You can now apply online for an Oregon Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

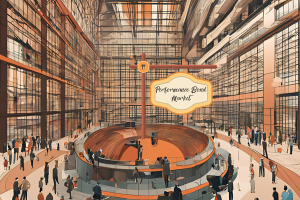

What is a Performance Bond in Oregon?

How do I get a Performance and Payment Bond in Oregon?

We make it easy to get a contract performance bond. Just click here to get our Oregon Performance Application. Fill it out and then email it and the Oregon contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in Oregon?

How much does a Performance Bond Cost in Oregon?

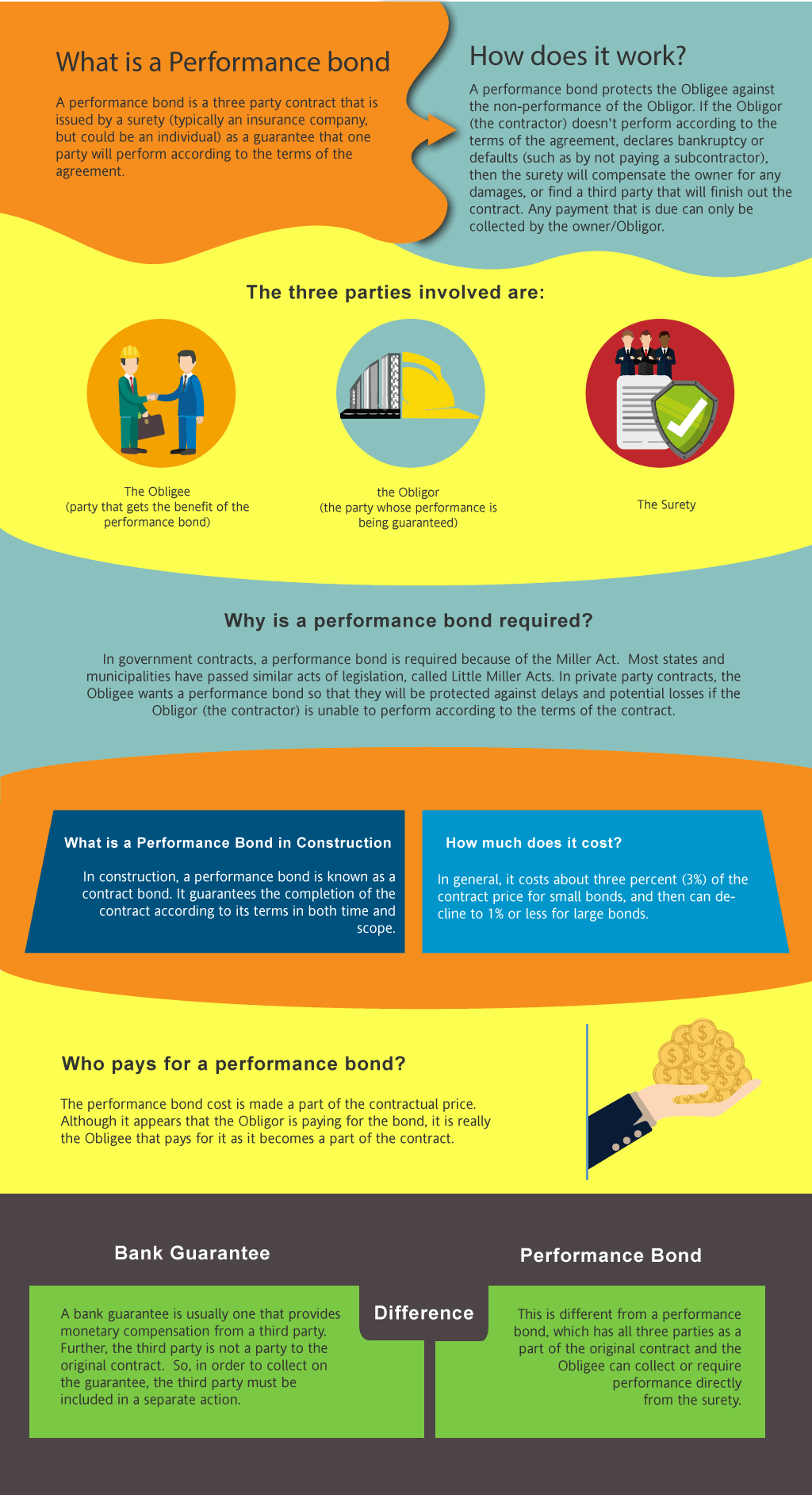

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in OR?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Oregon. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Ensure project completion and mitigate risk by understanding the purpose of performance bond today!

How to Get a Performance Bond in OR

Just call us. We’ll work with you to get the best Oregon bond possible.

We provide performance and payment bonds in each of the following counties:

Baker

Benton

Clackamas

Clatsop

Columbia

Coos

Crook

Curry

Deschutes

Douglas

Gilliam

Grant

Harney

Hood River

Jackson

Jefferson

Josephine

Klamath

Lake

Lane

Lincoln

Linn

Malheur

Marion

Morrow

Multnomah

Polk

Sherman

Tillamook

Umatilla

Union

Wallowa

Wasco

Washington

Wheeler

Yamhill

And Cities:

Portland

Salem

Eugene

Bend

Medford

Beaverton

Corvallis

Hillsboro

Albany

Grants Pass

See our Pennsylvania Performance Bond page here.

The Right Tool for the Job: Performance Bonds vs. Bank Letters of Credit

In our experience, one of the most common questions that arises when discussing performance bonds is how they differ from bank letters of credit (LoC). Both serve as financial guarantees, but we’ve come to understand that they function quite differently in how they work. The performance bond meaning is that of a surety bond provided by a third-party surety company, ensuring that a contractor completes a project as per the agreed terms. On the other hand, a letter of credit is a direct obligation from a bank, where funds are reserved to cover any potential project failures. From our perspective, the critical distinction lies in the fact that performance bonds offer broader protection by involving a surety who investigates claims, while a letter of credit simply releases funds when needed. This difference impacts not only the parties involved but also the overall risk management of the project.

A Non-Refundable Investment: Understanding Performance Bond Premiums

We’ve noticed that many people wonder whether performance bonds are refundable, especially when the project completes without issues. In general, performance bonds are not refundable because they serve as a form of insurance or guarantee that stays active throughout the project. Once the bond is issued, the premium is considered earned by the surety company, much like insurance policies. In our view, even if a project wraps up ahead of schedule or under budget, the costs associated with the bond remain non-refundable. However, we’ve observed that in rare cases, partial refunds may be negotiated if the bond is canceled early, but this is the exception rather than the rule.

A Financial Burden: The Costs Associated with Performance Bond Claims

We’ve come across situations where claims are filed on performance bonds, and it can be a complex process. When a claim is made, the surety company will first investigate to determine the validity of the claim. Based on our experience, if the claim is deemed legitimate, the surety will step in to either complete the project or compensate the obligee (the project owner) for the financial losses incurred. However, the principal (the contractor) is ultimately responsible for repaying the surety for any losses or costs. We’ve learned that claims can significantly impact a contractor’s ability to obtain future bonds, so it’s crucial to avoid claims by maintaining clear communication and fulfilling all contractual obligations.

The Release Criteria: When Are Performance Bonds Obtained?

We’ve consistently found that timing plays a critical role in the release of performance bonds. Generally, performance bonds are released once the project is completed and all contractual obligations have been met. However, what we’ve discovered is that the exact timing of the bond release can vary depending on the specific terms of the bond and any warranty periods stipulated in the contract. Some bonds remain in effect during a maintenance period, ensuring that any defects or issues that arise post-completion are resolved before the bond is fully released. In our observation, understanding these timelines is crucial for contractors and project owners alike.

A Strong Safety Net: The Benefits of 100 Percent Performance and Payment Bonds

We’ve had firsthand experience with 100 percent performance and payment bonds, which are common in larger construction projects. This type of bond provides full coverage for both performance and payment, meaning it guarantees not only that the contractor will complete the project as agreed but also that subcontractors, suppliers, and laborers will be paid. In our professional lives, we’ve often worked with these bonds, and they offer a high level of protection for all parties involved. Through our own efforts, we’ve seen that securing such comprehensive coverage can prevent disputes and ensure smooth project execution, making it a popular choice in the industry.

A Quick Process: Understanding the Time to Get a Performance Bond

We’ve come to appreciate that the time it takes to secure a performance bond can vary significantly depending on several factors. For smaller projects, we’ve noticed through our work that bonds can be issued within a matter of days if the contractor has a strong track record and financial stability. However, for larger or more complex projects, the process may take several weeks, as the surety company conducts a thorough review of the contractor’s financials, project details, and risk factors. In our dealings with surety companies, we’ve found that providing complete and accurate documentation can expedite the bonding process.

A Dangerous Situation: The Risks of Lapsed Performance Bonds

We’ve encountered situations where performance bonds expire before the project is completed, and this can lead to serious complications. If a performance bond expires, the contractor may be in breach of contract, and the obligee can demand that a new bond be issued. We’ve realized through our work that an expired bond can halt progress on a project and result in penalties or additional costs. We’ve personally witnessed how crucial it is for contractors to monitor the bond’s expiration date and ensure timely renewals if necessary, as failing to do so can jeopardize the entire project.

See more at our Wisconsin Performance Bond page.

Learn more on Court Bonds Portland Oregon