You can now apply online for a Tennessee Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Tennessee?

How do I get a Performance and Payment Bond in Tennessee?

We make it easy to get a contract performance bond. Just click here to get our Tennessee Performance Application. Fill it out and then email it and the Tennessee contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Discover what happens when a performance bond is called - unraveling the intricate repercussions and critical decisions.

How much does a Performance Bond Cost in Tennessee?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in TN?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Tennessee. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

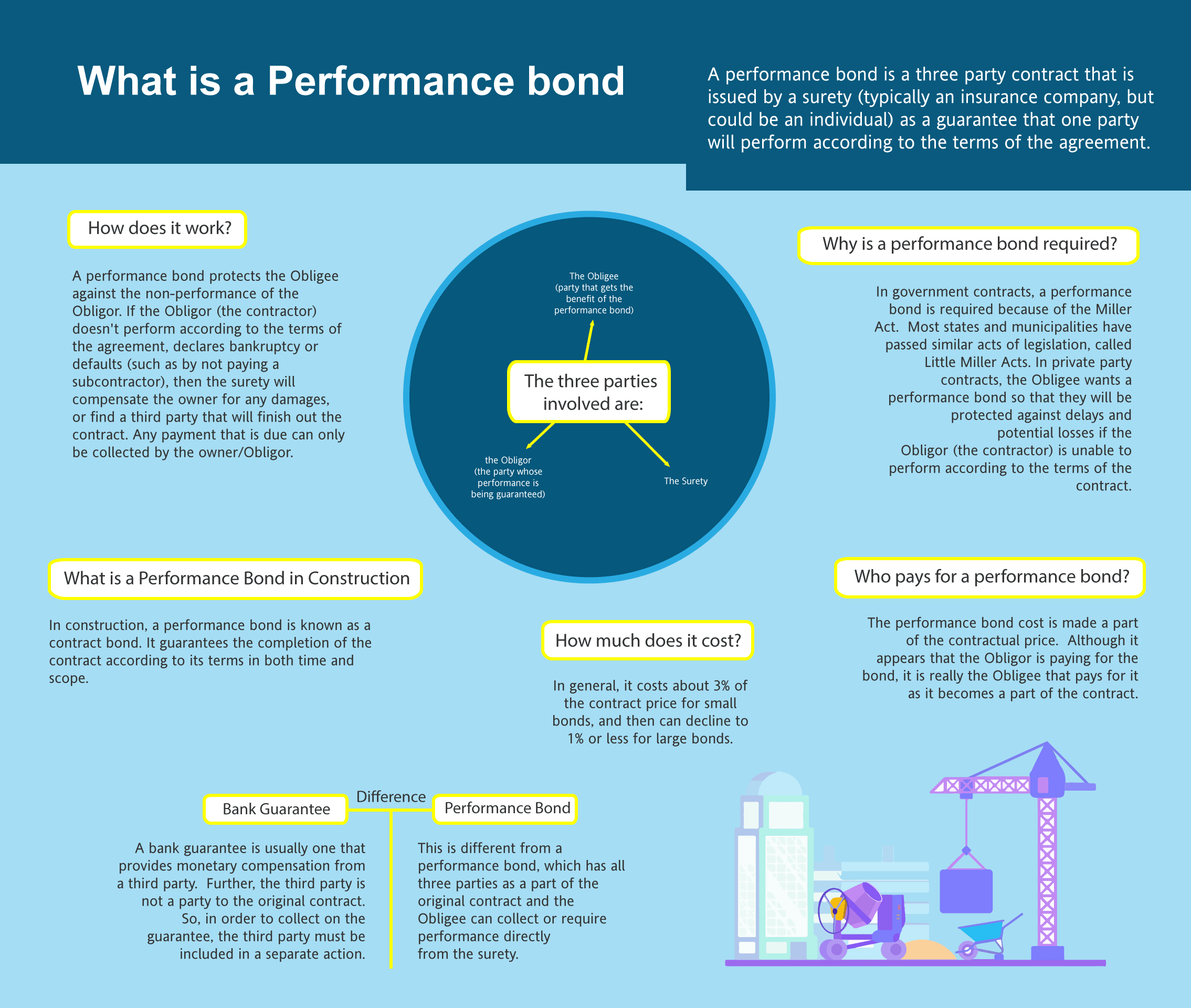

How does a Performance Bond Work?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

How to Get a Performance Bond in TN

Just call us. We’ll work with you to get the best Tennessee bond possible. We provide performance and payment bonds in each of the following counties:

Anderson

Bedford

Benton

Bledsoe

Blount

Bradley

Campbell

Cannon

Carroll

Carter

Cheatham

Chester

Claiborne

Clay

Cocke

Coffee

Crockett

Cumberland

Davidson

Decatur

DeKalb

Dickson

Dyer

Fayette

Fentress

Franklin

Gibson

Giles

Grainger

Greene

Grundy

Hamblen

Hamilton

Hancock

Hardeman

Hardin

Hawkins

Haywood

Henderson

Henry

Hickman

Houston

Humphreys

Jackson

Jefferson

Johnson

Knox

Lake

Lauderdale

Lawrence

Lewis

Lincoln

Loudon

McMinn

McNairy

Macon

Madison

Marion

Marshall

Maury

Meigs

Monroe

Montgomery

Moore

Morgan

Obion

Overton

Perry

Pickett

Polk

Putnam

Rhea

Roane

Robertson

Rutherford

Scott

Sequatchie

Sevier

Shelby

Smith

Stewart

Sullivan

Sumner

Tipton

Trousdale

Unicoi

Union

Van Buren

Warren

Washington

Wayne

Weakley

White

Williamson

Wilson

And Cities:

Nashville

Memphis

Knoxville

Chattanooga

Clarksville

Murfreesboro

Jackson

Gatlinburg

Pigeon Forge

Johnson City

See our Texas Performance Bond page here.

Unraveling the Financial Safety Nets: Performance Bonds vs. Bank Letters of Credit in Tennessee

In our line of work, we’ve often noticed that businesses sometimes confuse performance bonds with bank letters of credit (LOCs). While both serve as financial security tools, their differences are significant. Performance bonds are issued by surety companies and guarantee that a contractor will fulfill their obligations, whereas an LOC is issued by a bank and offers a payment guarantee. What we’ve discovered is that performance bonds are typically less costly for contractors, as the surety only steps in if a claim is made, whereas an LOC immediately ties up a contractor’s credit. This distinction plays a vital role in a contractor's decision-making process when securing projects.

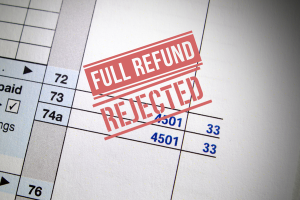

A Non-Refundable Commitment: Performance Bond in Tennessee

We’ve come to understand that performance bonds are generally non-refundable. When a contractor purchases a performance bond, they pay a premium that covers the surety's risk during the bond’s active period. In our professional life, we’ve consistently found that once a bond is issued, the premium paid is considered earned, regardless of whether the project is completed or not. Even if a project ends early or if the bond isn’t needed, contractors should be prepared for this upfront financial commitment, as refunds are rarely offered.

Performance Bond Claims: Navigating the Complex Landscape

Based on our experience, when a claim is filed on a performance bond, the situation can become complex quickly. The surety company steps in to investigate the claim and determine its validity. What we’ve experienced is that if the contractor is found in default, the surety will either pay out the claim amount or arrange for the project’s completion, depending on the bond’s terms. Contractors should know that they are ultimately responsible for reimbursing the surety, making it crucial to avoid bond claims whenever possible.

The Process of Releasing a Performance Bond in Tennessee

We’ve encountered situations where contractors are eager to understand when their performance bond will be released. In our observation, performance bonds are typically released once the contractor has fulfilled all contractual obligations, including any warranty periods. The release process involves sign-offs from all parties, ensuring the project has been completed satisfactorily. We’ve often found ourselves in conversations with contractors who underestimate the importance of project documentation, as proper records can expedite the bond release process.

Decoding The Power of 100 Percent Performance and Payment Bond

We’ve personally learned that a 100 percent performance and payment bond provides comprehensive protection to project owners. In our dealings with contractors, we’ve often come across the requirement for this bond, which covers the total contract value. The performance aspect guarantees that the work will be completed, while the payment bond ensures that subcontractors and suppliers are paid. From our perspective, this type of bond offers peace of mind to project owners and can be a key factor in securing large contracts.

Speeding Up the Performance Bond Process: Tips and Tricks

In our experience, the time it takes to secure a performance bond can vary based on several factors. We’ve consistently observed that well-prepared contractors with a strong financial history can obtain a bond within a few days. However, contractors with weaker credit or less experience may find the process takes longer, as the surety conducts a more thorough review. We’ve been in a position to advise contractors to plan ahead and start the bond process early to avoid project delays.

Avoiding the Bond Cliff: The Importance of Performance Bond Renewal

We’ve learned from our work that allowing a performance bond to expire can lead to significant issues. If a bond expires before the project is completed, the contractor may be considered in default, and the project owner could terminate the contract. In our view, contractors must ensure that bonds are renewed or extended when necessary to avoid jeopardizing their reputation and financial standing. We’ve been involved in situations where timely communication with the surety helped avoid such pitfalls, underscoring the importance of proactive bond management.

See more at our Missouri Performance Bond page.