Performance Bond

What are Performance Bonds?

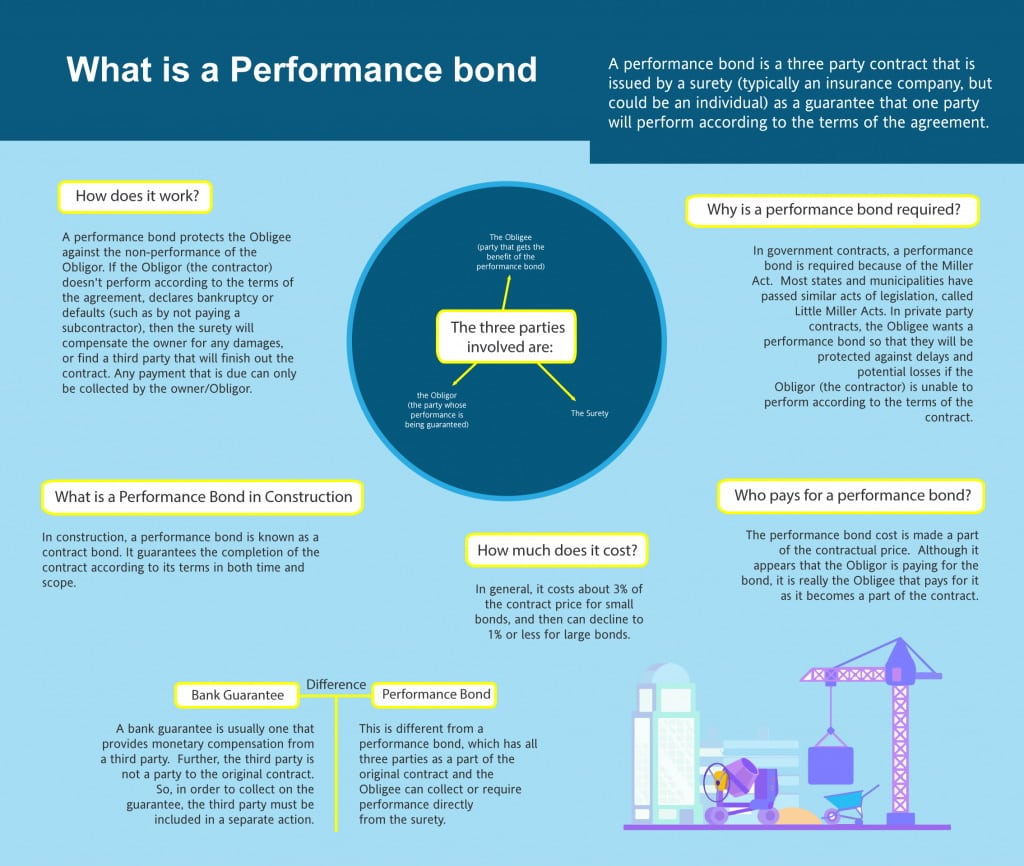

A Performance Bond is a bond issued by a surety company (think large insurance company) that guarantees the satisfactory completion of a project or a job (i.e., a construction project).

Performance Bonds ensure that a contractor will complete their work according to the terms of the contract. The terms and conditions provide for when the project will be built (and to what standards), and at what price. The bond further protects the owner from a default on the part of the contractor due to a delay in construction or construction work that is substandard.

What is a Performance Bond in Construction?

How Do Performance Bonds Work?

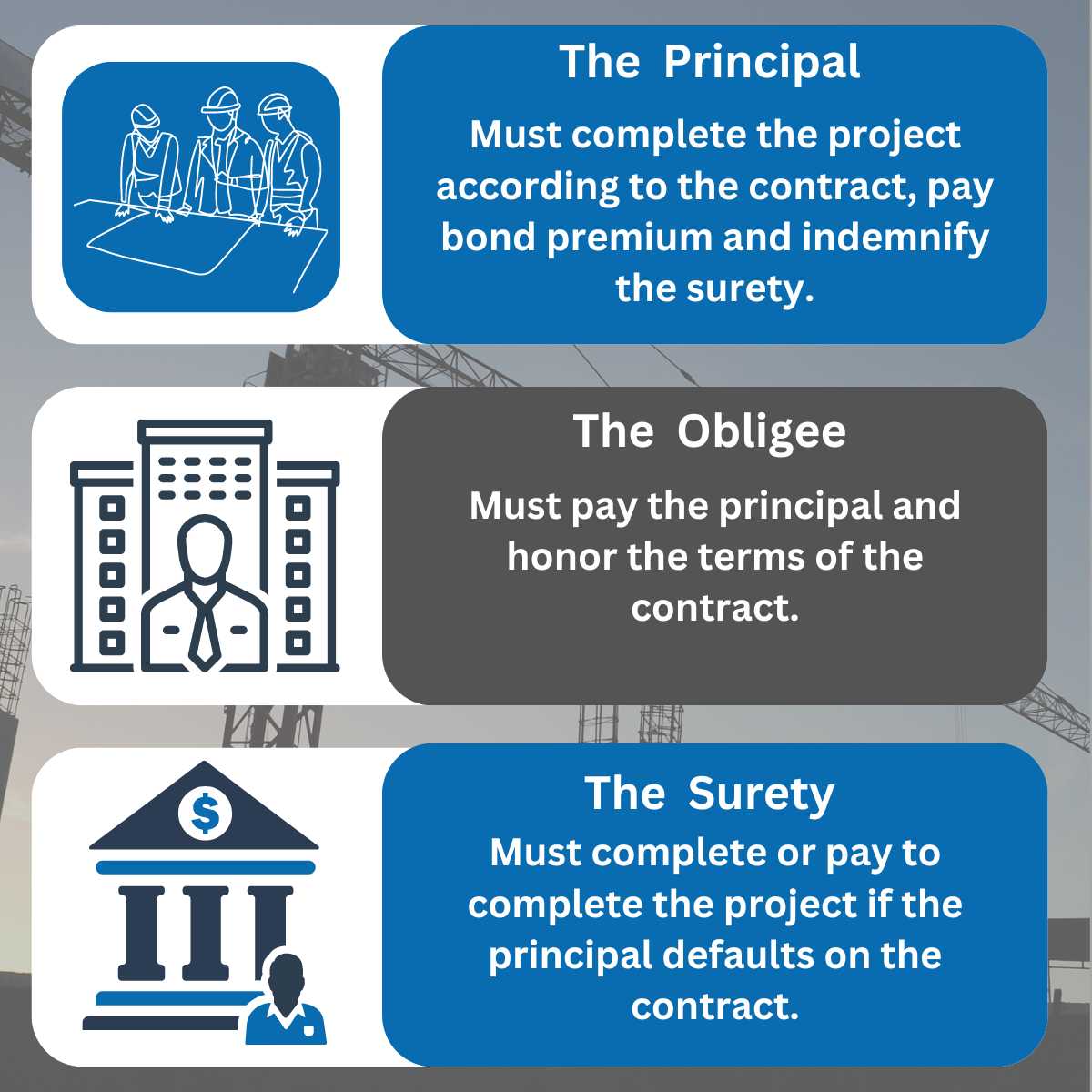

Principal

Obligee

Surety

What Do Performance Bonds Cost?

Performance Bonds Cost between 0.5% – 3% of the contract amount. In our experience, most contractors will pay between 1% – 2% of the contract amount. The price of a performance bond depends on several factors including the credit and financial strength of the customer and the type of work being bonded. Other factors such as the length of the contract and warranty period may also add the cost.

Who Pays for a Performance Bond?

How Do You Get a Performance Bond?

We Run Credit

We run a simple personal credit check.

Submit An Application

Complete an online application or print and email one to us.

The Contract

Send us the contract or purchase order needing a performance bond.

For larger performance bonds, an application, personal financial statement and often company financial statements may be required. Swiftbonds represents many of the nation's leading bond companies to get contractors the approval they need at the best terms possible. We have helped thousands of contractors nationwide get performance bonds. Contact us to learn why we are one of the nation's leading performance bond companies!

Why Do I Need a Performance Bond?

What is Performance Bond and Payment Bond?

Performance Bonds are often written together with Payment Bonds. However, these are two different types of surety bonds and guarantees. While a performance bond guarantees the completion of a contract for a set price, a payment bond guarantees that certain subcontractors and material suppliers will be paid for their work. Payment bonds are necessary on public projects because subcontractors and suppliers do not have mechanic's lien rights. However, payment bonds are often used on private projects as well to ensure that they remain lien free.

When a performance bond is written together with a payment bond, there is only one cost for both bonds. In our experience, it is very common for both bonds to be required together. The obligee really gets 200% coverage for their project for the price of 1 bond because the performance bond normally covers 100% of the contract amount, while the payment bond also covers 100% of the contract amount.

Are Performance Bonds Insurance?

It is easy to mistake performance bonds for insurance. In fact, many insurance companies write performance bonds. However, performance bonds are not insurance. They are a type of surety bond called a “Contract Surety Bond.” Performance bonds are actually a three-party agreement between. The principal on the bond purchases the performance bond for the benefit of a third-party, which is the obligee. Insurance is a two-party agreement. The insured purchases insurance for the benefit of themselves. See here for our California Performance Bonds.

A second major difference is what happens in a claim. Performance bonds require the principal to indemnify the bond company if a loss occurs. This means that the principal not only pays the premium, they are also financially responsible for losses. Alternatively, an insured buys an insurance policy and then transfers most of the risk to the insurance company. The insured may be responsible for a deductible, but the insurance company is financially responsible for any remaining loss. In this way, performance bonds are more closely related to a credit than to insurance. See here for the definition of a performance bond.

Differences Between Performance Bonds and Bank Letters of Credit

Cost - 0.5% - 3%.

Generally, not collateralized.

Does not restrict other borrowing.

Requires defense of claims.

Cost - Tied to interest rates. 1% - 5%.

Cash or hard collateral often required.

Borrowing is usually reduced by LOC amount.

Taken with no defense if a claim occurs.

Another advantage of performance bonds is cost. Performance bonds are not directly influenced by interest rates. Their cost tends to be more stable. Letters of credit are often tied to a benchmark rate and can fluctuate with the overall economy.

If a claim does occur, performance bonds require that a claims professional investigate the claim before paying. Bank letters of credit have no such protection. The line of credit is generally paid on demand and it would be up to the contractor to try and recover through legal means.

Performance Bond Frequently Asked Questions

What is a Performance Bond in Construction?

When Are Performance Bond Released?

Are Performance Bonds Refundable?

What is a 100 Performance and Payment Bond?

What Happens if a Claim is Filed on a Performance Bond?

What Happens if a Performance Bond in Called?

How Long Does it Take to Get a Performance Bond?

How Do You Collect on a Performance Bond?

Understanding Surety Bonds in Public Works Projects

Public works projects often involve a complex interplay of contract law, risk management, and financial safeguards to ensure timely and quality completion. Instruments like maintenance bonds, supply bonds, completion bonds, and performance bonds provide essential financial security to project owners by mitigating default risk. Under the Miller Act and state little miller acts, contractors working on federal or state projects must furnish performance and payment bonds that align with the legal requirements of the Federal Acquisition Regulation. These bonds, along with subdivision bonds and fidelity bonds, address diverse risks by providing coverage for construction obligations, financial mismanagement, and even employee dishonesty. Moreover, alternatives like bank guarantees, letters of credit, and financial guarantees offer additional layers of security, often with the backing of suretyship principles or collateral.

What is a Bonding Rate?

What Are the Three Types of Construction Bonds?

Managing Claims and Legal Remedies

When a contractor fails to meet project expectations, owners may file performance bond claims to recover damages or enforce completion. A valid performance bond claim, governed by the federal Miller Act or state regulations, provides a legal pathway to resolve disputes and minimize financial losses. However, bond premiums, completion bond costs, and compliance with liquidated damages clauses can impact project budgets. In such cases, legal remedies may extend beyond bonds to include commercial bonds, financial guarantees, or even federal bonds, depending on the scope of the default. Owners must carefully assess financial security mechanisms, including the role of performance bond insurance, to ensure adequate protection while navigating potential defaults or disputes. Balancing these tools ensures robust risk mitigation for both public and private sector projects.

What Happens if Performance Bond Expires?

What is a Warranty Bond?

Other Featured Surety and Construction Articles

Exploring Recourse for the Obligee When the Principal is in Default

What Recourse Does the Obligee Have if They Believe the Principal Is in Default? If the obligee believes that the principal is in default, they typically have several avenues for recourse. First, they may review the terms of the contract or agreement to determine the...

Can the Obligee Require the Principal to Obtain Additional Insurance Coverage?

Can the Obligee Require the Principal to Obtain Additional Insurance Coverage? In the realm of surety bonds and contractual agreements, the relationship between the obligee, principal, and surety is governed by specific terms and conditions. One crucial aspect often...