You can now apply online for a North Carolina Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

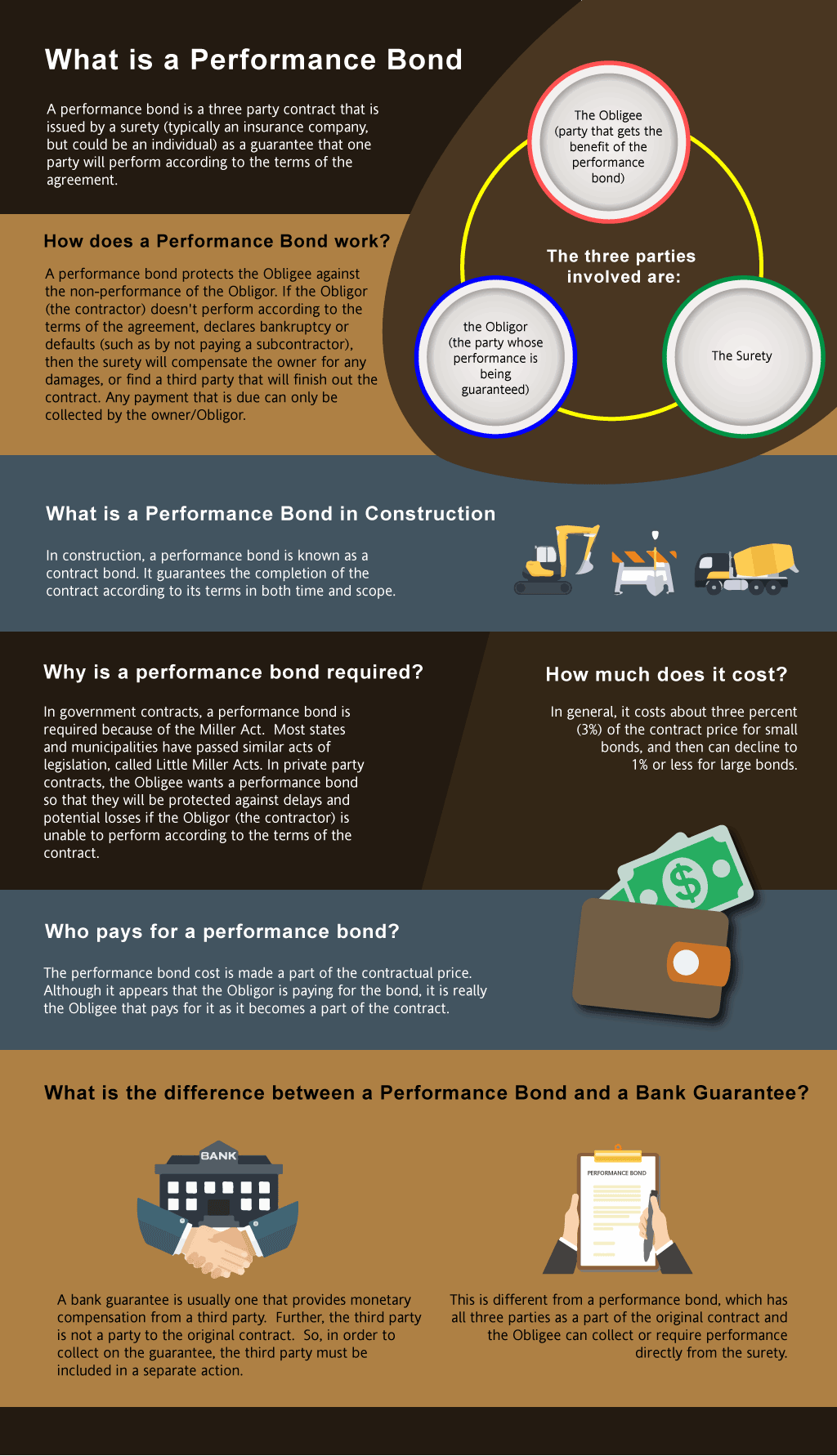

What is a Performance Bond in North Carolina?

How do I get a Performance and Payment Bond in North Carolina?

We make it easy to get a contract performance bond. Just click here to get our North Carolina Performance Application. Fill it out and then email it and the North Carolina contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Performance and Payment bond definition in North Carolina?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in NC?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of North Carolina. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover what is performance bond in construction and ensure your ventures are safeguarded—learn more today!

How to Get a Performance Bond in NC

Just call us. We’ll work with you to get the best North Carolina bond possible.

We provide performance and payment bonds in each of the following counties:

Alamance

Alexander

Alleghany

Anson

Ashe

Avery

Beaufort

Bertie

Bladen

Brunswick

Buncombe

Burke

Cabarrus

Caldwell

Camden

Carteret

Caswell

Catawba

Chatham

Cherokee

Chowan

Clay

Cleveland

Columbus

Craven

Cumberland

Currituck

Dare

Davidson

Davie

Duplin

Durham

Edgecombe

Forsyth

Franklin

Gaston

Gates

Graham

Granville

Greene

Guilford

Halifax

Harnett

Haywood

Henderson

Hertford

Hoke

Hyde

Iredell

Jackson

Johnston

Jones

Lee

Lenoir

Lincoln

McDowell

Macon

Madison

Martin

Mecklenburg

Mitchell

Montgomery

Moore

Nash

New Hanover

Northampton

Onslow

Orange

Pamlico

Pasquotank

Pender

Perquimans

Person

Pitt

Polk

Randolph

Richmond

Robeson

Rockingham

Rowan

Rutherford

Sampson

Scotland

Stanly

Stokes

Surry

Swain

Transylvania

Tyrrell

Union

Vance

Wake

Warren

Washington

Watauga

Wayne

Wilkes

Wilson

Yadkin

Yancey

And Cities:

Charlotte

Raleigh

Greensboro

Wilmington

Asheville

Durham

Fayetteville

Winston-Salem

Cary

Chapel Hill

See our North Dakota Performance Bond page here.

Distinguishing Financial Safeguards: Performance Bonds vs. Bank Letters of Credit

In our view, understanding the distinction between performance bonds and bank letters of credit is crucial for navigating the construction industry in North Carolina. From what we’ve seen, performance bonds, issued by surety companies, serve as a guarantee that contractors will fulfill their obligations, whereas bank letters of credit provide a financial backstop in the form of payment security. We’ve consistently found that performance bonds offer superior protection for project owners, as they ensure project completion even in cases of contractor default. However, the nuances between these financial instruments can be complex to understand, making it essential to choose the right option for your project.

Understanding the Non-Refundable Nature of Performance Bonds: A North Carolina Perspective

We’ve come to understand that the question of whether performance bonds are refundable is a common concern among contractors in North Carolina. Based on our experience, performance bonds are typically non-refundable once issued. This is because the bond serves as an ongoing financial guarantee for the project owner throughout the duration of the contract. We’ve encountered situations where contractors hoped for a refund after early project completion or bond cancellation, but these requests are usually denied. The reason is clear: the bond’s purpose is to cover potential risks from start to finish, making refundability a rare exception.

Navigating the Claims Process: When a Bond is Called Upon in NC

Through our own efforts, we’ve gained insight into the process that unfolds when a claim is filed against a performance bond. When a contractor in North Carolina fails to meet their contractual obligations, the project owner may file a claim on the bond. We’ve learned that this initiates a detailed investigation by the surety company, often leading to complex negotiations. Once a claim is validated, the surety company steps in to ensure the project’s completion, either by hiring a new contractor or compensating the project owner. We’ve noticed that this process, though sometimes contentious, is vital for protecting the project owner from financial loss.

The Final Hurdle: How and When Performance Bonds Are Released?

In our professional life, we’ve had firsthand experience with the anticipation surrounding the release of performance bonds. We’ve consistently found that the release typically occurs after the project is completed and all contractual obligations are fulfilled. This process, common in North Carolina construction projects, usually involves a formal closeout, including inspections and approval of final documentation. We’ve observed that ensuring all subcontractors and suppliers are paid is a key factor in this release. The timing can vary, but the bond release is a significant milestone, marking the contractor’s successful completion of their responsibilities.

Comprehensive Coverage: The Power of 100 Percent Performance and Payment Bonds in NC

From our perspective, the 100 percent performance and payment bond is a vital tool in safeguarding large-scale construction projects in North Carolina. We’ve come to recognize that this bond covers the full value of the contract, guaranteeing both the completion of work and payment to subcontractors and suppliers. We’ve found that this dual protection is essential, especially in high-stakes projects, as it minimizes the risk of financial disputes and ensures all parties are adequately protected. This type of bond is particularly favored for its comprehensive coverage, providing peace of mind to project owners.

Timing Matters: The Process of Obtaining a Performance Bond in North Carolina

We’ve had numerous experiences with the process of securing performance bonds, and we’ve observed that the timeline can vary depending on several factors. In our observation, contractors in North Carolina can expect the process to take anywhere from a few days to several weeks. We’ve found that the contractor’s financial standing and project history play significant roles in expediting or delaying the bond issuance. Contractors with solid financials and a proven track record tend to experience fewer delays, while others may face a more prolonged process due to additional financial scrutiny.

Risks and Consequences of an Expired Performance Bond in North Carolina

In our practice, we’ve been involved in situations where a performance bond was nearing its expiration, and the potential risks were significant. We’ve realized that if a performance bond expires before the project’s completion, it can leave the project owner vulnerable to various risks, including the contractor failing to finish the work. In our experience, it’s crucial for both contractors and project owners in North Carolina to closely monitor bond expiration dates. We’ve consistently observed that renewing or extending the bond in a timely manner is essential to avoid lapses in coverage, which could lead to financial losses and disputes.

Conclusion: The Importance of Performance Bonds in North Carolina Construction

We’ve come to the conclusion that performance bonds are indispensable in the construction industry, particularly in North Carolina. These bonds provide critical protection for project owners, ensuring that projects are completed as agreed and that all financial obligations are met. Our experience tells us that understanding the intricacies of performance bonds—from the differences with bank letters of credit to the importance of bond renewal—can make a significant difference in the success of a construction project. As we’ve consistently found, the peace of mind provided by performance bonds is invaluable, making them a crucial element in safeguarding the interests of all parties involved.

See more at our North Dakota Performance Bond page.