Pinto

Panola

Parker

Parmer

Pecos

Polk

Potter

Presidio

Rains

Randall

Reagan

Real

Red River

Reeves

Refugio

Roberts

Robertson

Rockwall

Runnels

Rusk

Sabine

San Augustine

San Jacinto

San Patricio

San Saba

Schleicher

Scurry

Shackelford

Shelby

Sherman

Smith

Somervell

Starr

Stephens

Sterling

Stonewall

Sutton

Swisher

Tarrant

Taylor

Terrell

Terry

Throckmorton

Titus

Tom Green

Travis

Trinity

Tyler

Upshur

Upton

Uvalde

Val Verde

Van Zandt

Victoria

Walker

Waller

Ward

Washington

Webb

Wharton

Wheeler

Wichita

Wilbarger

Willacy

Williamson

Wilson

Winkler

Wise

Wood

Yoakum

Young

Zapata

Zavala

And some of the cities we’re in:

Houston

Dallas

Austin

San Antonio

Forth Worth

El Paso

Arlington

Waco

Corpus Christi

Lubbock

College Station

Ensure project success with our contract performance bond—secure your investment and mitigate risk today! See our Utah Performance Bond page here.

Differences Between Performance Bonds and Bank Letters of Credit

In our experience, one of the most significant distinctions between performance bonds and bank letters of credit lies in the nature of the financial guarantee each provides. Performance bonds are surety bonds issued by a surety company that guarantees a contractor will complete a project according to the contract terms. If the contractor fails, the surety company compensates the project owner. On the other hand, bank letters of credit are issued by financial institutions and act as a direct guarantee of payment, usually upon presentation of specific documents. We’ve come to the conclusion that while both instruments provide protection, performance bonds are more focused on ensuring project completion, whereas letters of credit ensure payment for services or goods.

Are Performance Bonds Refundable?

We’ve often noticed that performance bonds are generally non-refundable. When a performance bond is issued, the premium paid to the surety company is considered earned upon issuance. This is because the surety company is taking on the risk from the moment the bond is in place. We’ve come across situations where contractors may ask for a refund if the project is canceled or completed early, but based on our experience, refunds are rarely granted. The reasoning behind this is that the surety has already provided the financial backing, and the risk, even if minimal, remains until the bond is formally released.

What Happens if a Claim is Filed on a Performance Bond?

In our observation, when a claim is filed on a performance bond, it can trigger a series of investigations by the surety company. We’ve seen firsthand that the surety will typically assess whether the claim is valid, which involves reviewing the contract terms, the work completed, and any reasons provided for the claim. If the claim is found to be legitimate, the surety may step in to pay for the completion of the project, up to the bond’s limit. Our experience tells us that this process can be complex, often leading to negotiations or even legal disputes, depending on the circumstances of the claim.

When are Performance Bonds Released?

We’ve learned through doing that performance bonds are typically released once the project has been completed to the satisfaction of all parties involved. This usually includes fulfilling all contractual obligations and passing any required inspections. In our professional life, we’ve often found that the bond release process can take some time, as it involves confirming that no claims are outstanding and that all aspects of the project have been satisfactorily addressed. We’ve consistently observed that the final release of the bond provides reassurance to the contractor that their obligations have been met and that the surety’s involvement in the project is concluded.

What is a 100 Percent Performance and Payment Bond?

We’ve had the chance to work on projects that required a 100 percent performance and payment bond, and we’ve observed that this type of bond offers comprehensive protection for project owners. In our view, a 100 percent bond means that the bond covers the full value of the contract for both performance and payment. This ensures that the contractor not only completes the project as agreed but also pays all subcontractors, suppliers, and laborers. We’ve come to appreciate the security this provides to project owners, as it minimizes the risk of financial loss due to contractor default or non-payment issues.

How Long Does It Take to Get a Performance Bond?

We’ve encountered situations where obtaining a performance bond was time-sensitive, and we’ve found that the timeframe can vary depending on several factors. In our dealings with surety companies, we’ve noticed that the process can take anywhere from a few days to several weeks. Factors influencing this include the complexity of the project, the contractor’s financial standing, and the thoroughness of the underwriting process. We’ve often noticed that contractors who have an established relationship with a surety company or who have a strong financial history can obtain bonds more quickly, sometimes within a day or two.

What Happens if a Performance Bond Expires?

We’ve been in the position where a performance bond was approaching its expiration date, and we’ve learned that if a performance bond expires before the project is completed, it can lead to significant issues for all parties involved. In our understanding, the expiration of a performance bond does not automatically release the contractor from their obligations. We’ve seen firsthand that project owners might require an extension of the bond, and if the bond is not renewed or replaced, the contractor could be in breach of the contract. Our experience has taught us that it’s crucial to monitor bond expiration dates closely and to take proactive steps to renew or replace them as necessary to avoid potential disputes or project delays.

See more at our Mississippi Performance Bond page.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]