You can now apply online for a South Carolina Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in South Carolina?

How do I get a Performance and Payment Bond in South Carolina?

We make it easy to get a contract performance bond. Just click here to get our South Carolina Performance Application. Fill it out and then email it and the South Carolina contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in South Carolina?

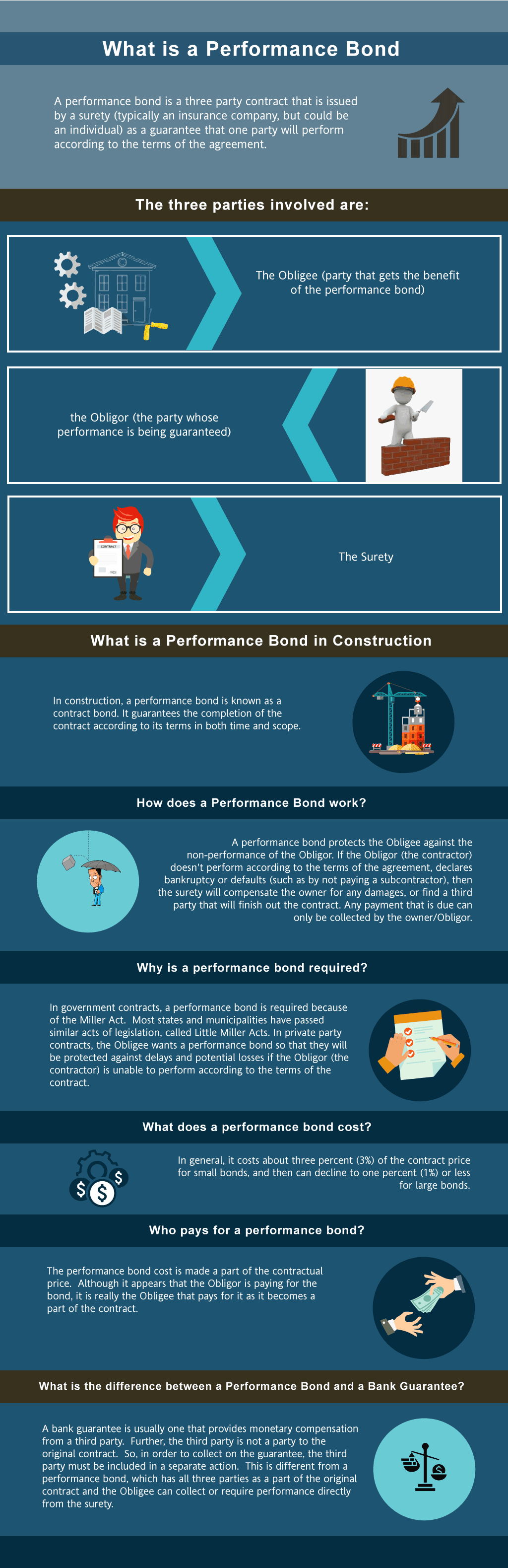

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in SC?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of South Carolina. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in SC

Just call us. We’ll work with you to get the best South Carolina bond possible.

We provide performance and payment bonds in each of the following counties:

Abbeville

Aiken

Allendale

Anderson

Bamberg

Barnwell

Beaufort

Berkeley

Calhoun

Charleston

Cherokee

Chester

Chesterfield

Clarendon

Colleton

Darlington

Dillon

Dorchester

Edgefield

Fairfield

Florence

Georgetown

Greenville

Greenwood

Hampton

Horry

Jasper

Kershaw

Lancaster

Laurens

Lee

Lexington

McCormick

Marion

Marlboro

Newberry

Oconee

Orangeburg

Pickens

Richland

Saluda

Spartanburg

Sumter

Union

Williamsburg

York

And Cities:

Charleston

Columbia

Greenville

Myrtle Beach

Spartanburg

Florence

Hilton Head Island

Rock Hill

Summerville

Mount Pleasant

See our South Dakota Performance Bond page here.

Ensure your project’s success and financial security with a performance surety bond today!

Performance Bonds vs Bank Letters of Credit in South Carolina: What are the Differences?

From our perspective, one of the most critical differences between performance bonds and bank letters of credit lies in their purpose and scope. Performance bonds, often required in South Carolina construction projects, guarantee that contractors will fulfill their contractual obligations. On the other hand, we’ve consistently found that bank letters of credit serve as a financial guarantee, ensuring payment but not necessarily completion of the project. What we’ve come to understand is that performance bonds provide a higher level of security for project owners, ensuring both financial compensation and project fulfillment.

A Final Decision: Non-Refundable Performance Bonds in South Carolina

We’ve had the opportunity to work with several contractors and surety companies in South Carolina, and in our experience, performance bonds are generally non-refundable once issued. The premium is considered earned upon issuance, regardless of whether the bond is ever called upon. We’ve found that refunds are rarely granted, except in cases where the project is canceled before it begins. Even then, the refund process is often complex, and based on our experience, it’s vital to review the bond’s terms and conditions to clarify refund eligibility.

Facing the Consequences: Exploring Performance Bond Claims

In our dealings with claims on performance bonds in South Carolina, we’ve observed that the filing of a claim can lead to significant repercussions for contractors. Once a claim is validated, the surety steps in to resolve the issue, either by completing the project or compensating the project owner. What we’ve seen firsthand is that contractors remain responsible for reimbursing the surety for any costs incurred, and repeated claims can harm the contractor’s reputation, making it difficult to secure future bonds. We’ve realized that thorough vetting and monitoring are critical to avoiding these costly claims.

The Speed of Approval: Considering the Timeframe for Obtaining a Performance Bond in South Carolina

In our line of work, we’ve often noticed that performance bonds in South Carolina are released only after the project owner confirms that all contractual obligations have been met. We’ve encountered numerous projects where bond release was delayed due to unresolved issues or incomplete inspections. In our observation, ensuring a timely bond release requires diligent project management and transparent communication with the project owner. Final inspections and sign-offs are typically required to initiate the bond release process.

Key to Peace of Mind: 100 Percent Performance and Payment Bonds in South Carolina

We’ve discovered through trial and error that a 100 percent performance and payment bond is particularly valuable in South Carolina construction projects. In our professional experience, this type of bond provides comprehensive protection, covering both the performance of the contractor and payments to subcontractors and suppliers. We’ve often found that this dual protection is preferred by project owners, as it minimizes the risk of financial disputes and project delays, ensuring that both obligations are fulfilled.

The Timeline: How Quickly Can You Secure a Performance Bond in South Carolina?

We’ve come to notice that the process of securing a performance bond in South Carolina can vary widely, depending on the complexity of the project and the contractor’s financial standing. From what we’ve seen, smaller projects often allow for bonds to be issued within a few days, while larger, more complex projects can take several weeks. We’ve learned that financial documentation, including credit checks and background checks, can significantly impact the approval time, making it essential for contractors to be well-prepared before applying for a bond.

Avoiding the Bond Cliff: Timely Renewal

We’ve encountered situations where the performance bond for contractor created serious issues when the bond expired before project completion in South Carolina. In our view, it’s crucial for contractors to stay on top of expiration dates and renew their bonds well before they lapse. We’ve personally witnessed cases where an expired bond led to project delays and even legal consequences. We’ve realized through our work that proactive bond management is essential for avoiding costly disputes and ensuring uninterrupted project progress.

See more at our West Virginia Performance Bond page.