You can now apply online for a South Dakota Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in South Dakota?

How do I get a Performance and Payment Bond in South Dakota?

We make it easy to get a contract performance bond. Just click here to get our South Dakota Performance Application. Fill it out and then email it and the South Dakota contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

What’s a performance bond in South Dakota?

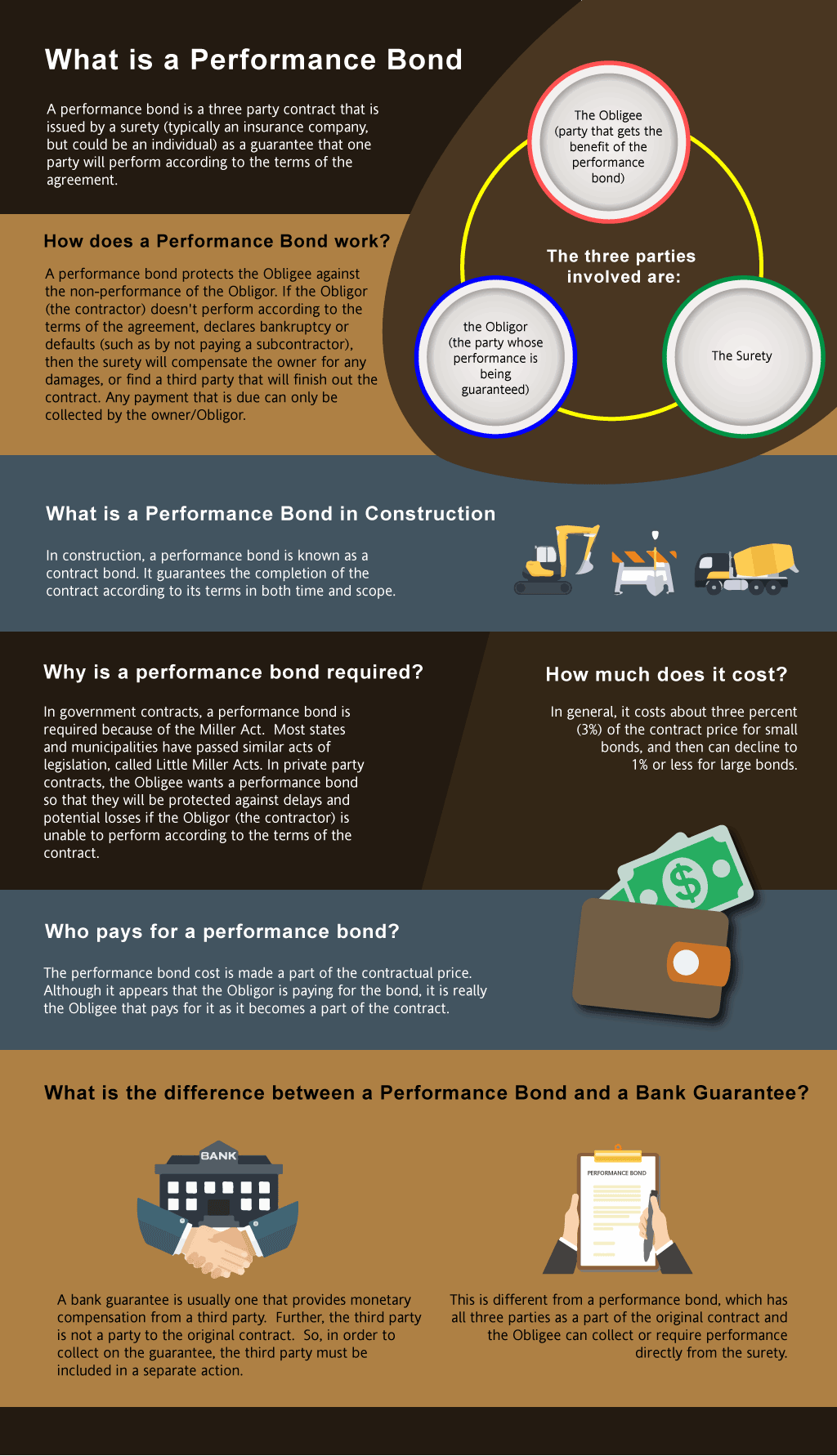

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in SD?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of South Dakota. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in SD

Just call us. We’ll work with you to get the best South Dakota bond possible.

We provide performance and payment bonds in each of the following counties:

Aurora

Beadle

Bennett

Bon Homme

Brookings

Brown

Brule

Buffalo

Butte

Campbell

Charles Mix

Clark

Clay

Codington

Corson

Custer

Davison

Day

Deuel

Dewey

Douglas

Edmunds

Fall River

Faulk

Grant

Gregory

Haakon

Hamlin

Hand

Hanson

Harding

Hughes

Hutchinson

Hyde

Jackson

Jerauld

Jones

Kingsbury

Lake

Lawrence

Lincoln

Lyman

McCook

McPherson

Marshall

Meade

Mellette

Miner

Minnehaha

Moody

Pennington

Perkins

Potter

Roberts

Sanborn

Shannon

Spink

Stanley

Sully

Todd

Tripp

Turner

Union

Walworth

Yankton

Ziebach

And Cities:

Sioux Falls

Rapid City

Aberdeen

Brookings

Pierre

Mitchell

Yankton

Spearfish

Deadwood

Sturgis

See our Tennessee Performance Bond page here.

Discover how does bonding work in construction and enhance your understanding today!

Comparing Performance Bonds and Bank Letters of Credit in South Dakota: What You Need to Know

From our perspective, the most significant difference between performance bonds and bank letters of credit in South Dakota lies in their respective roles in safeguarding construction projects. Performance bonds guarantee that contractors will complete the project according to the contract’s terms, offering project owners more comprehensive protection. We’ve noticed that bank letters of credit, while ensuring financial compensation if a contractor defaults, do not provide the same assurance of project completion. In our dealings with clients, we’ve consistently found that performance bonds are favored for their dual coverage of performance and financial risk.

Reading the Fine Print: Understanding Refund Terms

We’ve encountered many situations where clients ask if performance bonds in South Dakota are refundable. In our professional life, we’ve consistently observed that once the bond is issued, the premium is non-refundable, regardless of whether the bond is called upon. However, we’ve come across rare cases where a project cancellation might lead to partial refunds, though this is highly dependent on the surety’s terms. We’ve come to appreciate that understanding the bond’s terms and conditions upfront can prevent misunderstandings regarding potential refunds.

Surety’s Role: Completion or Compensation

In our observation, filing a claim on a performance bond in South Dakota triggers significant actions by both the surety and contractor. If the claim is validated, the surety steps in to either finish the project or compensate the project owner. We’ve seen firsthand that contractors remain responsible for repaying the surety for any expenses, leading to possible financial strain. Our experience has shown us that repeated claims can hurt a contractor’s credibility, affecting future bonding opportunities. This makes it crucial for contractors to meet their obligations to avoid claims.

Confirming Completion: The Release Criteria

We’ve consistently found that the release of a performance bond in South Dakota typically happens once the project owner certifies that the work has been completed in accordance with the contract. From what we’ve seen, this process often involves inspections and final approvals. We’ve had the privilege to assist contractors through this stage, and we’ve learned that clear communication with the project owner is key to avoiding delays in bond release. Without final approval, the bond remains active, leaving the contractor exposed to potential claims.

The Dual Protection: 100 Percent Performance and Payment Bond in South Dakota

What we’ve discovered is that 100 percent performance and payment bonds provide essential coverage for both contractors and project owners in South Dakota. This bond ensures the contractor fulfills their obligations and that all subcontractors and suppliers are paid. In our dealings with project owners, we’ve noticed that this dual protection helps avoid payment disputes and ensures smooth project progression. We’ve grown to understand that securing this type of bond can greatly benefit contractors who want to demonstrate their commitment to completing the project successfully.

How Long Should You Wait to Secure a Performance Bond in South Dakota?

We’ve noticed that the time it takes to secure a performance bond in South Dakota varies depending on the contractor’s financial standing and the project’s scope. From our experience, smaller projects often result in bond approval within days, while larger, more complex projects can take weeks. We’ve observed that financial documentation, credit history, and background checks are critical in expediting or delaying the process. In our work, we’ve learned that being well-prepared and maintaining financial health can help contractors secure bonds more efficiently.

Avoiding Legal Pitfalls: The Risks of Expired Performance Bonds

We’ve been in situations where contractors faced difficulties due to an expired performance bond before project completion. We’ve realized through our work that when a bond expires prematurely, the contractor risks being considered in default by the project owner. We’ve also found that renewing the bond before expiration is essential to maintain the project’s protection. From our perspective, proactive bond management ensures contractors stay compliant and avoid costly legal or financial issues that could arise from an expired bond.

See more at our New Hampshire Performance Bond page.